Late-in-life divorce—also called gray divorce—is on the rise. Divorce rates for Americans over age 50 are “booming,” according to an April 2021 feature in Kiplinger, which reports that rates have roughly doubled since the 1990s. While divorcing at any age is difficult, starting over at older ages has financial considerations that often require a new approach to money.

Experts say the gray divorce trend is driven by factors that include longer life expectancies and a loosening of the stigma around divorce. Now dissatisfaction with spouses after spending months at home together during the pandemic also may be contributing to the divorce rate.

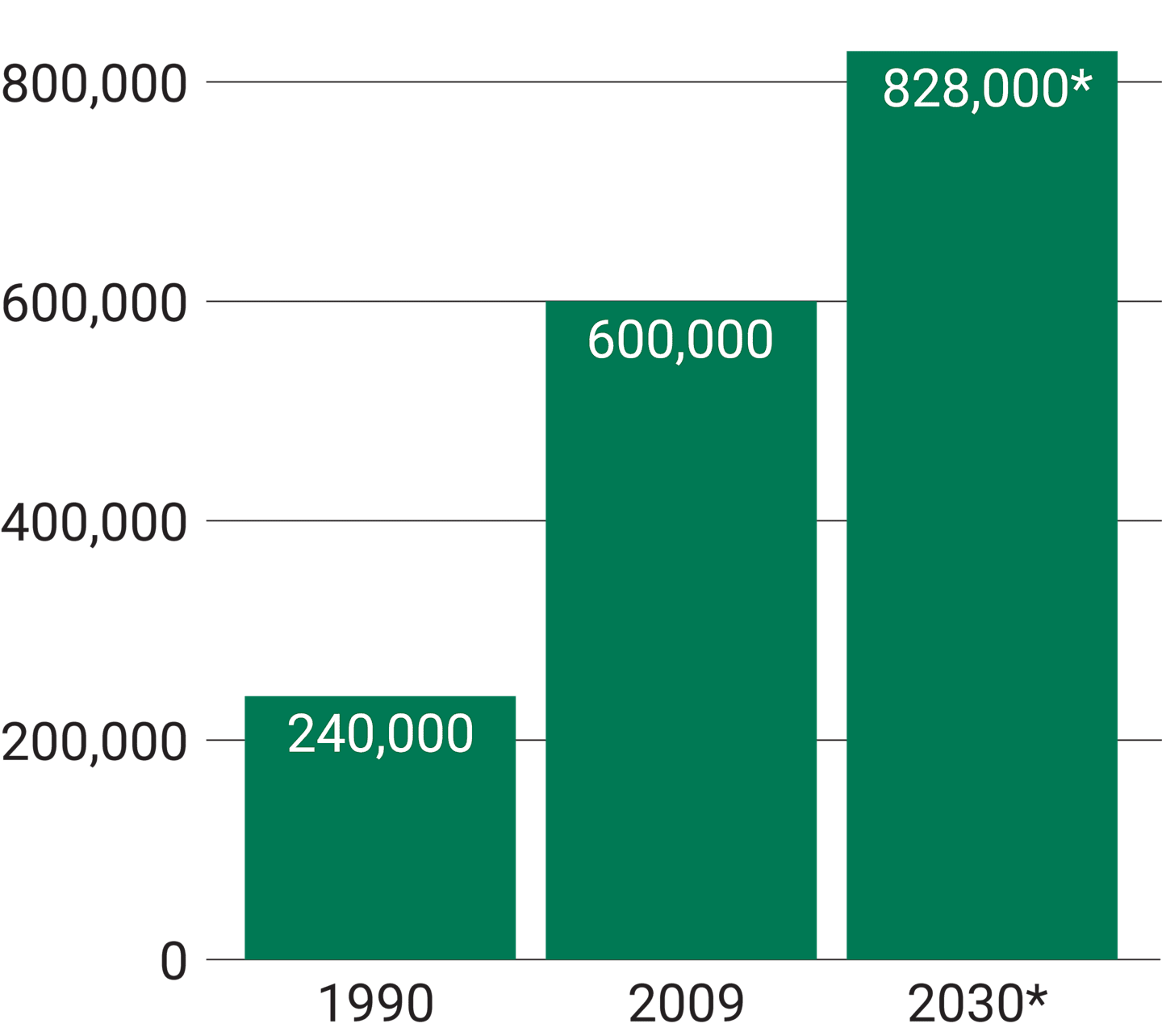

Gray Divorce Is On the Rise

Number of divorces per year by those ages 50+ in the U.S.

*Projected. Source: "The Gray Divorce Revolution," Susan Brown and I-Fen Lin, Bowling Green State University. Original research published 2012 using date from 1990 U.S. Vital Statistics Report and the 2010 American Community Survey.

Ending a long-time marriage is emotionally challenging. But it can also have a real financial impact on both parties—especially the wife. In the year following a divorce, women were nearly twice as likely as men to be in poverty reports the U.S. Census Bureau.

Here are some financial tips both men and women should consider during and after a late-in-life divorce.

Take a Financial Inventory of Your Assets and Liabilities

As part of divorce proceedings, you and your former (or soon-to-be former) spouse will likely have to list out all your assets such as retirement accounts and real estate holdings. You’ll do the same with liabilities, like car loans and credit card debt.

Unfortunately, if you live in a community property state, you may be held financially liable for half of the debts your ex acquired during the marriage, even if you didn’t know about them. But once you know what you’re getting or giving up in a divorce settlement, you’ll be able to start to plan financially for your next chapter.

Create a New Budget

Divorce may mean a reduction in your income and a change in your living situation, so you’ll likely need to revisit your budget. Based on your new income, can you afford to keep your house (unless the divorce decree requires it to be sold)? Would downsizing to a smaller place or renting make more sense? What expenses can you eliminate or reduce? If your spouse managed most financial matters during the marriage, you’ll also want to get a handle on things like how and when the mortgage or insurance premiums get paid.

Once you’ve created a new budget, be careful to follow it. The temptation to use credit cards can be greater when your income has been reduced. But resist that urge if you can. Accumulating debt close to retirement could have a negative long-term effect on your financial future.

Revisit Your Retirement Planning

Gray divorce may impact your retirement picture, especially if you’re required to transfer some of your retirement assets to your ex-spouse. Often, a Qualified Domestic Relations Order (QDRO) is used to make a tax-free transfer of retirement plan assets between the owner and the current or former spouse during a divorce. However, the IRS can charge taxes and penalties on transfers that are not deemed a QDRO.

Take another look at your retirement income plans. You might want to adjust your planned retirement date or save more aggressively going forward to make up for assets that went to your ex.

You’ll also probably want to consider the impact on Social Security . If you are age 62 or older and your marriage lasted 10 years or longer, you may be eligible to claim benefits under your ex-spouse’s name. If you remarry or the Social Security benefit based on your own work history is higher, you may not qualify.

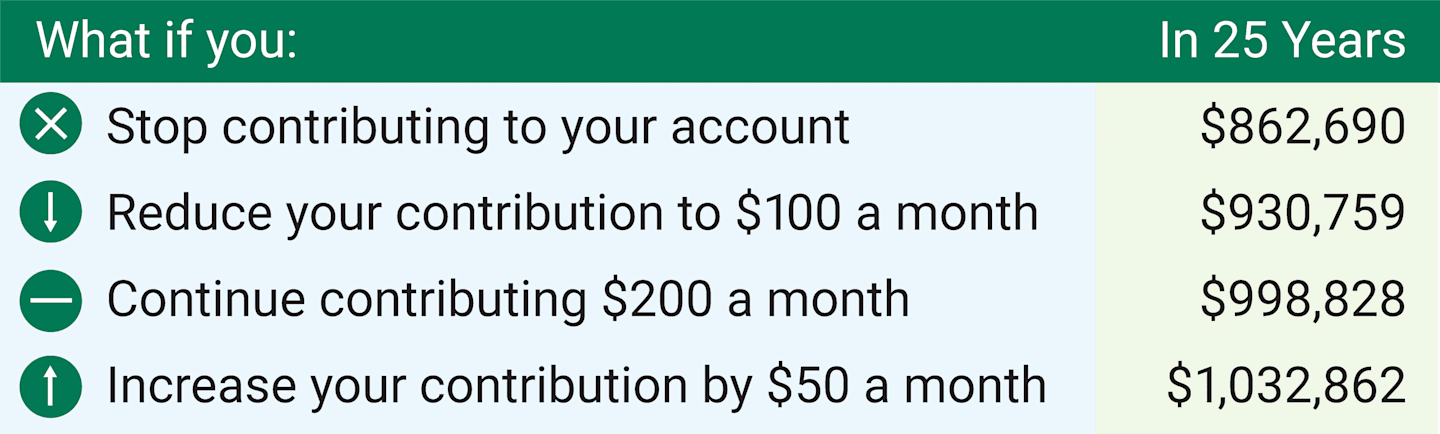

How Changing Your Retirement Contribution Can Impact Your Future

Let’s say you’ve been saving $200 a month in your retirement account and have $200,000 today. What could happen to your savings in 25 years if you change your monthly savings amount?

Source: American Century Investments, Future Value Calculator, Financial Calculators from Dinkytown.net 2021.

Hypothetical calculators assume a 6% investment return for 25 years in no particular investment, reinvestment of all realized gains, dividends and interest, and do not account for fees, expenses or taxes. If all taxes, fees and expenses were reflected, reported values would be lower.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Update Beneficiaries

Divorce can be an emotionally trying time. But don’t forget to update your beneficiaries on retirement accounts, life insurance policies or other assets. If you overlook this detail, your ex-spouse could wind up getting your IRA or life insurance payout if you die before he or she does. If that’s not your intention, take a few moments and update the beneficiary to someone else.

Consult an Expert

You may be unsure about how a divorce will impact your taxes or your retirement planning. If that’s the case, consider talking to an accountant, lawyer or financial planner who can advise you on transferring retirement assets in a tax-efficient manner and on making changes to your retirement savings strategy.

Late-in-life divorce can be challenging, but remember that there are professionals who routinely deal with situations like yours. They are available to provide rational guidance and support when you need it.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.