Risk vs. Reward: Balancing Your Investment Strategy

When you understand the relationship between investment risk and reward, you can create a portfolio to get you on track toward your financial goals.

Key Takeaways

There is no way to completely avoid risk when investing, but some types of risk can be reduced with the right strategies.

A portfolio’s risk level should depend on the investor’s comfort with risk, along with their specific goals and time horizon.

Understanding specific investment challenges—like market risk, inflation, interest rates and credit risk—can also help.

Weighing potential risks and rewards is important for any kind of decision-making, like buying a house or switching careers. It's also true for investing. Knowing some of the risk factors and how to manage them may help you make better investment choices.

Take the Right Risk for You

All investing involves risk. Taking on too much risk can be scary, but it might also help you get the returns you need to reach your goals. There’s also a difference between how much risk you can take in theory and how much you’re willing to handle in reality.

As you think about your investment strategy, you have to consider two things: your time horizon and your risk tolerance.

Time Horizon: How Much Time Do You Have?

The longer you have to invest, the more risk you can likely take because your investments have time to recover from market drops. Generally, the closer you are to your goals, like retirement, the less risk you’ll want to take.

Risk Tolerance: How Does Risk Make You Feel?

Knowing your willingness to take risks can help you choose investments that best suit you. Avoiding risk (or taking as little risk as possible) may prevent you from reaching your goals. On the other hand, choosing riskier investments to compensate for a lack of savings could put your investments in a precarious position.

How Your Risk Needs May Change Over Time

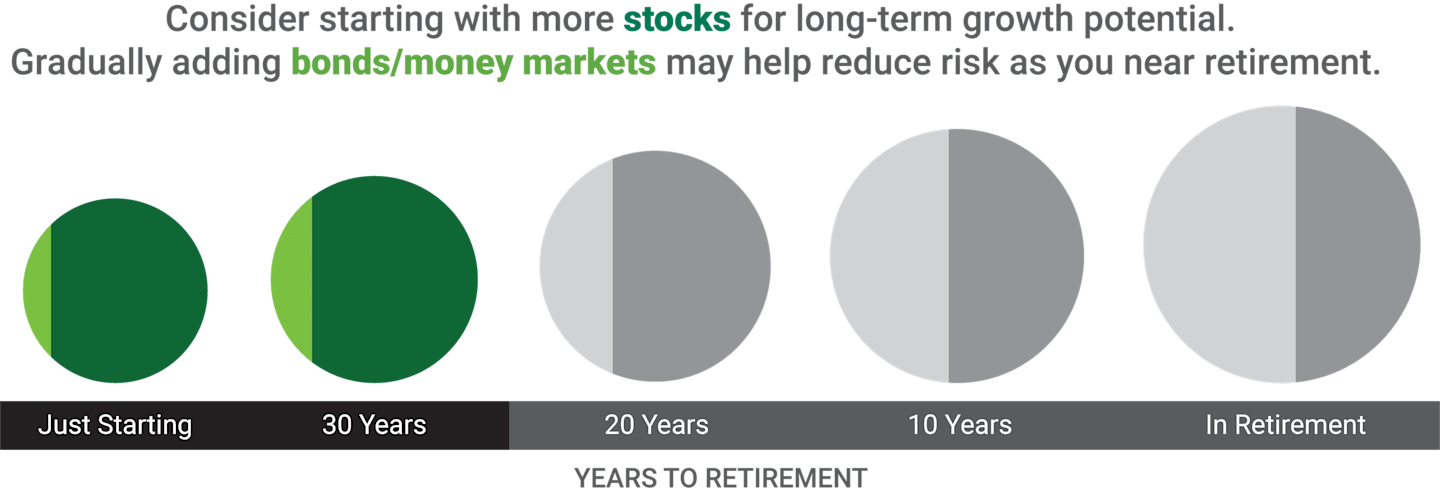

Hypothetical Portfolio Illustration

Younger investors often start with smaller account balances. A stock-heavy portfolio might seem riskier, but theoretically, with lots of time to add to savings, market ups and downs have the potential to be absorbed before retirement.

Source: American Century Investments. The examples indicate hypothetical allocations. The circles assume increased contributions over time and are not meant to indicate gains based on market performance.

Your specific percentages of stocks, bonds and money market investments will vary depending on your own goals, time frame and risk tolerance, but this may give you a place to start as you evaluate your current and future investment plans.

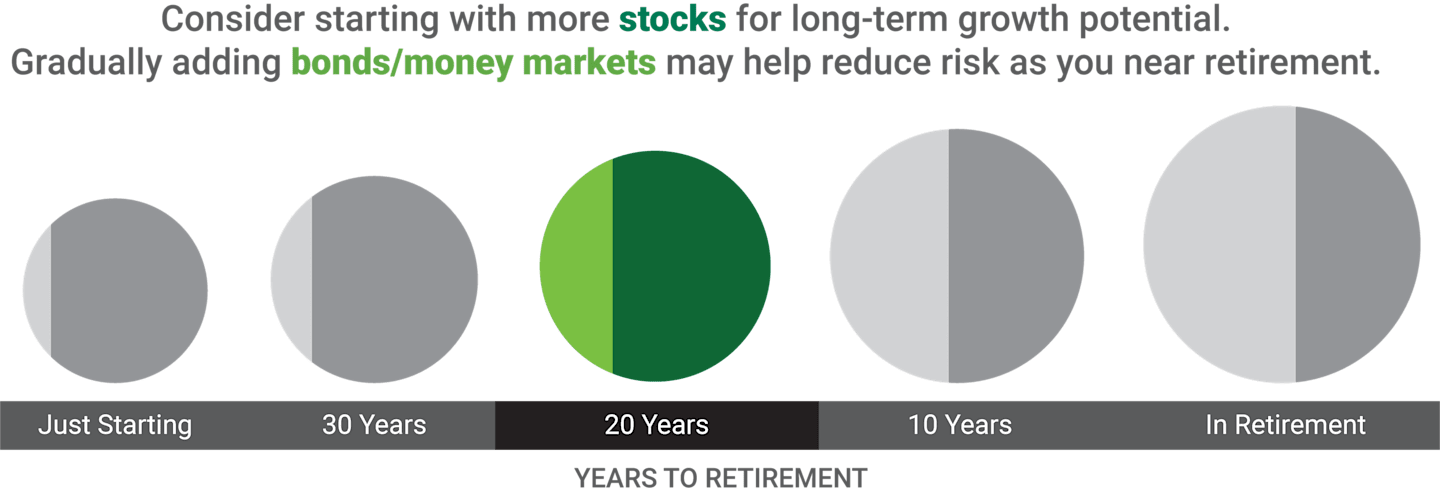

As your salary increases, commit to investing as much as you can. Your regular contributions and the return potential of stocks are both important factors as you seek to grow your account balance. A smaller allocation to bonds may help hedge against market downturns.

Source: American Century Investments. The examples indicate hypothetical allocations. The circles assume increased contributions over time and are not meant to indicate gains based on market performance.

Your specific percentages of stocks, bonds and money market investments will vary depending on your own goals, time frame and risk tolerance, but this may give you a place to start as you evaluate your current and future investment plans.

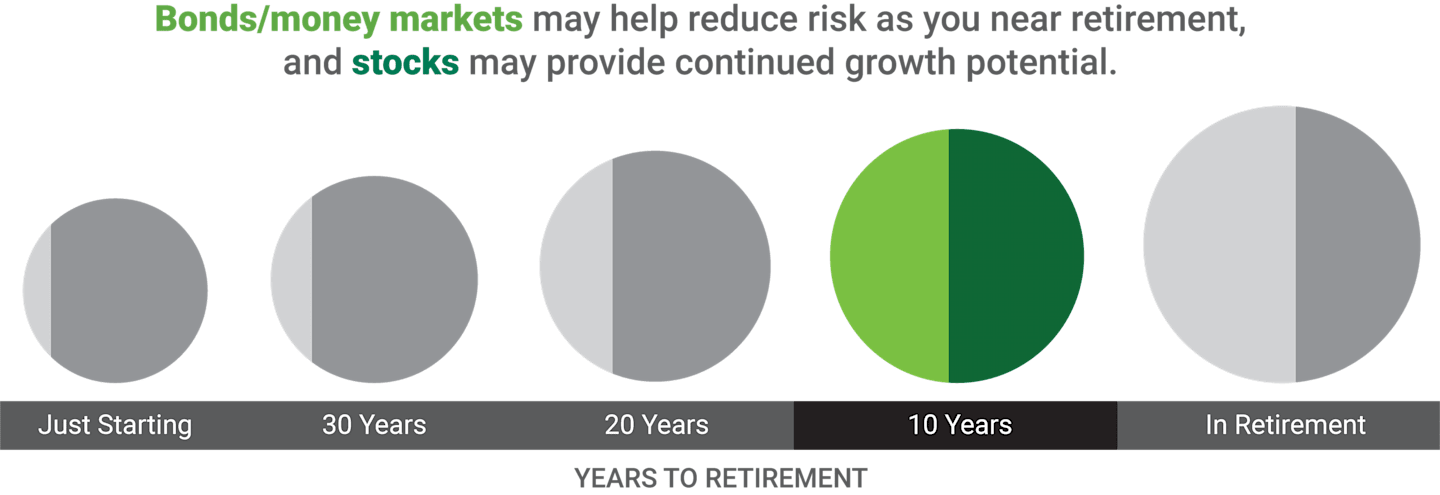

Risk looks different if you’ve got more to lose, especially if you’re counting down to your last paycheck. After years of saving, you’ll want to preserve your money. Balance your growth potential with conservative investments that may offer a buffer in case of market volatility.

Source: American Century Investments. The examples indicate hypothetical allocations. The circles assume increased contributions over time and are not meant to indicate gains based on market performance.

Your specific percentages of stocks, bonds and money market investments will vary depending on your own goals, time frame and risk tolerance, but this may give you a place to start as you evaluate your current and future investment plans.

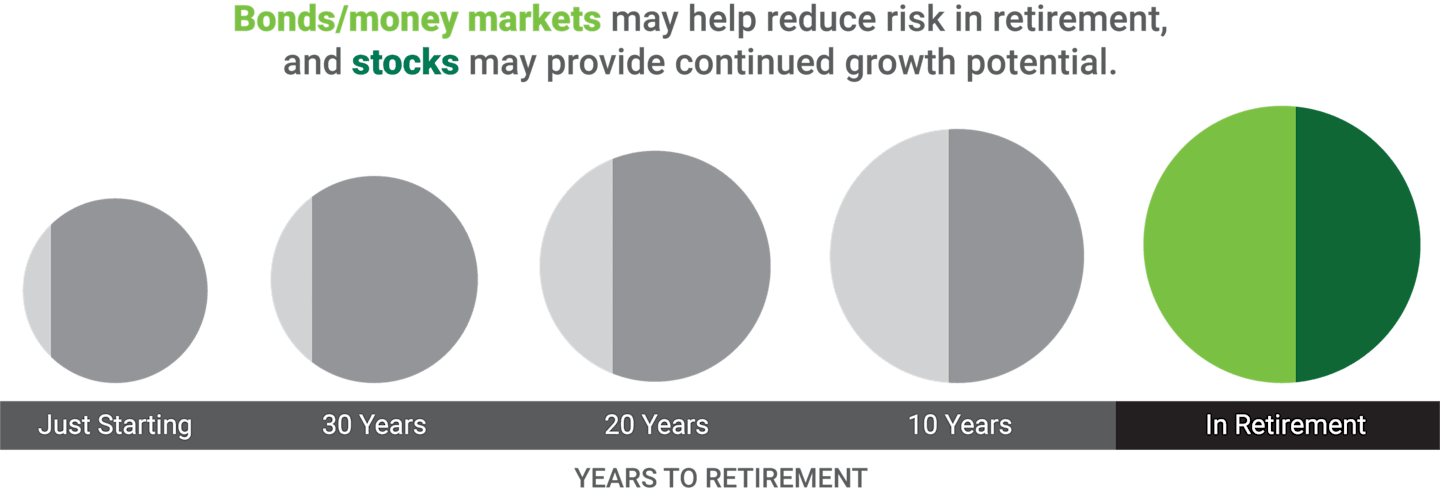

You’ll need to have a plan to make sure your money lasts. Calculating your expenses can help you determine a suitable withdrawal rate from your investments. Too little and you’ll have to adjust your lifestyle. Too much and you’ll deplete your accounts. (Learn more about retirement income strategies or talk to a financial consultant.)

Source: American Century Investments. The examples indicate hypothetical allocations. The circles assume increased contributions over time and are not meant to indicate gains based on market performance.

Your specific percentages of stocks, bonds and money market investments will vary depending on your own goals, time frame and risk tolerance, but this may give you a place to start as you evaluate your current and future investment plans.

Find Your Risk Comfort Zone

To find your comfort level with risk, consider your reaction to a steep market decline. Are you tempted to sell your stocks? Or are you willing to keep investing, even as your balance goes down?

How you answer can give you a good idea about your risk tolerance. It can also help you decide what kinds of investments to include in your portfolio and how much of each.

Understand Investing Risks

There are many different kinds of investing risks—some you can prepare for. Here are the most common.

Market Risk

Economic events can cause the value of your investments to drop. Market volatility can be spurred by anything from political events to weather—anything that causes investors to be wary.

Strategy: Diversify

There’s no way to eliminate market risk, but diversifying your portfolio may help mitigate your potential losses. Diversification means including a mix of investment types that react in different ways when markets change. When one area of the market is not performing well, it may be offset by others that are.

💡 Be sure to stick with your plan. A long-term outlook reduces the temptation to buy or sell based on emotion or short-term events.

Inflation

Inflation—the increase in the prices of goods and services—can erode your purchasing power if your investments can’t keep pace. Inflation has averaged about 2.5% for the last 20 years.1 If you don't achieve a rate of return that’s higher than inflation, your investments won’t be able to buy as much down the road. This means you will have to invest much more, wait longer to retire or even potentially never reach your intended goals.

Strategy: Add Investment Risk

You may need to take on some additional investment risk to get returns that will outpace inflation. Note that riskier investments can mean higher highs, but also lower lows.

💡 You can also hedge against rising prices with investments that are specifically designed to combat inflation.

Interest Rates

Changes in interest rates affect bond investments. Higher interest rates usually mean lower bond prices, and vice versa.

Strategy: Choose a Shorter Duration

A bond’s duration measures its price sensitivity to changes in interest rates. Shorter-duration bonds are usually less volatile when interest rates rise. The longer the duration, the more the bond’s price will change.

💡 Corporate bonds and mortgage-backed bonds are generally less sensitive to interest rate changes than other types of securities.

Credit Risk

Investing in bonds comes with the possibility that the bond issuer will fail to repay the loan. Credit ratings reflect an issuer’s financial strength and ability to make timely interest payments.

Strategy: Look for Quality

Higher credit quality can help decrease your risk. Investment-grade bonds have less risk of issuer default but also lower yield potential (rate of return). They have credit quality ratings of BBB or higher.

💡 While high-yield bonds carry a higher risk of default, they have more yield and return potential. High-yield bonds have credit-quality ratings of BB or lower.

Avoid Market Timing

One of the most important things you need to remember is that it's impossible to predict what will happen. Straying from your investment strategy to try to time the market (attempting to sell or buy to get ahead of the market) is a risk in itself.

Talk to a Professional

If you're sensitive about taking risks with your money, you may need to speak with a professional who can explain how to choose the right risk for your situation. Even if you feel your risk tolerance is at zero, that doesn't mean that you should avoid investing completely.

Investing is currently one of the only ways to save enough of a nest egg for retirement. If you don’t put your money in the stock market, you won’t be able to reap any potential rewards. Call us or request a call to figure out how to balance your investing goals and risk tolerance.

U.S. Bureau of Labor Statistics, Consumer Price Index as of Sept. 14, 2023.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Credit letter ratings indicate the credit worthiness of the underlying bonds in the portfolio and generally range from AAA (highest) to D (lowest).