Bring Retirement in Focus

Consolidate Your Retirement Accounts Here

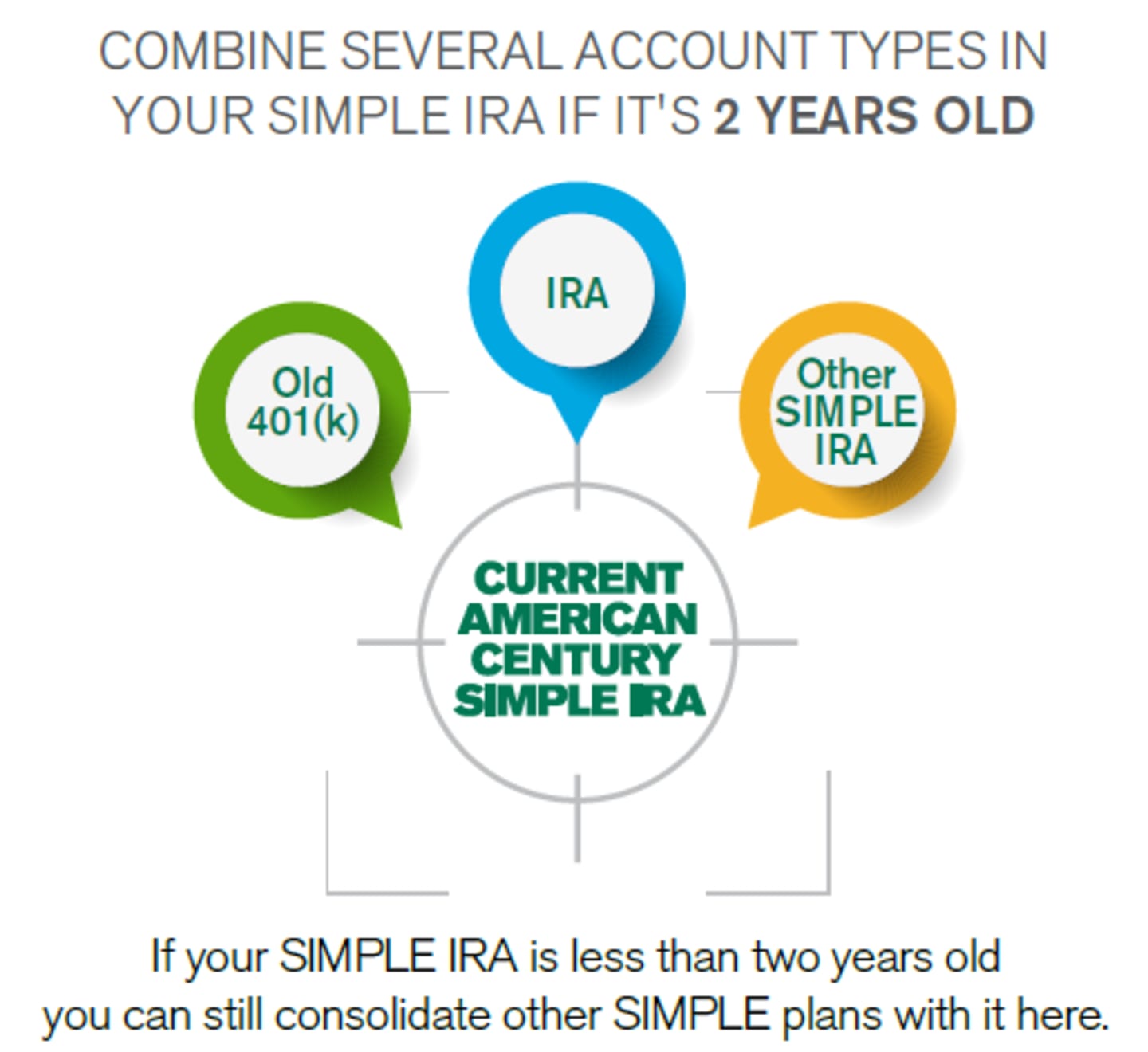

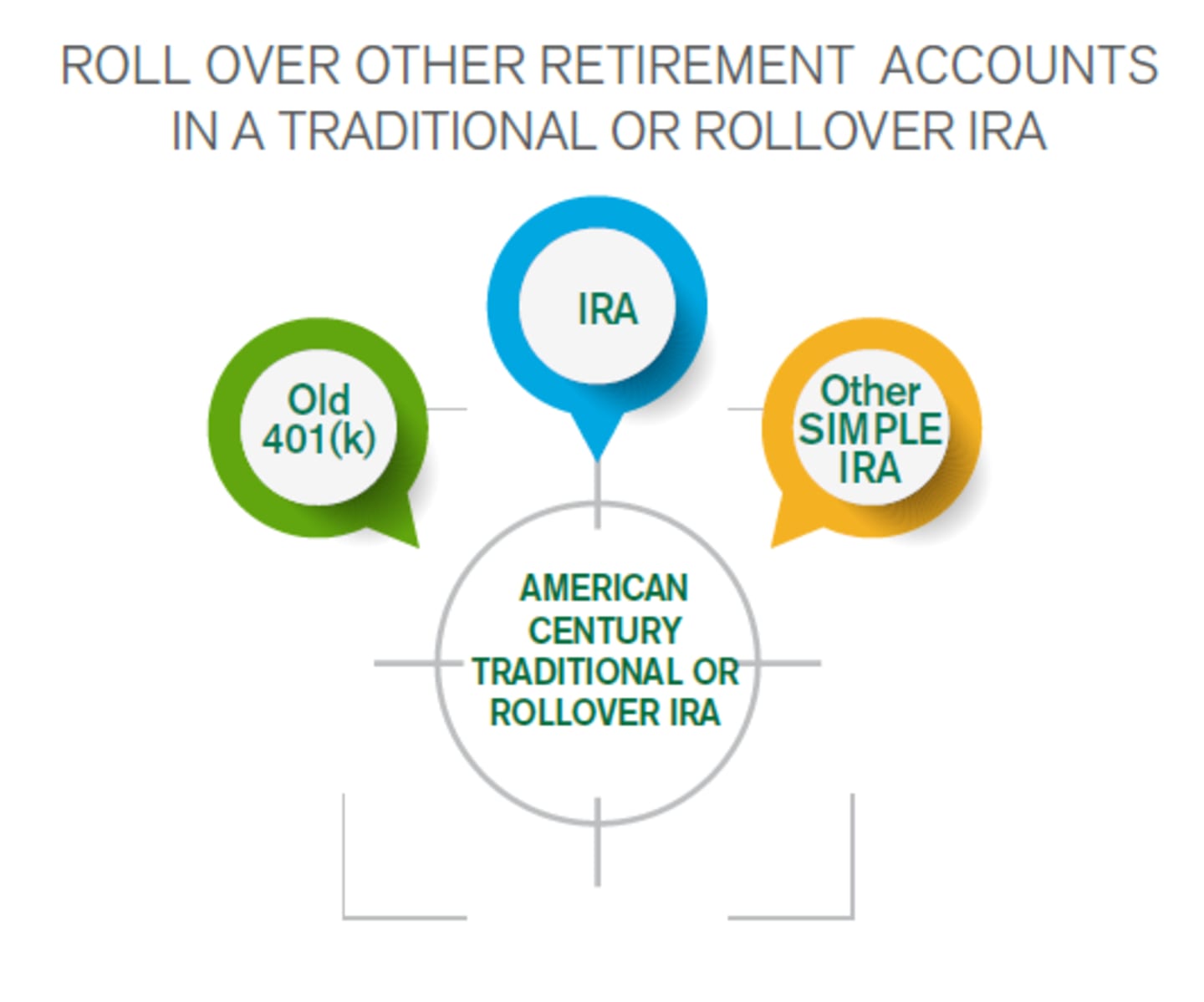

A great added benefit of your SIMPLE IRA is the ability to consolidate retirement savings from other places in your current account. Which types you can consolidate depends on how long you’ve had the account. Another option is to consolidate other retirement accounts into a Traditional or Rollover IRA here.

Two Ways to Consolidate

Six Reasons to Consolidate

Track progress

toward retirement easier

Manage risk

easier as your situation changes or during market ups and downs

See clearly

where your money is invested

Make better decisions

about adding or decreasing types of investments

Spot gaps

and avoid duplicate investments

Qualify for fee discounts

price breaks or other asset-based benefits

Before You Move Your Money

Be sure to ask your current providers about potential consequences, including taxes, penalties, charges or specific fees for liquidating or transferring your assets.

Transfer

Transfer a SIMPLE or other IRA from another custodian to your SIMPLE IRA at American Century Investments.

Rollover

Roll over your money from a 401(k), 403(b) or other employer-sponsored plan to a Rollover IRA at American Century Investments.

This information is for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. There are different options available for your retirement plan investments. You should consider all options before making a decision. Our representatives can help you evaluate all of your distribution options.

You should consider the fund's investment objectives, risks, charges and expenses carefully before you invest. The fund's prospectus or summary prospectus, which can be obtained by calling 1.800.345.2021, contains this and other information about the fund, and should be read carefully before investing. Investments are subject to market risk.

American Century Investment Services, Inc., Distributor

©2025 American Century Proprietary Holdings, Inc. All rights reserved.