American Century® Retirement Date Hybrid Trust

Cost-Effective Hybrid QDIA Solution Available Exclusively through Empower

Now with a 5-Year Track Record

The Alpha Potential of Active Management.

The Cost-Effectiveness of Indexing.

Actively managed equity and fixed income strategies from American Century Investments®

Low-cost, indexed large-cap equity strategies from State Street Global Advisors

Fixed Account allocation managed by Empower Annuity Insurance Company of America (Empower) seeks to provide portfolio stability.

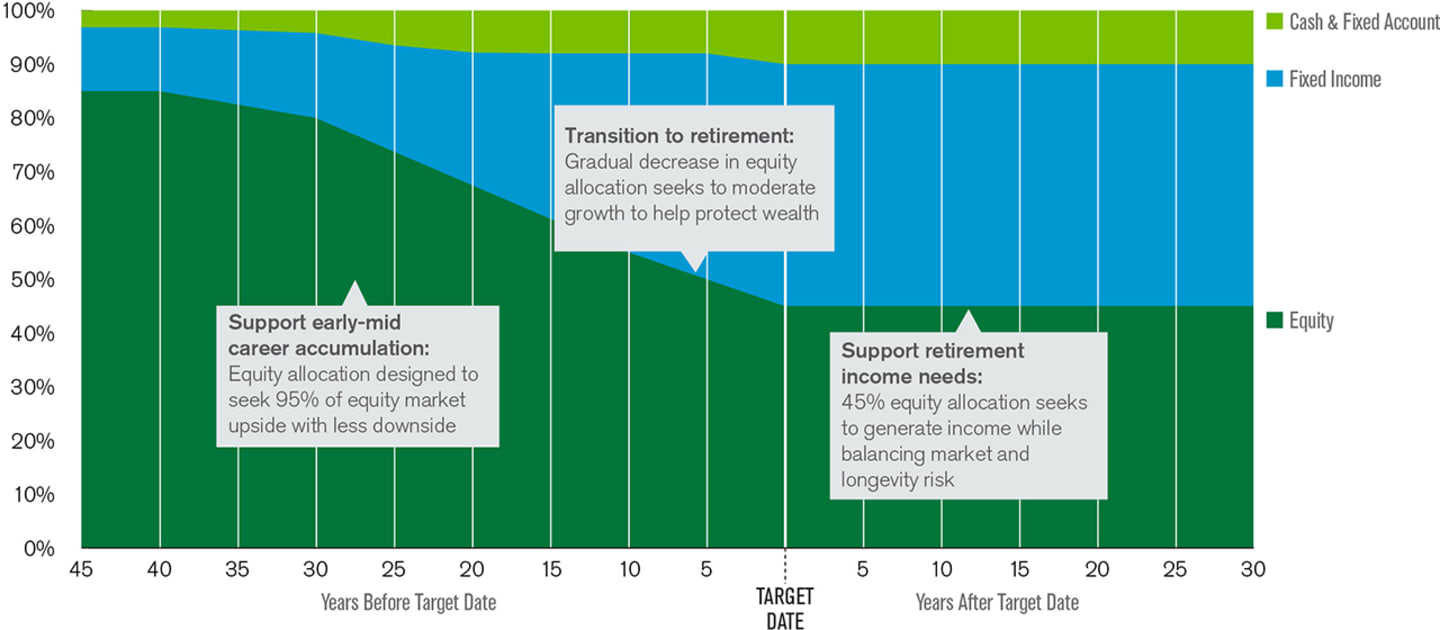

The Conviction of American Century's Risk-Aware Glide Path

Seeks greater certainty of outcomes for more participants:

Balance-of-risk framework designed for multiple risks and market environments

Increased likelihood of success for a greater number of participants

Key Facts

Call us to learn how our flatter glide path helps more participants reach their goals.

Full Asset Class Coverage

Stocks

(Actively Managed)

American Century Investments®

Mid Cap Growth

Mid Cap Value

Small Cap Growth

Small Cap Value

Non-U.S. Developed Large Growth

Non-U.S. Developed Large Value

Non-U.S. Developed Small Cap

Emerging Markets

Global Real Estate

Bonds

(Actively Managed)

American Century Investments®

High Quality Bond

High Yield Bond

Inflation-Linked Bond

Short Duration Inflation-Linked Bond

Non-U.S. Bond

Global Hedged Bond

Emerging Markets Debt

Cash & Equivalents

(Actively Managed)

Empower

Fixed Account

American Century Investments®

U.S. Government Money Market

Stocks

(Indexed)

State Street Global Advisors

Large Cap Growth

Large Cap Core

Large Cap Value

Resources

Provides key information about the glide path philosophy, underlying investments, share class availability and pricing (Financial Professional Use)

Delves into our glide path philosophy, the rationale for its flatter shape and its record of attractive risk-adjusted returns. Also provides our views on target-date selection and review criteria (Financial Professional Use)

Includes performance information and commentary as well as the team’s perspective on the market environment and portfolio positioning going forward (Financial Professional Use)

Includes a market overview as well as contributors to and detractors from performance (Retail-approved)

Includes standardized performance and allocations for all vintages (Retail-approved)

Have Questions?

Contact your American Century Investments® Service Representative or your Relationship Manager.

This information is for educational purposes only and is not intended as investment or tax advice.

The Trust consists of a series of common or collective trust funds established and maintained by Benefit Trust Company (BTC) under a declaration of trust. American Century Investment Management, Inc. is the advisor to the trust. The trust is not registered with or required to file prospectuses or registration statements with the SEC or any other regulatory body, and accordingly, neither is available. The trust is available only to certain qualified retirement plans and governmental plans and is not offered to the general public. Units of the trust are not a bank deposit and not insured or guaranteed by any bank, government entity, the FDIC or any other type of deposit insurance. You should carefully consider the investment objectives, risk, charges, and expenses of the trusts before investing.

Benefit Trust Company (BTC) is a non-depositary trust company with operations in Overland Park, Kansas. As an independent fiduciary and fund sponsor, BTC maintains the fund and oversees all compliance related functions for the fund including trade monitoring, pricing, performance, annual reporting and investor eligibility. American Century is not affiliated with Empower Retirement, Empower Financial Services, Inc., or its parent company Empower Annuity Insurance Company of America.

Information presented is intended to supplement discussions between American Century Investments and tax-qualified retirement, pension, profit-sharing, stock bonus, and other employee benefit trusts and certain eligible governmental plans (defined as "Eligible Plan" in the Declaration of Trust exempt under Revenue Ruling 81-100 (1981-1 C.B. 326) (as amended, from time to time). The information is not applicable if you are not an Eligible Plan. This does not constitute an offer or solicitation of any security or product, nor constitute a recommendation of suitability of any investment strategy for a particular investor. Material presented is prepared from information sources believed to be accurate, but there is no guarantee of accuracy. Any potential purchaser may pay actual expenses that are more or less than those presented above, and their investment may lose value. There is no guarantee, contract, or agreement, expressed or implied with the recipient of this information that the above expenses will be received. Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

Fees are subject to change.

FOR FINANCIAL PROFESSIONAL USE ONLY/NOT FOR DISTRIBUTION TO THE PUBLIC

RO894699 07/19

You should consider the fund's investment objectives, risks, charges and expenses carefully before you invest. The fund's prospectus or summary prospectus, which can be obtained by calling 1.800.345.2021, contains this and other information about the fund, and should be read carefully before investing. Investments are subject to market risk. Download Prospectus: Mutual Fund or Exchange Traded Fund (ETF).

American Century Investment Services, Inc., Distributor

©2026 American Century Proprietary Holdings, Inc. All rights reserved.