Welcome to American Century Investments®

The Countdown Is On!

Your retirement plan is closing, but there's still time to move your money to continue saving. Get started by completing the easy online form. We’ll help with the rest. Call 1-800-331-8331 for free guidance.

Thinking about Cashing Out? Think Again.

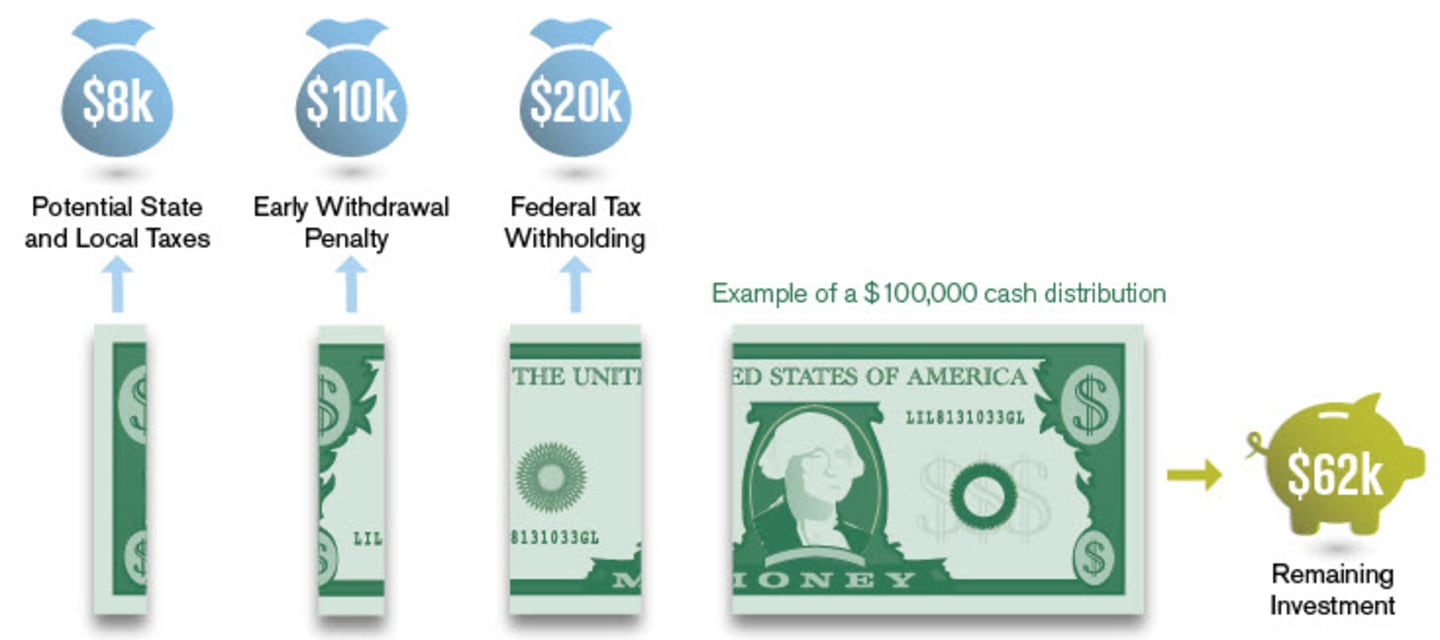

It's tempting to cash out your retirement savings, especially for short-term expenses. However, you could lose a significant portion from taxes and penalties.

Depending on your situation, you could end up with about 60% of your original amount.*

Prefer to hear more about your options?

Call us at 1-800-331-8331.

*Taxes are deferred until withdrawal. State and local income taxes may also apply at withdrawal. A 10% penalty will be imposed for early withdrawal.

Special rules apply to Roth assets. Please consult your tax advisor. Penalty may apply if you don’t meet the age requirements.

For Illustrative Purposes Only.

Keep Saving Today to Avoid Future Regret

You've come this far. Continue saving for the retirement you want and avoid looking back with regret in your future. Learn from the experience of others and find tips to save more now.

Ready to keep saving? Call us at 1-800-331-8331.

Answers for Your Questions

A retirement plan closing can leave you wondering what to do with your money. Many options are available, each with its own pros and cons. American Century Investments is here to help participants like you keep your retirement dollars on track. Review the options in our educational tools tab below or call a Rollover Specialist at 1-800-331-8331 to discuss them.

A Rollover Individual Retirement Account (IRA) allows you to save for retirement tax-deferred, meaning you won't pay taxes until you withdraw the money. It's intended for money "rolled over" from a qualified retirement plan. Rollovers involve moving assets from an employer-sponsored plan, such as a 401(k) or 403(b).

Investment Options

We believe a sound diversification strategy aligned with your goals is the foundation of long-term investing success. A good mix of investments is key to weathering the ups and downs of the market. Explore our target date portfolios designed specifically for retirement investing, or build your own portfolio from our complete list of funds.

Option 1: Invest with Target-Date Portfolios

Explore One Choice® Target Date Portfolios, designed specifically for retirement investing. Simply find a fund based upon your birth year and future retirement date. Your money will be automatically diversified in up to 16 funds in a single investment.

A One Choice Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date.

Each target-date One Choice Target Date Portfolio seeks the highest total return consistent with American Century Investments' proprietary asset mix. Over time, the asset mix and weightings are adjusted to be more conservative. In general, as the target year approaches, the portfolio's allocation becomes more conservative by decreasing the allocation to stocks and increasing the allocation to bonds.

By the time each fund reaches its target year, its target asset mix will become fixed and will match that of One Choice In Retirement Portfolio.

Explore One Choice Target Date Portfolios

Key Benefits:

• Instant, broad diversification

• Professionally and actively managed

• Asset mix becomes more conservative

One Choice® In Retirement Portfolio

Birth Year: 1962 or earlier

Retirement Year at Age 65: 2027 or earlier

Birth Year: 1963 – 1967

Retirement Year at Age 65: 2028 – 2032

Birth Year: 1968 – 1972

Retirement Year at Age 65: 2033 – 2037

Birth Year: 1973 – 1977

Retirement Year at Age 65: 2038 – 2042

Birth Year: 1978 – 1982

Retirement Year at Age 65: 2043 – 2047

Birth Year: 1983 – 1987

Retirement Year at Age 65: 2048 – 2052

Birth Year: 1988 – 1992

Retirement Year at Age 65: 2053 – 2057

Birth Year: 1993 – 1997

Retirement Year at Age 65: 2058 – 2062

Birth Year: 1998 – 2002

Retirement Year at Age 65: 2063 – 2067

Birth Year: 2003 and after

Retirement Year at Age 65: 2068 and after

Option 2: Build Your Own Portfolio

Research your portfolio from our complete list of actively managed mutual funds.

Educational Tools

We understand all the different options that you are facing when deciding what to do with your 401(k) money. Our educational pieces and calculators are designed to help you make the decision that's right for you.

Resources

Cash Out Calculator

While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses, know that you could lose a significant portion of that money right from the start.

Don't Leave Your Savings Behind

You don't have to leave your retirement money behind. Learn more about the benefits of rollovers, and find out how easy it is to get started.

Fees Matter

Even a small fee can make a significant impact to your savings over the years. Take time to understand the long-term costs of advisor fees.

Invest with Impact

ADP and American Century Investments are working together to provide rollover solutions. Get to know American Century Investments.

Frequently Asked Questions

Taking your retirement plan money in cash may provide quick access, but it may not be the best long-term financial move because of the possible tax consequences. You can end up with about 60 percent of your original savings due to taxes and penalties if you’re under age 59½. Plus, you lose the opportunity for your investment to continue to grow in a tax-deferred account.

Yes, you can make contributions to your IRA, subject to the IRS annual contribution limits . But you must keep Roth IRA and traditional IRA money separate.

If you combine rollover assets and new contributions in the same account, the combined assets are considered "commingled" and may not be able to be rolled over into a new employer's plan.

Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan (including a SEP or SIMPLE IRA plan), as long as you stay within the IRS annual contribution limits .

Yes. You can roll over Roth dollars from a qualified retirement plan (for example, a 401(k) plan), into a Roth IRA. With a Roth IRA, you make contributions with money you've already paid taxes on (after-tax) and your money may potentially grow tax-free. Different from a Traditional or Rollover IRA, you won't pay taxes when you withdraw the money in retirement, as long as you have had the account for at least five years and you are at least age 59½.

For 65 years, American Century Investments has helped people like you invest for their financial futures. Our goal is to help you succeed.

As our client, you have access to free guidance about how different investments may work together to help you make decisions about your portfolio. If you want direction about how to invest, take advantage of one of our advice options for a portfolio recommendation based on your needs.

We know that how we invest and serve you matter as much as the mission. They’re important for your investing world and the world we all live in. The whole world? Yes.

Every year, 40% of our dividends fund breakthrough medical research aimed at defeating diseases that affect all of us, like cancer and Alzheimer’s. When you invest with us, you also become part of the story. Learn more about this unique purpose and how we’re in it together.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

Your employer and American Century Investments are working together to provide retirement solutions to help you stay on the right path toward retirement. That includes help deciding the next step for your retirement savings and free investment guidance.

Get started by completing the easy online form.

We’ll help with the rest.

Diversification does not assure a profit nor does it protect against loss of principal.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

This information is for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. There are different options available for your retirement plan investments. You should consider all options before making a decision. Our representatives can help you evaluate all of your distribution options.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

If withdrawals are made within the first two years of participation in the SIMPLE IRA, the penalty increases to 25%.

ADP, LLC, ADP Broker-Dealer, Inc., and their affiliates (collectively, "ADP") and American Century Investment Services, Inc. and its affiliates (collectively, "American Century") are independent contractors. Nothing in the following materials or agreements should be construed to create or provide for any other relationship between ADP and American Century, including but not limited to joint venture or partnership. Neither ADP nor its affiliates provide investment or tax advice to participants, alternate payees or beneficiaries (collectively, "Participants") in retirement plans to which they provide recordkeeping or administrative services ("Retirement Plans"), nor serve in a fiduciary capacity with respect to Retirement Plans.

You should consider the fund's investment objectives, risks, charges and expenses carefully before you invest. The fund's prospectus or summary prospectus, which can be obtained by visiting americancentury.com, contains this and other information about the fund, and should be read carefully before investing. Investments are subject to market risk.

American Century Investment Services, Inc., Distributor

©2026 American Century Proprietary Holdings, Inc. All rights reserved.