Biosimilars: A Cure for the Higher Price of Complex Drugs?

Anticipating a biosimilar boom, our new series focuses on how these medicines disrupt specialty drug pricing, the changing industry landscape and investor opportunities.

Key Takeaways

Biosimilars are an innovative class of drugs whose use has surged in recent years.

Biosimilar competition will likely be a thorn in the side of brand-name drug companies for years.

Biosimilars are cheaper to make and compete on price with brand-name drugs, lowering patient costs.

Prescription drugs are a big business in the U.S. Two out of three Americans take at least one prescription medication, with sales topping $603 billion in 2022.1

Moreover, after considering all rebates and discounts, Americans face nearly 190% higher prescription costs than consumers in many European and North American countries.2

Considering this eye-opening data, it’s no wonder that drug prices are a kitchen table issue for many people. We need medicines more than ever, but high prices can put them out of reach for many or force painful compromises in family budgets.

Politicians and U.S. regulators are trying to address this problem with drug pricing solutions like encouraging the development and use of biosimilar drugs. These medications are less expensive alternatives to their brand-name biologic counterparts.

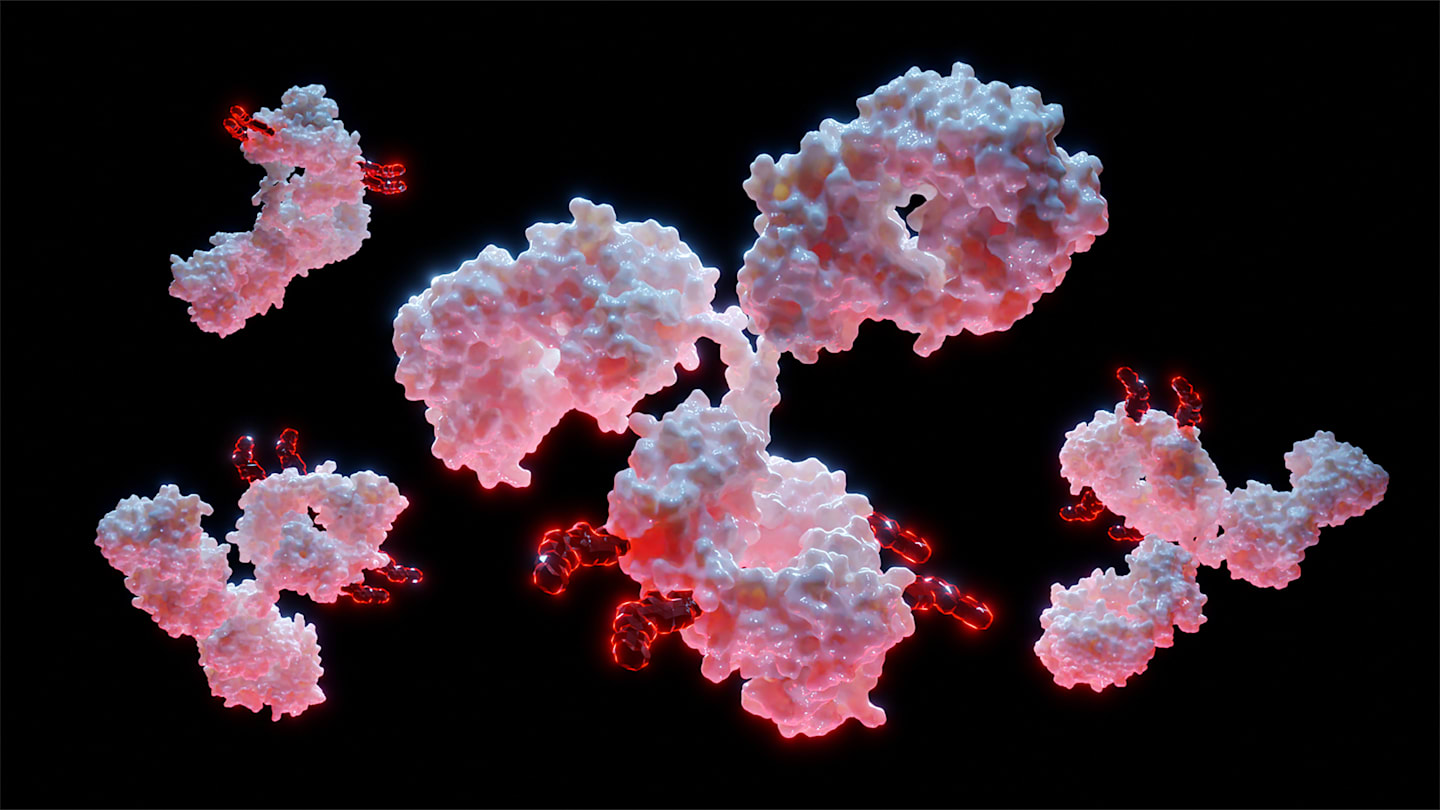

Biologics — What Are They?

Biologics are complex molecules obtained from living organisms (thus the “bio-” in their name). They are almost always administered through an injection or infusion. They are ideal for fighting various debilitating diseases, including macular degeneration, some cancers, anemia and Crohn’s disease.

Even though biologics can be highly effective, they come with eye-popping price tags because their makers seek to recoup years of research and development (R&D) costs. For this reason, even though a tiny fraction of all prescriptions are written for biologics, they make up more than 40% of drug spending each year in the U.S.3

What Are Biosimilars, and How Do They Work?

Biosimilars mimic Food and Drug Administration (FDA)-approved biologic drugs. They are made from the same living cells or microorganisms, and their makers assert that biosimilars are just as effective and safe as the original drugs. Biosimilars can be used interchangeably with their reference biologics because they have the same efficacy, safety and side effects.

Biosimilars vs. Generic Drugs

Biosimilars are not the same thing as generics. Compare their differences in Figure 1. Generics are direct copies of brand-name pharmaceuticals. So, when a brand-name medication comes off patent protection, competitors can replicate its chemical recipe and sell a cheaper version.

It’s a different story for biologics. Given that the medications are developed from living cells or microorganisms, it’s impossible to replicate them exactly. Therefore, biologics have no generics. Instead, biosimilars copy biologic drugs using processes far more complex and costly to develop than true generics. Biosimilars aren’t identical to biologics, but there are no clinical differences in their potency, purity and safety.

Figure 1 | Biosimilar Drugs vs. Generic Drugs: Key Differences

Biosimilars

- Generally made from living sources.

- Require a specialized process to produce.

- Very similar, but not identical, to original biologics.

- Faster development process using public information from original biologic approval.

- Usually cheaper than original biologics.

Generics

- Generally made from chemicals.

- Have a simpler process to copy.

- Copy of brand-name drugs.

- Faster development process using public information from brand-name drug approval.

- Usually cheaper than brand-name drugs.

Source: “Biosimilars,” U.S. Food and Drug Administration, March 1, 2023.

Biosimilar Benefits

Biosimilars can be made more efficiently than their original brand-name counterparts thanks to:

Lower development costs. The active ingredients in biosimilars have already been proven safe and effective, so their R&D costs are typically 15 to 20 times lower than those of their reference drugs.4

Reduced uncertainty. The heavy lifting in designing the biologic drug and showing that it is safe and effective has already been done. Therefore, the likelihood of success for biosimilars is much higher than for an original biologic.

Faster development. It takes an average of six to nine years to develop a biosimilar drug, compared to 12 years for a biologic.

With the cost savings, biosimilars can hit the market at a lower price and potentially lure patients from a heavily marketed brand name product.

How Biosimilars Lower Drug Prices

There’s no disputing that biosimilars have brought down prices in markets where they compete with brand-name drugs. Given the regulatory support for lowering drug prices, drugmakers are making headway in marketing their biosimilar products. At last count, 45 approved biosimilars compete against 15 brand-name drugs in the U.S.5

Today, the choice between a biologic and a biosimilar often comes down to price, and that’s usually not much of a contest. In the U.S., the average price of a biosimilar at launch is 50% less than the price of its reference biologic.6 From that starting point, the average sales price of a biosimilar and the original biologic typically declines for 18–24 months before leveling off.

In the U.S., the price of many biosimilars then declined by anywhere from 9% to 24% per year after a biosimilar was launched, reflecting the effect of competition and new entrants.7

Though it’s taken time for biosimilars to gain traction in the U.S., they have been available in Europe and Japan for many years. One-to-one comparisons shouldn’t be made between the U.S. and these countries and regions because their drug pricing and regulatory regimes are vastly different.

Nevertheless, the uptake of biosimilar drugs in Japan and Europe offers insights into how the market may develop in the U.S. In the EU, biosimilars and their underlying biologics prices often decline for two years (or more) after the biosimilar comes to market.

Regulators in some European countries are more open to biosimilars than others, allowing interesting comparisons. Not surprisingly, biosimilars often achieve high market share in a supportive regulatory environment. In countries with higher regulatory hurdles, the adoption of biosimilars instead of biologics is usually much lower.

Pricing and market share go hand in hand. As a result, companies that make biologics must cut their prices or risk losing most of the market they once owned.

Investors Take Notice

Drug makers secure their places in the market (and investors’ hearts) if they can create blockbuster drugs with up to 20 years or longer of patent protection. Biosimilars threaten these economics.

Case in point, all eyes are on AbbVie, the maker of Humira®, a blockbuster injectable biologic used to treat arthritis and Crohn’s disease. Sales were $21 billion in 2022, making it the world’s top-selling drug and among the bestselling drugs ever.8

In 2023, Amgen introduced a biosimilar to compete with Humira. In response, AbbVie discounted Humira’s nearly $7,000-per-month list price to defend its market share. New Humira biosimilars priced below even that level will likely gain a sizable chunk of this huge market.9

Biosimilars competition will likely be a thorn in the company’s side for a year or two while it stabilizes.10 Others can look forward to similar effects as their drugs lose exclusivity and will need to compete.

Stay Tuned for the Next Article in Our Biosimilars Series

Next in our series, we’ll look at how biosimilars are changing the health care space. Some companies will win, and some will lose. They’ll say biosimilars aren’t fair. So far, the mode of operation in the U.S. has been, “Don’t hate the player, hate the game.” Biosimilars help them alleviate the high price of drugs.

Authors

Investment Analyst

Explore More Insights

Singlecare, “Prescription Drug Statistics,” November 29, 2023.

Samantha McGrail, “U.S. Prescription Drug Prices 256% Higher Than Other Countries,” Pharma News Intelligence, February 3, 2021.

IQVIA Institute, “Biosimilars in the United States 2023-2027,” January 2023.

Association for Accessible Medicines, “The U.S. Generic & Biosimilar Medicines Savings Report,” September 2023.

“Biosimilar Approvals,” The Center for Biosimilars,” January 25, 2024.

Association for Accessible Medicines, “The U.S. Generic & Biosimilar Medicines Savings Report,” September 2023.

Tony Hagen, “Tis the Year of the Humira Biosimilars,” Managed Healthcare Executive, January 11, 2023.

Zoey Becker, “CVS Caremark to Kick AbbVie’s Humira Off Some Formularies in Favor of Cheaper Biosimilars,” Fierce Pharma, January 4, 2024.

Brian Orelli, “AbbVie Raises Guidance,” The Motley Fool, October 30, 2023.

Orelli, The Motley Fool, October 30, 2023.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.