Beyond U.S. Big Tech: Rethinking Global Growth Investing

We see a broadening in the market and growth opportunities beyond the Magnificent Seven.

Key Takeaways

Amid rising uncertainty and market volatility, we see market leadership reshuffling away from U.S. exceptionalism and Magnificent Seven trades.

We believe our Global Growth strategies are well-suited to current conditions as investors seek opportunities across a wider universe of companies.

A focus on earnings acceleration can serve as a powerful sign of investment potential.

As U.S. exceptionalism moderates and trade-related volatility surges, market leadership is expanding across a broader set of opportunities.

U.S. equities and large-cap tech have outperformed for several years, largely thanks to tech-led innovation. While we still see opportunities in the U.S., other regions show signs of increased potential.

European companies stand to gain from increased levels of fiscal stimulus, which could impact banking, defense spending and other aspects of the economy.

Select Japanese firms, such as IT consulting firms, may draw strength from the country’s emphasis on investing in IT capabilities and infrastructure. Corporate governance reform is further strengthening the case for Japanese stocks.

Opportunities are expanding within the U.S. in areas like electric utilities, which, after decades of slow growth, may benefit from a surge in electricity demand.

We believe we have identified companies benefiting from these and other trends through an investment process centered on accelerating earnings growth. We’re looking for companies whose growth rates are increasing over time.

We think this approach may be especially effective because the broadening market offers more opportunities across more regions and sectors.

Signs of Broader Global Growth in 2025

Over the last several years, global investors have generated strong returns by narrowly focusing on a small group of U.S. growth stocks. Essentially, they just needed to take a position in U.S. large-cap stocks — primarily those from the Magnificent Seven.

However, this trend may be changing as more businesses show stronger returns.

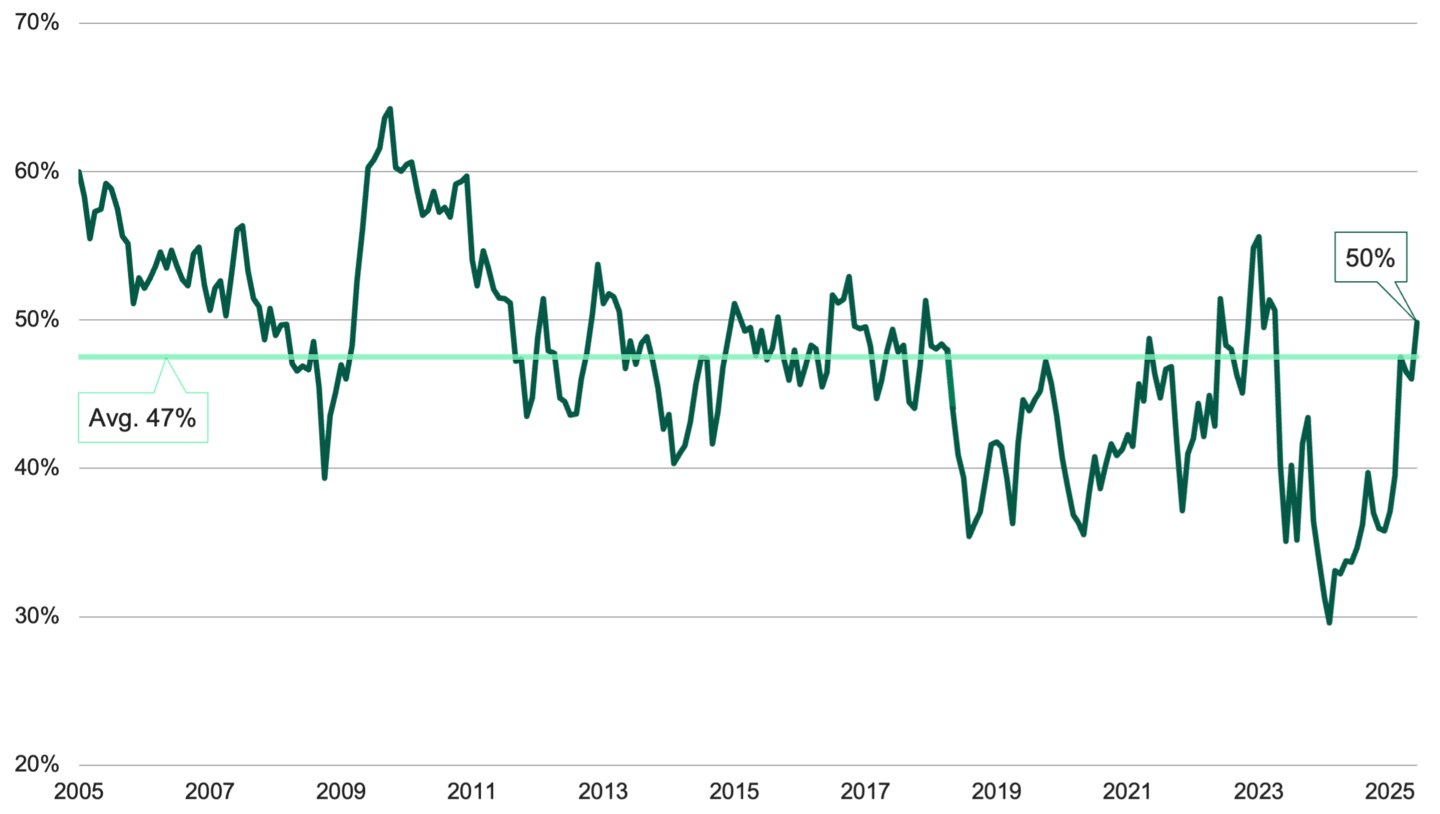

In recent years, a smaller percentage of companies outperformed the global index, especially in 2023 and 2024 (see Figure 1). In 2025, the trend started to reverse, indicating that more companies are recording above-average growth.

Figure 1 | Growth Expands to a Larger Group of Stocks

Data from 1/31/2005–5/30/2025. Source: American Century Investments. Past performance is no guarantee of future results.

Are the Magnificent Seven Stocks Losing Market Dominance?

The Magnificent Seven supplied a large percentage of S&P 500® Index returns over the past few years. These stocks traded with a high degree of correlation with each other, even though they had different business exposures and business fundamentals. This highly correlated performance worked to the disadvantage of active managers who differentiated across the names.

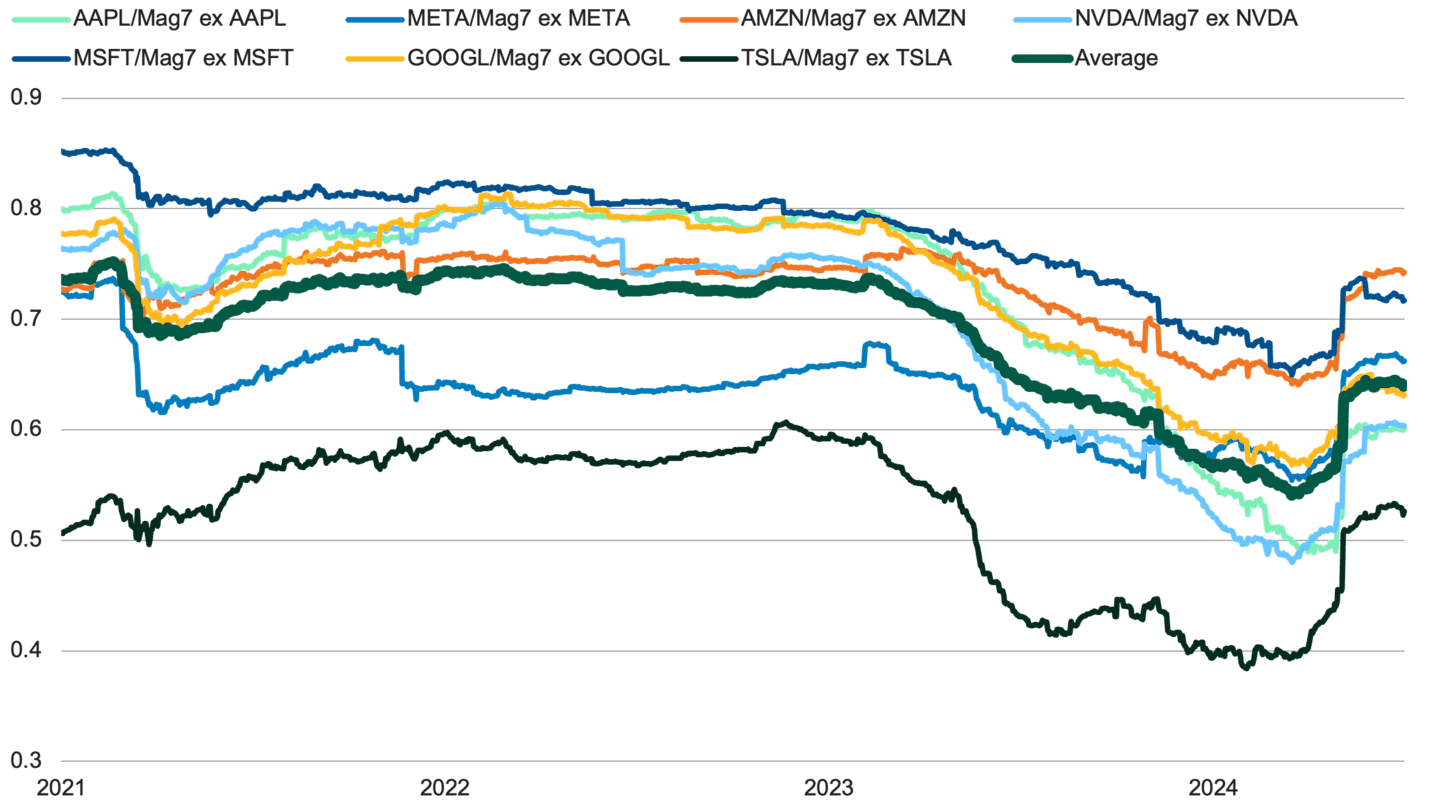

Today, we are starting to see the correlation between these seven companies weaken as equity prices begin to reflect the fundamental characteristics of individual firms. You can see this shift in Figure 2, which shows the average correlation between each Magnificent Seven stock against the other six stocks in that group.

Figure 2 | Magnificent Seven Stocks May Be Trading Less as a Group

Data from 1/1/2021–12/31/2024. Source: FactSet. Past performance is no guarantee of future results.

This softening trend suggests that investors are beginning to evaluate and price each stock based on the underlying company’s fundamental characteristics and growth trajectory.

Finding Growth Potential in Unexpected Sectors and Industries

We continue to see opportunities in the U.S., not just in the areas traditionally known for growth.

For example, we see increasing potential in sectors such as electric utilities. While utilities haven’t grown much in recent decades, that could change in the coming years. Electricity demand has been forecasted to rise thanks to artificial intelligence (AI), clean energy adoption, CapEx spending on maintenance and general economic growth.

We believe our investment process can shine in situations like this because we’re open to ideas that other asset managers may overlook.

Earnings Acceleration’s Key Role in Our Investment Process

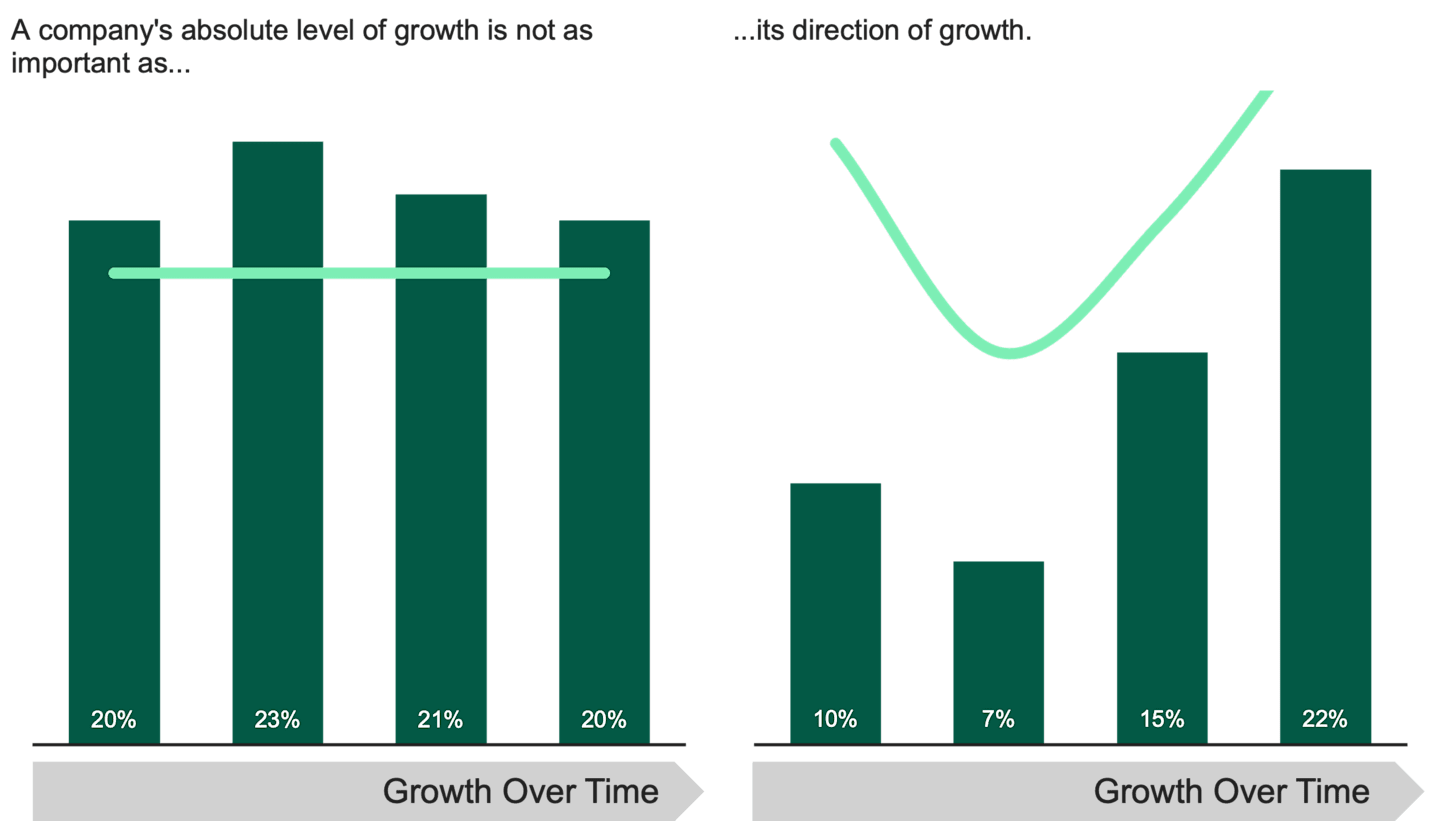

Our Global Growth team has a track record of finding opportunities in this broader opportunity set. We focus on identifying companies where the direction of growth is accelerating and fundamentals are improving. This contrasts with traditional growth approaches, which may emphasize the absolute level of growth or other backward-looking metrics.

Our process prioritizes earnings acceleration because research has shown that it is significantly associated with stock price movement.1

Figure 3 | Stocks With Accelerating Growth Could Outperform Over Time

Source: American Century Investments.

We also look for the cause of that improvement, whether it’s the release of new products, merger activity, cyclical tailwinds, a change in management or some other event. By doing so, we believe this helps us determine if the uptick in earnings is likely to endure.

We think this emphasis on earnings acceleration can create several advantages for investors.

Our portfolios are well diversified across regions and sectors because we seek earnings acceleration wherever possible.

We don’t limit ourselves to the fastest growers. We may take positions in companies with modest current growth so long as there is a catalyst for growth rates to accelerate. We seek to find these opportunities before the market fully recognizes the opportunity.

In our view, this approach is better than owning companies with high but flat or declining growth rates.

The Role of Active Management in Global Growth Strategies

Unpredictability has been the watchword for 2025. Trade policy, geopolitics, and other forces constantly introduce new uncertainty into the global investment landscape.

However, we think attractive opportunities still exist. Our asset managers can conduct thorough analysis and focus on taking advantage of opportunities quickly and nimbly. We believe our Global Growth strategies, with their fundamentals-first philosophy, are primed for this moment.

Authors

Explore Our Global Growth Equity Capabilities

Xiaoping Zhang, Ted Harlan, Jim Zhao and Richard Adams, “Revisiting Earnings Acceleration as a Source of Diversifying Excess Returns ,” American Century, 2021.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

©2026 Standard & Poor's Financial Services LLC. All rights reserved. For intended recipient only. No further distribution and/or reproduction permitted. Standard & Poor's Financial Services LLC ("S&P") does not guarantee the accuracy, adequacy, completeness or availability of any data or information contained herein and is not responsible for any errors or omissions or for the results obtained from the use of such data or information. S&P GIVES NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE IN CONNECTION TO THE DATA OR INFORMATION INCLUDED HEREIN. In no event shall S&P be liable for any direct, indirect, special or consequential damages in connection with recipient's use of such data or information.