Q4 Earnings Show Strength Heading Into 2026

Earnings Watch: Earnings growth in the fourth quarter remained positive across regions.

Key Takeaways

Tech firms plan for bigger AI outlays, but investors increasingly want to see a return on investment.

Revenue growth remained strong overall, although some areas experienced softer demand.

Mid- and small-cap companies are seeing accelerating earnings growth for the first time in a few years.

Corporate earnings improved during the fourth quarter as stocks capped a year marked by aggressive artificial intelligence (AI) spending, trade disruptions and other trends.

Leaders at many companies expressed a disciplined view during their earnings calls, but their outlook didn’t appear to be recessionary.

This quarter’s earnings highlights include:

Companies in the S&P 500® Index reported positive earnings growth led by information technology (IT), industrials and communication services.1 Most firms beat quarterly estimates. Consumer discretionary, materials and health care were areas of weakness.

European companies recorded stronger earnings growth compared to the previous quarter.2 Materials, communication services and financials were leaders. Consumer discretionary, industrials and energy were the weakest sectors.

In Japan, earnings growth was positive, with most companies surpassing estimates.3 Communication services, consumer staples and health care were areas of strength. Consumer discretionary, energy and utilities were the weakest.

Emerging markets saw positive growth led by IT, industrials and real estate.4 Consumer discretionary, communication services and utilities were weakest.

To gain a deeper understanding of the current market conditions and future expectations, explore our latest Investment Outlook.

Five Takeaways from Q4 Earnings Growth

1. Big Tech Accelerates AI Spending as Scrutiny Increases

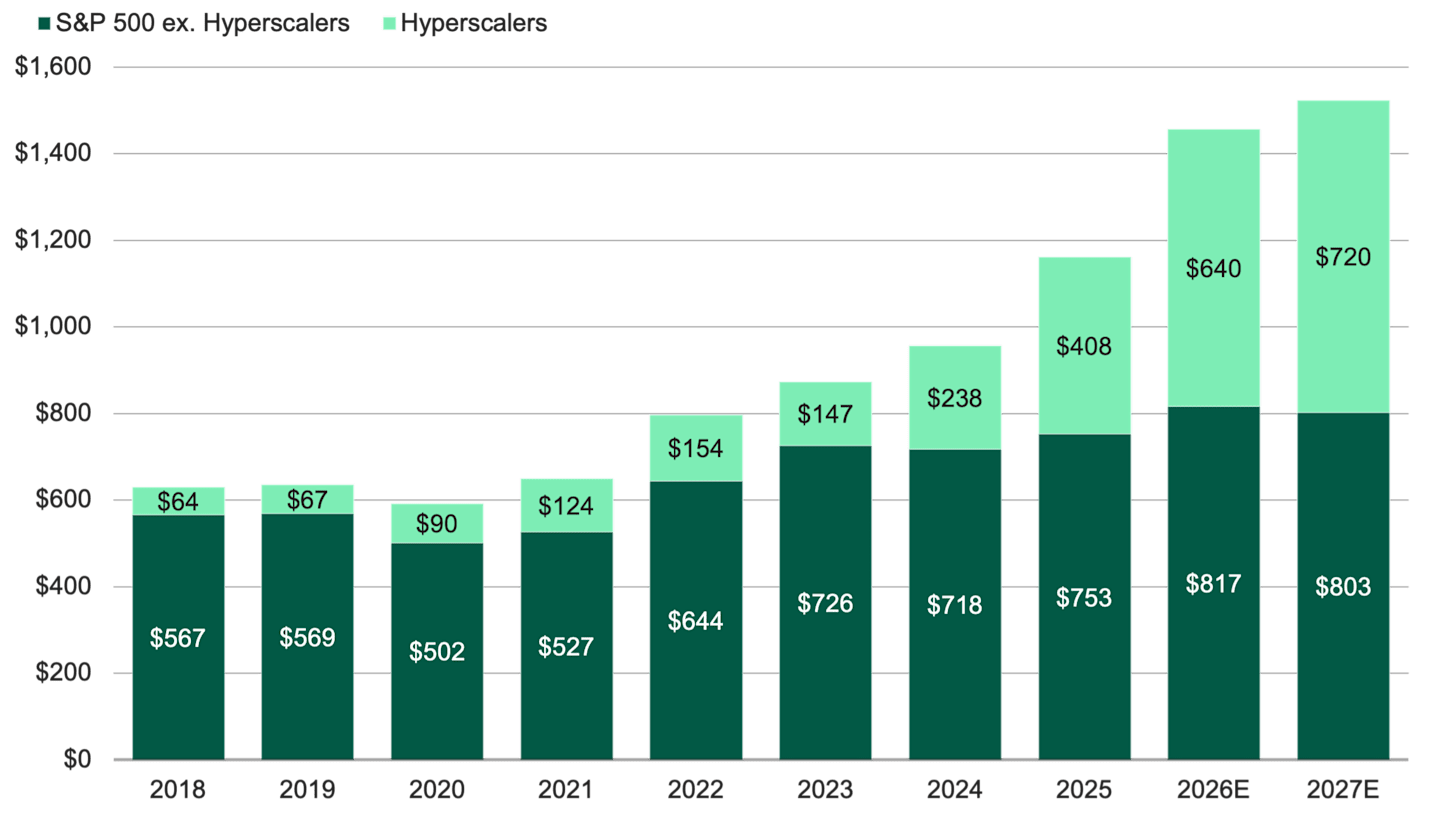

The largest technology companies plan to spend even more on AI-related capital expenditures in 2026 and beyond, as shown in Figure 1.

Figure 1 | Hyperscaler Spending Fuels Big Tech Companies

Capital Expenditures ($ Billions)

Data from 12/31/2018 – 12/31/2025. Source: FactSet, Company Reports. Hyperscalers: Amazon, Alphabet, Meta, Microsoft and Oracle. Estimates are as of 2/19/2026 and are subject to change. Forecasts are not a reliable indicator of future performance.

However, as AI spending rises, investors are increasingly focused on execution and monetization.

Microsoft shares declined after its latest earnings call, where executives reported higher-than-expected CapEx spending. Revenues beat expectations, but growth in its cloud business slowed.5 Microsoft execs also said demand is still strong.

Meanwhile, Meta Platforms also reported higher AI spending, but it also pointed to a 24% increase in revenue.6

Meta credited its AI investments with part of the win because its models have made its ads more efficient and effective.

“We are now seeing a major AI acceleration. I expect 2026 to be a year where this wave accelerates even further on several fronts.”

Mark Zuckerberg, CEO – Meta Platforms

2. Revenue Growth Continues Amid Softer Demand in Some Sectors

Overall, companies reported strong revenue growth for the fourth quarter of 2025. In fact, early results for the S&P 500 were the best since late 2022.7

Nearly all sectors enjoyed year-over-year growth, and three – information technology, communication services and health care – were headed for double-digit growth.

At the same time, we also spot potential signs of slowing growth.

Through mid-February, 74% of reporting companies had earnings-per-share that beat expectations, slightly below the five-year average of 78% and 10-year average of 76%.8

A growing number of companies are experiencing lower sales volumes, particularly in the consumer discretionary sector.

In some cases, price increases are helping offset softer demand. For example, Procter & Gamble and Mondelez have reported higher sales or revenues despite lower volumes.9

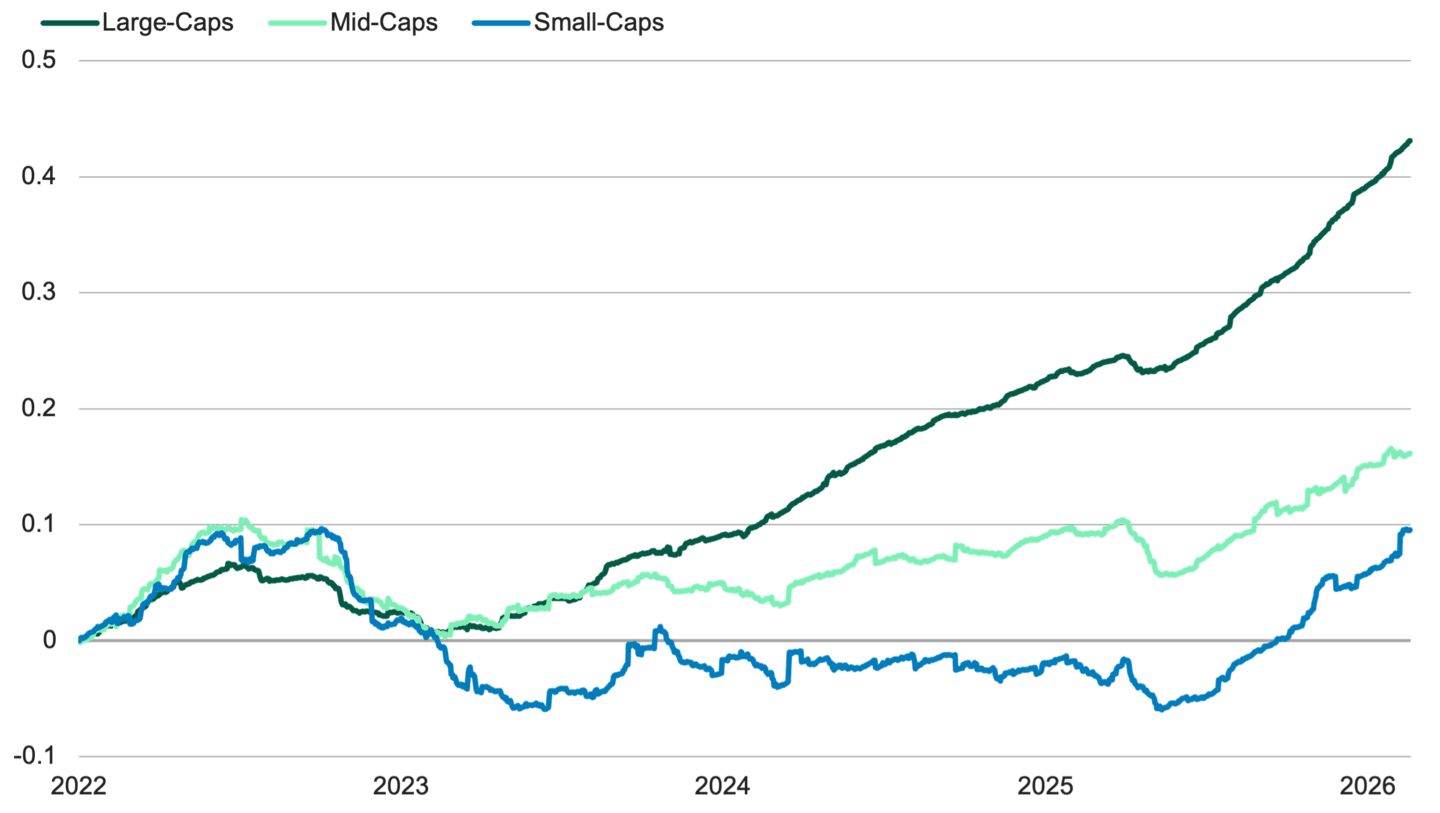

3. Earnings Growth Improves for Mid- and Small-Caps

After a period of relatively flat or declining growth, the earnings of small- and mid-size firms are starting to match the same upward trajectory of larger stocks. See Figure 2.

Figure 2 | Earnings Growth Rates Are Synchronizing Across Market Capitalization

Cumulative Change in Analysts’ Next-12-Month Earnings Estimates

Data from 1/3/2022 to 2/26/2026. Source: Bloomberg. Large-caps represented by the S&P 500® Index. Mid-caps represented by the S&P MidCap 400® Index. Small-caps represented by the S&P SmallCap 600® Index. Past performance is no guarantee of future results.

We think there are a few reasons this is happening.

Small- and mid-caps tend to have less exposure to international markets, so they might feel less pain from currency shifts. Reshoring efforts could help them, too.

Recent interest rate cuts may benefit smaller firms more because they often have more floating-rate and short-term debt.

Small- and mid-caps logged weaker earnings growth in 2024 and 2025. They may enjoy more favorable year-over-year comparisons.

4. Currency Shifts Complicate Results for Multinationals

Weakness in the U.S. dollar has created a new challenge for some firms, particularly non-U.S. companies that generate significant revenue in the U.S.

When they repatriate their earnings, moving them from U.S. dollars to a currency that has appreciated against the dollar, their results can look weaker than expected.

SAP, the enterprise software firm, noted that it reports results on a constant-currency basis, which adjusts for currency fluctuations.10 Doing so provides a clearer picture of true demand, the company argues.

Look at its cloud business. Using a constant-currency analysis, the value of that backlog rose 30% in 2025. Without accounting for currency differences, the increase was only 22%.11

It’s important to note that currency shifts can also act as a tailwind for some companies.

A recent analysis showed that S&P 500 firms that generated more revenue outside the U.S. did better than those whose revenue was mostly U.S.-based.12

5. European Banks Look to Build on Strong 2025

European banks experienced robust growth last year, as the EURO STOXX Banks Index rose roughly 76%.13

Societe Generale, for example, described 2025 as a “defining year” that set new records for revenues and group net income.14 BNP Paribas reported a “sharp acceleration” in the results for the fourth quarter. It also upgraded its outlook for 2028.15

The European Central Bank has cut interest rates, but they’re still above pre-COVID levels, supporting banks’ net interest income.

Several banks have also taken steps to improve their operations, and they enjoy good credit quality and capital positions.

Societe Generale has spent the last few years working to improve efficiency and profitability. BNP Paribas has cut its cost-income ratio by several percentage points since 2021 and is undertaking a new structural transformation plan.

Earnings Forecast: Growth Expected Across Regions in 2026

Analysts are expecting S&P 500 earnings growth of 10.98% in the first quarter and 14.25% for 2026 overall.16

Meanwhile, analysts expect emerging markets to deliver earnings growth of 17.45% in the first quarter and 26.88% for the year.17

Forecasts call for Japanese earnings growth of 36.44% in the first quarter and 10.59% for the year.18 In Europe, analysts predict earnings growth of 0.02% for the first quarter and 9.69% growth for the full year.19

Authors

Senior Client Portfolio Manager

Senior Client Portfolio Manager

Learn More About Our Global Growth Strategies

We focus on investing in companies with accelerating growth characteristics and earnings power.

FactSet, S&P 500 Index, as of 2/18/2026.

FactSet, MSCI Europe Index, as of 2/18/2026.

FactSet, MSCI Japan Index, as of 2/18/2026.

FactSet, MSCI EM Index, as of 2/18/2026.

Xavier Martinez, “Microsoft Earnings Prompt Tech Stock Selloff,” Wall Street Journal, January 29, 2026.

FactSet, Meta Platforms Q4 2025 Earnings Call, January 28, 2026.

John Butters, “S&P 500 Reporting Highest Revenue Growth in 3 Years,” FactSet, February 17, 2026.

John Butters, “S&P 500 Earnings Season Update: February 13, 2026,” FactSet, February 13, 2026.

FactSet, Procter & Gamble Q2 2026 Earnings Call Transcript, January 22, 2026; Mondelez International, “Mondelez International Reports Q4 and FY 2025 Results,” February 3, 2026.

FactSet, SAP Q4 2025 Earnings Call Transcript, January 29, 2026.

SAP, Fourth Quarter and Full-Year 2025 Results, Presentation Deck, January 29, 2026.

John Butters, “S&P 500 Companies With More International Exposure Reporting Higher Earnings Growth for Q4,” FactSet, February 9, 2026.

FactSet, EURO STOXX Banks Index, 1/1/2025 to 12/31/2025.

FactSet, Societe Generale Q4 Earnings Call Transcript, February 6, 2026.

FactSet, BNP Paribas Q4 2025 Earnings Call Transcript, February 5, 2026.

FactSet, S&P 500 Index, as of 2/18/2026.

FactSet, MSCI EM Index, as of 2/18/2026.

FactSet, MSCI Japan Index, as of 2/18/2026.

FactSet, MSCI Europe Index, as of 2/18/2026.

Forecasts are not a reliable indicator of future performance.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.

©2026 Standard & Poor's Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.