2026 REITs Outlook: Turning Headwinds into Tailwinds

Much like the broader market, certain areas of the real estate sector perform better than others. In 2025, listed REITs have outperformed broader equity indices and generated notable excess returns.

Key Takeaways

As the effects of the pandemic, inflation and rising rates wane, we believe that 2026 has the potential to revive REITs.

We think favorable macroeconomic trends, historically low valuations and tightening real estate supply may contribute to a strong year for REITs.

Ongoing trends like the growth of artificial intelligence (AI) and an aging population should benefit senior housing and data centers, in our view.

From a fundamental standpoint, 2025 was a good year for real estate investment trusts (REITs).

Key metrics used by investors to track REIT performance improved significantly in 2025. During the first three quarters of 2025, aggregate funds from operations increased by 6.2% compared to the same period in 2024. Similarly, net operating income rose by 4.7%, and total dividends grew by 6.3%.1

However, from an investment perspective, REIT performance was somewhat muted as investors focused on high-profile AI stocks for much of 2025. But as we move into 2026, signs indicate that the market may be broadening.

Many of the headwinds weighing on the sector over the past five years have eased, creating a compelling environment where REITs may likely offer an attractive combination of value, income and growth within a single sector.

What Could Make REITs Stand Out in 2026?

The post-pandemic environment was a multi-faceted challenge for REITs.

People stopped going to offices, prompting employers to reassess the amount of office space they would need going forward. Government restrictions on public gatherings buffeted retail real estate. The coronavirus posed a particular threat to elderly people, making senior housing a place to avoid. Supply chain disruptions hampered industrial REITs.

On a broader level, the economic threat posed by COVID triggered a wave of government stimulus. This led to inflation, which led to higher interest rates. Elevated interest rates are often poison for real estate, as they tend to increase financing and construction costs.

Many of the pandemic's worst effects have now reversed, becoming tailwinds for REITs.

Here are other key factors supporting our view of the potentially strongest outlook for REITs in a decade.

Macroeconomic Tailwinds: Rate Easing and Growth Signals

Despite ongoing predictions of peril, the U.S. economy remains stable. The unemployment rate has ticked up in recent months but remains low by historical standards. The Federal Reserve cut interest rates last year and is expected to continue easing monetary policy in 2026. Central banks in most key international markets have been even more aggressive in lowering rates.

We believe lower rates could lead to more favorable financing and refinancing conditions for REITs. The average weighted interest rate on total REIT debt was 4.1% in the third quarter of 2025, which is near historic lows.2

This means debt costs and access to capital could improve if rates continue to fall. And with REITs enjoying relatively strong balance sheets, payout ratios should be sustainable, and REITs could take advantage of opportunistic external growth or return capital to shareholders through share buybacks.

The average weighted term to maturity of REIT debt at the end of the third quarter was 6.2 years, indicating that maturity schedules are comparatively manageable.3

Additionally, midterm elections could boost real estate equities. Wells Fargo Securities research shows that, since 1990, real estate has been the top-performing sector during midterm years.

The 2026 elections will feature 36 gubernatorial races, as well as contests for the House and Senate. Elections can create policy uncertainty, and Wells Fargo Securities’ research suggests that real estate may benefit in such environments, as investors spot the highly visible cash flows and yields that REITs can offer.

Supply Contraction: Limited New Builds and Pricing Power

Developers struggled to add new supply to the market after the pandemic. Supply chain chokepoints increased the cost of construction materials, and higher interest rates complicated the pro formas for new development projects.

We expect this trend to continue, with new supply forecast to decline by 20% to 70% in key sectors, such as apartments, industrial, self-storage and senior housing.

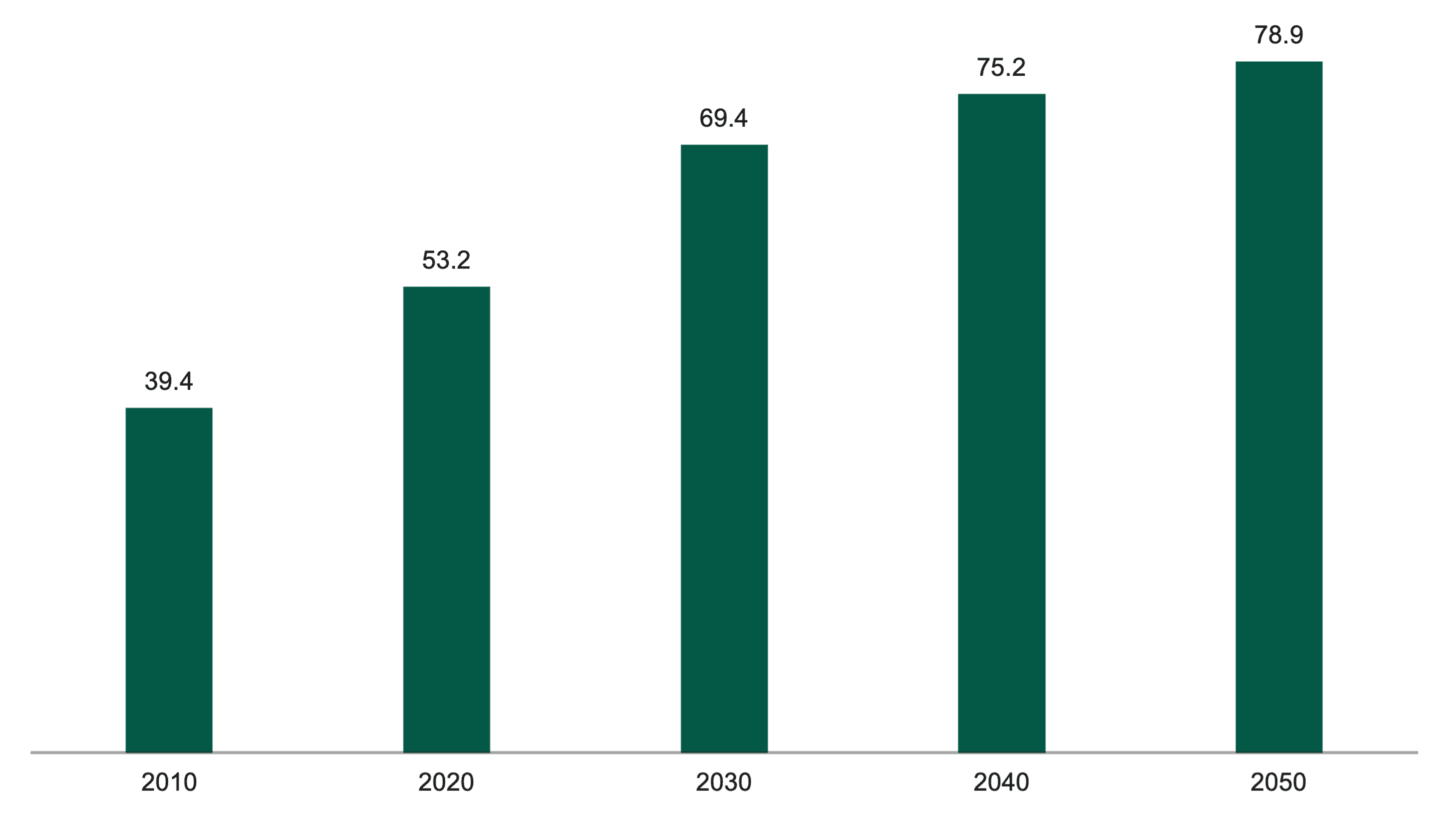

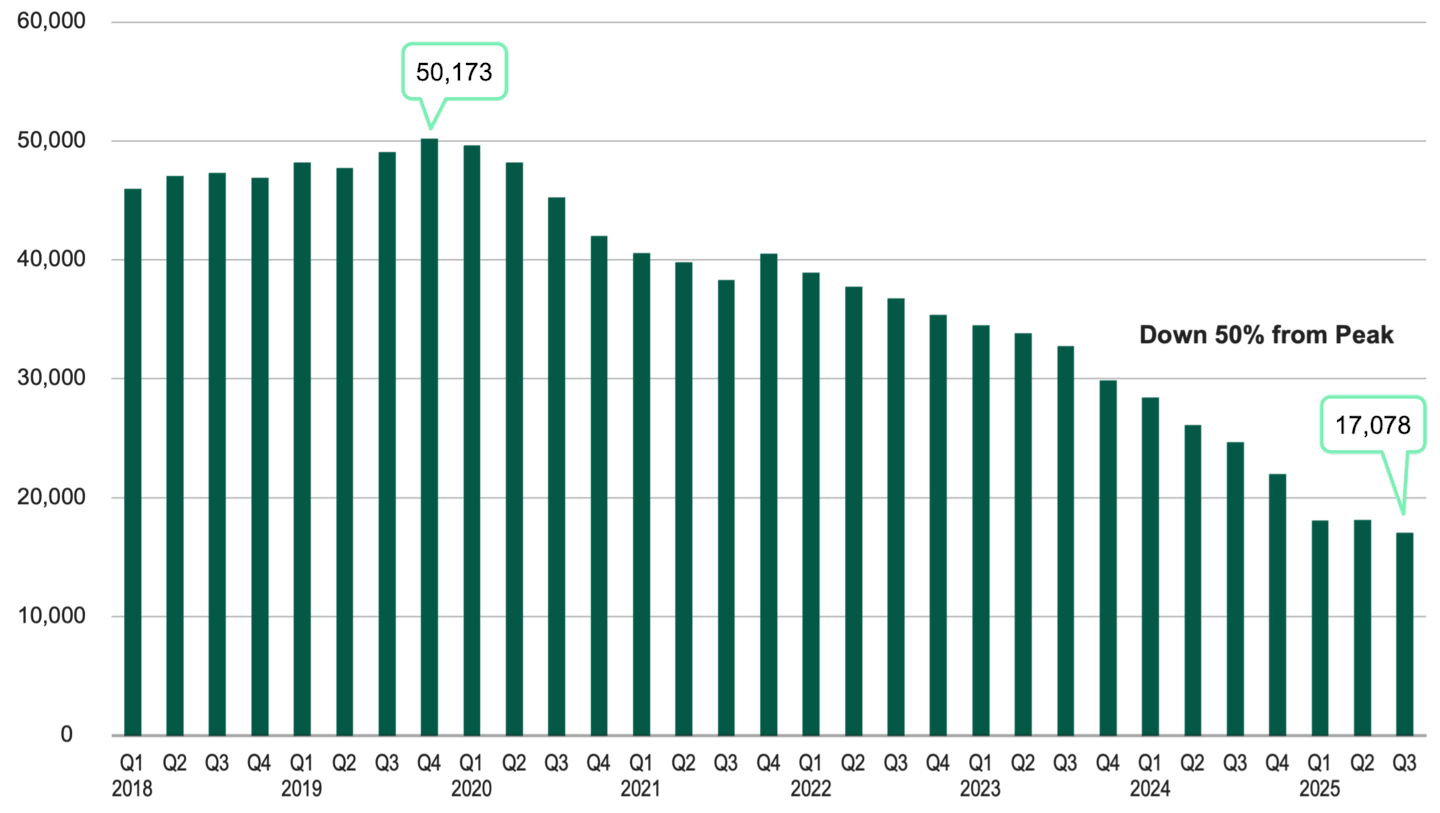

This has resulted in significant pricing power for owners of existing real estate, particularly in senior housing, where the U.S. senior population faces a declining supply of new construction. See Figures 1 and 2.

Figure 1 | U.S. Senior Population Continues to Grow

Estimates as of 2020. Source: U.S. Census Bureau.

Figure 2 | Senior Housing Isn’t Keeping Up with Rising Senior Population

Data from 1/1/2018 – 9/30/2025. Source: NIC MAP Data Service, Evercore ISI Research.

That, along with stable net operating incomes, has led to accelerating earnings growth.

We believe that health care, industrial and retail REITs could be the leading real estate sectors in growing their earnings and dividend distributions.

Secular Demand: Senior Housing, Retail and Data Centers

We have identified other areas within global real estate that may outperform for reasons beyond supply limitations. Here are three examples of sectors benefiting from different themes and trends.

Senior housing: Demographic trends indicate aging populations in the U.S., Canada, Western Europe and elsewhere, many of whom will move out of their homes to seek senior housing accommodations. Meanwhile, there has been a lack of new supply built over the past four years, which we believe creates long-term growth potential for health care REITs that own senior housing.

Retail: There’s a record imbalance in retail supply and demand that favors retail property owners. These properties also enjoy robust leasing pipelines, which enhance landlords’ pricing power. News reports suggest that consumers are reining in their spending. While this is true in some pockets of the consumer economy, like automobiles, retail spending remains strong. Resilient spending, coupled with a limited new supply of real estate, is supporting the retail sector.

Industrial/data centers: The continuing onshoring trend and expanding e-commerce demand should provide secular support for industrial REITs. AI continues to proliferate rapidly, which we expect to remain a tailwind for data center REITs.

Real Estate Forecast for 2026

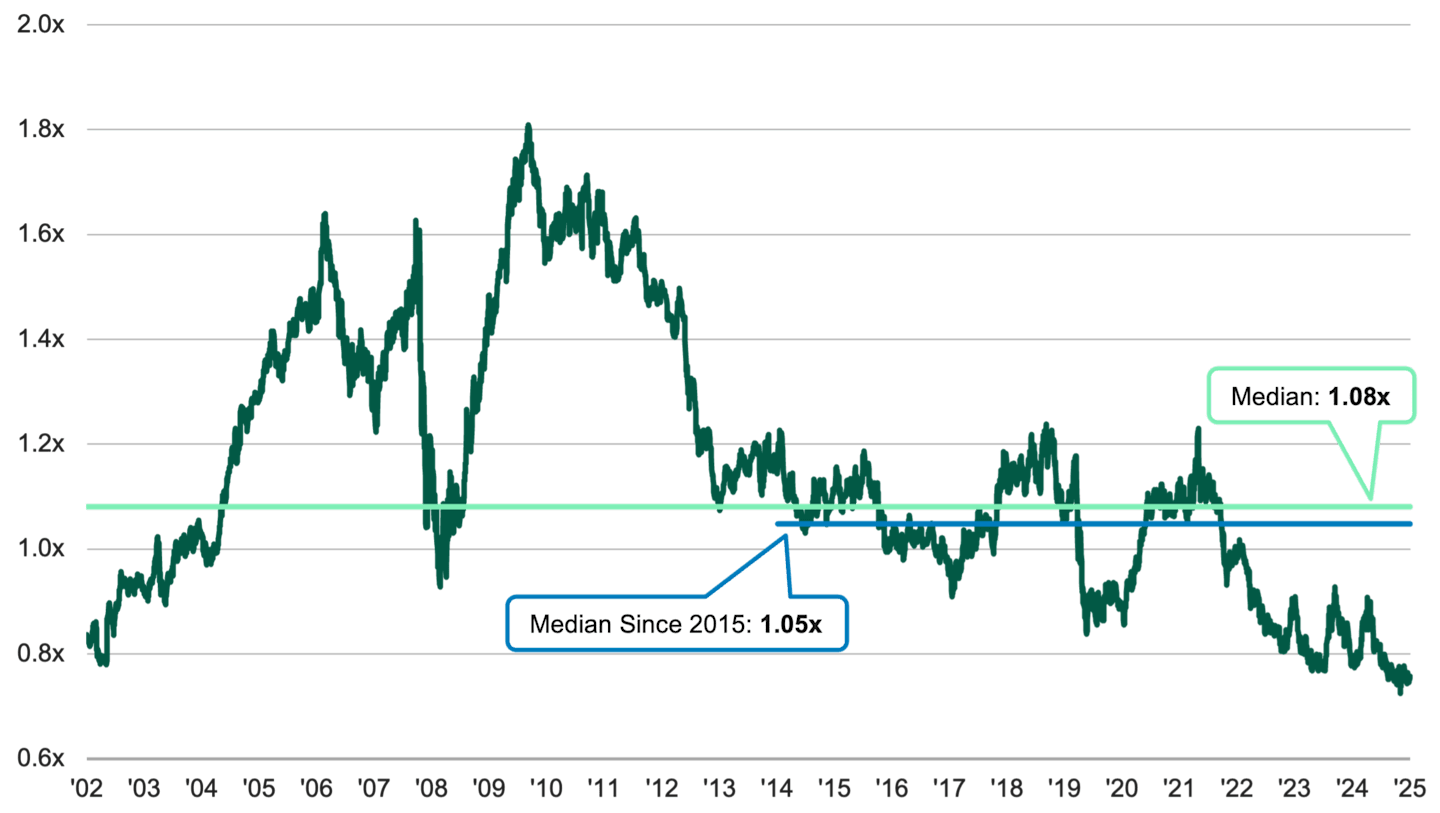

Going into 2026, we believe REITs are attractively valued compared to the broader equity market, as illustrated in Figure 3.

Figure 3 | S&P 500 Real Estate Relative Multiples Show Discounts in Real Estate

Data from 12/31/2002 – 12/31/2025. Source: FactSet, Raymond James Research.

We generally expect the global REITs asset class to deliver strong total returns in 2026, driven by 6% to 7% earnings growth and a 4% dividend yield. This is due to a tightening of supply across key property types, resulting in pricing power and rent growth.

Moreover, REIT balance sheets are generally robust, and their historically low valuations could offer a good entry point for long-term investors.

Authors

Senior Portfolio Manager

Portfolio Manager

Client Portfolio Manager

Explore Our Real Estate Capabilities

John Worth, “Converging Forces: REITs, Institutional Investors, and Global Real Estate in 2026,” December 8, 2025.

Jeanne Arnold, “REITs Deliver Solid Operational Performance; Balance Sheets Remain Strong,” Nareit, November 13, 2025.

Nareit, Nareit T-Tracker®: Quarterly Operating Performance Series,” accessed January 2, 2026.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.