Retirement Plan Savings Rates Are Up. Why Are Target-Date Funds Standing Still?

Plan sponsors may want to take a closer look at participant savings rates when evaluating TDF suitability.

Key Takeaways

We believe contribution rates in 401(k) plans have risen over the past 20 years, which could affect plan fiduciaries’ TDF suitability analyses.

The higher the savings rate, the less potential risk a participant needs to take with their retirement savings.

We believe choosing TDFs based on bull market returns can cause 401(k) plans with higher savings rates to take on greater potential risks for participants.

Good news: 401(k) savings rates have increased over the past 20 years, especially in the last five years.

While each retirement plan has unique characteristics that plan sponsors must consider, we believe many plan sponsors may not have fully considered how today’s higher savings rates affect target-date fund (TDF) suitability. Is this due to outdated assumptions, inertia or a lack of awareness about the significant role savings rates play in determining appropriate 401(k) equity allocations and glide paths?

Academic research on lifecycle investing since Samuelson (1969) and Merton (1969) has firmly established the well-known principles behind target-date investing, including the interplay of financial wealth and human capital in determining optimal equity allocations along the glide path.

More recently, novel research by a team of academics and practitioners, “On Optimal Allocations of Target Date Funds” (Gabudean et al., 2021), shows that TDF allocations should reflect savings rates, among other key characteristics about plan participants.1 Yet many plan sponsors appear to prefer TDFs that have delivered high returns in recent years, regardless of how much their participants are saving.

Plan sponsors who have focused on returns would probably favor TDFs with high equity allocations, as these returns have been calculated over a prolonged bull market. If that’s the case, using performance as the primary criterion may be too narrow an approach because it ignores savings rates and participants’ risk tolerance.

The U.S. Department of Labor Employee Benefits Security Administration says plan fiduciaries must periodically review the plan’s investment options to ensure that they are still appropriate, pointing out that, “If the employees don’t understand the [TDF’s] glide path assumptions when they invest, they may be surprised later if it turns out not to be a good fit for them.”2

In other words, returns are only one of several criteria that determine suitability.

Why Optimal Allocations and Savings Rates Are Inseparable

We believe optimal TDF allocations depend primarily on a plan’s savings rate. Holding all else equal, plan participants with a relatively high savings rate will accumulate more retirement savings over time than those with a relatively low savings rate.

However, the benefit of those higher savings only comes to fruition if all other factors are equal, particularly investment risk. Committed savers whose TDFs include overly aggressive equity allocations are more likely to experience losses in a market downturn, especially in the 10 years or so before retirement. In this case, if the market declines, their higher savings will not have the intended benefit due to sequence-of-returns risk.

Figure 1 compares two plan participants who initially earn $50,000 per year and whose wages/salaries increase 4% annually. Participant A saves 11% in a TDF that earns a 9% annual return. Participant B saves less — 10% per year — but earns more, 10% versus 9% annually.

Even after 15 years, Participant A still has more than Participant B and has probably experienced less stress during the market swings that occurred over the period. For these plan participants who were just starting out with no prior savings in their 401(k)s, our analysis shows it would take 17 years for the benefit of a 1% higher return to catch up to the benefit of a 1% higher savings rate.

Figure 1 | Higher Savings Rates Can "Outperform" Higher Returns

Comparing outcomes for two participants.

This data is for illustrative purposes only. Source: American Century Investments.

De-Risking for Plan Participants

Defined contribution (DC) plan fiduciaries should consider the interplay between savings rates and returns the way defined benefit (DB) plan sponsors consider the plan’s funding status. When a DB plan is fully funded, it typically reduces its equity allocations, de-risking the plan.

A 401(k) plan with a high savings rate is analogous to a DB plan that is close to fully funded (not the same, of course, but the analogy is reasonable). In this situation, we believe that TDFs with less risk would be more suitable.

Excessive risk in the form of high equity allocations is unnecessary for participants who are on track to meet their retirement goals. And while saving more is better than saving less, taking too much risk with those savings increases the likelihood of experiencing a consumption shortfall in retirement.

With this in mind, plans whose participants have moderate to high savings rates may want to reconsider using TDFs that have delivered high returns during bull markets without examining other suitability criteria. While strong returns are appealing, they could suggest an underlying misalignment with participants’ needs.

TDF Suitability and Today’s 401(k) Savings Rates May Be Disconnected

The relationship between savings rates and optimal TDF equity allocations is no secret, yet in practice, there is a significant disconnect between the two. Data from one of the largest 401(k) plan administrators show that average combined savings rates (including both employee and employer contributions) have risen markedly since 2005 — perhaps as much as doubling — to 14.1% in 2024.3

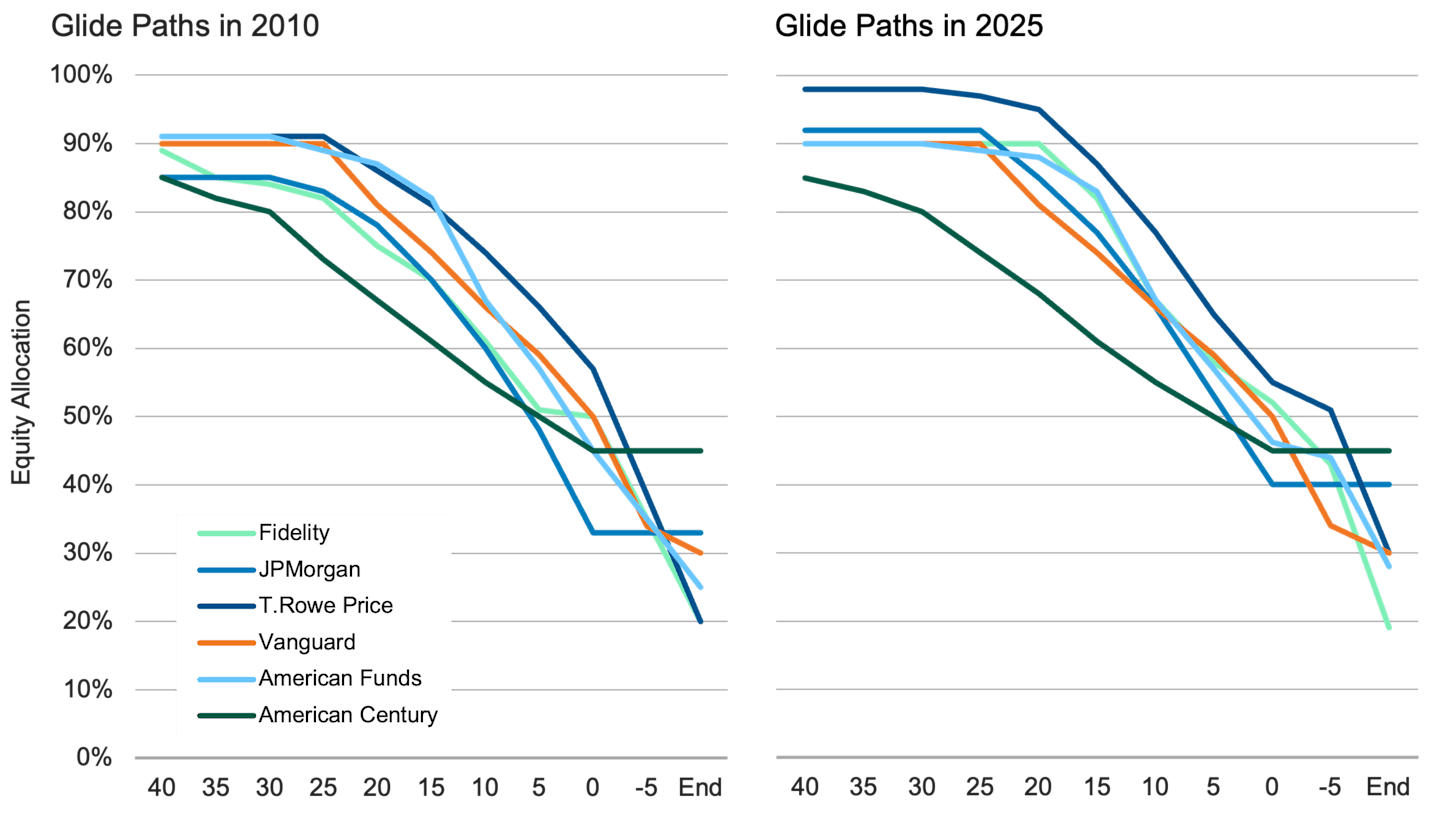

Nevertheless, most plan sponsors have not revisited their TDF selections to reassess suitability. In fact, even though savings rates have increased, equity allocations across TDF glide paths have become more aggressive, not less. See Figure 2.

Figure 2 | Equity Allocations in Many TDF Glide Paths Have Increased Despite Higher Savings Rates

Data as of 12/31/2010 and 6/30/2025. Source: Morningstar, fund prospectuses.

To satisfy the suitability requirement, we believe plans with higher savings rates, which increase their participants’ financial wealth with potential certainty, may need to consider more conservative TDFs.

In the research noted above, Gabudean et al. (2021) show that the increase in savings rates since 2005 should have led to a mass replacement of TDFs with aggressive equity allocations in favor of those with 15%–20% less equity.4

However, our proprietary model indicates that for employees with a moderate risk profile and more than 10 years until retirement, TDFs offered by some of the largest providers have equity allocations 13 to 25 percentage points higher than what our research suggests is optimal, given moderate savings rates (defined as 7%-12% for participants’ and employers’ contributions, combined).5 For plans with savings rates above 12%, TDF equity allocations can be as much as 30 percentage points higher than what we believe is optimal.

Balancing Risk and Return for Target-Date Funds

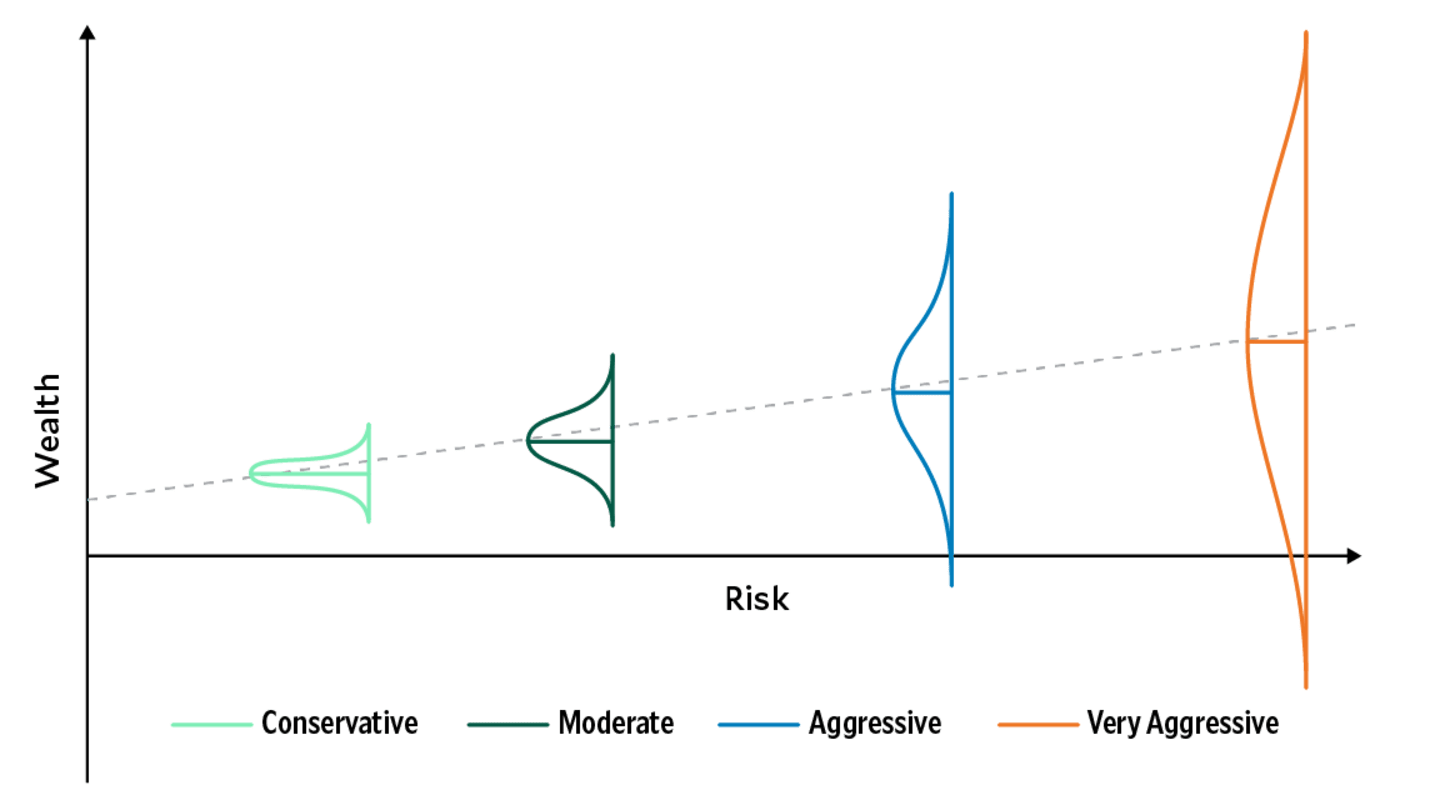

As Figure 3 illustrates, increasingly aggressive equity allocations in TDFs produce higher expected wealth at retirement, in terms of median outcomes. But medians (and averages) only tell part of the story. As equity allocations increase, the possible distribution of wealth outcomes grows wider and more uncertain.

TDFs with aggressive/very aggressive equity allocations greatly increase the chance that plan participants will enter retirement with savings that are either substantially above or below the median outcome. Ending up with higher-than-expected (above-the-median) returns would be great, but outcomes below the median are equally likely. TDFs with higher equity allocations, therefore, have the potential to leave a retiree no better off than a TDF with lower equity allocations.

Figure 3 | The Range of Outcomes for Plan Participants Widens as TDFs Take On More Risk

For illustrative purposes only.

It’s important to remember that many of today’s plan participants don’t know what it feels like to lose a big chunk of their retirement savings due to a combination of overly aggressive equity allocations and a bear market. The U.S. stock market has roughly tripled in value over the past decade, so loading up on equities has worked well over that time.6 But history is no guarantee of future performance, and no one knows when the next bear market will occur, or how long it will take to recover from the downturn.

Of course, the U.S. economy is remarkably resilient, and the stock market has always recovered from downturns to eventually deliver new highs. But for a given individual’s retirement savings, timing is critical.

Recall that the U.S. stock market had only just recovered from the dot-com era bust when the 2008 Financial Crisis began (that market downturn actually started in 2007). Combining those two periods resulted in a “lost decade” for equities that would have negatively impacted plan participants close to retirement and invested in TDFs with high equity allocations.7

The Role of Risk Tolerance in TDF Suitability

While plan participants can control their savings rates, they cannot control market returns or volatility. There’s also no way to know if or when the market will deliver heavy losses. When 401(k) plans consider higher equity allocations through TDFs, it's important to keep in mind the balance of risk and reward.

While these allocations can offer potential growth, participants should be aware of the associated risks, especially during market downturns. Plans with average savings rates can often find a balanced approach that aligns with their participants' needs without relying solely on aggressive equity investments.

In our view, the concept of suitability for retirement savings calls for adjusting investment risk on behalf of plan participants responding to the call to save more. This is especially important when we note that roughly two-thirds of plan participants classify their risk tolerance as “moderate.” In other words, for many individuals, the pain of losses is felt much more sharply than the “euphoria” of gains of equal magnitude.

Reassessing TDF Suitability for Today’s Participants

The suitability of glide paths in target-date funds must closely align with the evolving landscape of participant savings rates to optimize retirement outcomes and mitigate risk. As 401(k) contribution rates continue to rise, ERISA Plan fiduciaries may want to reassess their Investment Policy Statements and TDF selections to emphasize suitability in a way that reflects the reality of today’s savings rates and plan participants’ risk tolerance.

We believe that by aligning glide path equity allocations with current participant savings behaviors — instead of relying on past performance — fiduciaries can help their plan participants achieve their retirement goals.

Authors

Senior Retirement Strategist

Take a Closer Look at Our Multi-Asset Solutions

The journey matters as much as the outcome.

Radu Gabudean, “On Optimal Allocations of Target Date Funds,” Gabudean et al., Journal of Retirement, Fall 2021.

Employee Benefits Security Administration, U.S. Department of Labor, “Target Date Retirement Funds — Tips for ERISA Plan Fiduciaries.” February 2013.

Estimates of historical savings rates can vary as different plan administrators due to differences in the types of companies included, whether savings rates in discriminatory plans are included, the fact that fewer companies contributed to 401(k) plans 15+ years ago, and other factors. See “Fidelity: 401(k) Balances Little Changed Over 2011”, CNBC, February 2012, and “Average 401(k) Contribution Increased in 2011: Fidelity”, ThinkAdvisor, February 2012.

Radu Gabudean, Francisco Gomes, Alexander Michaelides, and Yuxin Zhang, “On Optimal Allocations of Target Date Funds,” Journal of Retirement, Fall 2021.

American Century’s proprietary Target-Date Blueprint using a hypothetical retirement plan with moderate savings rate and moderate risk tolerance.

Based on the Russell 1000® Total Return Index for the period 12/31/2014 to 12/31/2024.

Emelia Fredlick, “What We’ve Learned From 150 Years of Stock Market Crashes,” Morningstar, September 12, 2025.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.