Why Should Insurers Consider Securitized Bonds?

The securitized sector offers yield, quality and duration profiles that may help insurers meet their investment goals and policyholder obligations.

Key Takeaways

We believe the securitized sector offers compelling alternatives for insurance companies to expand opportunities and enhance portfolio management.

This diverse sector features securities with yield and diversification profiles that may help companies meet key investment and policyholder objectives.

We believe ABS are particularly attractive within the securitized market due to their potential advantages over traditional fixed-income sectors.

Insurance companies’ fixed-income investment portfolios have traditionally focused on high-quality corporate bonds to help achieve effective asset-liability management and other goals. Historically, these securities have generally satisfied their portfolios’ yield and quality objectives.

However, we think emphasizing corporates may sideline other goals, such as yield enhancement, duration strategy and diversification.

In our view, the securitized sector represents an attractive diversifier for these portfolios, offering a mix of features to help insurers achieve effective portfolio management. Many securitized bonds feature less duration risk than corporate bonds. Additionally, securitized securities have provided favorable yield and correlation profiles compared with corporate and government bonds.

Traditional Insurance Portfolio Allocations Limit Opportunity

Many institutional investors, including insurers, favor highly rated corporate bonds and other traditional bond sectors, including debt backed by the U.S. government and its agencies. These issuers comprise most of the Bloomberg U.S. Aggregate Bond Index, a popular benchmark for fixed-income portfolios.

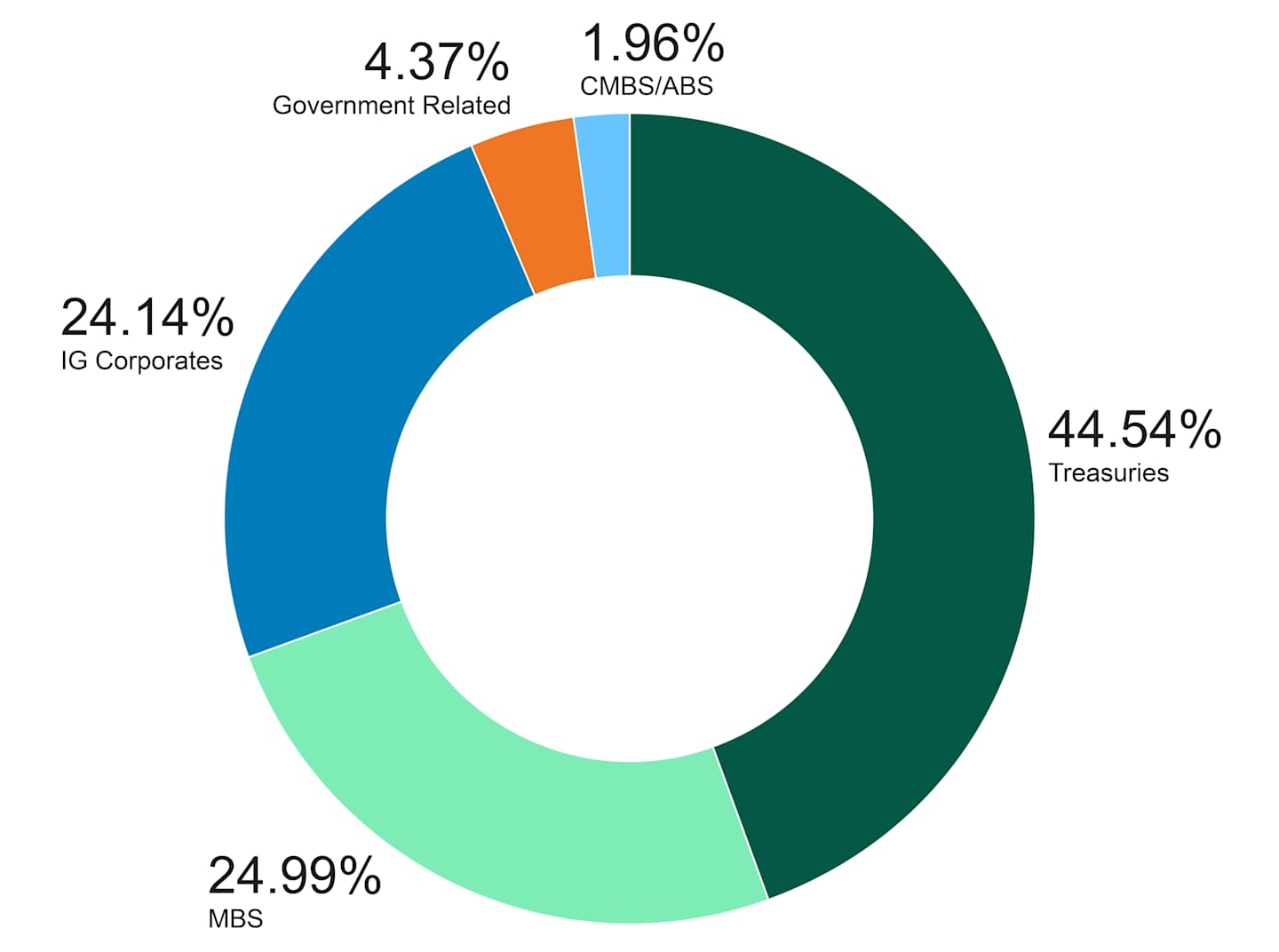

Meanwhile, asset-backed securities (ABS), commercial mortgage-backed securities (CMBS) and other structured debt make up less than 3% of the index. See Figure 1. Accordingly, portfolios tracking this widely used benchmark have little exposure to an important bond market sector.

Figure 1 | Treasuries, Government MBS Dominate the U.S. Bond Market

Bloomberg Barclays U.S. Aggregate Bond Index Weights by Sector

Data as of 3/31/2025. Source: FactSet.

Diversifying Insurance Portfolios Beyond Core Bonds

We believe the U.S. bond market makeup highlights compelling opportunities for fixed-income investors who want to expand their performance potential without sacrificing quality or liquidity. While the securitized sector represents only a sliver of the Bloomberg U.S. Aggregate Bond Index, it’s a large (yet underfollowed) component of the fixed-income market. With $14 trillion in outstanding securities, the securitized sector comprises approximately 23% of the total U.S. bond market.1

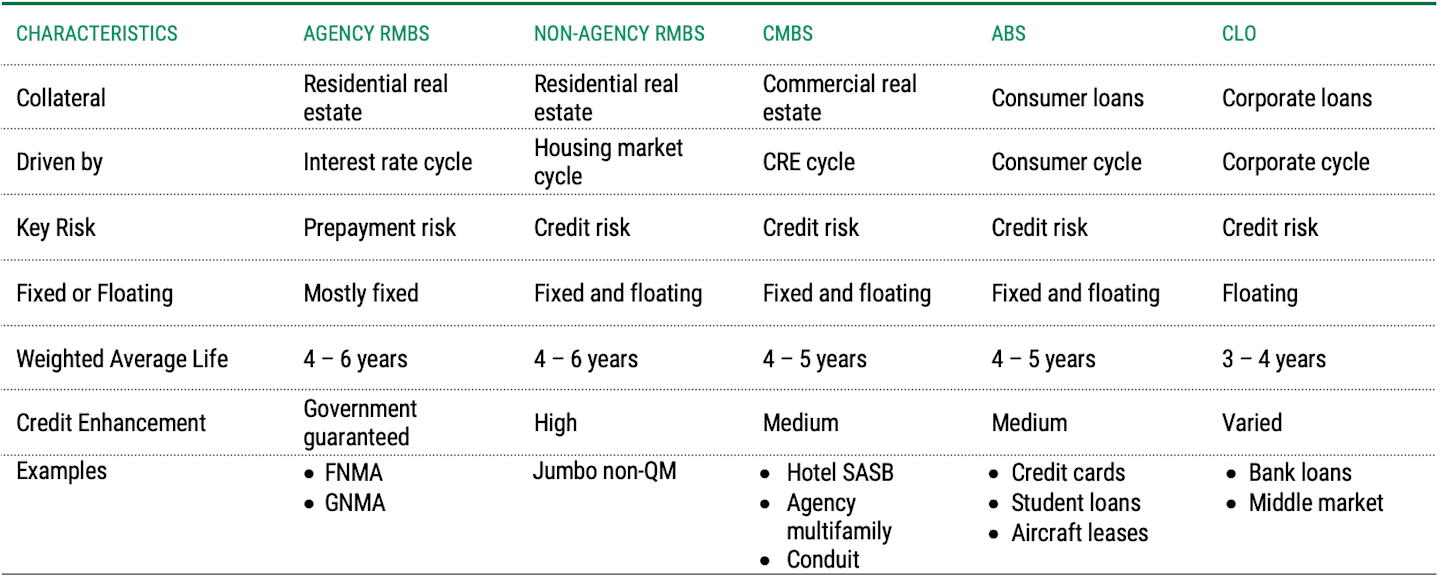

As Figure 2 illustrates, the securitized market includes a variety of securities representing different collateral, risks and yield opportunities.

Figure 2 | Securitized Products Offer Investors a Variety of Risk Exposures

Types of Securitized Credit

Data as of 3/31/2024. Source: SIFMA, American Century Investments. For illustrative purposes only.

We favor a flexible approach to the securitized sector, seeking to boost yield, reduce correlation and enhance risk-adjusted returns versus core assets. Our strategy seeks to deliver high-quality, diversified alpha with lower duration and higher yield. Additionally, clients can customize cash flows, yields and durations to meet their specific needs.

ABS Complement Corporate Bonds

Our broad securitized credit platform features the Non-Traditional ABS strategy, focusing on the largest and most diverse securitized subsector. ABS issuance has soared in recent years, reaching $389 billion in 2024, a 44% jump compared with 2023.2

We believe the broad ABS subsector merits greater attention due to its potential to deliver the following:

Diversification versus standard fixed-income sectors.

Higher yields and more predictable cash flows than many corporate bonds.

Lower default risk than high-yield corporate bonds.

Lower interest-rate sensitivity than traditional fixed-income sectors.

Investing Without Index Constraints

Most investors are familiar with traditional ABS, including bonds backed by various consumer loans and credit card debt. Securities backed by consumer debt generally comprise the ABS component of the Bloomberg U.S. Aggregate Bond Index.

We favor a broader approach that expands our ABS universe beyond index constraints. In our view, ABS backed by unconventional, underfollowed and under-allocated debt have typically offered more compelling opportunities for sophisticated portfolios. These esoteric ABS include debt backed by:

Aircraft leases.

Apartment rentals.

Data centers.

Timeshares.

Cellular towers.

Music royalties.

We believe alternative ABS complement portfolios with large corporate bond allocations. The non-cyclical and non-corporate characteristics of many ABS fortify the diversifying power of these securities. Incorporating collateralized loan obligations (CLOs) and other securitized bonds into the asset mix further enhances diversification and overall performance potential.

Highlighting the Role of ABS in Diversified Insurance Portfolios

ABS, CLOs and other securitized bonds generally offer higher yields than comparable-maturity government bonds. We believe focusing on select non-traditional, underfollowed investment-grade securities also delivers potential yield advantages versus corporate bonds. Additionally, because they represent pools of assets, ABS and other securitized securities are structured more favorably than corporate bonds, often with lower durations.

These differences highlight the yield, performance, credit quality and duration advantages our Non-Traditional ABS strategy strives to deliver to diversified portfolios.

Tranche Structure Promotes Credit Quality Alternatives

Due to their tiered issuance structure, investment-grade ABS typically have low default rates. In this structure, lower-rated ABS tranches absorb losses first, which helps boost the creditworthiness of higher-rated tranches. We believe this feature is particularly attractive in economic slowdowns, when high quality is often in high demand.

Furthermore, during periods of broad market volatility and uncertainty, many investors seek higher-quality fixed-income exposure for liquidity, risk management and equity market diversification. In our view, high-quality ABS may better fulfill that role than most corporate bonds.

Managing Interest Rate Risk with Lower-Duration ABS

ABS naturally amortize and pay down each month. Securities in higher tranches pay back principal to investors more quickly, given their priority in the tiered structure.

As a result, all ABS, and especially those in higher tranches, have lower expected durations than most fixed-income assets. Accordingly, we believe ABS can help temper the effects of ongoing interest rate volatility and help investors achieve more balanced duration exposure.

Savoring the ABS Sweet Spot

In our view, the investing “sweet spot” includes ABS tranches rated A and BBB, which typically offer sufficient spread and yield to:

Make the investments compelling relative to corporate bonds.

Potentially provide loss-absorption protection from lower-rated tranches.

Deliver exposure to principal paydowns that help keep durations relatively short.

By focusing on these tranches, we believe we can offer insurance portfolios an attractive alternative to corporate bonds with greater exposure to interest-rate volatility. This sweet-spot focus also highlights a potential advantage versus bonds with higher credit risk and lower yields.

How Experience, Access and Innovation Define Our Non-Traditional ABS Strategy

We believe the securitized sector offers appealing diversification, risk management and cash flow opportunities for insurers and other institutional investors. The sector’s diverse and complex securities differ from traditional government and corporate bonds, highlighting their complementary nature.

In our view, effectively managing a portfolio of securitized securities requires cutting-edge research, thoughtful analysis and an unwavering commitment to investor goals. American Century Investments’ Non-Traditional ABS strategy seeks to embody these qualities via:

1. Seasoned Investors

A team of securitized sector veterans actively manages the strategy, seeking attractive yield and return potential while managing risk. These professionals have guided portfolios through various credit cycles, building extensive deal structures and loan-analysis expertise, and strong trading relationships. The team combines fundamental research and scrutiny with innovative quantitative tools to assess macro, market and issuer data, ensuring portfolio positioning and performance meet expectations.

2. Unparalleled Service

Our securitized team collaborates with clients to build portfolios that meet specific goals. The team also regularly provides clients with insight into individual holdings, portfolio performance expectations and risk considerations. We believe this level of portfolio manager access and personal attention ensures our portfolios remain in sync with client objectives.

3. Proprietary Tools

Our strategy incorporates a proprietary system designed to highlight key opportunities and evaluate risk quickly. Our Securitized Credit Analytics (SCAN) tool is exclusive to our process, providing regularly updated metrics and constant surveillance of all portfolio holdings. SCAN also enables custom client reporting.

The Role of Securitized Assets in Institutional Portfolios

We believe securitized securities offer important features for fixed-income investors seeking to diversify their portfolios. We think they’re suited to enhance performance potential in institutional portfolios, particularly those with outsized corporate bond allocations.

Slowing economic growth and ongoing interest-rate volatility create a more challenging investment backdrop for many insurers. In our view, high-quality securitized bonds, particularly ABS, could provide more attractive and consistent yield potential than lower-quality corporate bonds. Additionally, we believe the shorter-duration profile of ABS further highlights the risk-adjusted opportunities available to investors.

Authors

Mindset Built for Market Uncertainty

We aim to provide the stability, steady income and risk management that asset allocators seek from their bond portfolios.

SIFMA, December 31, 2024.

SIFMA Research, “Quarterly Report: US Fixed Income 4Q24,” January 2025.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Investments in fixed income securities are subject to the risks associated with debt securities including credit, price and interest rate risk.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.