Supply Crunch Drives Success for Senior Housing REITs

A favorable supply-and-demand dynamic has made senior housing a strong performer in the real estate sector.

Key Takeaways

Senior housing REITs have thrived due to persistent supply shortages and strong demographic-driven demand.

Occupancy and pricing power remain high as construction lags far behind the growing need for senior housing units.

We believe these dynamics provide a stable and enduring tailwind for senior housing, a rarity in real estate investments.

Investing in real estate investment trusts (REITs) requires navigating a complex landscape of variables and risks.

One major factor to consider is REITs' sensitivity to fluctuations in interest rates. Consumer behavior can also play a significant role in determining the value of these investments.

For example, a shift toward online shopping can lead to a decline in the value of retail malls. Similarly, office tenants may find that older office building floor plans no longer meet their needs.

Given these dynamics, real estate investors are on the lookout for the rare, enduring growth trend in the sector. In today’s market, we think senior housing represents one of the strongest opportunities among REITs.

Senior housing REITs have thrived because there simply aren’t enough senior housing units to meet the growing demand. As the U.S. population ages, more people may need these facilities' specialized accommodations, yet new construction is lagging far behind.

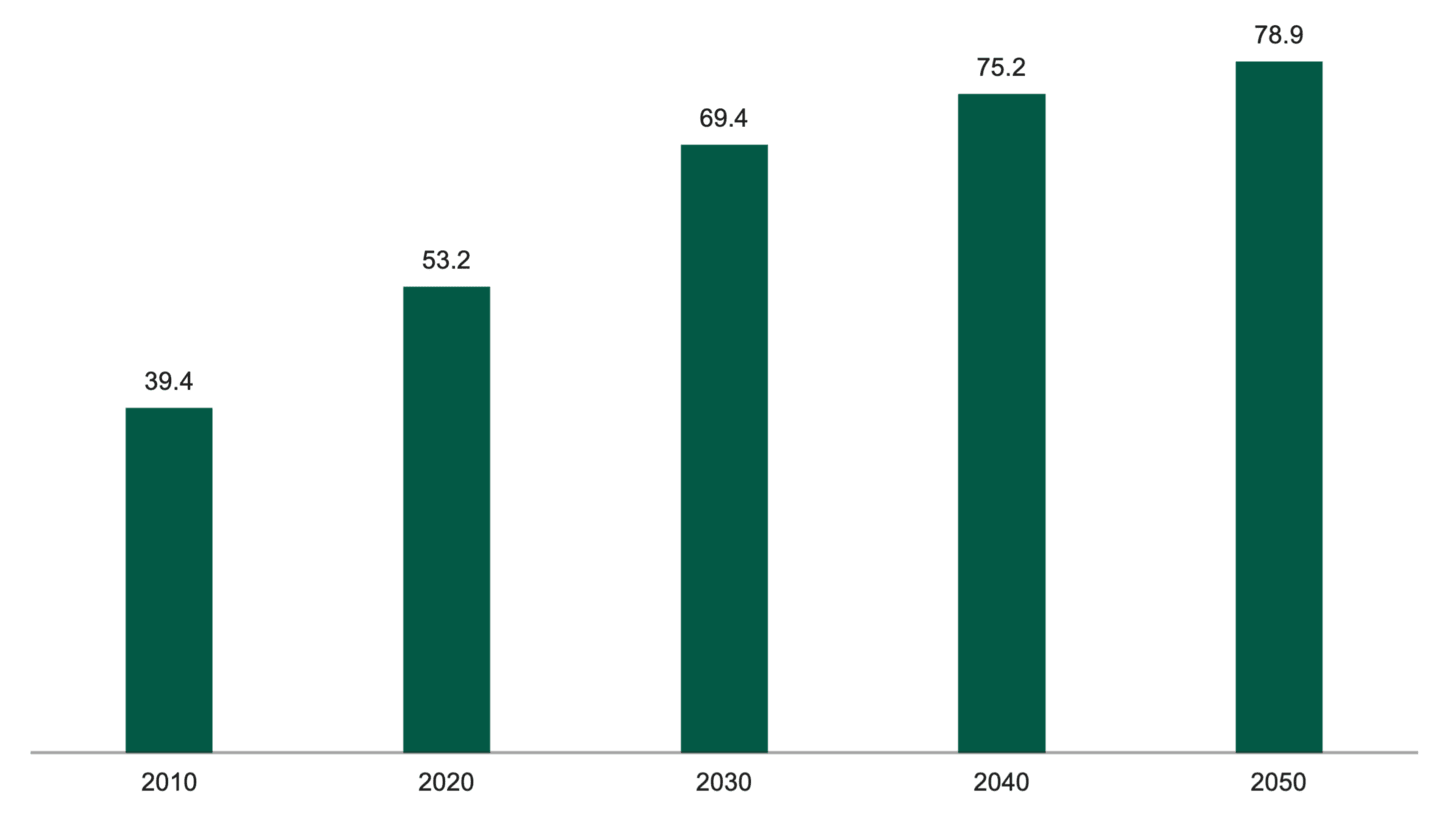

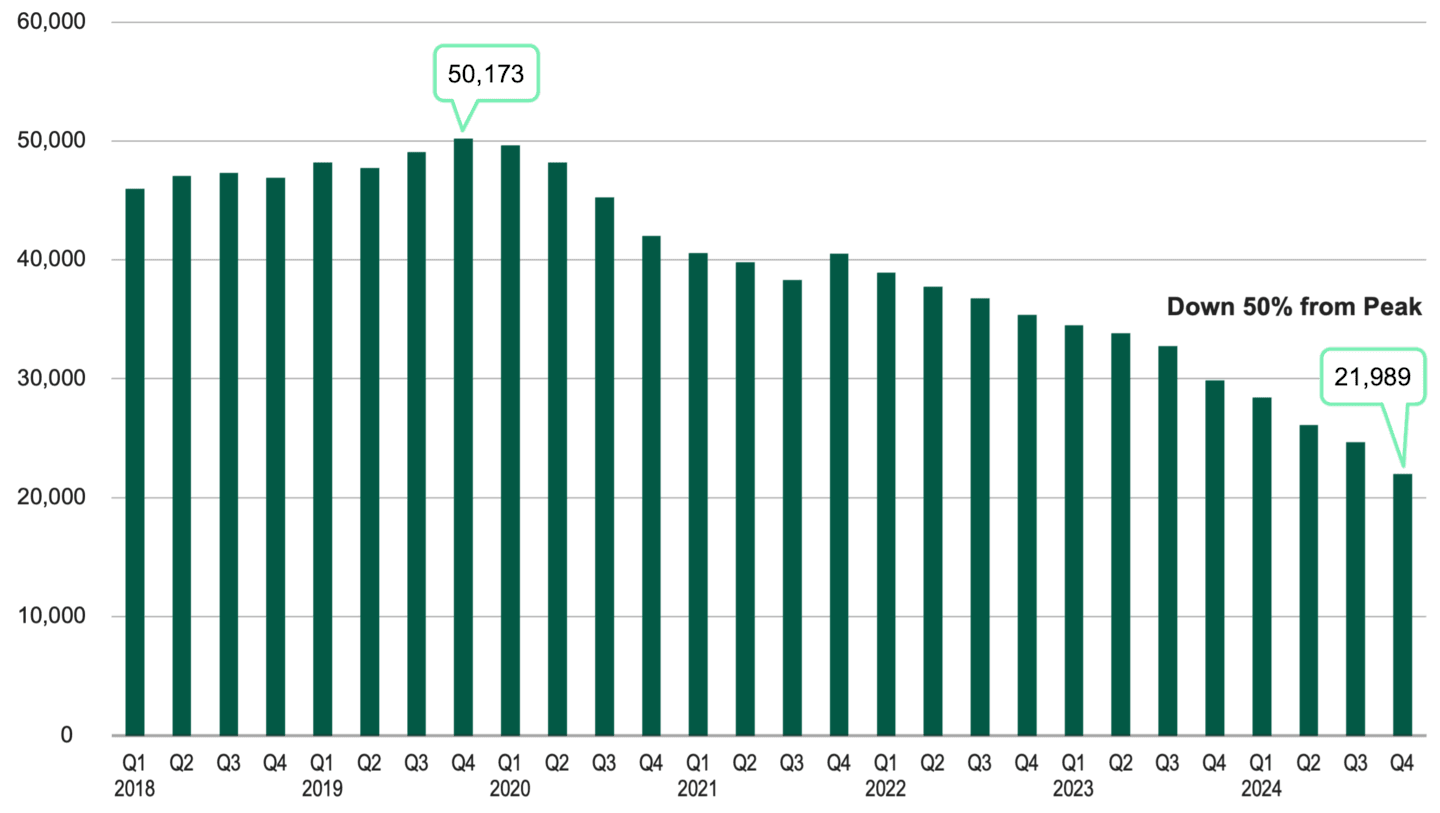

As shown in Figures 1 and 2, this supply-and-demand imbalance potentially gives current operators strong pricing power, allowing them to steadily increase rents and maintain high occupancy rates.

Figure 1 | The Number of People Turning 65 Is Soaring

Data as of 2020. Source: U.S. Census Bureau.

Figure 2 | The Number of New Senior Housing Units Is Dwindling

Data from 1/1/2018 – 12/31/2024. Source: NIC MAP Data Service, Evercore ISI Research.

Unlike other factors that might affect real estate values, the favorable dynamics behind senior housing aren’t likely to change soon. Building new senior housing takes time — developers can’t add new supply overnight.

According to the National Investment Center for Senior Housing and Care (NIC), the average time to construct a new senior housing community rose to 24 months in 2023, up from 16 months in 2015. Labor shortages, scarce building materials and limited financing options have slowed the timeline for building new senior housing.1

Demographic shifts also move slowly, often over many years or even decades. Right now, about 8,000 Americans turn 75 every day. By 2031, the number of individuals aged 75 or older is expected to reach 34 million, up from 27 million in 2025.

While most senior housing facilities set the minimum age for residency at 55, the average age of residents is much higher, around 86.2

We believe these factors combine to create a strong, lasting advantage for senior housing REITs.

How Senior Housing Became a Key REIT Trend

Our Global Real Estate team at American Century seeks to generate alpha by identifying long-term positive trends in real estate, whether by sector or region.

Our team saw an opportunity in senior housing and started taking a closer look at health care REITs in the second half of 2020. Senior housing faced significant challenges during this period. The COVID-19 pandemic severely impacted the sector, as senior communities house those most at risk from the virus in close quarters.

In the post-pandemic environment, the Federal Reserve drastically increased interest rates to tame inflation, which was driven by a period of extraordinary government stimulus. High interest rates, inflation and constrained supply chains for construction materials meant developers couldn’t build new senior housing units in meaningful numbers.

Inflation has come down in recent years, and supply chains have opened up. However, elevated interest rates, a barren financing landscape, and labor shortages mean that very few senior housing projects are under construction.

NIC reports that 100,000 new senior housing units need to be built each year until 2040 to meet the growing demand. However, only 4,000 new units are expected to open this year and next.

As a result, occupancy rates in senior housing, which are already high, may continue to rise. With occupancy remaining elevated, existing facilities will maintain strong pricing power.

Long-Term View on Senior Housing REITs

We believe this disjointed supply-and-demand dynamic supports senior housing REITs. It’s not just a U.S. phenomenon, as similar dynamics are serving as tailwinds for REITs in Canada and Europe.

Across the broader market, senior housing posted a 4.00% return through the second quarter, the highest among property types in the National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index. According to the NIC, senior housing outperformed the NCREIF index by 85 basis points in the second quarter.3

Looking ahead, we believe senior housing may have a durable advantage due to lasting supply constraints and demand fueled by long-term demographic trends.

Authors

Senior Portfolio Manager

Portfolio Manager

Client Portfolio Manager

Explore Our Real Estate Capabilities

Omar Zarahoui, “Rising Construction Durations in Senior Housing: Beyond the Pandemic Effect,” National Investment Center for Seniors Housing & Care, December 18, 2023.

Baker Tilly, “Trends in the Senior Living Industry,” April 20, 2022.

Caroline Clapp, “Senior Housing Posts Highest NCREIF Property Type Return in the First Half of 2025,” National Investment Center for Seniors Housing & Care, August 18, 2025.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.