UCITS

Global and emerging markets exposure through pooled funds

Overview

American Century Investments® currently sub-advises multiple UCITS Funds (Nomura Funds Ireland, plc), advised by Nomura Asset Management U.K. Ltd.

UCITS Funds

The Fund seeks to achieve an attractive risk-adjusted return by investing in a high-conviction portfolio of 30-50 global equity securities identified as exhibiting improving fundamentals and accelerating growth. Our active approach seeks to deliver performance above the benchmark through stock selection and not macro or sector allocations.

Benchmark: MSCI AC World Index

Inception Date: 7 November 20111

The Fund seeks to achieve an attractive risk-adjusted return by investing in global equity securities identified as exhibiting improving fundamentals and accelerating growth. Our active approach seeks to deliver performance above the benchmark through stock selection and not macro or sector allocations.

Benchmark: MSCI AC World Index

Inception Date: 14 April 20101

The Fund seeks to achieve an attractive risk-adjusted return by investing in emerging market equities across the full capitalization range identified as exhibiting improving fundamentals and accelerating growth prospects. Our active approach seeks to deliver performance above the benchmark through stock selection and not macro or sector allocations.

Benchmark: MSCI Emerging Markets Index

Inception Date: 30 August 20131

The Fund seeks long-term growth by investing much-needed capital in emerging market securities that are making efforts to improve their sustainability profile. The investment team leverages qualitative and quantitative metrics to identify and engage with companies that have improving sustainability profiles in an effort to generate alpha and drive real-world outcomes.

Benchmark: MSCI Emerging Markets Index

Inception Date: 4 March 2020

The Fund seeks to achieve an attractive risk-adjusted return by investing in small capitalization companies (as defined by MSCI) in developed and emerging markets across the globe. The Fund seeks to invest in companies exhibiting improving fundamentals and accelerating growth. Our active approach seeks to deliver performance above the benchmark through stock selection and not macro or sector allocations.

Benchmark: MSCI AC World Small Cap Index

Inception Date: 2 July 2019

A large cap investment seeking innovative, rapid-growth companies within a high-conviction portfolio. The strategy typically holds 30-45 holdings and focuses on generating long-term returns through stock selection.

Benchmark: Russell 1000 Growth Index

Inception Date: 30 June 2021

Availability, Literature and Daily NAV

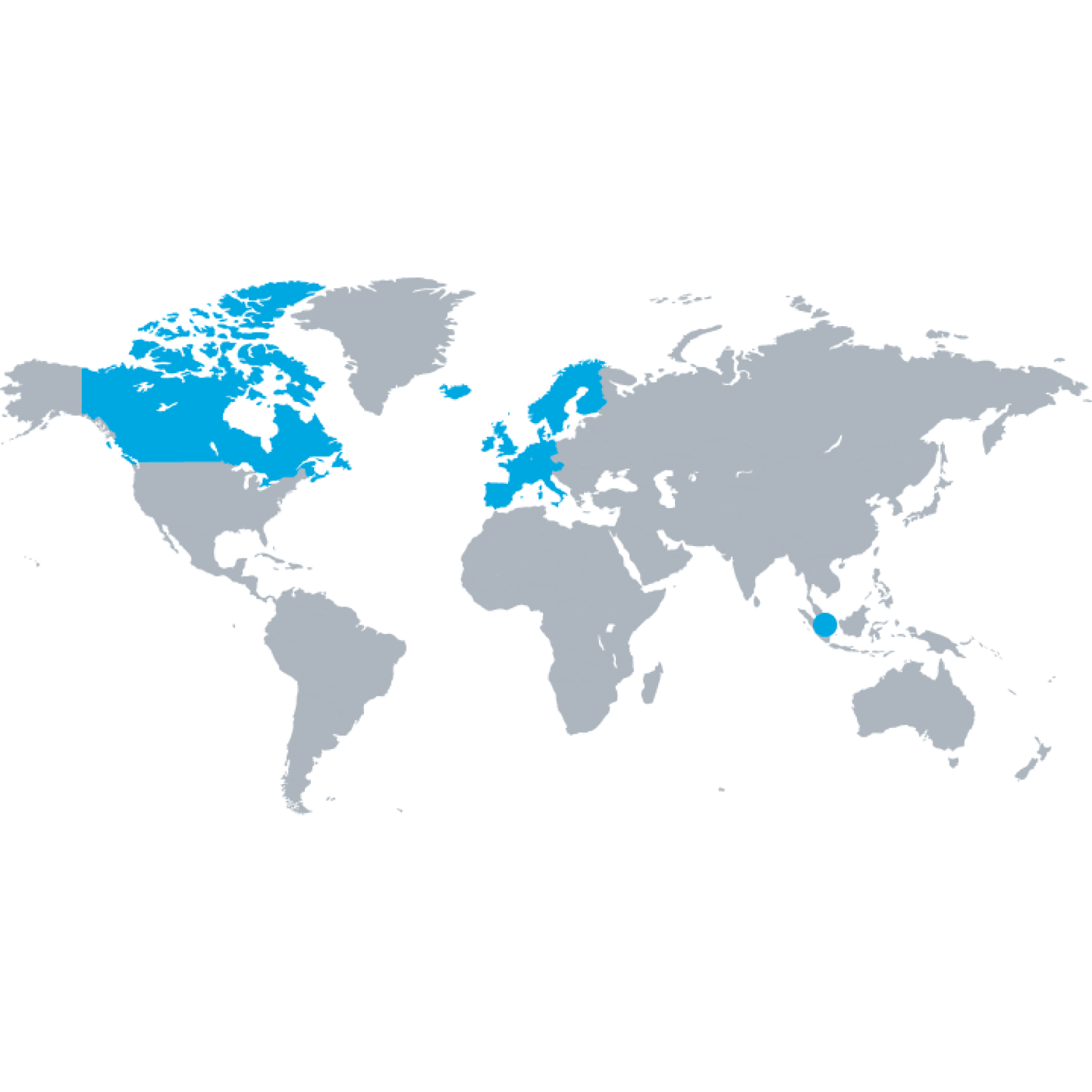

American Century Investments sub-advises UCITS Funds (Nomura Funds Ireland, plc), advised by Nomura Asset Management U.K. Ltd. The sub-funds have been authorised for sale in:

Austria

Belgium

Canada

Denmark

Finland

Germany

Iceland

Ireland

Italy

Luxembourg

Netherlands

Norway

Portugal

Singapore

Spain

Sweden

Switzerland

United Kingdom

If you are a resident of one of these countries, access the Fund Documents page to view:

Daily NAV on the UCITS funds,

a listing of the funds available in your country and

multi-lingual versions (if available) of Fact Sheets, Key Investor Information Documents, Prospectus and other relevant documents.

Breakthrough Medical Research

40% of Our Dividends Help Defeat Diseases

We have two powerful missions: To help our clients succeed financially and to fund life-changing medical research. 40% of our dividends go to our controlling owner, the Stowers Institute for Medical Research, an incredible place where scientists seek to defeat diseases that touch all of us. Like cancer. And Alzheimer’s.

American Century Emerging Markets Transition Equity Fund (previously named "American Century Emerging Markets Sustainable Impact Equity Fund"). Effective on 28 April 2025, the Sub-Fund has been re-named and re-classified as an Article 8 fund under the Sustainable Finance Disclosure Regulation (EU) 2019/2088 (SFDR). Details of the new strategy can be found in the pre-contractual Annex attached to the Sub-Fund's Supplement.

This fund launched on 2 August 2019, as a result of the merger of the American Century SICAV with Nomura Funds Ireland plc. The launch date refers to the launch date of the original fund.

The EU Sustainable Finance Disclosure Regulation ("SFDR") requires investment firms to formalise how sustainability is integrated into their business and processes, and to make public and client-facing disclosures on sustainability matters. The aforementioned disclosures relating to Nomura Asset Management U.K. Limited are published on our website at https://www.nomura-asset.co.uk/responsible-investment-asset-management/esg-sustainable-investment/ . Product related disclosures regarding Nomura Funds Ireland PLC and its sub-funds can be found in the prospectus. American Century Emerging Markets Transition Equity Fund is an Art. 8 fund according to SFDR. American Century Concentrated Global Growth Equity Fund is an Art. 8 fund according to SFDR. American Century Emerging Markets Equity Fund is an Art. 8 fund according to SFDR. American Century Global Growth Equity Fund is an Art. 8 fund according to SFDR. American Century Global Small Cap Equity Fund is an Art. 8 fund according to SFDR. American Century U.S. Focused Innovation Equity Fund is an Art. 6 fund according to SFDR.

The funds are sub-funds of Nomura Funds Ireland plc, which is authorised by the Central Bank of Ireland as an open-ended umbrella investment company with variable capital and segregated liability between its sub-funds, established as an undertaking for Collective Investment in Transferable Securities under the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011. The UCITS funds are not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Nomura Asset Management U.K. Ltd. is authorised and regulated by the Financial Conduct Authority.