Global Small-Caps Plug Into Higher Demand for Electricity

Smaller companies could help meet a pressing need for the world economy.

Key Takeaways

Global electricity demand is expected to grow in the coming years because of data center buildouts, increased electrification and other forces.

Aging power grids, supply chain issues and workforce shortages complicate efforts to meet this demand.

We think global small-cap companies could help meet the increased demand while navigating supply constraints.

The global demand for electricity is increasing, but constraints limit efforts to grow the power supply and distribution. Overcoming these constraints could help smaller firms that are building power plants, upgrading the power grid and addressing other needs.

Small-cap companies typically bring innovative ideas and the ability to pivot quickly to solve emerging challenges. This agility may prove especially valuable as global electricity demand surges.

Power-hungry use cases like artificial intelligence (AI), semiconductors, building electrification and electric vehicles (EVs) drive the need for more generation and efficient distribution. Small-caps could be well positioned to meet these needs — potentially creating significant opportunities worldwide.

How Much Is Global Electricity Demand Rising?

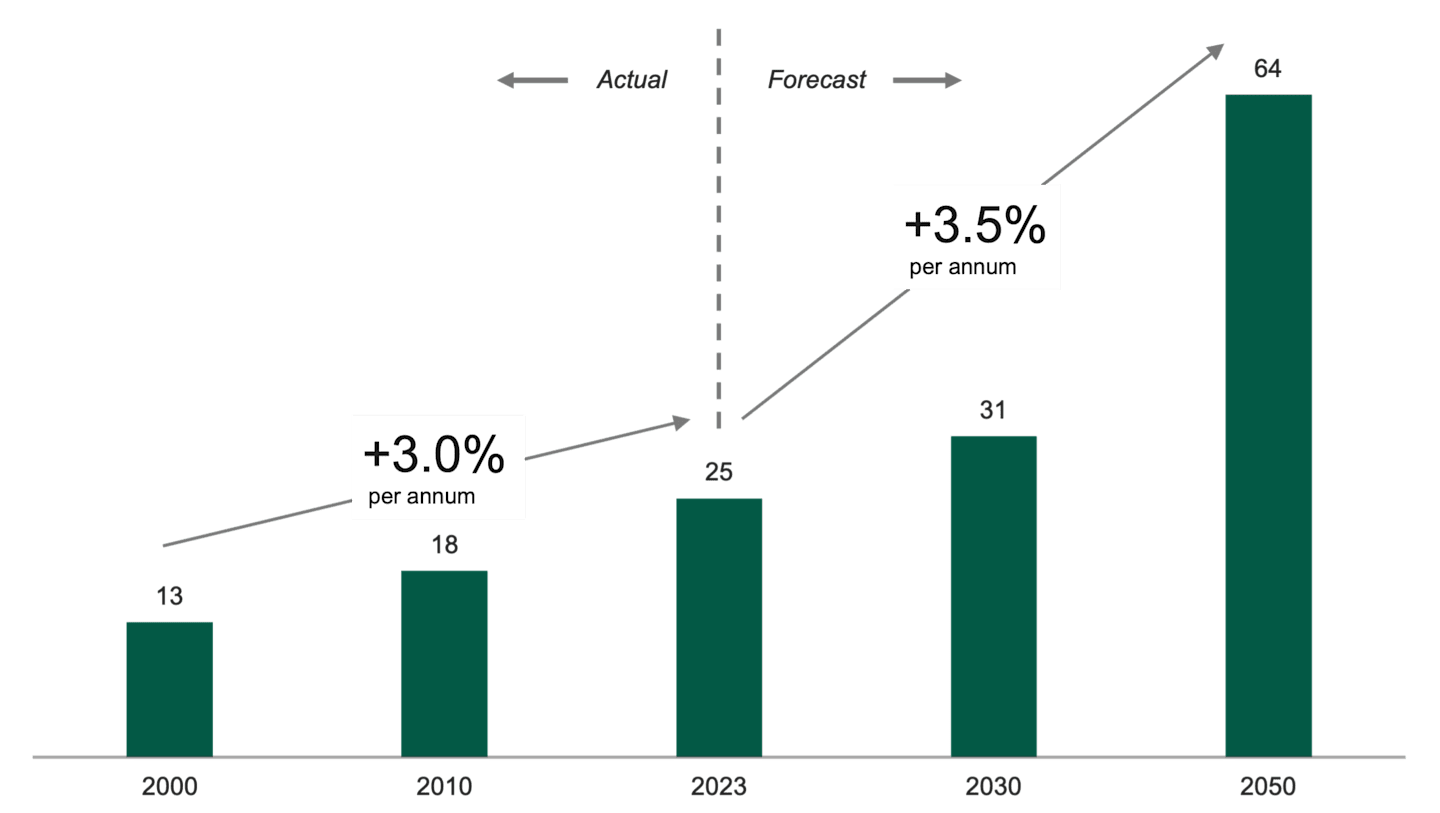

As Figure 1 shows, the worldwide need for electricity is expected to continue climbing over the coming years.

Figure 1 | Global Power Consumption Forecast to Climb Higher

Data as of 9/17/2024. Source: International Energy Agency, International Renewable Energy Agency and McKinsey & Co.

In the U.S., demand for electricity has seen modest growth in recent years, but that’s changing. Global tech provider ICF forecasts that demand will rise 25% by 2030 and 78% by 2050.1

Global growth drivers include:

Data center construction: More high-density mega data centers are being built worldwide to support AI-related demand. These centers consume massive amounts of power, and an International Energy Agency study concluded that their electricity consumption will double by 2030.2

Growing industrial demand: Emerging markets are using more power as their economies expand. In the U.S., the onshoring of manufacturing is a key driver of higher electricity demand.

Increased electrification: A larger portion of the world’s population now has access to electricity. Rising use of EVs, transportation, air conditioning and other devices drives demand, along with building electrification.

We also see idiosyncratic drivers in different markets. Take Europe as an example. Because of tensions with Russia, countries are working to diversify energy sources and modernize their power grids to manage demand growth and improve energy security.

What Factors Limit the Ability to Meet Electricity Demand?

Aging Power Grids

New power plants, wind farms and other projects are having difficulty connecting to the power grid. If a project isn’t connected to the grid, the power it generates can’t be shared with businesses, homes and other end users.

Some delays are due to time-consuming permitting processes. Grid capacity is also an issue: The system doesn’t always have enough lines and substations to carry the power generated by new facilities. As a result, there’s a sizable backlog of projects waiting for grid connections.

Last year, the International Energy Agency (IEA) compiled a list of solar and wind projects in advanced stages of development worldwide that are still waiting for connections. These projects represented about 1,650 gigawatts of generation capacity, which is more capacity than the U.S. alone had in 2024.3

Small-caps like Switzerland-based R&S Group are essential in modernizing the power grid by supplying key power and distribution transformers.

Supply Chain Delays

Some companies wait years for the components and equipment needed for construction and infrastructure projects. The industry is seeing a surge in orders, and many of these items require extensive customization, which delays fulfillment times.

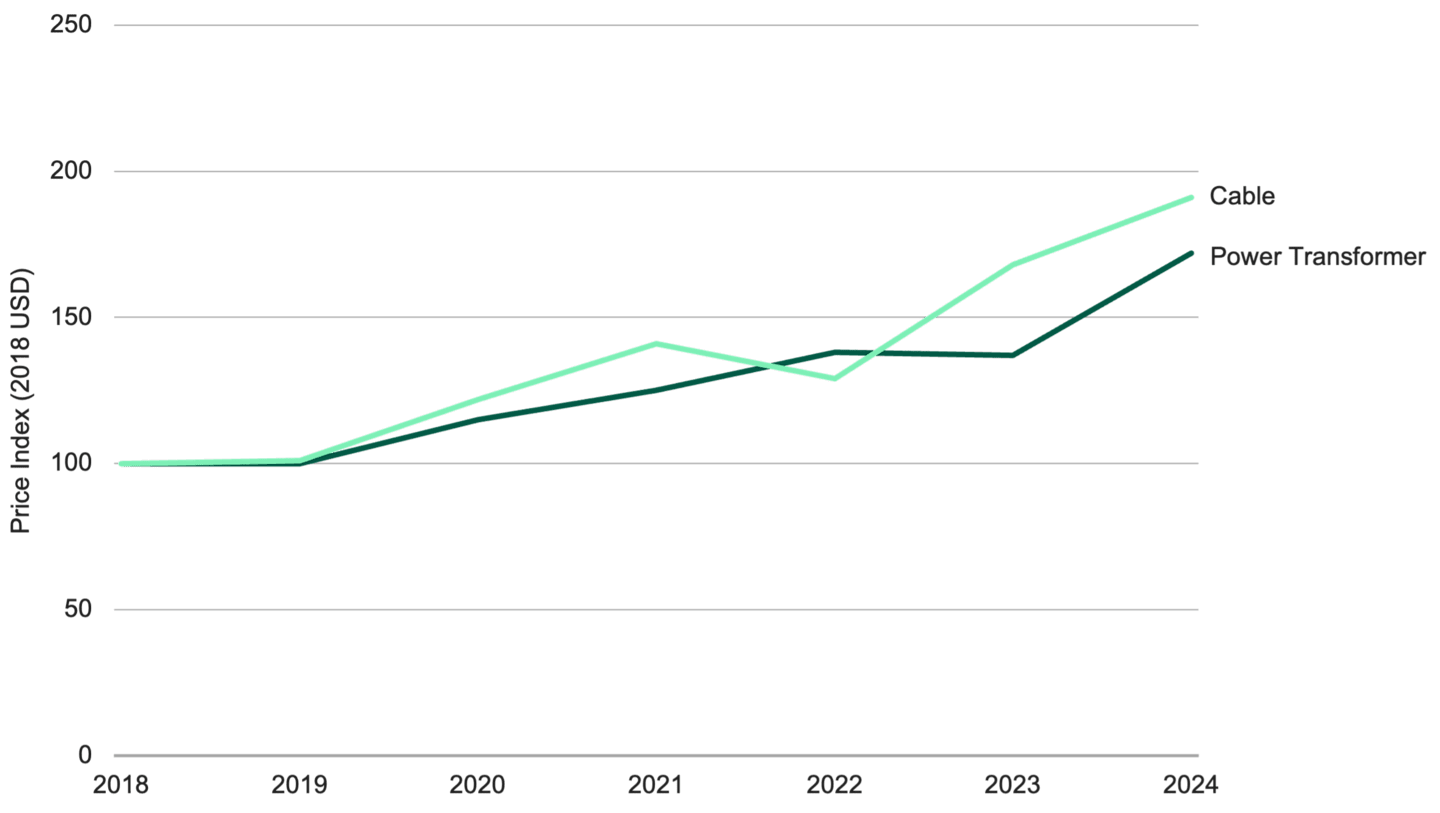

The IEA reports that procuring cables for transmission projects can take two to three years. The wait for large transformers can stretch to four years.4

At the same time, the cost of these components continues to rise, as noted in Figure 2.

Figure 2 | Transformer and Cable Prices Climb Higher

Data as of 2/24/2025. Source: International Energy Agency.

Skilled Workforce Shortage

As of 2023, about 8 million people globally worked in the power grid and storage sector. According to an IEA forecast, the workforce needs to grow by 1.5 million workers by 2030.5

How Could Global Small-Caps Benefit from Higher Electricity Demand?

Smaller Firms Often Offer Distinctive Innovations and Services

Some smaller companies, such as Mirion Technologies, offer expertise that are helpful in energy projects and grid upgrades. The firm offers instruments and control systems to ensure nuclear reactors operate safely and efficiently.

Mirion recently acquired Certrec, whose solutions help power-generating facilities manage regulatory compliance and lower risk.6 The company’s significance is demonstrated by the fact that every U.S. nuclear reactor facility uses Certrec solutions.

Specialty engineering and design firms may also benefit from higher demand, as their know-how could accelerate the review and permitting process for new projects.

Domestically Focused Small-Caps May Have an Edge

Governments incentivize energy projects that use domestically produced goods in some countries and states.

For example, the Inflation Reduction Act of 2022 offered tax credits to projects that included steel, iron or manufactured products from the U.S.7

These programs could help small-caps, which typically focus more on their home markets.

The Upside Might Be Larger for Smaller Companies

We think smaller firms are more likely to benefit materially from surging electricity demand.

Compared to a larger company with several business lines, a typical small-cap firm generally concentrates on just one or two areas. Therefore, a surge in demand in one of these areas can significantly impact the smaller company’s earnings.

At the same time, small companies participate in essentially every aspect of electrification. By owning global small-caps, investors can gain exposure to higher earnings growth at a more attractive valuation.

However, not all the companies exposed to this trend will deliver profitable growth. Their competitive positioning, balance sheet strength, management and track records still matter.

What Are Some Specific Opportunities for Small-Caps?

Infrastructure Development and Modernization

Energy construction projects tend to be very large, and smaller companies play key roles thanks to their specialties.

For example, SPIE Global Services Energy designs installs, and maintains energy infrastructure. The firm has detailed knowledge of renewables and energy-transition projects.

Grid projects boost demand for companies that supply the necessary metals and materials, such as mine operator Capstone Copper or mining and mineral processing equipment provider Weir Group.

Nuclear Services

The world could set a record for nuclear power generation this year, and more nuclear plants are under construction.8

New technologies like small modular reactors (SMRs) may offer an important source of growth. SMRs provide standalone and continuously available energy, combined with production efficiency and low carbon footprints.

This supports demand for companies involved in plant design, nuclear technology development and environmental remediation, including AtkinsRéalis.

Related Products and Services

Other companies have seen increased demand due to their expertise in power and backup systems for critical infrastructure, industries and various applications.

Finning, a dealer that sells, rents and services equipment and engines, is one such example. Its power systems business provides critical backup solutions to data centers.

An Expanding Role for Global Small-Caps

Based on current forecasts, rising electricity demand supports greater economic growth in the coming years. Meeting this demand is crucial for companies involved in AI, EVs and the global economy overall. We believe small-cap companies will likely have an important role to play in this effort.

Authors

Senior Portfolio Manager

Senior Client Portfolio Manager

Explore Our Global Small-Cap Capabilities

ICF, “Electricity Demand Expected to Grow 25% By 2030,” Press Release, May 20, 2025.

Thomas Spencer and Siddharth Singh, “Energy and AI,” International Energy Agency, April 2025.

Yasmina Abdelilah, Ana Alcalde Báscones, Vasilios Anatolitis, Heymi Bahar, and Piotr Bojek, et al., “Renewables 2024,” International Energy Agency, October 2024; Lindsey Buttel, “America’s Electricity Generation Capacity, 2025 Update,” American Public Power Association, April 2025.

Alana Rawlins Bilbao and Tim Gould, “Building the Future Transmission Grid,” International Energy Agency, February 2025.

Alana Rawlins Bilbao and Tim Gould, “Building the Future Transmission Grid,” International Energy Agency, February 2025.

Mirion Technologies, “Mirion Acquires Certrec, a Leader in Regulatory Compliance and Advanced Digital Applications for the Nuclear Industry,” Press Release, July 31, 2025.

U.S. Internal Revenue Service, “Domestic Content Bonus Credit,” May 29, 2025.

Eren Çam, Marc Casanovas, and John Moloney, “Electricity Mid-Year Update 2025,” International Energy Agency, July 2025.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.