What Trends Are Guiding Global Small-Caps in 2026?

Higher demand across multiple industries points to a stronger year for many smaller companies.

Key Takeaways

We believe rising energy demand from AI, reshoring and industrial upgrades is creating strong growth opportunities for global small-cap companies.

In our view, Europe’s expanding defense and infrastructure budgets, plus Japan’s pro-growth policies, are helping set the stage for stronger small-cap performance.

Improving supply chains, higher M&A and IPO activity, and attractive valuations may position small-caps for accelerated earnings growth in 2026.

Global small-cap equities are gearing up for stronger potential growth in 2026, supported by trends in artificial intelligence (AI) infrastructure, European defense spending and pro-growth policies in Japan.

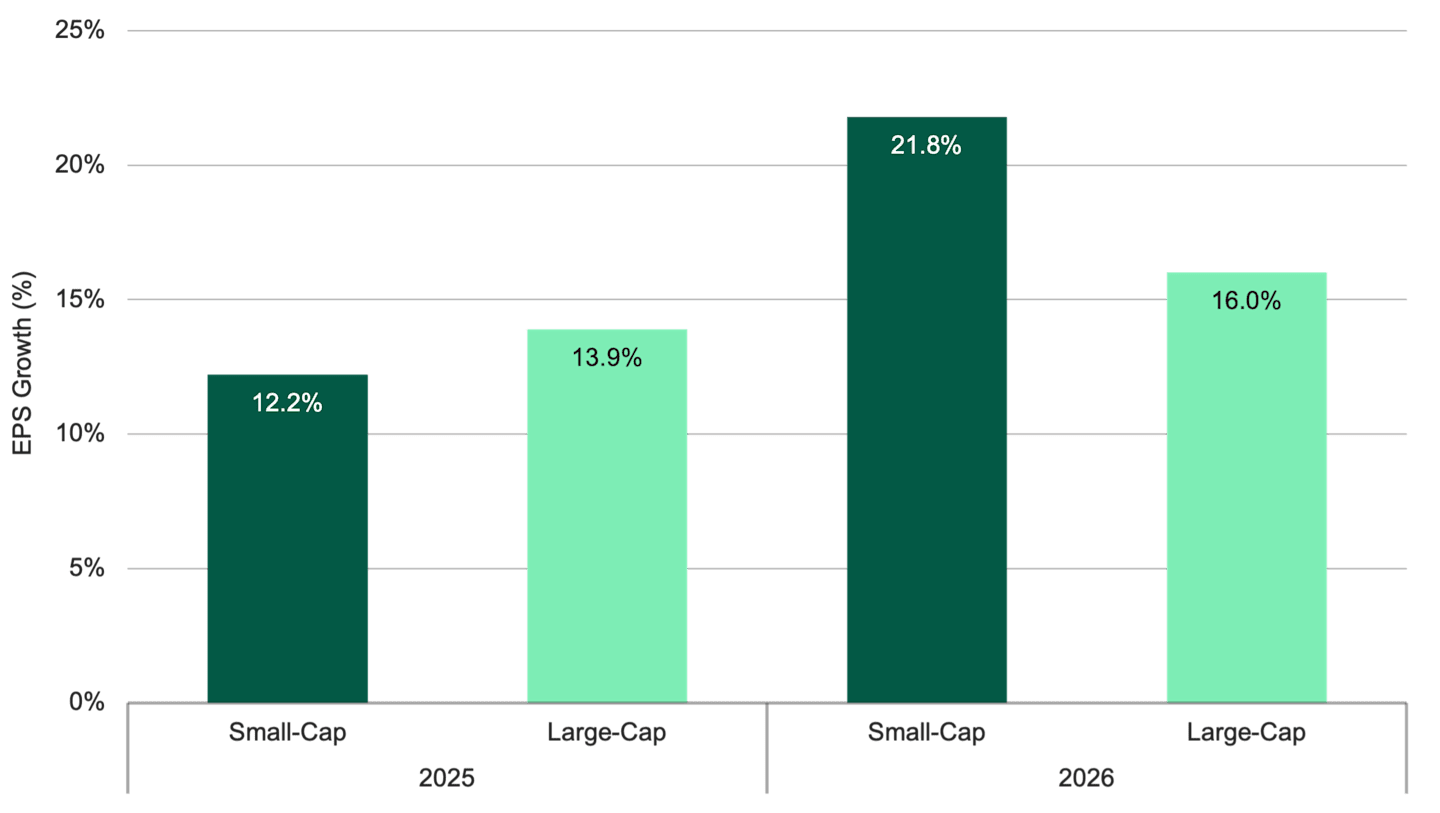

Based on consensus expectations, global small-caps are expected to outpace their larger-cap peers in earnings growth, as shown in Figure 1.

Figure 1 | An Improving Outlook for Small-Cap Earnings Per Share vs. Large-Caps

2025 vs. 2026 Calendar Year EPS Growth: MSCI ACWI IMI Regions

Data as of 12/31/2025. Source: FactSet. Forecasts are not a reliable indicator of future performance. Evaluates the equal-weighted average FactSet consensus estimate of EPS growth rates for index holdings in stock currencies. Small-cap: < $5B, Large-cap: > $5B.

Small-caps have tended to succeed on the strength of their expertise, business models and other stock-specific drivers. However, larger economic and regulatory forces can also affect their performance.

Our team sees several factors that could create the conditions for more robust growth. These include the prospect of a more favorable interest rate environment, tax breaks for U.S. consumers and a lighter regulatory regime for businesses.

Top Trends Supporting Global Small-Cap Growth in 2026

AI Growth Is Driving Global Energy Demand

Major tech firms like Alphabet, Meta and Microsoft intend to spend heavily on AI-related infrastructure again in 2026.1 We think companies in the energy, utilities and industrials sectors could stand to benefit from these initiatives.

That’s because AI requires significantly more power than traditional computing. In fact, the International Energy Agency estimates that the world’s data centers could double their electricity consumption by 2030.2

Increased manufacturing activity tied to reshoring may also support higher energy demand.

We view this trend as a significant driver for small-cap firms that design power plants, upgrade electrical grids and manufacture critical machinery. Small-caps typically possess specialized experience that makes them essential for this kind of work.

CECO Environmental, a provider of air purification and HVAC systems, exemplifies a company that is facing increased demand for data centers and power generation.

While we see continued opportunity, we are closely monitoring the sustainability of CapEx spending tied to AI.

Strong Air Travel Demand and Improving Aerospace Supply Chains

In recent years, aerospace companies have experienced delays and disruptions in their supply chains involving engines and other critical components. That situation has eased considerably, allowing production to accelerate.

At the same time, aerospace companies are working through a sizable backlog of orders, and global air traffic is still substantial.

Many airlines also need to replace aging fleets, further boosting demand for major aerospace companies and the smaller firms that supply them.

We believe small-cap companies like Hexcel, a market leader in advanced composite materials, are well-positioned to benefit from improving trends. Hexcel supplies advanced composites that are 5 times stronger and 30% lighter than aluminum, directly supporting airlines’ sustainability and fuel-efficiency goals.3

Europe Prepares to Ramp Up Defense, Infrastructure Spending

Last year, European leaders outlined plans to increase spending on defense and infrastructure as the region confronts a more aggressive Russia.

The EU’s Readiness 2030 plan calls for an additional €800 billion in defense-related spending, including a €150 billion fund that member states can tap.4

NATO members have also agreed to boost their defense spending from 2% of their GDP to 3.5% by 2035.5 Each country would also dedicate another 1.5% to related needs, such as infrastructure, cyber defense and civil preparedness.

Over the coming months, this funding is expected to start flowing to companies involved in this effort, potentially supporting small-cap firms that supply larger contractors. The EU aims to begin work on its highest-priority projects during the first half of 2026.6

Japan’s Growth Outlook Continues to Improve

Sanae Takaichi, Japan’s recently elected prime minister, has made economic growth her top priority. Takaichi’s government rolled out an economic stimulus package worth about $135 billion, with measures designed to help households cope with higher costs.7

The prime minister has also signaled government support for key fields, including AI and semiconductors, cybersecurity and shipbuilding.8

These moves build on earlier policies, such as Japan’s corporate governance reforms and a national digitalization effort. Potential small-cap beneficiaries include technology consulting firms and Japanese companies with plans to increase dividend payouts, unwind cross-shareholdings and buy back shares.

An example is 77 Bank, a regional Japanese bank, which is delivering improved revenues, profits and returns on equity. The management team is cutting costs and exploring ways to boost its valuation, including share buybacks and increased dividend payouts.

Tariffs, Policy Support Encourage More Reshoring

We continue to see companies plan to begin or expand manufacturing of semiconductors, pharmaceuticals, autos and other goods in the U.S.

The Semiconductor Industry Association, for example, has identified hundreds of billions in planned private-sector investment in U.S.-based chip production.9

Higher U.S. tariffs are encouraging many reshoring efforts, but other factors — including a desire to strengthen supply chains and more supportive government policies — also play a role.

The One Big Beautiful Bill, for example, includes measures that incentivize U.S.-based production, such as full expensing for new equipment.10 The CHIPS Act offers support for the domestic production of semiconductors.11

This could all serve as a tailwind for companies supporting reshoring efforts through plant construction, energy solutions, automation and other sectors. Small-caps typically gain more directly from an increase in industrial manufacturing.

The trend faces obstacles, including higher tariff-related costs for machinery and other resources that must still be imported. Overall, however, we view this as creating significant opportunities for small-cap firms involved in reshoring.

M&A and IPO Trends Shaping Small-Caps in 2026

Forecasters predict that mergers and acquisitions will rise in 2026, alongside an uptick in initial public offerings (IPOs).

The EY-Parthenon Deal Barometer expects a 3% increase in overall M&A deal volume in 2026.12 The value of these deals has been climbing, too. Through the first nine months of 2025, deal value was 36% higher compared to a year earlier.

When Deloitte surveyed dealmakers about 2026, the vast majority said they anticipated more and bigger deals.13 However, fewer respondents expected to see a “significant” increase in deal volume.

Meanwhile, global IPOs picked up during the third quarter of 2025, particularly in India, China and the U.S.14 Favorable conditions, such as lower interest rates and continued strength in AI, could support more offerings in 2026.

We believe small-caps could stand to benefit from a rise in dealmaking if it results in a re-rating in stock prices and higher valuations.

Global Small-Cap 2026 Outlook: A Focus on Fundamentals

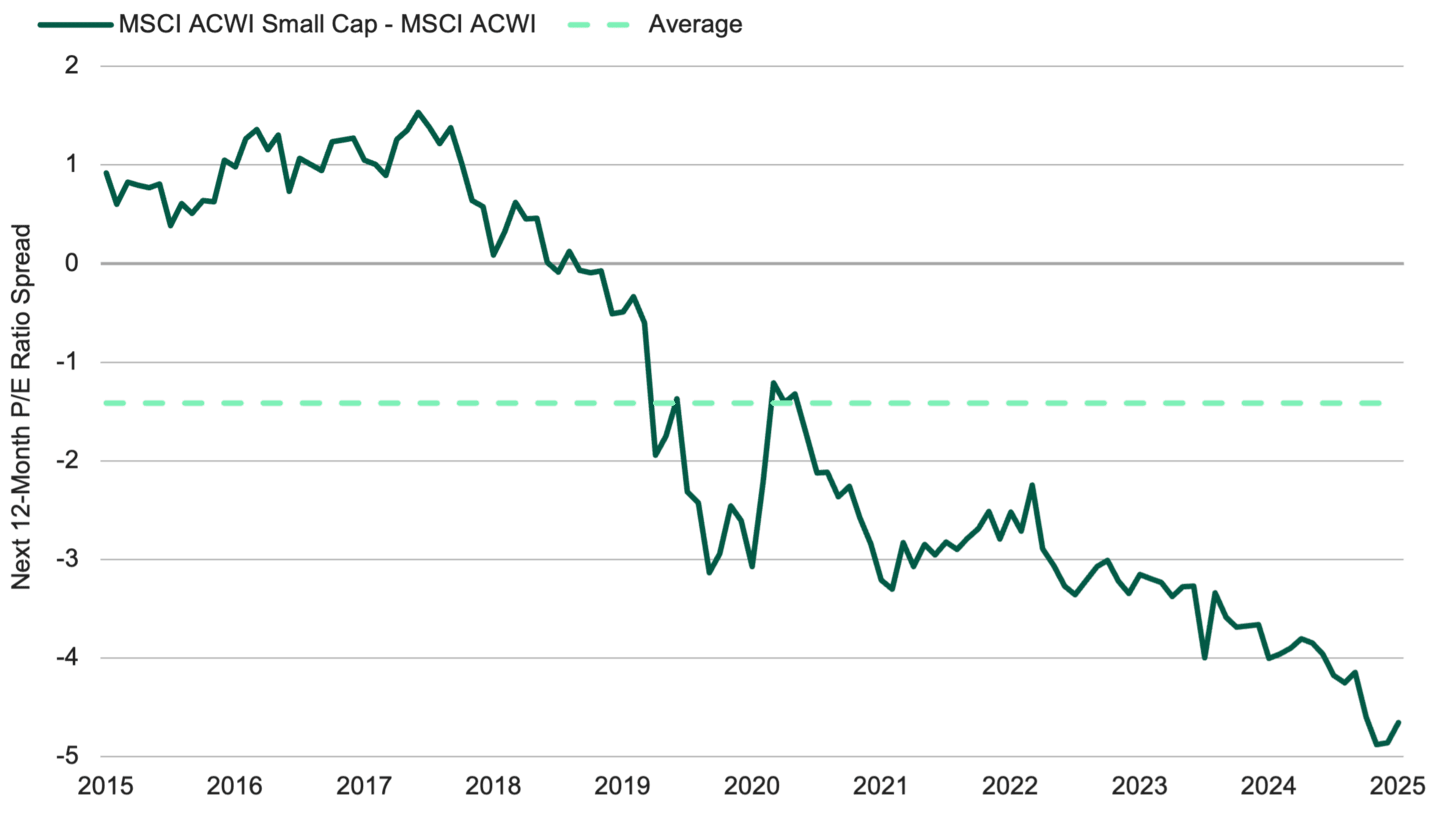

We see an improving environment for small-cap investing in 2026. Valuations are attractive, earnings growth is expected to accelerate, and interest rate headwinds may turn into tailwinds.

With valuations now sitting below long-term averages as seen in Figure 2, the case for revisiting the asset class looks increasingly compelling.

Figure 2 | Small-Caps Sit at a 10-Year Low Compared to Larger Firms

Spread in Next 12-Month Price-to-Earnings Ratio (MSCI ACWI Small Cap – MSCI ACWI)

Data from 12/31/2015 – 12/31/2025. Source: FactSet. Past performance is no guarantee of future results.

There is no shortage of small-cap companies benefiting from strong secular and cyclical trends. However, it’s still essential to evaluate each firm individually, based on a thorough analysis of its fundamental characteristics.

As global markets evolve, we believe our team’s disciplined approach helps us identify attractive opportunities in small-cap companies across various sectors and regions.

We remain focused on identifying firms with accelerating, sustainable growth while taking advantage of the persistent inefficiencies and volatility in small-cap markets.

Authors

Senior Client Portfolio Manager

Senior Portfolio Manager

Explore Our Global Small-Cap Capabilities

Alphabet, Transcript – Q3 2025 Earnings Call, October 29, 2025; Meta, Transcript – Q3 2025 Earnings Call, October 29, 2025; Microsoft, Transcript – Q1 2026 Earnings Call, October 29, 2025.

International Energy Agency, “Energy and AI: World Energy Outlook Special Report,” April 10, 2025.

Hexcel, Composites Value Proposition, as of January 7, 2026.

European Commission, “Preserving Peace – Defence Readiness Roadmap 2030,” October 16, 2025.

NATO, “Defence expenditures and NATO’s 5% commitment,” December 18, 2025.

European Commission, “Preserving Peace – Defence Readiness Roadmap 2030,” October 16, 2025.

Megumi Fujikawa, “Japan Approves $135 Billion Stimulus Shot to Help Households, Economy,” Wall Street Journal, November21, 2025.

Prime Minister’s Office of Japan, “Policy Speech by Prime Minister Takaichi Sanae to the 219th Session of the Diet,” October 24, 2025.

Semiconductor Industry Association, “State of the U.S. Semiconductor Industry 2025,” July 2025.

The White House, “The One Big Beautiful Bill Is Igniting an American Business Boom,” August 6, 2025.

Congress.gov, H.R. 4346 – CHIPS and Science Act, August 9, 2022.

Gregory Daco and Mitch Berlin, “M&A Outlook: Stronger US Deal Market in 2026 Despite Mixed Economic Signals,” EY Parthenon, October 28, 2025.

Adam Reilly and Barry Winer, “2026 M&A Trends Survey: A Tale of Two Markets,” Deloitte, November 2025.

EY Ireland, “Global IPO Market Rebounds in Q3 2025 amid Easing Volatility and Rising Investor Confidence,” Press Release, October 16, 2025.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.