The Trump Energy Policy Landscape

Potential political headwinds won’t derail the push for alternative energy sources.

Key Takeaways

Trump Administration policies create headwinds in the drive for alternative energy sources to help ensure energy independence.

Nevertheless, demand for renewable energy exceeds the current supply.

Despite passage of the One Big Beautiful Bill (OBBB) and continued policy uncertainty, renewable energy remains an indispensable cog in the overall U.S. energy picture.

President Trump’s victory in the 2024 presidential election brought with it almost unprecedented uncertainty regarding policies his new administration might pursue. Now with the passage of the One Big Beautiful Bill (OBBB) and numerous executive orders, the administration’s energy policy continues taking shape.

From tariffs to regulatory changes to shifting geopolitical and domestic priorities, the months since the election – and particularly since Trump’s inauguration – have unsettled investors. That sense of uncertainty is particularly true in an environment in which the Federal Reserve continues fighting stubborn inflation and, at least temporarily, stopped lowering interest rates.

For the energy sector, the Trump Administration’s focus on boosting traditional fossil fuel production creates some headwinds for renewable energy. Nonetheless, the administration can’t avoid addressing the practical demands of an economy dependent on plentiful and reliable energy, a growing national security priority.

While not immune from choppy policy waters, venture capital investors have the benefit of investing over a longer time horizon, which allows them to pursue innovations that could help feed (and fuel) future demand. The sturdiest venture capital ideas tend to reflect business models that aren’t reliant on government policy decisions — in other words, those that can flourish without direct government financial support and aside from politics.

Perhaps no venture capital sector better exemplifies this principle than alternative energy sources, such as renewables.

Renewables are increasingly able to compete with legacy energy sources on price, reliability and availability and can solve for fundamental demand needs. Renewable energy projects often come online quicker than traditional energy plants and production. Finally, they offer an expanding source of job creation – something every presidential administration desires.

Despite the Trump Administration’s vocal support of traditional fossil fuels, renewable energy sources are likely to continue to grow as part of a diverse mix of sources to help ensure energy independence. The business and job growth opportunities within renewable energy remain palpable and should endure – regardless of government policies that may present short-term challenges.

Assessing Headwinds Facing Renewable Energy

The Inflation Reduction Act (IRA) passed during former President Biden’s administration targeted more than $400 billion in subsidies and tax credits to help curb carbon emissions.1 Touted as the biggest piece of legislation in U.S. history aimed at improving the environment, the financial package supported numerous renewable energy ventures.

Specifically, the IRA expanded the scope and permanence of investment and production tax credits used by providers of renewable energy.2 These credits have fed the strong growth of the renewables sector in the past 20-30 years.

The Trump Administration, however, has expressed support for more traditional drilling of fossil fuels and has specifically targeted wind and solar subsidies for removal. The OBBB sunsets and removes certain subsidies and tax credits supporting renewable energy, including those for solar and wind.

The bill also rolls back core electric vehicle and battery tax credits. It’s less supportive for low-emissions hydrogen than the IRA. It boosts funding for critical mineral extraction but reduces incentives for processing them. It maintains IRA’s nuclear power tax credits but creates some regulatory uncertainty regarding new construction.

Meanwhile, fossil fuels remain significantly subsidized. At the same time, renewables face substantial permitting and regulatory barriers. Leveling that playing field arguably would benefit renewables more than tax credits.3

Yet Job Growth and State Support Present Tailwinds

The IRA’s broad financial support for renewables veered to many projects in the South and West, boosting businesses and creating jobs in numerous states that swung in Trump’s direction in the 2024 election. Despite present legislation, the bill has produced results and will show positive impacts in the future by laying down a future playbook for legislation to support a resilient power grid.

Overall, hiring in renewable energy has grown at twice the rate of hiring in fossil fuels and twice the rate of the overall economy.4 The 334 projects in 40 states announced in the first two years of the IRA created 109,278 jobs and spurred $126 billion in private investment.5

That growth caused 18 members of the House Republican Conference to craft a letter three months prior to the election asking U.S. House Speaker Mike Johnson not to seek the IRA’s repeal. Similar pushback is why Mark Wetjen, former acting chair of the U.S. Commodity Futures Trading Commission, sees the Trump Administration “leaving a good portion of the legislation intact.”6

Meanwhile, aside from federal support, many state and local policies continue promoting renewable energy. Bipartisan support for reforms in the permitting process to speed energy projects provides additional tailwinds. In addition, profitable windows of opportunity still exist for solar, wind and other renewable sources.

In addition, the U.S. Supreme Court last year narrowed the ability of regulators to change course without Congress’ approval. That could limit the Trump Administration’s ability to sharply change direction on renewable energy.7

Demand Drivers

The year 2025 will be defined by a race to overcome constraints and fill a growing gap between supply and demand for clean energy.⁸

The biggest reason renewable energy ventures will remain attractive despite policy uncertainty relies purely on economics. Simply put, demand for it outstrips supply.

Driven by insatiable thirst for electricity from AI data centers, demand for electrical power – essentially unchanged for two decades – grew 2% in 2024, according to the U.S. Energy Information Administration. The EIA expects demand will increase another 2% in both 2025 and 2026.9 (Notably, renewables can aid large AI providers in locating power sources much closer to these large data centers, overcoming existing transmission-grid challenges.)

The EIA has forecast that solar, wind and battery storage generation will supply the lion’s share of the anticipated increase in electricity demand. For example, the EIA projected that the electric power sector will add 26 gigawatts (GW) of new solar capacity in 2025 and 22 GW in 2026.10 Along with that, innovation in the U.S. power and transmission grid also remains key. Conversely, the EIA projects U.S. crude oil production will begin leveling off next year, despite the Trump Administration’s stated support for addition drilling.

That will continue a noticeable trend. Buoyed by record-high public and private investment, renewable energy enjoyed a banner year in 2024. Solar and wind projects accounted for 90% of all electrical capacity additions in the first nine months of the year. Overall, business and consumer investment in renewables has increased 71% since 2022, totaling a half-trillion dollars.11

Market-driven regulation will help drive ongoing demand for renewables. Seventeen U.S. jurisdictions, for instance, have statutory clean energy requirements for utilities, with attainment years beginning in 2032.12

In addition, renewable projects benefit from an inherently quicker pace of execution compared with traditional energy. New natural gas-fueled power plants and nuclear-powered facilities – some of which can take as long a decade to deploy – simply take longer to come to fruition than their renewable counterparts.

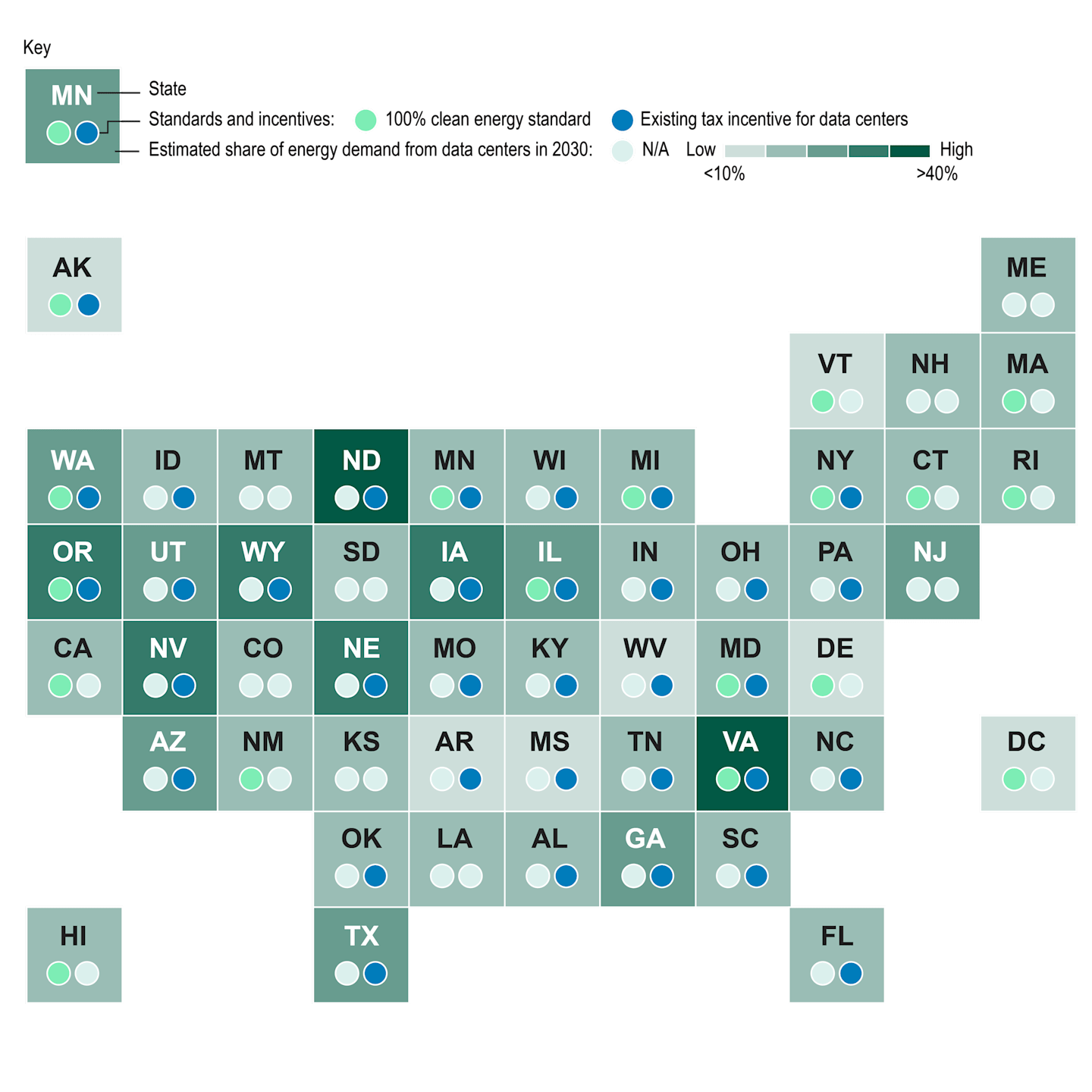

State Policies Impact Ability to Meet Data Center Load Growth With Renewables

Source: Deloitte analysis of data from S&P Global, Stream Data Center, Tax Notes, Electric Power Research Institute, US Department of Energy, National Renewable Energy Laboratory, and Smart Electric Power Alliance.

The increasing ability of renewable energy projects to continue expanding their scale and affordability, as Deloitte pointed out in its 2025 outlook, makes them potentially even more attractive in an uncertain policy environment.

Geothermal: An Essential Part of the Mix

An often overlooked but vital component of the renewable energy picture consists of geothermal production. Using steam or high-pressure hot water taken from the ground and converting it to energy, this process already heats homes and schools and aids industries such as paper and food production.13

The upfront costs of producing geothermal energy are relatively high. But long-term stable prices and low operational costs make it cost-effective compared to other modes of production. Moreover, many geothermal reservoirs essentially have sustained themselves indefinitely with proper management.

The global market for geothermal energy is forecast to increase to $117 billion in 2032, compared with $70 billion currently. In the U.S., the fastest-growing region, geothermal companies currently have 58 active development projects across nine states.14

Forecasts peg the geothermal industry will create 200,000 additional jobs globally by 2030. That growth should benefit from incentives such as the U.S. Department of Energy’s “Enhanced Geothermal Shot” program, which aims to cut geothermal electricity costs by 90% by 2035. Geothermal also has drawn unabashed support from U.S. Energy Secretary Chris Wright.15

Fervo Energy offers an example of a company that exemplifies the push for geothermal energy. Fervo employs advanced algorithms to identify the best geothermal energy sources. It has also developed precision horizontal drilling techniques to enhance potential for capturing resources.

In the fourth quarter of 2024, geothermal companies captured $503.6 million in venture capital funding … the bulk of which went to Fervo.16 Fervo is far from the only energy company tapping geothermal’s potential: Berkshire Hathway, led by famed investor Warren Buffett, operates BHE Renewables, a division whose assets include geothermal facilities.

Bottom Line

Energy is an indispensable contributor to our economy. We need that energy to be resilient and reliable. Despite short-term headwinds, renewable energy remains competitively positioned to continue playing a vital role in the U.S. energy equation for decades to come.

The Trump Administration has voiced its support of traditional fossil fuels. But renewable energy plays a key role in helping ensure energy independence – a goal of every administration. It remains a key component of the nation’s energy future, particularly with burgeoning demand from AI data centers.

As a result, market economics, rising demand for reliable energy sources and policy decisions will inevitably keep interacting. In the end, those factors will continue driving investment in renewables and their increased long-term implementation.

Discover Our Approach to VC Investing

Jason Bordoff, "America's Landmark Climate Law," International Monetary Fund, December 2022.

Brian Lips, "The Past, Present, and Future of Federal Tax Credits for Renewable Energy," NC Clean Energy Technology Center, November 19, 2024.

Jack Andreasen Cavanaugh, Anne-Sophie Corbeau, Tom Moerenhout, Matt Boweb, Ashley Finan & Noah Kaufman, "Assessing the Energy Impacts of the One Big Beautiful Bill Act," Center on Global Energy Policy at Columbia I SIPA, July 14, 2025.

Deloitte Research Center for Industrials and Renewables, " 2025 Renewable Energy Industry Outlook," December 9, 2024.

Allen Marks, "U.S. Energy Industry Trends To Watch In A 2025 Trump Presidency," Forbes, November 7, 2024.

Pitchbook NVCA, "Venture Monitor Q4 2024," January 2025.

Allen Marks, "U.S. Energy Industry Trends To Watch In A 2025 Trump Presidency," Forbes, November 7, 2024.

Deloitte Research Center for Industrials and Renewables, " 2025 Renewable Energy Industry Outlook," December 9, 2024.

U.S. Energy Information Administration, "EIA extends five key energy forecasts through December 2026," January 15, 2025.

U.S. Energy Information Administration, "EIA extends five key energy forecasts through December 2026," January 15, 2025.

Deloitte Research Center for Industrials and Renewables, " 2025 Renewable Energy Industry Outlook," December 9, 2024.

Deloitte Research Center for Industrials and Renewables, " 2025 Renewable Energy Industry Outlook," December 9, 2024.

RSS Staffing, Inc., "Geothermal Engineers: The Rising Demand & Opportunities, "RSS Podcast, January 25, 2025.

Fortune Business Insights Staff, "Geothermal Energy Market Size, Share & Industry Growth Analysis, By Type (Binary Cycle, Flash, and Dry Steam), By Application (Industrial, Commercial, Residential, and Others), and Regional Forecast, 2024-2032," July 7, 2025.

Saul Eberstein, "Energy Secretary Chris Wright Throws Support Behind Geothermal Boom," The Hill, March 6, 2025.

John MacDonagh, "Clean Energy VC Trends Q4 2024," Pitchbook, January 2025.

The portfolio managers use a variety of analytical research tools and techniques to help them make decisions about buying or holding issuers that meet their investment criteria and selling issuers that do not. In addition to fundamental financial metrics, the portfolio managers may also consider environmental, social, and/or governance (ESG) data to evaluate an issuer's sustainability characteristics. However, the portfolio managers may not consider ESG data with respect to every investment decision and, even when such data is considered, they may conclude that other attributes of an investment outweigh sustainability-related considerations when making decisions. Sustainability-related characteristics may or may not impact the performance of an issuer or the strategy, and the strategy may perform differently if it did not consider ESG data. Issuers with strong sustainability-related characteristics may or may not outperform issuers with weak sustainability-related characteristics. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and may not be available, complete, or accurate. Not all American Century investment strategies incorporate ESG data into the process.

No solicitation, offer, or distribution of any investment, security, financial instruments, or financial interest of any type is being made or is intended by any of this material. This material is provided for informational and educational purposes only.

Nothing herein constitutes a recommendation of any investment, security, financial instruments, financial interest of any type, or any investment strategy.

No representation or warranty is being made regarding the suitability of any investments, securities, financial instruments or strategies for any investor. The material on this site is provided “as is.” American Century does not warrant the accuracy of the materials provided herein, either expressly or impliedly, for any particular purpose and hereby expressly disclaims any warranties or merchantability or fitness for any particular purpose.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.