How Does U.S. Policy Influence the Reshoring Surge?

We believe policies aimed at boosting U.S. manufacturing capacity could potentially benefit small-cap stocks.

Key Takeaways

Micron Technology’s $200 billion investment in domestic semiconductor production is one of the biggest reshoring announcements in years.

Tariffs, geopolitical risks, policy support and customer preferences fuel the renaissance in reshoring.

With their domestic focus and ties to U.S. capital spending, small-cap companies may benefit from the reshoring boom.

American policymakers have worried about the decline of domestic semiconductor production for years.

Although this issue doesn’t often grab headlines, its implications are real. Semiconductor chips are essential components that power everything from digital calculators to military fighter jets. The U.S. faces serious risks by relying on countries like China and Taiwan for these chips, especially if something disrupts the supply chains.

Micron Technology’s June announcement that it plans to invest billions in semiconductor manufacturing in Idaho and New York represents a significant step toward restoring domestic chipmaking capabilities and bolstering the U.S. against potential supply chain vulnerabilities.

The news also signals more progress in reshoring, or the return of manufacturing and supply chain operations to the U.S.

Once cast aside by many as a nostalgic ideal, reshoring has become a necessary response to global instability, fragile supply chains and shifting economic incentives. From semiconductors to electric vehicles, the reshoring movement may reinvigorate the U.S. industrial and manufacturing sector.

Micron’s decision to expand domestic semiconductor manufacturing wasn’t made in isolation. This investment is expected to produce 90,000 direct and indirect jobs, meaning the large-cap company will rely on smaller businesses to support this significant initiative.1 These projects will include plant manufacturing, surrounding infrastructure, employee housing and much more.

This is just one reason why we believe the reshoring trend could potentially boost the case for small-cap companies beyond 2025.

How Reshoring Impacts U.S. Employment

The COVID-19 pandemic and the empty store shelves it brought helped highlight the need to reinvigorate domestic supply chains and manufacturing.

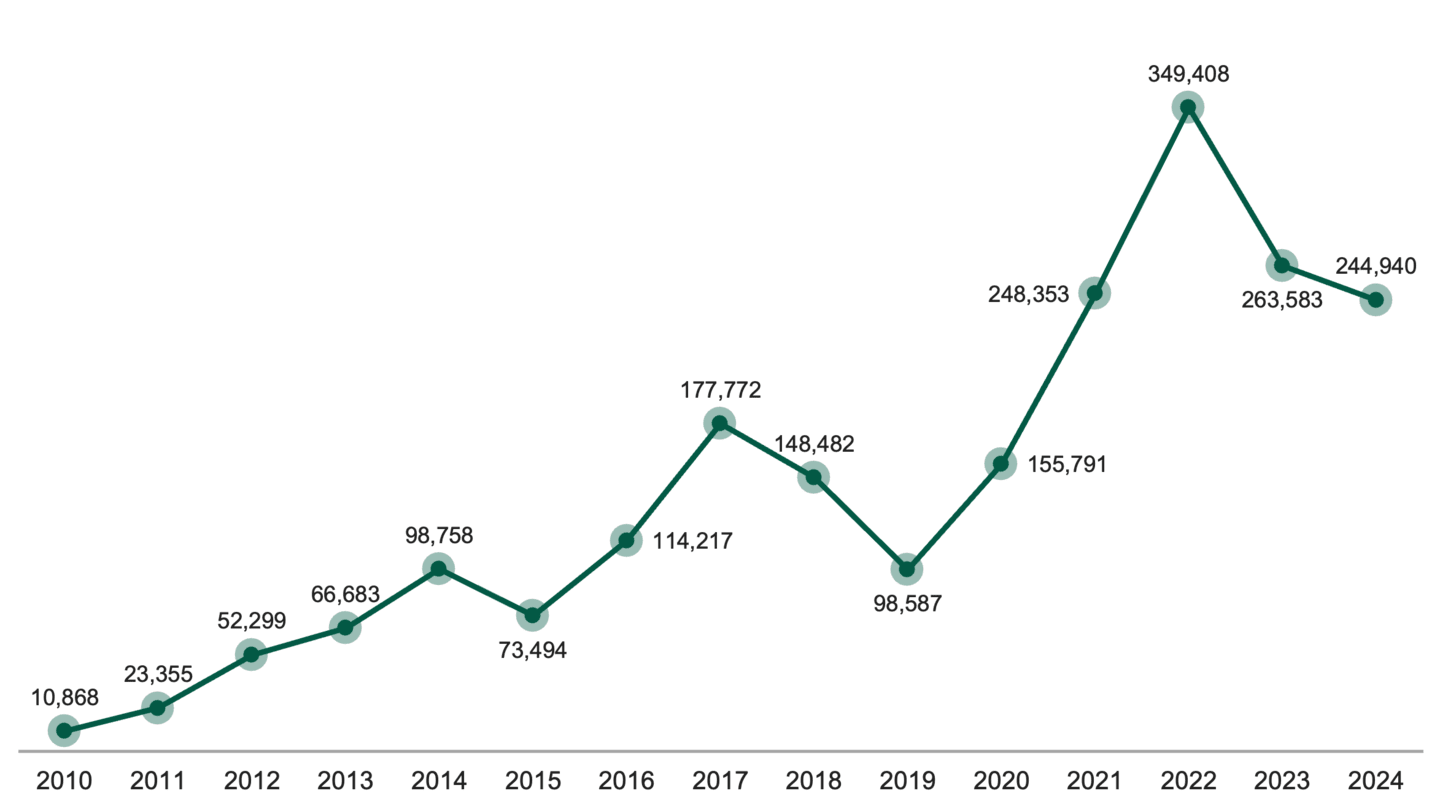

According to research by the Reshoring Initiative, job announcements resulting from reshoring and foreign direct investment (FDI) initiatives have surpassed 244,000 yearly since 2021, reaching a peak of 349,408 in 2022. See Figure 1.

Figure 1 | Reshoring Accelerates Year-Over-Year, Fueling U.S. Job Growth

Data from 12/31/2010 - 12/31/2024. Source: The Reshoring Initiative. Figures represent job announcements from production brought back to the U.S. and from FDI.

This momentum is visible in places like De Soto, Kansas, where Panasonic recently completed a $4 billion electric vehicle battery plant — the largest private economic development project in state history. As we described last year, the Panasonic plant has knock-on effects throughout the community that involve small-cap companies.

Such projects exemplify the broader reshoring wave across industries from automotive and semiconductors to pharmaceuticals and medical devices.

What’s Powering the Reshoring Trend in 2025?

Several forces have fueled reshoring’s renaissance:

Supply chain disruption. The pandemic exposed the vulnerabilities of global supply chains. Shortages in critical goods — from surgical masks to toilet paper to microchips — caused companies to rethink their dependence on offshore sourcing.

Tariffs. The Trump administration has imposed aggressive and protectionist tariff rates on key trading partners. This policy encourages companies to launch or expand their manufacturing operations in the U.S., especially for advanced technology and health care companies. The administration is negotiating trade deals with countries worldwide, which should result in improved clarity on U.S. policy and the implications for trading partners. We anticipate an increase in reshoring projects, which may boost gross domestic product (GDP) and earnings growth for smaller domestic companies.

Geopolitical risks. Heightened tensions with China and its potential threat to Taiwan, a major chip manufacturer, are major concerns for U.S. policymakers. The war in Ukraine, the threat of wider conflicts in the Middle East and broader global instability have made domestic production a national security imperative. U.S. tariffs and export controls have further incentivized companies to localize operations.

Policy tailwinds. Landmark legislation such as the CHIPS and Science Act and the Inflation Reduction Act has released hundreds of billions of dollars in federal incentives to boost domestic manufacturing. A recent example from the Trump administration included an announcement of tax credits for semiconductor manufacturers, which increased from 25% to 35% for those who begin constructing new plants before 2026. These policies are designed to strengthen supply chains while encouraging private investment in critical sectors like advanced technology.

Technological advancements. Automation, artificial intelligence (AI) and 3-D printing are narrowing the expense gap between domestic and offshore production.

Consumer preferences. Consumers increasingly want to know where their products come from, often opting for sustainable and American-made goods. These shifting preferences could influence where corporations obtain and produce their materials and the direction of their brand strategies.

Is the Reshoring Trend Built to Last?

While the reshoring trend has generally pointed upward since 2010, it will still encounter challenges. Labor shortages, permitting delays and the varying quality of infrastructure could hinder its progress.

Reshoring’s long-term success may depend on the extent to which the current and future presidential administrations support policies that are favorable to reshoring, the availability of a trained workforce and technological advancements.

Still, the economic impact has already materialized. Manufacturing employment has rebounded to nearly 13 million jobs, particularly in the South and Midwest.2

We believe the implications could be significant, particularly for those focused on small-cap stocks. As we’ve mentioned before, small-cap companies — many of which are highly correlated with capital expenditures and derive most of their revenues domestically — could stand to benefit from the reshoring boom.

How Reshoring Could Evolve Post-2025

Reshoring has evolved from a novel concept to a significant aspect of the post-COVID economy. If companies establish manufacturing operations in the U.S., it could positively impact labor markets, influence capital allocation decisions and help shape investment strategies.

To the extent that the economy, political will and available resources continue to support reshoring, we believe small-cap equities could benefit.

Authors

Senior Investment Director

Explore Our Small-Cap Capabilities

Micron Technology, “Micron and Trump Administration Announce Expanded U.S. Investments in Leading-Edge DRAM Manufacturing and R&D,” Press Release, June 12, 2025.

AllAmerican.org, “The Reshoring Movement in American Manufacturing,” April 16, 2025.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.