2026 Investment Outlook

First Quarter

How Innovation Shapes Market Opportunities in 2026 and Beyond

Markets often reinvent themselves. Each generation sees ideas that start small, feel experimental and ultimately reshape entire industries. I think of the late 1990s and early 2000s as a prime example — not as a “boom and bust,” but as the formative stage of the internet revolution.

Infrastructure investment helped define that era, including broadband networks, fiber optics, data centers, early e-commerce platforms and the first connected consumer experiences. At the time, some of these projects seemed overly ambitious; in hindsight, they laid the groundwork for the modern digital economy.

These breakthroughs shape our daily lives. They occurred because investors and companies embraced innovation early — even though success wasn’t guaranteed. It was the willingness to commit capital despite uncertainty that made the technologies we can’t imagine living without.

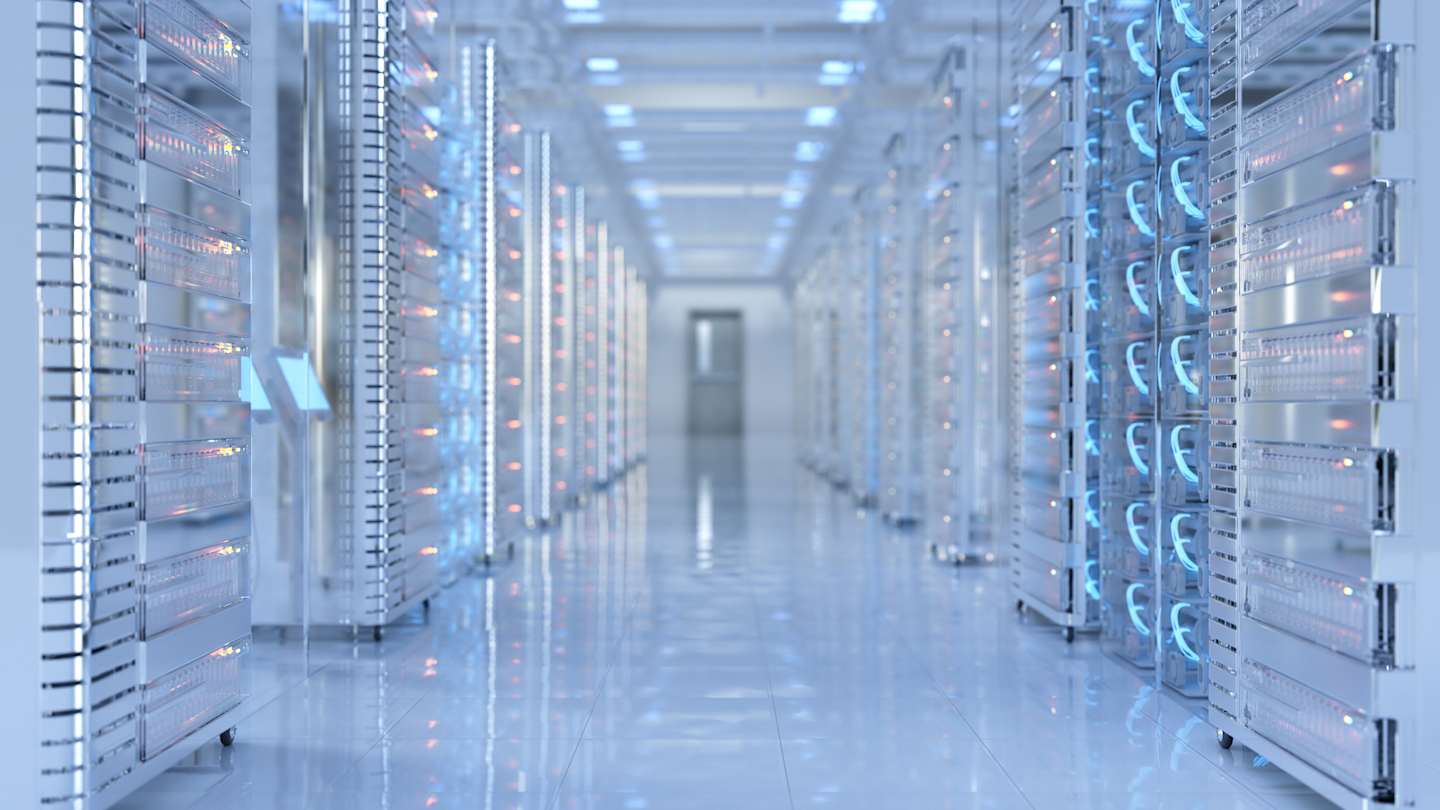

We’re seeing a similar surge today — this time in artificial intelligence (AI). Capital is flowing into compute capacity, modern data centers, and the upgrades to power and grid infrastructure needed to support next-generation workloads.

As with the internet buildout, we might not see an immediate payoff. However, the pattern is familiar: Investment comes first, followed by adoption and then productivity gains across various sectors. We need to be patient because history shows that infrastructure-led innovation takes time to deliver broad productivity improvements.

We believe our clients may benefit from being well-positioned to take part in this cycle, all while staying true to their valuation principles and maintaining a balanced portfolio.

Stay the Course: Embrace Innovation Over Time

We have a consistent philosophy. First, stay invested. Markets don’t wait for perfect clarity, so remaining invested may help keep you exposed to innovation even during periods of uncertainty.

Second, maintain exposure to areas that are underappreciated or undervalued. It’s not unusual for breakthroughs to emerge from corners of the market that are overlooked or undervalued in relation to their long-term potential. A diversified portfolio may help capture the next wave of innovation before it becomes mainstream.

Third, stay anchored to a long-term, risk-adjusted asset allocation. Strategic allocation — not short-term timing — remains an important driver of wealth creation and risk management.

FOMO and Loss Aversion Are True Barriers to Investment Success

Two behavioral biases often undermine well-designed investment strategies.

Fear of missing out (FOMO) tempts investors to chase and pay too much to participate in hot themes. These risks increase when gains are concentrated in a relatively small number of companies. Meanwhile, loss aversion may tempt you to exit the market during temporary drawdowns, potentially missing the compounding effect of innovation.

Taken together, these forces can undermine the work you put into developing thoughtful, balanced portfolio positioning. Avoiding these pitfalls is critical for long-term success.

2026 Outlook: Opportunity with a Dose of Reality

As discussed in this edition of our Investment Outlook, our investment teams see solid fundamentals along with some potential challenges in the new year. Growth tailwinds from capital and consumer spending might support economic momentum. However, a cautious Federal Reserve is likely to proceed more slowly than the futures markets suggest, as it balances inflation risks with labor market stability.

Global opportunities extend beyond the most crowded parts of the U.S. market. Structural drivers range from defense and infrastructure spending in Europe to governance reforms and digitalization in Japan and innovation leadership in emerging markets.

Meanwhile, today’s relatively high yields, combined with interest rates that are likely to remain steady or gradually decline, create a constructive backdrop for fixed-income investors. We believe this environment lends itself to an active and diverse approach.

Be Prepared for What Comes Next

The early internet era demonstrates that innovation often begins small, progresses in phases, and then becomes essential. We believe a disciplined long-term strategy — one that remains committed, diversified and grounded in risk-adjusted principles — may help investors take advantage of both current opportunities and future breakthroughs.

We wish you all the best in the new year. Thank you for entrusting your assets to us.

Chief Investment Officer

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, bond prices fall. The opposite is true when interest rates decline.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.