2026 U.S. Equity Outlook

First Quarter

Key Takeaways

Growth Stocks: We see tremendous opportunities in artificial intelligence (AI) and innovation ahead, but the path is likely to be rocky.

Value Stocks: Investor appetite for risk has increased interest in unprofitable and non-revenue stocks, creating an unstable footing in an environment filled with uncertainties.

Growth Stocks

Walking the Tightrope: Navigating Risks and Opportunities in U.S. Markets

The market seems to be focused on three main issues:

Questions about stock valuations.

The sustainability of spending on AI.

The likelihood of more interest rate cuts by the Federal Reserve (Fed).

None of these has a simple, straightforward answer. We expect volatility to continue, but this shouldn’t obscure significant opportunities.

Concentration and Valuation Remain Issues

Valuations on large-cap stock indexes are high compared to historical averages. Growth stocks are similarly expensive relative to value stocks. Market concentration in the top 10 and top 20 companies also remains at remarkably high levels.

The implication is that heavy reliance on a handful of companies increases the risk of poor results or forecasts. And if growth expectations — particularly those related to AI — prove unrealistic, corrections could be sharp.

However, it’s also true that corporate earnings growth has been strong, and forecasts for 2026 are even better. If companies can meet or surpass their 2026 forecasts, that would be a positive sign for valuations and the market.

Will Stimulus Shift the Fed’s 2026 Playbook?

The outlook for monetary policy is complicated. On the one hand, the market has been pricing in additional rate cuts in late 2025 and 2026. On the other hand, we doubt that the Fed will cut as aggressively as the market seems to expect. This is because all the major core inflation measures are rising and remain well above the Fed’s 2% target, according to the latest data.

Note, too, that there’s already positive monetary stimulus in the pipeline because there’s a considerable lag between Fed rate changes and their eventual economic effects. As a result, the Fed’s rate cuts in late 2024 should just now be beginning to take effect.

We expect further stimulus in early 2026 to come from tax refunds under the One Big Beautiful Bill. Our analysis shows that those making between $50,000 and $500,000 will receive refunds ranging from $580 to $4,900. We estimate that approximately 107 million tax returns fall in this range. Will the Fed feel the need to slash rates further with so much stimulus on the way?

AI: Bubble or Breakthrough?

We understand the talk about the AI bubble. Yes, the technology could be the most economically transformative tool ever created. However, massive investment is necessary to turn that potential into reality.

Some companies in the AI ecosystem have experienced strong profit growth. However, others have seen their stocks perform exceptionally well despite the gap between initial AI infrastructure spending and the cash flow generated by that investment.

While the questions are valid, we disagree with the broad conclusions about an AI bubble. Bubbles are usually marked by excess, such as excess capacity and excessive debt, which are two clear examples.

But it should be clear that, so far, the availability of chips and computing power is severely limited. Chip company results indicate that demand for computing power greatly surpasses their capacity to supply it.

We don’t currently see excessive debt financing. The largest spenders on AI are Alphabet, Amazon.com, Meta Platforms and Microsoft. These companies are also among the most profitable worldwide, and their investments are funded by free cash flow.

A third question is, what’s the payoff for these investments? We’d say that all the companies mentioned above report significant bottom-line improvements from using AI. So, the largest AI spenders and most advanced AI users are seeing a contribution to profitability from the technology.

Indeed, the main takeaway from their third-quarter earnings reports is that AI spending is expected to be significantly higher in 2026 than in 2025. So far, we haven’t mentioned anything about sovereign AI. However, NVIDIA CEO Jensen Huang recently attended the U.S./Saudi Investment Forum. Saudi Arabia, the United Arab Emirates, the U.K., the EU? It’s hard to believe, given the bubble narrative, but there’s arguably upside risk in AI spending.

Individual Security Selection Will Be Key in 2026

Of course, we don’t believe that all AI spending or companies are created equal. Investments that are debt-financed and have uncertain use cases are right to be questioned.

We’re continuing to seek more evidence of a return on AI investment by asking pointed questions of corporate management teams. This is a crucial component of our approach. We believe that identifying potential AI winners will come from deep, fundamental research and insight into company financials.

Add it all up, and we’re investing in AI-related stocks that we believe demonstrate strong fundamentals, solid business trends and attractive risk/reward profiles over several years. While we expect some short-term turbulence as the challenges we mentioned are addressed, we believe that AI is a transformative technology. Companies that successfully navigate this environment will likely reap the benefits in the long run.

Value Stocks

No Revenue, No Earnings, No Problem in Today’s Market

In Oklo Inc.’s most recent quarterly report, the word “revenue” doesn’t appear on its statement of operations. The company doesn’t make any money.

Yet, the share price for this maker of small nuclear reactors is up 374% over the last year through November 18.

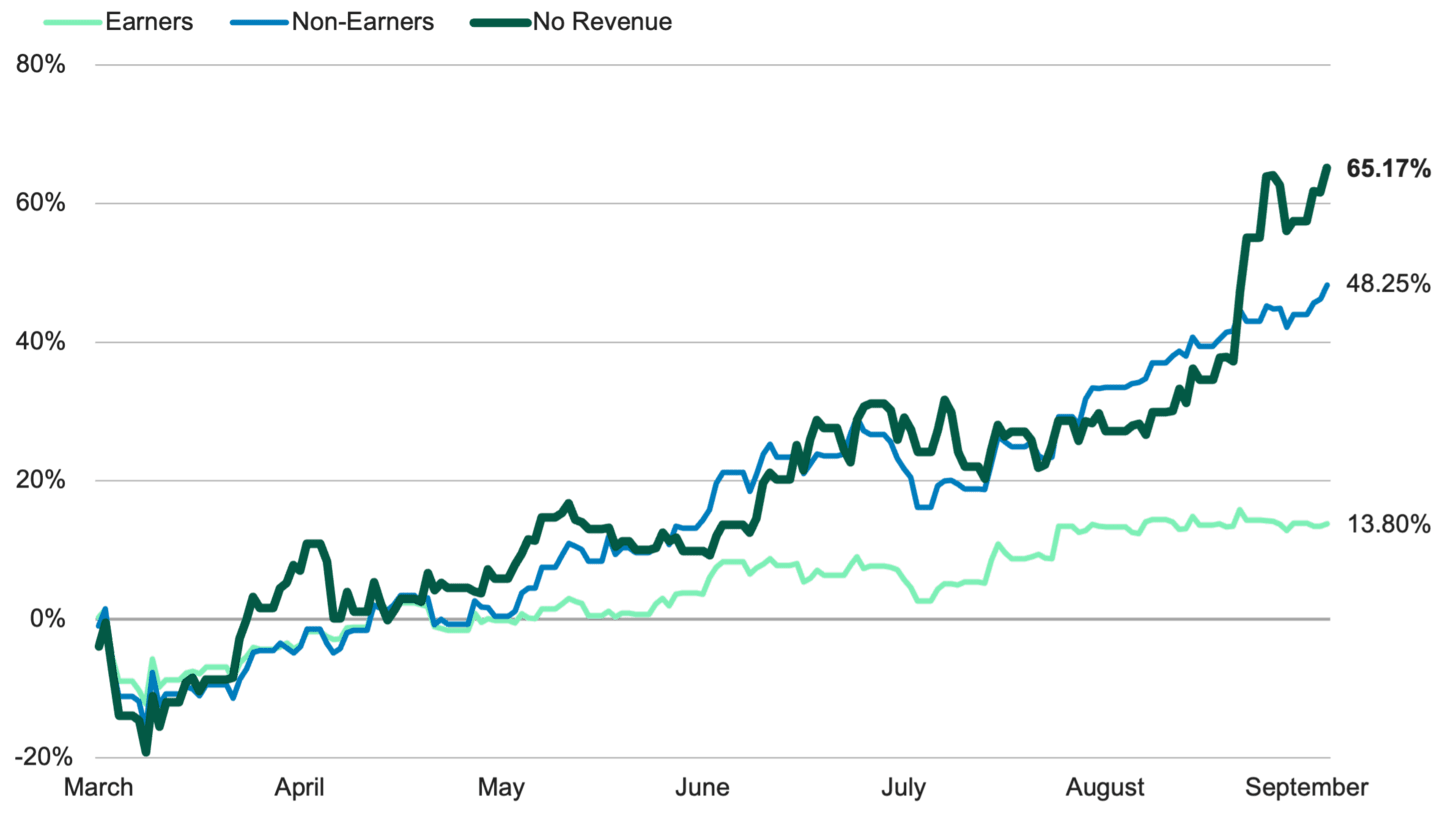

Oklo isn’t an outlier in today’s market environment. As Figure 1 illustrates, companies in the Russell 2000® Value Index that generate no revenue or are unprofitable have outperformed those that make money.

Figure 1 | Companies With No Revenues Have Climbed 65% Since March

Russell 2000® Value Index (Q1-Q3 2025)

Data from 3/31/2025 – 9/30/2025. Source: FactSet. Past performance is no guarantee of future results.

Much of the attention surrounding today’s risk-on environment centers on the performance of the so-called Magnificent Seven mega-cap stocks or investments related to AI.

However, Figure 1 demonstrates how the riskier stocks among smaller companies have surged this year, compared to those of profitable companies with steadier fundamentals.

As value investors who seek to invest in companies with business models we think are durable, today’s risk-on landscape presents a challenge. However, history tells us that while investing in riskier stocks can offer short-term rewards, a downturn can reverse these fortunes, while higher-quality stocks have tended to outperform over time.

There are legitimate reasons why a small-cap company might not generate revenue or profit.

In Oklo’s case, it’s developing a nuclear power product. Since Oklo aims to build and sell power from small nuclear reactors, this process is inherently capital-intensive and subject to rigorous regulatory review. Nuclear power also carries political and societal sensitivities.

Given the power demands of AI, Oklo could benefit if its mini-reactors reach the market. However, despite its share performance, the company faces several challenges before it can turn a profit.

Over the past year, even more speculative investments have performed strongly, driven by investors’ increased risk appetite.

Cipher Mining builds data centers for Bitcoin mining. As a result, the company’s share performance — up 118% through November 18 over the past year — is closely linked to cryptocurrency prices. This might appeal to investors seeking quick gains. However, we believe that cryptocurrencies are too volatile and lack clear indicators for why their prices, which have mostly been falling recently, fluctuate.

Instead, we gravitate toward stocks that we believe present less risk. One example is stocks that pay consistent dividends. These companies tend to exhibit strong business fundamentals and are typically less susceptible to market swings.

Dividends are also a significant source of income, accounting for nearly a third of total returns since 1940. We believe that dividends are particularly significant in today’s expensive stock market, where price returns are likely to be muted going forward.

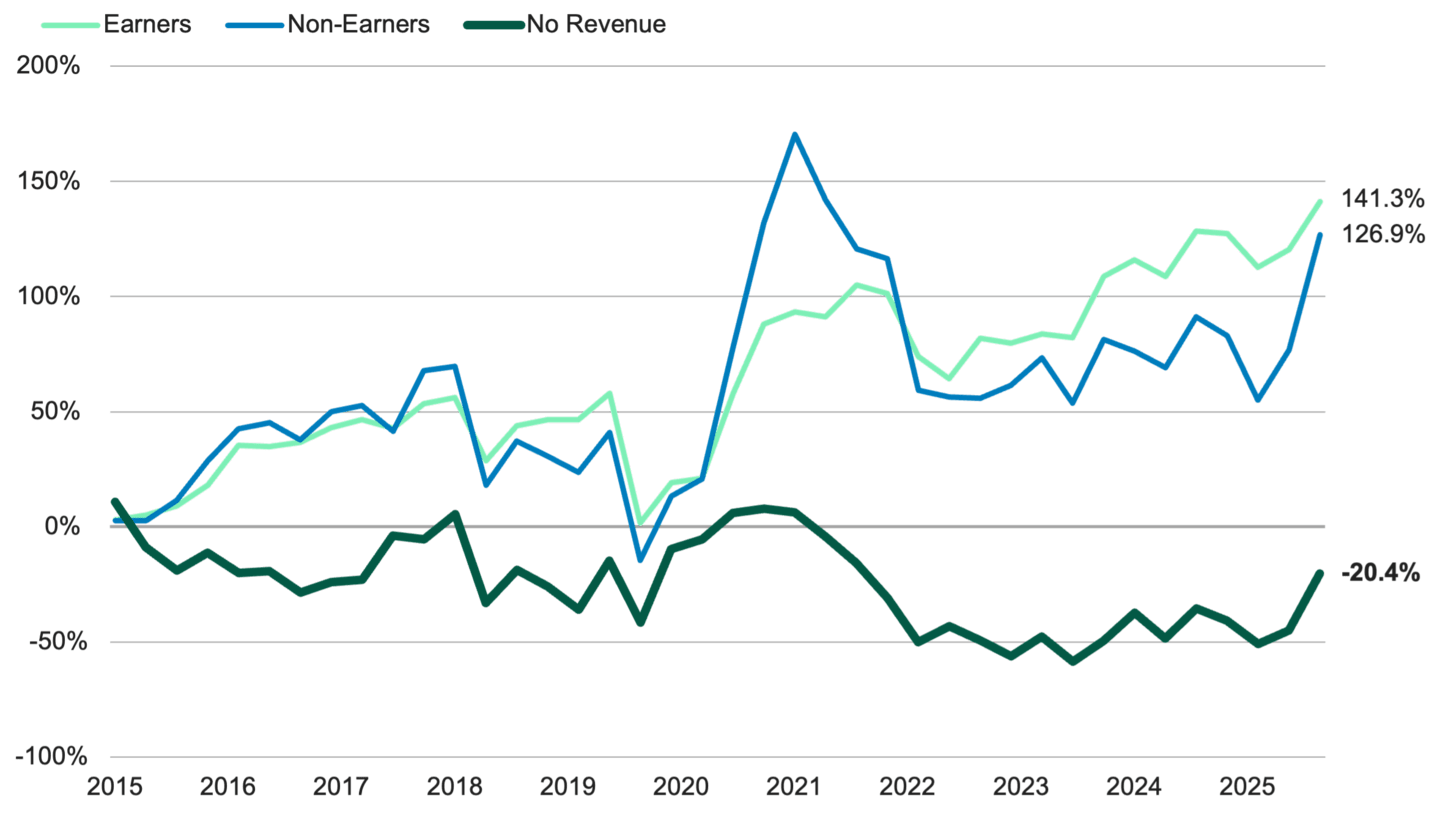

Still, as investors grab up risk assets, dividend stocks have fallen behind. Even so, no-revenue companies in the Russell 2000® Value Index, whose performance has recently soared in the market, don’t, in our view, present suitable long-term strategies. Figure 2 shows that these companies have produced negative returns over the past decade.

Figure 2 | Companies With No Revenue Have Historically Underperformed

Russell 2000® Value Index (Last 10 Years)

Data from 9/30/2015 – 9/30/2025. Source: FactSet. Past performance is no guarantee of future results.

The impulse to chase the rapid rise of lower-quality stocks is understandable. However, we believe, and historical data supports, that a focus on higher-quality investments can outperform over time.

Appetite for Change: What’s Next for Packaged Food Stocks?

There’s a lot of talk these days about whether an AI bubble exists, which draws comparisons to the internet bubble of the late 1990s and early 2000s.

A better contemporary comparison — at least for now — to the dotcom crash is how packaged foods stocks have performed. Packaged food stocks in the S&P 500 have trailed the broader index by 43% over the past two years, echoing the same group's underperformance in the two years before the dot-com bubble burst.

In the two years following the dot-com crash, stocks in tech-related subsectors lagged behind the broader index by roughly the same margin that packaged food companies are lagging today (packaged food companies experienced several years of outperformance after the dot-com crash).

The packaged foods industry aligns well with the broader investment thesis for consumer staples: People need to eat, so they will continue to buy food, even if the economy sours.

However, several broad conditions have recently bedeviled food stocks, which have been weighed down by weak volumes. Some consumers are eating healthier, which often means eating less. Other consumers are taking GLP-1s, better known as weight loss drugs, which also cause them to eat less.

Then, there are lower- to middle-income consumers who feel uneasy about the economy or their own finances, leading them to spend less on food or opt for cheaper private label offerings. This trade-down may partly result from food companies maintaining the higher prices they charged during the pandemic for too long.

This all sounds bad for packaged food companies, and for now, it is. Some of these challenges to food stocks could ultimately be fleeting, as they have been in the past. Cocoa prices were a big problem for snack companies a year ago, but have largely normalized this year. It’s not the first time consumer preferences have shifted, and food companies have often innovated to meet these changes.

But food companies have tumbled precipitously. While it’s possible they make up the ground they’ve lost, it’s hard to see that happening in the foreseeable future.

Explore Our Global Growth and Global Value Capabilities

©2026 Standard & Poor's Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, bond prices fall. The opposite is true when interest rates decline.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.