Key Risks After the Stock Market Rally

Are investors looking past important risks following the market’s recovery from April’s lows? We believe opportunities in lower risk, quality value strategies remain.

Key Takeaways

Market volatility from early in the year has given way to a technology stock-led market rally that erased April losses.

Even with negotiated tariff rates, the effective tariffs are much higher than at the beginning of 2025.

We believe diversified portfolios with low-volatility and defensive holdings could help mitigate market risks.

In 2024, the effective U.S. tariff rate was 2.5%.

However, on April 2, 2025, President Donald Trump announced a series of sweeping and eye-popping tariffs in the White House Rose Garden.

Calling it “Liberation Day,” Trump’s announcement caused global stocks to tumble as investors worried about the impact of trade levies on inflation and the value of U.S. Treasuries, among other things. Days later, Trump decided to pause implementing most of the tariffs so that countries could try to negotiate deals with the U.S.

The effective tariff rate is now about 17.6%.1 Yet the market seems to be ignoring this historic spike in tariffs and treating the de-escalation of Liberation Day’s outsized rates as though the White House has abandoned its tariff ambitions altogether. The market’s steep losses in April were erased before the end of May despite no clear resolution to the trade wars.

We believe this situation illustrates how investors are overlooking several market risks. Some risks present earlier in the year persist and have, in some cases, become more pronounced, while new ones have also emerged.

While risks may seem negative and discussions about them can sound like dire forecasts, they can also offer opportunities if managed effectively.

We believe one way to prepare for and potentially offset the impacts of these risks is to diversify your portfolio with low-volatility and defensive holdings. Our research shows that value stocks have demonstrated resilience in past market downturns.

U.S. Debt and Deficit Risks in 2025

Experts have long warned that the United States’ growing budget deficits and rising debt levels seriously threaten its financial stability. Nonetheless, lawmakers have added more debt to the country's balance sheet.

The legislation known as the “Big Beautiful Bill,” which Trump signed into law on July 4, doesn’t reduce the federal government’s debt, which now stands at $36 trillion. The legislation raises the debt ceiling by $5 trillion. The nonpartisan Congressional Budget Office estimates the law will increase budget deficits by $3.4 trillion over the next decade.2

The consequences of the nation’s deteriorating fiscal situation are already playing out. In May, Moody’s cited the $36 trillion debt load in its decision to downgrade the U.S. sovereign debt rating and change its outlook on the nation’s finances from “stable” to “negative.”3 The U.S. has enjoyed an AAA rating from Moody’s since 1919.

We believe what matters more than a credit rating is the details behind it. The U.S. now pays more in interest expense than it does on defense. Projections have the nation’s debt-to-gross domestic product (GDP) ratio, already near 100%, breaking the records set after World War II, when the federal government bankrolled a multi-year global war with debt.4

The lack of financial flexibility and the resulting reliance on borrowing make bond traders less sure about the country’s ability to pay its obligations. Higher bond yields can reflect uncertainty about the health of the broader U.S. economy, and these concerns can trickle into the stock market.

Indeed, on April 8, the S&P 500® Index fell 19% below its mid-February peak as bond yields soared after Trump’s Liberation Day announcement.5 The next day, he announced a pause on most Liberation Day tariffs due to the risks presented by higher yields.

Trade Tensions

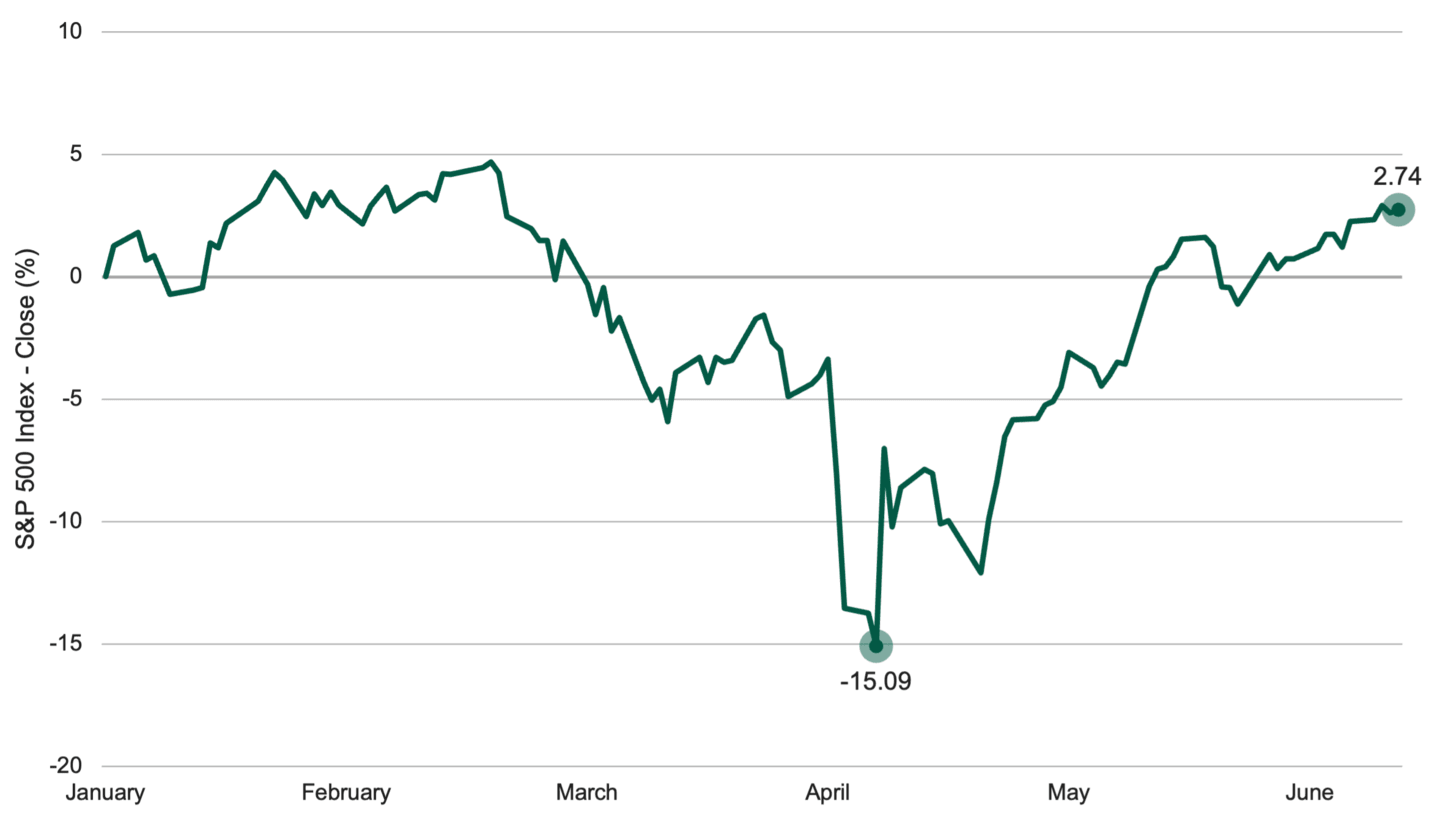

Figure 1 shows that the S&P 500 has been up 20% since April 8, reflecting a sense among equity investors that the worst tariff risks may have passed.

Figure 1 | April Losses Bring May Rallies

S&P 500 Performance Since January 1, 2025

Data from 1/2/2025 - 6/12/2025. Source: FactSet. Past performance is no guarantee of future results.

While some of the Trump administration’s highest announced tariffs — like 145% on Chinese products — are unlikely to return, the White House has few concrete trade deals in hand.

The herky-jerky nature of U.S. tariff policy and the uncertain outcomes have made business leaders cautious, leading them to delay hiring and long-term investments.6 However, since April, the stock market’s returns suggest that investors are unfazed.

U.S. negotiations with China first appeared like they were not going well. Then things de-escalated as the summer wore on. They could re-ignite.

The larger, attention-grabbing Liberation Day tariff rates obscure some of the more sizable and lasting tariffs the U.S. has planned. On June 4, for example, the U.S. doubled its tariff rate on steel and aluminum imports to 50%.7 These tariffs and Chinese export controls on rare earth minerals could slow American manufacturing and trade.8 The U.S. announced a 50% tariff on copper imports and goods coming in from Brazil, both effective on August 1. Those could go away, or new ones could pop up. It reflects the unpredictable nature of U.S. trade policy.

Geopolitical Risks Continue

Geopolitical conflicts that some investors hoped would lessen with Trump’s return to the White House show few signs of abating.

In June, Israel began bombing Iran due to suspicions that Iran was advancing its efforts to develop nuclear weapons. The U.S. joined this effort by conducting airstrikes on Iranian sites involved in uranium enrichment.

The bombing ended with a ceasefire, although the extent to which the bombing campaign derailed Iran’s ability to develop nuclear weapons is unclear. And given the long-running tensions between Iran and Israel, it’s hard to predict whether a ceasefire between the two countries will last.

Similarly, the Israel-Hamas conflict continues with no end in sight.

A ceasefire in the Russia-Ukraine War remains out of reach. Russian President Vladimir Putin has shown little interest in Trump's appeals to discuss a potential path to peace, and Trump himself is displaying less enthusiasm for resolving the war.

Investors have managed these conflicts, but the risk of escalation into a broader conflict — such as direct confrontation between Russia and Europe or a renewed Israel-Iran conflict — that could impact markets remains.

Is the U.S. Job Market Losing Strength?

One of the more resilient features of the U.S economy since the COVID-19 pandemic has been the strength of the labor market. The unemployment rate has hovered around 4% since January 2022, a rate generally considered as full employment. Additionally, job openings rose in April, modestly beating expectations.

Still, signs of trouble in the labor market are emerging.

Fewer Americans are quitting their jobs, indicating that workers believe they can’t easily find opportunities elsewhere. Layoffs are also starting to increase.9

Payroll processing firm ADP reported that May brought the lowest level of private sector hiring in two years, far below estimates. April’s hiring figures were revised downward.10

Recent college graduates have said that finding work is increasingly difficult, with companies increasingly using artificial intelligence (AI) to handle tasks that entry-level workers once performed.11

Taken together, we believe these figures point to a softening of the labor market, which is often followed by broader macroeconomic distress.

How Tariffs Are Affecting U.S. Consumers

Target, the popular retailer that appeals to both budget and luxury shoppers, revised its full-year sales outlook in May after reporting weak comparable sales.12 Company executives said that the dip in performance was due to worries about tariffs and consumers pulling back on discretionary spending.

Other consumer-facing brands are also bracing for reduced spending. Ford lowered its guidance, predicting it would sustain a $1.5 billion hit from tariffs.13 Toymaker Mattel abandoned its sales forecast because consumer spending was too difficult to predict. The company plans to raise prices to offset tariff costs.14

Student loans – some $1.6 trillion worth – are hitting the pocketbooks of nearly 43 million borrowers. The expiration of loan amnesty programs from the COVID-19 pandemic and the elimination of certain affordable payment plans mean less money for discretionary spending.15

In circumstances like these, American Century’s Value team favors brands in the consumer staples sector. During periods of market volatility, shoppers often hesitate to buy non-essential items. However, they usually continue to spend on the essential things needed for daily life, such as diapers, toothpaste, eggs and bread.

Corporate Earnings Outlook Amid Tariff Pressures

Walmart warned in May that consumers should expect higher prices on store shelves. Although Walmart executives said the company would try to absorb some of the tariff-related price hikes, the extensive nature of Trump’s tariffs means that certain costs will inevitably be passed on to consumers.16

Walmart’s announcement caught the attention of the White House. The president took to social media to insist that Walmart absorb the effects of tariffs instead of raising consumer prices.

Walmart and other companies will try to balance how much of the tariff-related costs to absorb or to pass higher prices on to consumers. Either scenario risks the strength of corporate earnings.

AI Volatility and Potential Market Implications

AI has been the rocket fuel for the stock market since late 2022. This promising technology has attracted massive investment and made market darlings out of technology companies like Nvidia.

While AI is here to stay, this corner of the market is fraught with risks. Technology stocks sold off earlier this year when a Chinese startup claimed to have created a powerful AI model at a fraction of the cost of more widely used applications.

More recently, Meta postponed the release of its AI model, Behemoth, as the company is struggling to meaningfully enhance the product beyond what is currently available in the market.17

These developments highlight broader concerns regarding AI, notably whether the potential for monetization justifies the amount of investment.

Consequently, stocks related to AI tend to be volatile and can experience significant drops whenever new advancements raise questions among investors about the technology’s viability.

Staying Focused During Economic Shifts

It’s easier for investors to prepare rather than react, both practically and mentally. Risks are always present, and a risk-on environment often makes it more challenging to identify potential dangers. Some risks are temporary and may resolve over time, while others, if they materialize, can lead to more significant and lasting changes in the market.

In either case, we believe investors can take steps to prepare and mitigate their exposure if these risks or others meaningfully affect the market, not by timing the market but by diversifying the types of equities in their portfolios.

Our strategies are designed for investing rather than speculating. Given the market's risks, we believe it’s a good time to revisit allocations to high-quality, risk-aware value portfolios.

Authors

Senior Client Portfolio Manager

Explore Our Global Value Capabilities

Budget Lab, “State of U.S. Tariffs,” July 7, 2025.

Congressional Budget Office, “Information Concerning the Budgetary Effects of H.R.1, as Passed by the Senate on July 1, 2025,” July 1, 2025.

Davide Barbuscia and Pushkala Aripaka, “Moody’s Cuts America’s Pristine Credit Rating, Citing Rising Debt,” Reuters, May 17, 2025.

Lawrence Delevingne, Yoruk Bahceli, Davide Barbuscia, and Dhara Ranasinghe, “How Bond Market Vigilantes Could Check Trump's Power,” Reuters, January 19, 2025.

Louis Jacobson, PolitiFact, “What Is the Bond Market, and Why Does it Matter for the Economy?” PBS News, April 17, 2025.

Max Zahn, “'Danger zone': Top Companies Weather Uncertainty as Trump's Tariffs Fluctuate,” ABC News, June 4, 2025.

Ana Swanson and Ian Austen, “Higher U.S. Tariffs on Steel and Aluminum Imports Take Effect,” New York Times, June 4, 2025.

Sylvia Ma, “Crackdown on IllegalMines as China Tightens Critical Mineral Controls amid Row with U.S.,” South China Morning Post, June 4, 2025.

Paul Wiseman, “U.S. Job Openings Rose in April, Signaling Resilience in the American Labor Market,” Associated Press, June 3, 2025.

Jeff Cox, “Private Sector Hiring Rose by Just 37,000 in May, the Lowest in More Than Two Years, ADP Says,” CNBC, June 4, 2025.

Kevin Roose, “For Some Recent Graduates, the A.I. Job Apocalypse May Already Be Here,” New York Times, May 30, 2025.

Melissa Repko, “Target Cuts Sales Outlook as Retailer Blames Tariff Uncertainty and Backlash to DEI Rollback,” CNBC, May 21, 2025.

Nora Eckert and Nathan Gomes, “Ford Pulls Guidance, Warns It Will Take $1.5 Billion Hit from Trump's Tariffs,” Reuters, May 6, 2025.

Katy Bernato, “Ford, Marriott, Mattel: A Look at Companies That Pulled or Cut Guidance This Week,” Wall Street Journal, May 9, 2025.

Julia Harte, “Student Loan Quagmire Frustrates Borrowers - and Alarms Some Trump Voters,” Reuters, June 10, 2025; Adam Minsky, “Unprecedented Student Loan Overhaul in ‘Big Beautiful Bill’ Passes House, Heads to Trump,” Forbes, July 3, 2025.

Anne D’Innocenzio, “A Rare Warning from Walmart During a U.S. Trade War: Higher Prices Are Inevitable,” Associated Press, May 15, 2025.

Meghan Brobrowsky and Sam Schechner, “Meta Is Delaying the Rollout of Its Flagship AI Model,” Wall Street Journal, May 15, 2025.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.