Space: The Final Economic Frontier

Space presents many business opportunities, but success requires deep pockets and expertise in complex engineering challenges.

Key Takeaways

The space economy’s growth potential is $1.8 trillion over the next 10 years, with applications ranging from weather monitoring to drug manufacturing.

Space presents diverse business opportunities, but successful companies must overcome substantial engineering and financial hurdles.

Industry leaders SpaceX and Rocket Lab offer unique combinations of launch services and the ability to manufacture the satellites they launch.

It's been more than 55 years since we landed on the moon. This was achieved only after a massive government effort, whose costs from the 1960 inception to the 1969 lunar landing are estimated at $28 billion, according to the online “Complete Guide to the Apollo Program.” Adjusted for inflation, that's $241 billion in today's dollars.

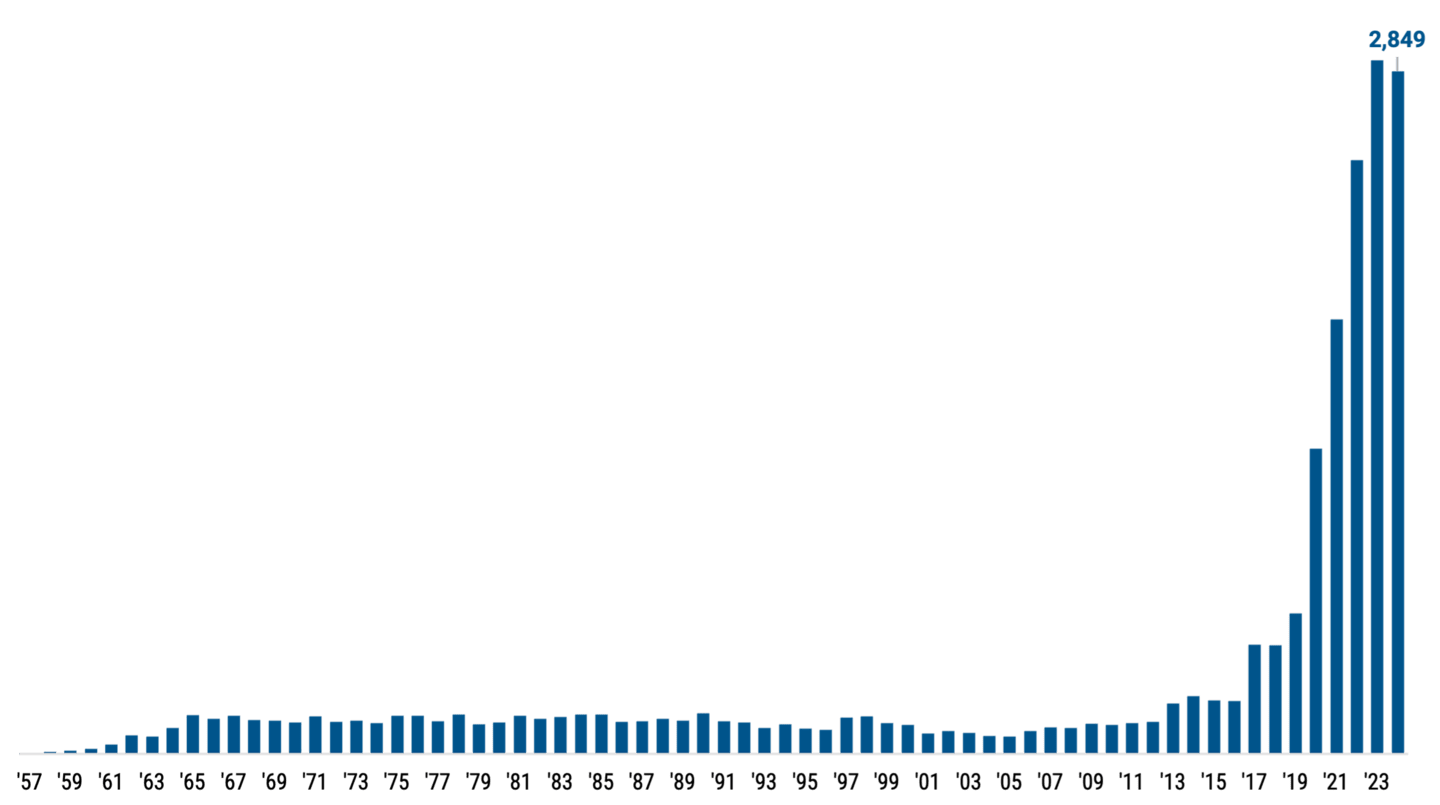

Since then, we have seen the remarkable evolution of space into an economic frontier of tremendous diversity and opportunity. A recent World Economic Forum report estimates that the space economy could amount to $1.8 trillion by 2035. If these projections hold true, the recent rapid rise in launch activity shown in Figure 1 could mark the beginning of a sustained period of growth.

Figure 1 | The Evolution of Space Launches Shows Massive Growth

Annual Number of Objects Launched Into Space

Data as of 12/31/2024. Source: OurWorldinData.org/space-exploration-satellites . United Nations Office for Outer Space Affairs (2025). Objects consist of satellites, probes, landers, crewed spacecrafts and space station flight elements launched into Earth orbit or beyond.

Diverse Applications in Space Economy

The total market opportunity covers a broad range of applications that include:

Weather monitoring and disaster mitigation.

Digital communication.

Travel and transportation (navigation and positioning) data.

Consumer and retail data.

Manufacturing and pharmaceutical processes best performed in the vacuum of space.

Resource extraction.

Tourism.

Defense.

For example, Varda Space Industries manufactures pharmaceuticals and other materials in space using its microgravity-enabled, robotic lab equipment. The dust-free vacuum of space allows the company to achieve results that aren't possible or as effective on Earth.

In a recent mission, Varda’s lab equipment was housed inside a Rocket Labs spacecraft (satellite bus) launched into space by a SpaceX rocket. A reentry capsule later returned the processed materials to Earth.

The Harsh Realities of Space Exploration

Though space travel is becoming more common, it’s not without risk. In March, two astronauts returned to Earth after their planned 10-day mission, which turned into 10 months of being stranded at the International Space Station due to a problem with their spacecraft. This year has also seen a SpaceX rocket explode after launch. Meanwhile, two companies attempted to land commercial modules on the moon for NASA, but only one succeeded.

This shows how challenging it is to get space exploration right. Launching rockets is the most critical aspect of all space-related activities. Launching is a costly and complicated engineering and manufacturing task.

Companies that manage to develop and build rockets must also figure out how to scale their operations to create a sustainable business. Due to the high costs and difficulty involved, successful launch providers have a significant competitive advantage.

Lowering Costs with Reusable Rockets

These factors explain why launch companies like SpaceX and Rocket Lab have chosen to develop reusable rockets, which significantly lower costs and increase efficiency. Both companies initially focused on smaller rockets to quickly deliver payloads into space. This strategy allows them to start generating revenue from launch services while they work on developing a recurring revenue service or application. SpaceX has successfully done this with its Starlink satellite network. However, whether Rocket Lab will pursue a similar approach or explore a different application altogether remains uncertain.

These two examples illustrate the engineering complexities, financial challenges and diverse business opportunities associated with space exploration. Given these costs and complexities, it’s likely no coincidence that many space companies are privately owned by some of the wealthiest men on the planet. Elon Musk owns SpaceX, and Jeff Bezos owns Blue Origin.

Virgin Galactic, a space tourism company founded by Sir Richard Branson, is publicly traded. However, the company has faced significant challenges. It began designing its Unity spacecraft in 2012, which completed its first commercial flight in 2023. Unfortunately, Unity was retired only a year later, allowing the company to concentrate on developing and launching its successor. The harsh realities of space travel and the financial markets have led to struggles for the company, and its stock currently trades at a fraction of its peak value.

Although the opportunities in space are compelling, the costs and hurdles to commercialization are significant. Due to these challenges, we believe careful and active security selection is essential to navigate the publicly traded companies in this sector.

Authors

Client Portfolio Manager

Explore Our Large-Cap Growth Capabilities

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.