Positioning for Growth with Global Small-Caps

Despite market uncertainty, we believe smaller companies are poised to experience strong earnings growth.

Key Takeaways

We believe attractive valuations, improving fundamentals and other tailwinds may benefit global small-caps.

In our view, focusing on small-cap companies with accelerating and sustainable growth could offer higher potential returns.

Investing in small-cap stocks now could allow investors to benefit from a potential market shift toward this asset class.

Even in today’s unpredictable market, we believe active investors can uncover attractive growth opportunities in smaller companies. These firms represent a dynamic, global universe for managers to identify those with specific drivers of earnings growth, ranging from product launches to bolt-on acquisitions.

Market Volatility Can Create Opportunities for Small-Caps

Economic downturns and risk-off markets can have a greater impact on the share prices of smaller companies. When conditions improve, however, these firms have historically rebounded and outperformed over the long term. We believe these characteristics make small-caps important diversifiers that may enhance the potential for improved returns.

In our view, now is likely a beneficial time to consider this class of equities. Compared to large-cap stocks, their valuations have fallen well below their historical 10-year average.1 In addition, an allocation to small-caps may help mitigate potential concentration risk from large positions in the Magnificent Seven while also improving returns.

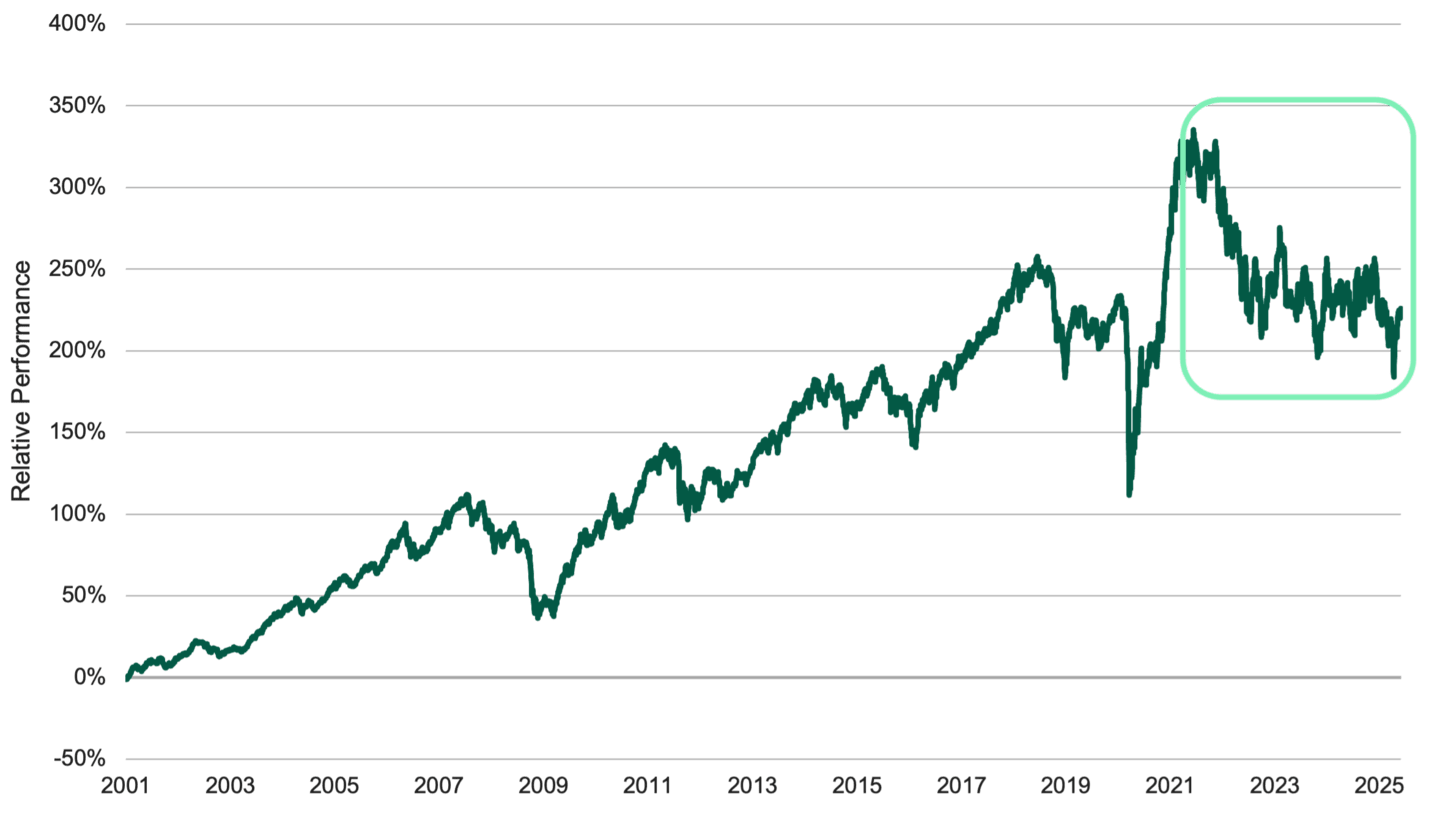

A natural bias to focus on recent trends may lead investors to overlook what we believe to be a compelling opportunity. Although small-cap stocks have lagged recently, they have outperformed over the last 25 years, as shown in Figure 1. This is partly due to their ability to deliver faster earnings growth than their large-cap counterparts.

Figure 1 | Despite Recent Underperformance, Small-Caps Have Historically Excelled Over the Long Term

MSCI ACWI Small Cap vs. MSCI ACWI Large Cap

Data from 1/1/2001 – 4/30/2025. Source: FactSet. Past performance is no guarantee of future results.

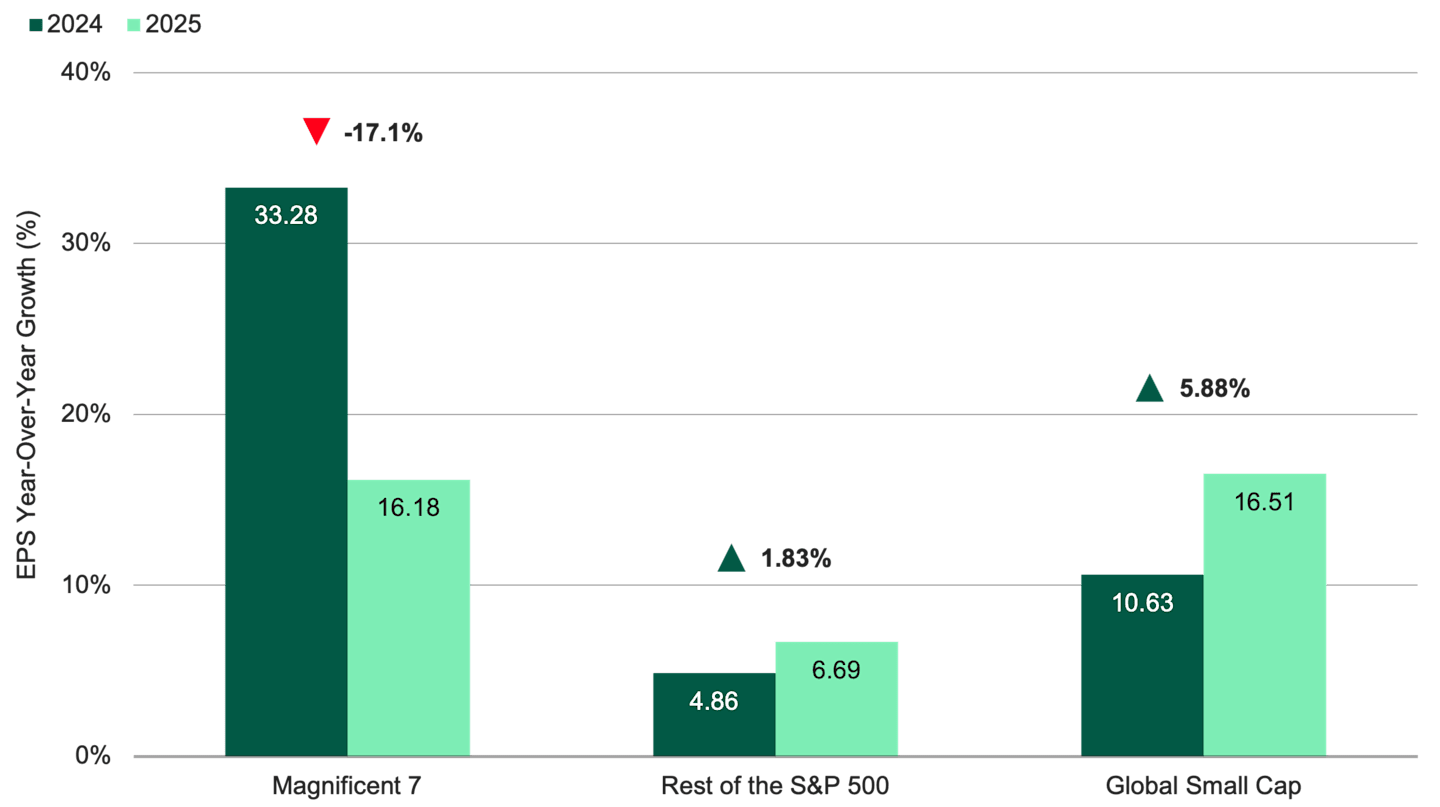

We think the near-term outlook for global small-caps is positive. According to consensus expectations, their earnings could increase faster this year than in 2024. See Figure 2.

Figure 2 | Global Small-Cap Earnings Are Expected to Accelerate in 2025

Data from 1/1/2024 – 5/31/2025. Estimates are as of 5/31/2025. Source: FactSet. Forecasts are not reliable indicators of future results. Based on FactSet consensus estimates. Earnings per share (EPS) growth rates for global small-caps evaluate equal-weighted FactSet consensus estimates for MSCI ACWI IMI Index holdings with market capitalizations <$5B. The Magnificent Seven includes: AAPL, AMZN, GOOGL, META, MSFT, NVDA and TSLA.

Select global small-cap firms may also offer a safeguard against higher tariffs. Such companies typically generate most of their revenues from their domestic markets.

Given the size of the universe, there’s no shortage of small-cap companies that generate most of their revenues domestically and whose costs are unaffected by rising tariffs. Examples include fitness club operators that generate 100% of their revenues domestically.

Targeting Earnings Acceleration in Global Small-Caps

By their nature, small-caps tend to be more volatile than large-caps, and historically, they have greater earnings growth variability. We think this creates opportunities. We’re nimble in our approach, actively seeking to invest in promising companies and taking advantage of share price dislocations.

We accomplish this by applying fundamental, bottom-up analysis. Our team searches for firms it believes are poised for positive growth inflections that could be sustained for at least 12 to 18 months. These companies might be integrating acquisitions, launching new products, changing leadership or experiencing other durable growth catalysts.

Earnings acceleration (EA), or earnings growth increasing at a greater rate over time, is a key emphasis for us. Our research shows that earnings acceleration is significantly associated with stock price outperformance.2

This differs from focusing solely on the absolute level of growth. In some cases, our process may favor firms with low current growth rates, but where we see potential for sustainable growth acceleration. With this approach, we aim to take positions in companies early, before their earnings climb and their share price rises correspondingly.

We believe emphasizing earnings acceleration can be especially effective in the global small-cap space. This asset class remains highly inefficient, in large part due to less analyst coverage and limited available information compared to large-caps. We believe our focus on change allows us to take advantage of these persistent inefficiencies.

We apply the same rigor to selling stocks, eliminating positions once we determine that we have maximized returns from an investment or if a company’s growth may decelerate. Here, too, homing in on EA provides an important signal about a company’s prospects.

Assessing the Current Landscape for Global Small-Caps

Improving company fundamentals — the kind that our investment process seeks — is a key driver of returns over the long run. We believe active management and bottom-up analysis can help pinpoint global small-cap companies well-positioned to grow their earnings at an accelerating rate, despite market uncertainty and volatility.

Getting the timing exactly right is nearly impossible. However, we believe more investors will also recognize the value and improving outlook for small-caps, leading to a rotation into these equities. Taking a position before that happens could enable portfolios to benefit more from the shift.

Authors

Senior Portfolio Manager

Senior Client Portfolio Manager

Explore Our Global Small-Cap Capabilities

FactSet, 4/30/2015 to 3/31/2025.

Xiaoping Zhang, Ted Harlan, Jim Zhao and Richard Adams, “Revisiting Acceleration as a Source of Diversifying Excess Returns,” American Century Investments, 2021.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.