U.S. Sustainable Large Cap Core Sustainability Report

Letter to Shareholders

Energy and human capital management are always priorities in sustainable investing. In this year’s letter, we want to highlight how they could be impacted by the growth of artificial intelligence (AI) and the global buildout of data centers.

We think generative AI could usher in a step change in productivity and growth for the global economy. As part of that, however, the world will be consuming a significantly greater amount of energy.

In the United States, electricity consumption had been flatlining since the early 2000s as energy efficiency more than offset economic growth. However, in recent years, U.S. electricity consumption has trended higher alongside a massive expansion of data centers. Analysts estimate consumption could increase by 5% to 10% through the end of the decade.

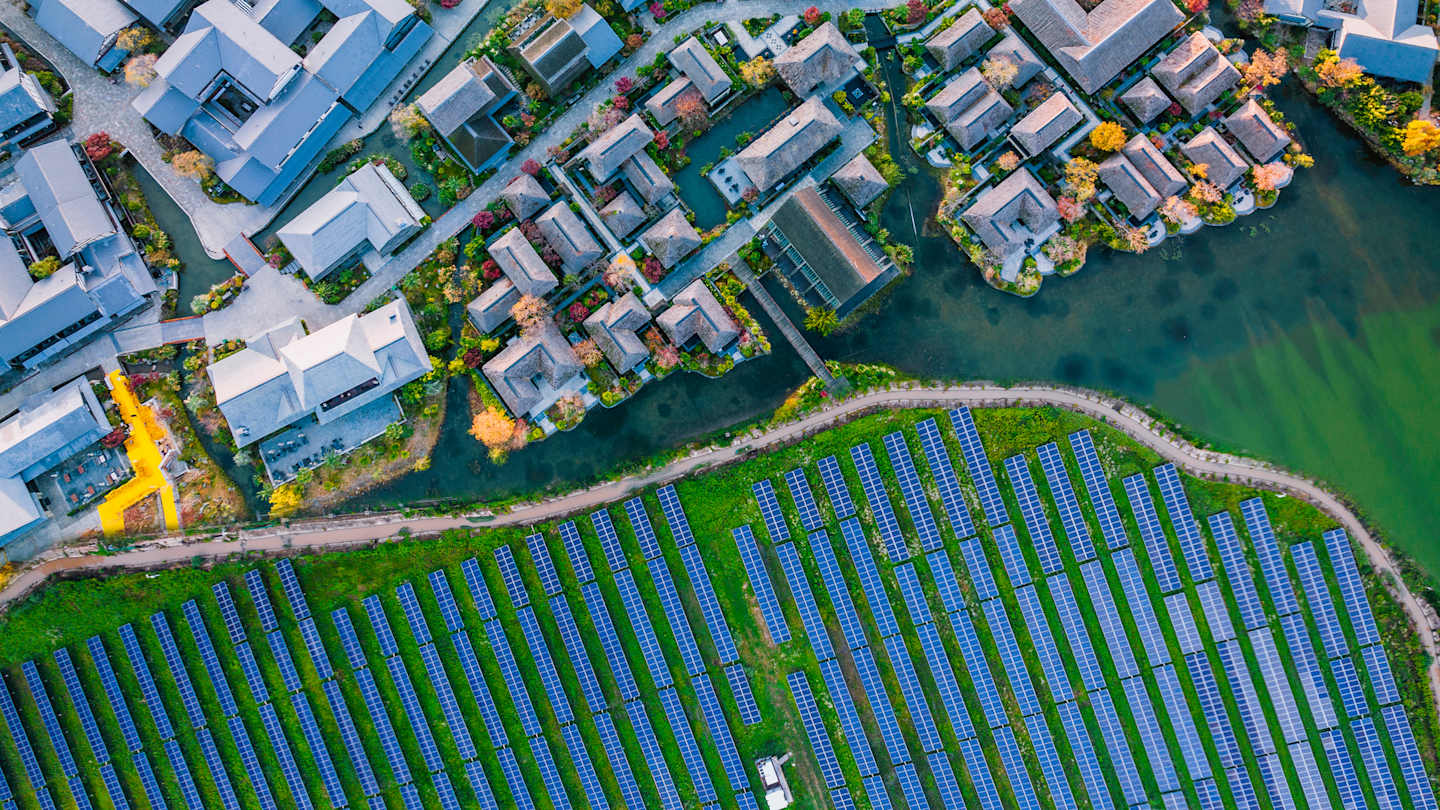

So far, renewable energy production has not been able to keep pace with this increased need. Over the longer term, through 2030 and beyond, analysts estimate renewables will catch up and make up a greater share of the energy supply. However, there will likely be a transition period through the end of this decade, where natural gas and liquified natural gas (LNG) will be critical for supplying energy to AI and data centers. As a result, carbon emissions are expected to increase through the end of the decade.

Going forward, more analysis will examine where individual companies obtain electricity. Many hyperscalers, for example, rely on a far greater mix of renewable energy sources than the overall grid, which could have a positive impact on aggregate carbon emissions.

Meanwhile, to justify the massive investment in AI and data centers, companies will need to achieve significant cost savings. Payroll may be one area where they try to find efficiencies.

While we believe AI will cause some job losses and reduce hiring in specific areas, the aggregate impact will likely be less than feared. We expect AI to create jobs, just as technology has in previous cycles, although we’re still in the early days of AI adoption.

AI hasn’t taken jobs at scale, but we’re beginning to see some initial impacts. The National Bureau of Economic Research conducted a study of ChatGPT’s impact that, according to initial results, points toward lower headcount for early-stage software developers.

Another recent analysis found that most jobs aren’t completely replaceable by AI. According to the study, only 4% of jobs are structured so that 75% of their responsibilities could be done with AI.

We believe AI will make many employees more productive in their current roles, allowing them to take on greater responsibilities. Retraining will be critical, and many companies are pursuing this path rather than firing workers. To quote NVIDIA CEO Jensen Huang, “You’re not going to lose your job to AI, but you’re going to lose your job to someone who uses AI.”

Authors

Senior Portfolio Manager

Portfolio Manager

Portfolio Manager

Download the Full Report

Learn more about leaders in the sustainability space, our proxy voting policies and the Sustainable Research team.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Diversification does not assure a profit nor does it protect against loss of principal.

The portfolio managers use a variety of analytical research tools and techniques to help them make decisions about buying or holding issuers that meet their investment criteria and selling issuers that do not. In addition to fundamental financial metrics, the portfolio managers may also consider environmental, social, and/or governance (ESG) data to evaluate an issuer's sustainability characteristics. However, the portfolio managers may not consider ESG data with respect to every investment decision and, even when such data is considered, they may conclude that other attributes of an investment outweigh sustainability-related considerations when making decisions. Sustainability-related characteristics may or may not impact the performance of an issuer or the strategy, and the strategy may perform differently if it did not consider ESG data. Issuers with strong sustainability-related characteristics may or may not outperform issuers with weak sustainability-related characteristics. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and may not be available, complete, or accurate. Not all American Century investment strategies incorporate ESG data into the process.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.