College & Education Investments

It's always a good time to start investing for education.

The Future Starts Here

With a little planning, it's possible to invest for education without breaking the bank. Putting aside money in an investment account early (and consistently) helps you and your student reduce the need for loans and lower the impact borrowing has on future goals.

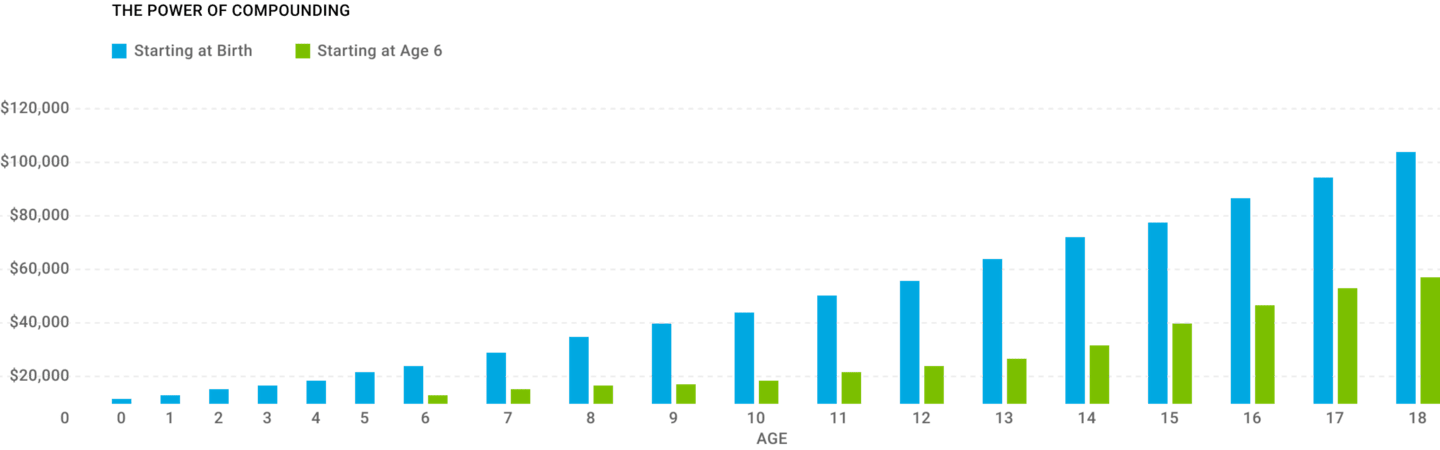

Start Early: How Compounding Adds Up Over Time

The more time you have for your education investment account to grow and compound, the more likely you are to reach your goals.

Compounding occurs when you earn money on your original investment, plus any earnings for that investment. Over time, compounding can have a powerful effect on your account balance.

Source: American Century Investments, 2022, Future Value Calculator, dinkytown.net. The hypothetical calculation assumes an initial investment of $2,500 and additional monthly contributions of $250 earning a rate of 6% annually over 12 and 18 years, respectively. It assumes reinvestment of all realized gains, dividends, and interest receipts and does not account for the effects of any added fees, expenses, or taxes that might be incurred. If all taxes, fees, and expenses were reflected, reported portfolio values would be lower. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Compare Options

Get to know your choices for college and education savings.

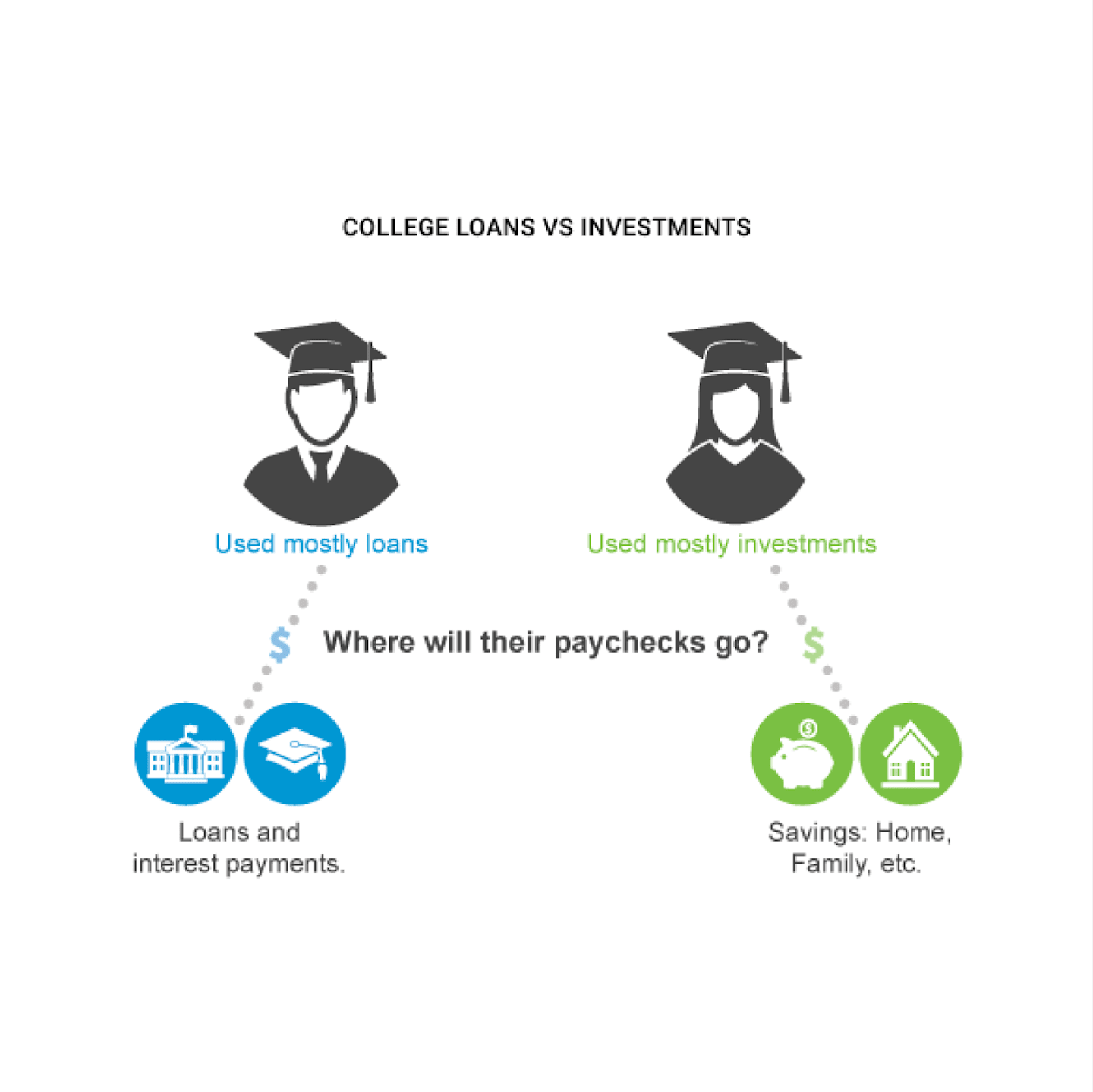

Late Start? Still Better Than Relying on Loans

If you're getting a late start, having some college savings is still better than borrowing the full amount.

Previous generations funded their education by taking out student loans. But as tuition rises, student debt is increasing too.

When students borrow less for their degrees, they can free up income when they’re ready to buy a new home, start a family or save for retirement.

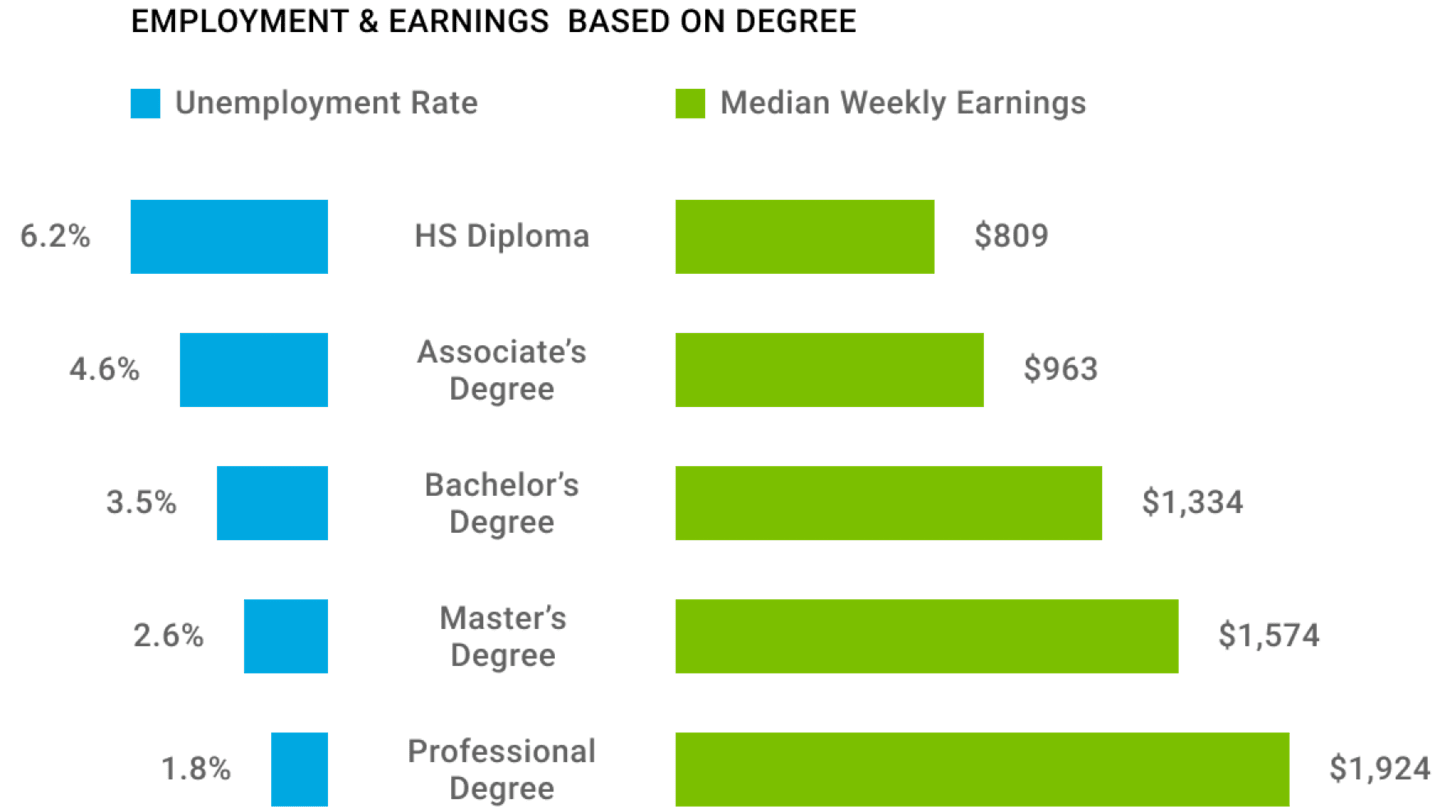

Source: U.S. Bureau of Labor Statistics, Current Population Survey. Data as of 2021. Note: Data are for persons age 25 and over. Earnings are for full-time wage and salary workers.

Hit the Books and Make More

Is college worth the investment? Data from the U.S. Bureau of Labor Statistics shows that workers with higher levels of education are likely to enjoy both higher incomes and lower unemployment rates.

Ready to Invest?

Learn about the different types of college and education investment accounts to find the one that fits your goals.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.