The Surprising Truth About Portfolio Diversification

Are some of your investments performing well while others aren't keeping up? Everything may be going according to plan. If not, you may need to revisit investment diversification.

Key Takeaways

Diversification means spreading your money among investments that respond differently to market changes.

Although it’s not a guarantee against loss, most professionals agree that a diversified portfolio is a sound long-term strategy.

A diversified mix is based on your risk tolerance and time horizon, and generally includes stocks, bonds and cash equivalents.

Diversification is often touted as the most important strategy in an investor’s toolkit. But if you read the fine print in your investment or financial education materials, you’ll often see this line:

“Diversification does not ensure a profit, nor does it protect against loss of principal.”

When some of the investments in your diversified portfolio are gaining during a particular market environment and a few others aren't keeping up (or are losing value), everything might be working as it should.

How can that be?

Let’s dive further into what diversification is in investing—and what it isn’t.

What Is a Diversified Portfolio?

Diversification simply means spreading your money over multiple asset classes (categories of investments) that respond differently to market changes.

At a high level, those types of investments include stocks, bonds and cash equivalents like money markets. Each asset class has its own characteristics: Stocks and bonds may perform differently when the economy is booming or slowing down, when interest rates rise or fall or when political events make headlines and cause stock market volatility.

Investing your money with different financial institutions or product types (stocks, mutual funds, exchange-traded funds, etc.) is not diversification. These variations won’t help if your investments all behave the same when markets move, and you really are not managing risk.

Diversification as an Investment Strategy

Think of diversified portfolios as a way to spread out the risk of your investments. That should mean less volatility overall in your portfolio. While it sounds complicated, investors can start diversifying their portfolios the moment they begin investing and reduce the potential risk.

If a portfolio is not diversified, it risks losing too much value if one asset dips. While no portfolio is without risk, a diversified portfolio has enough variety that not all value is lost when one investment declines.

Part of the secret of a diversified portfolio is creating a mix of low-correlation investments. A portfolio full of high-correlation investments is less diversified; if one asset begins to decline, the others are likely to as well.

Correlation measures how closely two things are related to each other. Investments with a correlation of +1 are closely related, while investments with a correlation of -1 are likely not related at all.

Correlation is measured historically, meaning that how closely assets are linked can change over time. Historical data and performance can help inform current investment strategies.

How To Diversify Your Portfolio

Diversified portfolios will look different based on your risk tolerance and timeline, but they’re generally a mix of these investments.

Stocks are often the higher risk or most aggressive element of an investor’s portfolio. Domestic stocks will not always carry the same types of risks as international stocks, meaning including both in a strategy could help spread out your risk.

Bonds are often considered less risky or volatile than stocks. Some provide the potential for income, which can provide investors with a buffer against less-predictable assets.

Cash equivalents like money markets, certificates of deposit and other short-term investments offer the least growth potential, but they offer liquidity and have lower risk.

These elements are the most common in investors’ portfolios, but they are by no means the only assets a person can invest in. Portfolios could also include alternative investments such as real estate investment trusts (REITs), commodities, sector funds or asset allocation funds.

It Looks Diversified, But Is It?

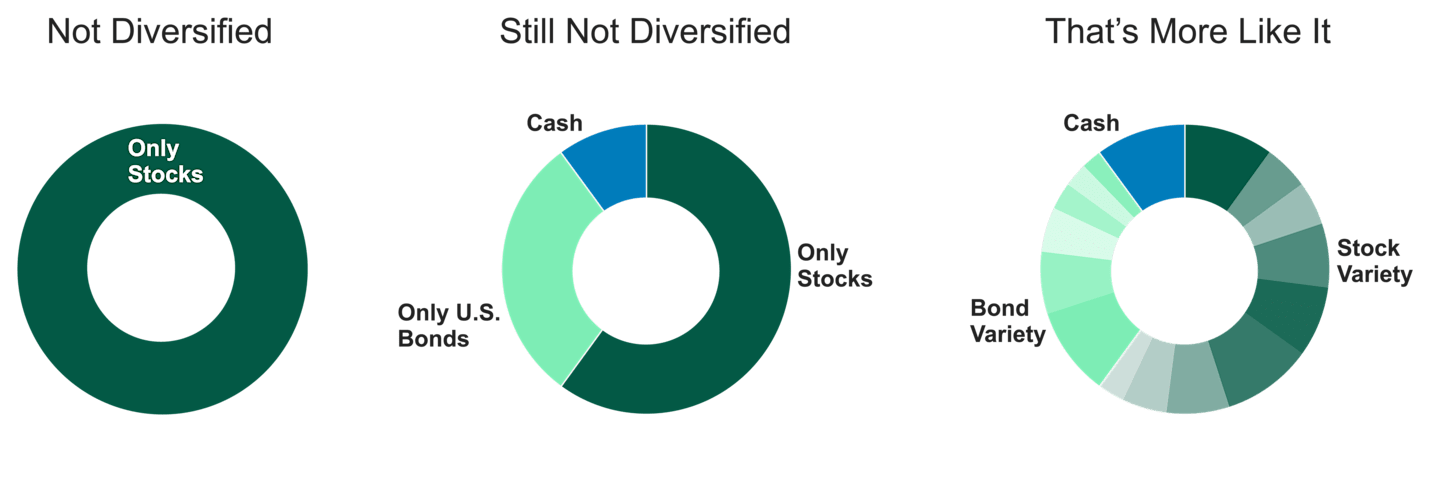

A portfolio can have a variety of underlying investments but still not be properly diversified.

Hypothetical Portfolios

Source: American Century Investments®. The hypothetical scenario is an example of what a diversified portfolio might look like. Cash includes cash equivalents such as money markets.

Diversification should also go beyond the general categories of stocks, bonds and cash equivalents. Each of these can be split further into more specialized categories.

Stocks

Bonds

Cash

Managing Risk In Your Portfolio

Some investments have more growth potential than others, so why not stick with all stocks, for instance? Because growth can go hand in hand with risk. Remember the old “eggs in one basket” saying? The risks can be real. For example, foreign stocks were up 18.24% in 2023, but were significantly lower in 2024 at 3.82%.1

Most investors aren't comfortable with such uncertainty, but research shows that no single asset has a repeatable performance pattern . Owning different asset classes, however, can help prepare you for various market conditions and may help provide more consistent, less volatile returns over time.

Diversified portfolios have the potential to benefit from some of the big gains (but not all) of their underlying assets and experience some (and not all) of the big losses. The end goal is a smoother pattern of performance and less anxiety for you. And, you might even have a better chance at reaching your investment goals.

Can Portfolios Be Over-Diversified?

Yes, portfolios can be over-diversified. For example, if you add a new asset to your portfolio that’s too similar to another, you could suddenly change your overall risk profile—either exposing you to too much risk or lowering your potential for long-term growth. That can throw a portfolio’s balance out of whack.

That’s why it is important to perform regular checkups on your portfolio and to rebalance your portfolio when it becomes unbalanced from market activity.

One Option: Pre-Diversified Portfolios

Diversifying your investments may seem complicated if you try to research and select each type of asset on your own. Most mutual funds allow you to spread your money across securities in a specific category.

You can go beyond that with a pre-diversified portfolio, which provides a mix of funds that cover multiple asset categories in a single product. More importantly, fund managers will carefully select and monitor the investments in these portfolios for their investors.

Take the Next Step

Do you feel under-diversified or need help with investment advice or financial planning? We offer options ranging from a one-time consultation to in-depth and ongoing help. You can also check out our pre-diversified portfolio for a convenient way to get the diversification you want.

American Century Investments, Bloomberg, 12/31/2024. Emerging markets stocks are represented by the MSCI Emerging Markets Index.

Russell Indexes allows investors to track current and historical market performance by specific market segment (large/mid/small cap) or investment style (growth/value/defensive/dynamic). They include both U.S. and global indexes.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Rebalancing allows you to keep your asset allocation in line with your goals. It does not guarantee investment returns and does not eliminate risk.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.