Your Portfolio Checkup Checklist

Portfolios and financial plans need periodic checkups. Find out when and why to reassess your investments, rebalance your portfolio or reconfirm your goals.

Key Takeaways

Investment portfolios and financial plans are not set in stone. They require periodic reviews to stay current with your needs.

You may wonder how often to checkup on your investments, or what questions to ask your financial advisor about your portfolio.

Learn how and when to reassess your investments, rebalance your portfolio and confirm whether your investments still align with your goals.

A solid financial plan and a well-aligned portfolio may give you an edge over those who rely on general goals or guesswork. However, for good financial health, it's essential to periodically reassess both as life and market conditions change. Take the time to conduct a thorough review of your portfolio, which may involve rebalancing and refining your overall financial strategy.

With this checklist, let’s examine why and when to review your finances.

☑ Check Up on Your Portfolio Quarterly or Annually.

Have you reviewed your overall portfolio in the last six months? In the last year (or more)? If not, you may be due for a portfolio checkup.

More than occasionally checking account balances, you need to set aside time for an in-depth look at your investments.

Checkups Are a Prescription for Portfolio Health

Your financial health depends on a carefully constructed investment plan that aligns with your age, risk tolerance and future goals. Periodic portfolio reviews can help ensure your plan stays on track.

Checking your portfolio doesn’t always require changes. Unlike medical symptoms, market fluctuations can often be managed with a "wait and see" approach. Reacting impulsively to volatility may lead to poor decisions, such as buying high and selling low—which are counterproductive to successful investing.

Making money and avoiding losses involve more than guessing the market's direction. To keep your portfolio on course, consider a more disciplined approach: Review your portfolio on a regular basis or whenever you experience major life events.

Steps for a Successful Portfolio Checkup

1. Prepare for Your Portfolio Checkup

Collect your quarterly account statements or log in online to review your holdings and performance over the past six to 12 months. Take note of any investments or withdrawals that have impacted your overall balances and assess whether they align with your initial financial plan or mark a significant deviation from your strategy.

You may also want to write down questions to ask your financial advisor about your portfolio during the review, if you’re working with a professional.

2. Examine Any Recent Life Changes

Life events like job changes, marriage, divorce, childbirth and retirement can greatly affect your investment strategy. Regularly reviewing your financial plan (which I’ll cover later) is crucial, and significant changes are a good reason for an unscheduled portfolio review.

Questions to consider about life changes:

Does this event affect my previously planned long-term goals?

Will I need to adjust the amount of money needed for those goals?

Do I need to add other people to my financial plan or change my beneficiaries?

Certain events may significantly change your plans, but make sure you use your review to stay committed to your future.

3. Decide if Your Risk Tolerance Has Changed

While life events could trigger a change in how you think about investment risk, your overall risk tolerance will likely evolve.

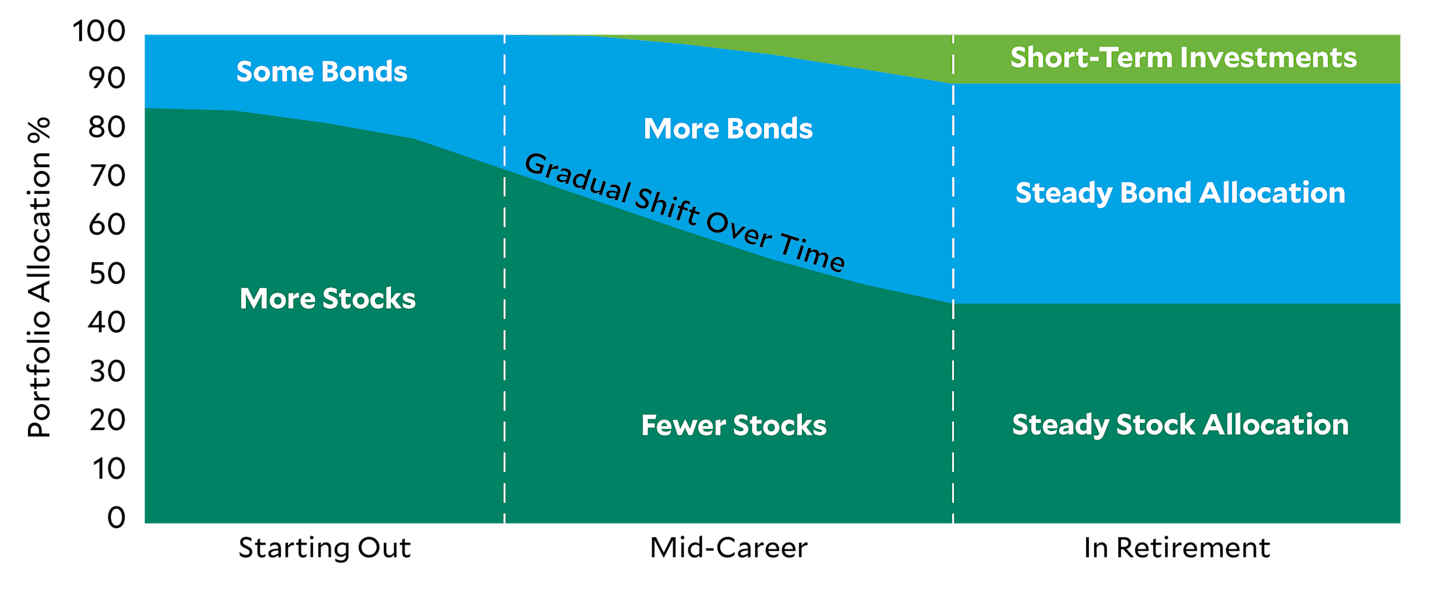

Younger investors typically benefit from stocks' long-term growth, while preretirees and retirees may prefer less risk as retirement approaches. Therefore, it's important to gradually decrease stock allocation over time. Regular portfolio reviews can help determine the right adjustments.

Evolving Portfolio Makeup

Sample Portfolio Shift in Stock, Bond and Short-Term Investments Over Time

Source: American Century Investments. Each investor's situation is different. This chart is for general educational purposes only.

4. Analyze Your Tax Situation

Taxes can play a significant role in your portfolio’s value over time. Investment income (through dividends or interest) and selling investments (with gains or losses) may impact your tax liability, so it’s important to monitor the tax implications of your investment decisions.

5. Watch Your Portfolio Weights

Have your portfolio allocations shifted since your last review? Recent market fluctuations may have altered the value and weightings of your holdings. It might be time to rebalance and realign with your original plan, which leads to the next item on our checklist.

☑ Rebalance to Restore Your Portfolio as Needed

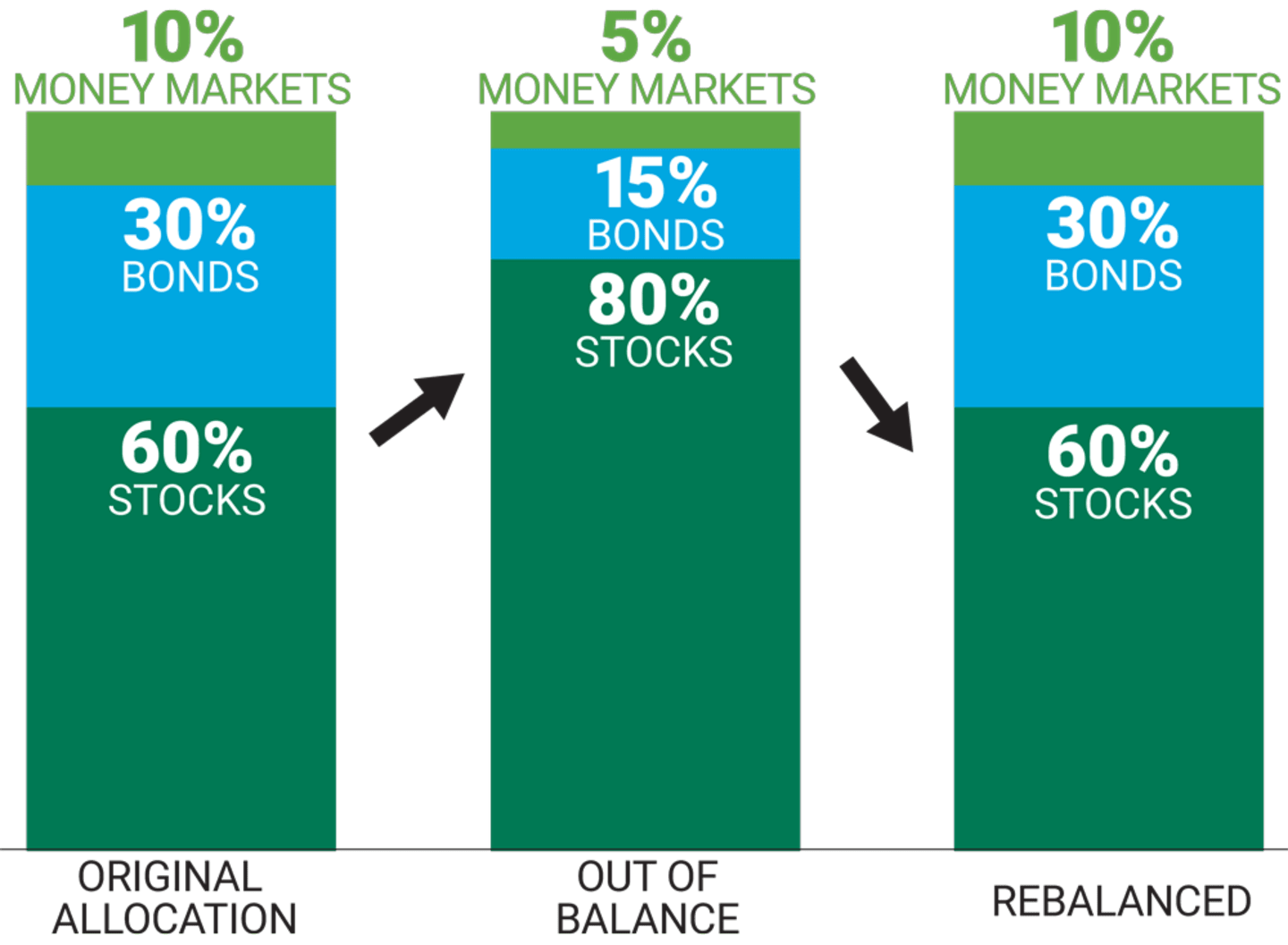

Rebalancing your portfolio is essential for maintaining your desired asset allocation over time, ensuring it aligns with your goals and risk tolerance. A well-diversified portfolio typically mixes stocks and bonds, which respond differently to market fluctuations. Without regular rebalancing, your asset allocation can drift, potentially exposing you to more risk than you’re comfortable with. Here's an example to illustrate the importance of rebalancing.

Rebalancing Your Mix

Sample Portfolio Allocation

Source: American Century Investments, June 2025

- Original allocation: You allocated 60% to stocks and 40% to bonds.

- Out of balance: If stock values rise, you'll have a higher percentage in stocks, increasing your risk.

- Rebalanced: To return to the original 60/40 mix, rebalance by selling stocks and buying bonds.

Keep in mind that this doesn’t mean you made a mistake to begin with. A portfolio falling out of whack is natural as the market fluctuates over time.

How to Rebalance Your Portfolio

There are various types of rebalancing, and the choice depends on your investment goals and time horizon. The key is to ensure that your portfolio’s asset allocation aligns with your objectives, especially if those goals have shifted.

Start by gathering your quarterly statements for your investment accounts or logging in to access them. Review your holdings to assess changes since your last evaluation. Then, consider your current life situation and whether your goals or time horizon has changed. Reflect on these questions carefully:

Has the timing you’ve planned for your portfolio changed? Are you on track to retire sooner or later than you anticipated? Do you plan on using non-retirement investments soon?

Have your financial goals changed? In addition to building a retirement nest egg, are you looking to invest for a child’s education or perhaps a property? (Our calculators can help you crunch the numbers.)

How much risk are you comfortable with? Has that changed in the past year?

After answering the questions, assess whether your goals have changed. Determine the appropriate asset mix, which may be your original allocation. Review your portfolio’s performance and consider selling or buying assets to align with your initial plan or adjust for any new goals.

Remember, rebalancing is more than just a look at the numbers. It’s an opportunity to revisit everything—your overall financial situation, your view of the economy and how the markets have been performing.

Can You Rebalance Your Portfolio on Your Own?

Rebalancing on your own can be challenging, and you might miss key market trends or personal insights. Partnering with a financial advisor can be beneficial, as they bring expertise and can help you explore factors you might overlook, ensuring a tailored approach to your investing strategy.

☑ Review Your Financial Plan at Least Annually

Different from an investment plan, your financial plan gives you a broader view of all your finances, like tax and estate planning, in addition to you portfolio. Once you have a plan in place, though, the story doesn’t stop there.

Why review your financial plan? A financial plan review addresses any adjustments needed and can help you know if you're on track. Or, it can help you formulate new goals as life changes.

What Questions Should You Ask Your Advisor During an Annual Review?

While there are so many things you could talk about in a financial plan review, you may want to focus on the most important one or two things for you. Your portfolio allocation (and making sure it still fits) is always a point of discussion. Where it goes from there depends on your needs. See our list of possible topics to get ideas for what questions you may want answered at your next review.

Financial Planning Review Checklist

What will you talk about at a financial plan review? Here is a starter list to consider from our consultants.

Life Changes

Marriage

Divorce

New baby

New grandchild

Caregiving responsibilities

Parent/child moving in

Financial Changes

New income source

Inheritance

Job changes or losses

Major purchase

Insurance policies

Starting a business

Future

Retirement planning:

• At least five years out

• Retirement transition

• In retirement

Investing tax strategies

Estate planning

In addition to checking out the potential topics about life changes, there are specific questions I believe could be very helpful about your investments, including:

How much risk am I really taking with my investments?

Does my current risk level fit my intentions?

How tax-efficient is my portfolio right now?

Am I too concentrated in one sector or stock?

Is my asset allocation still appropriate given the current market conditions?

Prep Before Your Review

Preparing for your review can help make sure the topics you want to discuss are covered. Take a little time to prep before your session to gather your thoughts.

Should You Review Your Financial Plan More Often?

This is a good conversation to have with your advisor. It may be as simple as asking how often you want your advisor to check in. Another telling question is, "What keeps you up at night?" Whatever your answer, it may be a good topic for you and your advisor.

How often you review your plan largely depends on your unique needs. We recommend at least an annual review, but you can review more often if needed. The frequency may also depend on where you are in the investor life cycle and your confidence in your plan.

What Does (or Doesn't) Trigger a Change to Your Plan?

Some investors think a review is necessary when headline news affects markets and the economy or when government policy changes could impact their investments. Not necessarily. With the right plan, very few market events will prompt a significant change. Even policy changes—such as taxes or retirement plan rules—don't happen overnight, so often, those can be addressed in an annual review.

When markets are incredibly volatile, you may be surprised by a 'stay the course' message from your advisor. But there's a reason. Your plan isn’t just for the best market years; it’s for the worst years, too. A good plan will account for market ebbs and flows.

Still, there may be circumstances that warrant a call with your advisor. Let's say the markets drop 20% before you were planning a big purchase, such as a home down payment, or your child is planning a wedding. Situations like these may be reasons to pick up the phone and make sure you're where you need to be.

You also need to be OK with the downside of the portfolio you pick. When markets perform well, it's easy to think you have a larger capacity for risk than you really do. Down markets will give you a better idea of how much risk you can tolerate.

Regular Reviews Can Keep Your Investments on Track

Setting aside time to review your finances—checking up on your portfolio, determining if you need to rebalance and reviewing your financial plan—can be important for reaching your goals. In addition to helping you know if you’re on track now, it can also help you make important decisions that may affect your family and your future.

Some clients may think they don’t have time for these critical reviews. I like them to consider the time spent in a different way: as a time-saving decision rather than a time-consuming one. For example, through routine reviews with my clients, we’ve been able to uncover tax harvesting opportunities and swap investments for more tax-efficient positions that can save them thousands of dollars a year. Not reviewing your portfolio and plan could lead to results you don’t want, such as one client who found out they still had their ex-spouse as primary beneficiary on their accounts.

Whether you review annually or more often, I encourage you to take those steps and not leave your investments or your finances to chance. If you need help, we’re here.

Authors

Financial Consultant

Ready for a Portfolio Checkup or Financial Plan Review?

We’re ready to help with a one-time consultation, financial planning in two or three consultations, or ongoing advice. You choose how you want to have your financial advice review.

Private Client Group advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. This service is generally for clients with a minimum $50,000 investment. Call us to determine the level of service that is appropriate for you. The advisory service provides discretionary investment management for a fee. All investing involves risk.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Rebalancing allows you to keep your asset allocation in line with your goals. It does not guarantee investment returns and does not eliminate risk.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.