5 Questions About Social Security Benefits

Social Security is a big financial step for most people’s retirement. Getting answers about when to claim and how to maximize your benefits is important before you file.

Key Takeaways

Social Security is important for retirement income for many people, and there are strategies that can help maximize benefits.

Understanding Social Security rules and requirements is crucial for retirement planning. Consider all factors that could affect your benefit amount.

Getting answers about Social Security is a good place to start. Here, you’ll find answers to five common questions about these benefits.

As retirement approaches, people begin thinking about their Social Security benefits. Some may be surprised that there are different strategies to maximize the amount they can receive. Knowing about your Social Security retirement benefits is crucial for making informed decisions as you prepare for your future.

Maximizing Your Social Security Benefits

There are a variety of factors to consider for how to get the most from your Social Security benefits, most of which center around when and how to claim them. That's important because when you start affects how much you could receive, not only per month, but throughout the remainder of your life, and potentially your surviving spouse’s life.

Waiting until retirement to figure out the rules and requirements could hurt your financial future. You could file too early and receive smaller payments, for example, or wait too long to get the most impact from your benefits. You also should know how to take advantage of benefits for spouses, ex-spouses and survivors.

Getting answers about Social Security can help you determine the right time to retire and receive benefits and make the right choices for you and your loved ones. Here are answers to five common questions that may help you get the most when you receive your Social Security benefits.

Click to jump to your question:

When Can I Claim Social Security Benefits?

Explore reasons to wait or claim benefits early (age 62).

How Do Spousal, Ex-Spouse and Survivor Benefits Work?

Understand relationships and timing for benefits.

Can I Work and Claim Social Security at the Same Time?

Know the guidelines to help avoid benefit reductions.

Do I Have to Pay Taxes on Social Security Benefits?

Learn when taxes become a consideration.

What if I Have Debt or Other Obligations?

Balance paying off debt and claiming your benefits.

Schedule a personal consultation with a financial consultant.

1. When Can I Claim Social Security?

The short answer is you can claim benefits at age 62, but there are earnings restrictions if you’re still employed. The longer you wait, the higher your benefit may be. Waiting until your full retirement age (FRA) or until age 70 can give you a higher benefit amount. Social Security determines FRA based on the year you were born.

Age 62: You can claim a percentage of your benefit.

Full retirement age (FRA): You are eligible to receive full benefits.

Age 70: You are eligible for maximum Social Security benefits.

1943-1954 – Age 66

1955-1959 – Age 66 + 2 months every year after 1954

1960 & after – Age 67

Drawing Social Security Early May Not Be the Best

Filing at 62 will reduce your full retirement age benefit by 30%. By delaying until age 70, you’d be eligible for up to 124% of your full benefits, depending on your full retirement age.

Assumes Full Retirement Age is 67. Increased benefits for delaying Social Security max out at age 70. Source: 2024 Social Security Retirement Benefits, December 2024.

So, when should you claim benefits? Besides age, consider other reasons to take Social Security earlier or later:

Do you have other sources of income you can rely on? Drawing benefits early may seem like a clear choice for those with little to no retirement savings. However, starting early means locking in lower benefits. You could consider working longer if your health permits. Remember that how much you make also impacts your Social Security benefits.

How will this affect your spouse or children? Timing is important when deciding when to claim for both you and your spouse. It could also impact what your spouse and children may receive if something should happen to you. If you are married, it’s important to have a claiming strategy, outlined later, that works best for all of you.

Does longevity run in your family? A person's survival probabilities depend on factors such as family health history, lifestyle and existing medical conditions. The longer you live, the more time you will need to draw benefits.

If you expect to live into your 80s, delaying Social Security may mean you accumulate more benefits—up to a breakeven point. Breakeven refers to the age when your total Social Security income from two options reaches the same amount.

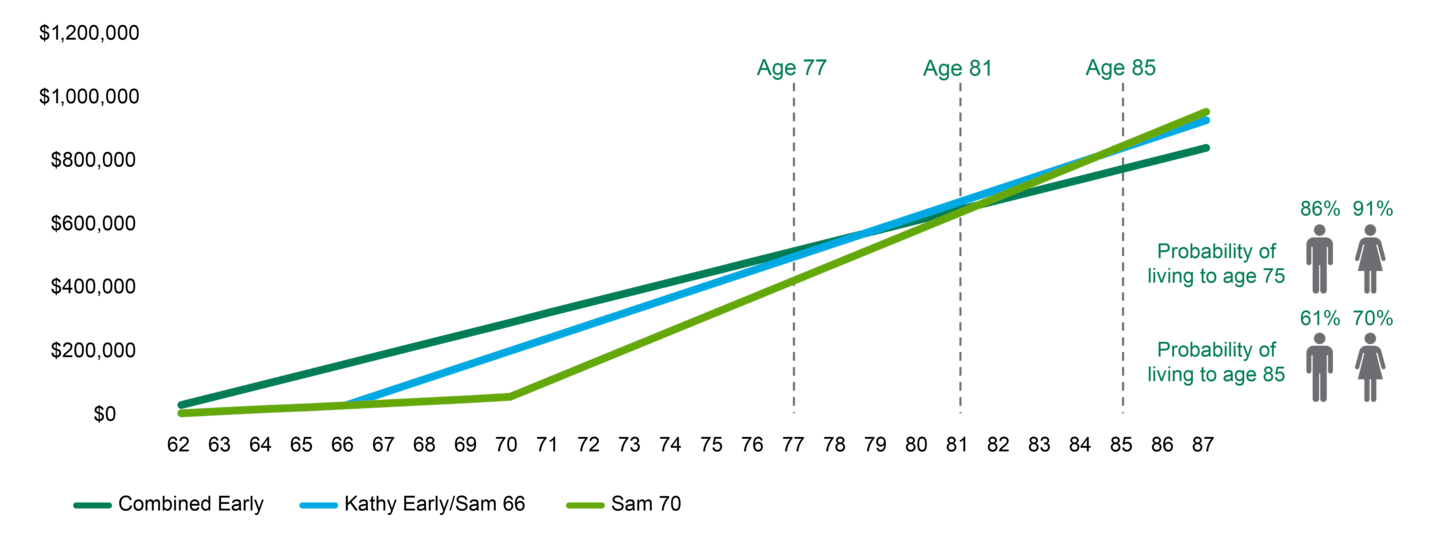

The chart shows three scenarios for Sam and Kathy, outlining their breakeven points in relation to their start dates. In this example, if Sam delays benefits until age 70, he'll need to live until age 81 to accumulate the same dollar amount of benefits he would if he started at age 62.

If Longevity Is on Your Side, Later May Be Better (the Reverse Is True Too)

Kathy $700/month, FRA 66. Sam $2,400/month, FRA 66. Probability of living to ages shown as of age 65. This chart represents an example of accumulated benefits with early filing combined with late filing to increase Social Security benefits. Results may differ depending on each individual's earnings history. This hypothetical situation contains assumptions that are intended for illustrative purposes only.

Source: Source: American Century Investments and American Academy of Actuaries and Society of Actuaries, Actuaries Longevity Illustrator, www.longevityillustrator.org, (accessed July 2023).

You can receive a six-month lump sum payment once you’ve reached FRA. Most people are not aware of this option, but the Social Security Administration will offer it if you file at FRA.

Taking your benefit all at once has pros and cons, including the possibility of lowering your benefit amount going forward. Receiving a substantial payment could push you into a higher tax bracket for that year. This might make you pay more taxes and possibly lead to a Medicare surtax, among other consequences. Carefully analyze the effects of this decision before you file.

2. How Do Spousal, Survivor and Ex-Spouse Benefits Work?

If you are married or were married before, think about how your spouse's benefits could increase your Social Security payments. Your benefit amount is determined by calculating three parts and averaging your earnings from the best 35 years.

One spouse may have a larger benefit than the other. This difference in benefits creates additional considerations for your decision on when each of you should claim.

Understanding how benefits for spouses and ex-spouses can be combined is crucial, especially for women. Women often take breaks from work to care for children or family members, and men typically earn more than women. This knowledge can help women maximize their benefits.

Spousal Benefits

Spouses are eligible to receive 50% of the primary worker's benefit or their own benefit amount, whichever is higher.

Must be married for at least 12 months

Can't apply for the benefit until your spouse has filed

Sam (primary worker)

Benefit = $2,000

Kathy (Sam's spouse)

Benefit amount = $800

Spousal Benefit = $1,000

Kathy will receive $1,000

Survivor Benefits

Survivor benefits are similar, except the survivor receives either the deceased spouse's benefit or their own benefit.

Surviving spouse is age 60 (50 if disabled)

Must be married at least 9 months prior to death, unless an accidental death

Sam (primary worker)

Benefit = $2,000

Kathy (Sam's spouse)

Benefit = $800

Sam passes away, and Kathy's benefit increases to $2,000

Ex-Spousal Benefits

If you are divorced, you may be eligible for 50% of your ex-spouse’s benefits. If you’ve been divorced for at least two years and are both at least 62, you can receive your ex-spouse’s benefits even if they are still working, if they qualify.

You have not remarried.

The marriage lasted more than 10 years.

You may qualify for survivor benefits if your former spouse is deceased.

If you continue to work, the earnings limits still apply.

Reduction/increase of benefits based on filing age still applies.

Sam (primary worker)

Benefit = $2,000

Kathy (Sam's ex-spouse)

Benefit = $800

Sam and Kathy divorce, and Kathy can file to increase the benefit to $1,000

Additionally, children up to age 18 (19 if a full-time high school student) and disabled children (even if 18 or older) may be eligible for benefits. Benefits are generally available only to unmarried children.

3. Can I Work and Claim Social Security at the Same Time?

Yes, although your benefits may be reduced depending on your full retirement age and how much you earn. For 2025 , here's how this would look:

Age | Earnings Limit | Benefit Reduction |

Before FRA | $23,400 | For every $2 over this limit, $1 is withheld from your benefit. |

Year You Reach FRA | $62,160 | For every $3 over this limit, $1 is withheld until the month you reach FRA. |

When considering these earning limits for Social Security, know what counts as “income.” Income that counts toward the limit includes all wages from job or net earnings if you are self-employed. That also includes bonuses, commissions and vacation pay.

What’s not counted toward the earnings limit and won’t reduce your benefit are pensions, annuities, investment income, interest, veterans benefits or other government and military benefits.1

4. Do I Have to Pay Taxes on Social Security Payments?

Maybe, but you’re never taxed on all of it. Taxes on Social Security depend on your overall income.

If you are an individual filer and your income is between $25,000 and $34,000, up to 50% of your Social Security benefits may be subject to your regular tax bracket. If your income is above $34,000, up to 85% may be subject to tax.

A couple with a combined income between $32,000 and $44,000 may have 50% of benefits subject to tax. The amount subject to tax rises to 85% if you earn more than $44,000 combined.

Your adjusted gross income + nontaxable interest + ½ of your Social Security benefit

= Your combined income

To spread out your tax burden, you can ask the Social Security Administration to withhold federal taxes from your monthly benefit when you apply.

5. What If I Have Debt or Other Obligations?

Private creditors can't touch Social Security, but federal agencies can garnish the benefits. Child support, alimony, back taxes and home and student loan defaults can reduce your benefits.

Unpaid student loans may have more of an impact for retirees, especially now that repayment obligations resumed after a pause following the 2020 pandemic. And strikingly, the number of student loan borrowers aged 60 has grown sixfold since 2004.2

Social Security and Income Replacement

If you’re carrying a lot of debt, you may want to consider paying it off before you retire and claim Social Security because your benefit won’t replace your current income.

Your income replacement rate will depend on your earnings. Social Security replaces a larger share of earnings for lower earners. Higher earners receive larger checks, but the benefit amount represents a smaller fraction of what they had been making.

This chart shows how Social Security benefits compare to a retiree’s past earnings for a “medium,” “high,” and “steady maximum” earner. Blue bars show what benefits a person retiring at full retirement age (age 67 for a person born in 1960) in 2024 would get. Green bars represent the retiree’s average lifetime earnings while working.

Sample Income Replacement Rates

Source: Replacement Rates for Hypothetical Retired Workers, www.ssa.gov, May 2024.

Social Security Cost of Living Adjustments

Social Security does have cost-of-living adjustments (COLA) almost every year, with some exceptions. Since 2000, the average COLA has been 2.59%.3

However, recent increases have been higher because of higher inflation. The increases can potentially help ease inflation pain for Social Security recipients. If you’re also working while drawing Social Security, consider how the COLA, combined with your income from a job, may impact your "provisional income.”

Bonus Question: What If My Employer Doesn’t Pay Into Social Security?

If your employer (such as a government agency or a business in another country) is not required to withhold Social Security taxes, any pension plan benefits you receive based on that work may reduce your Social Security benefits if you fall into one of the following categories:

- The Windfall Elimination Provision affects how the amount of your retirement or disability benefit is calculated if you receive a pension from work where Social Security taxes were not taken out of your pay. A modified formula is used to calculate your benefit amount, which may result in a lower benefit than you otherwise would receive.

- The Government Pension Offset occurs if you receive a pension from a federal, state or local government based on work where you did not pay Social Security taxes. Some or all of your spouse's, widow's or widower's Social Security benefits may be reduced.

Know Your Options Before Retirement

Social Security may be a large part of your overall retirement investing plan, so it's important to understand all your filing options before it's time to claim your benefits. You can contact the Social Security Administration up to four months before starting benefits, but you can review your options much earlier.

Socialsecurity.gov is a good resource, or you can call for an appointment at 1-800-772-1213.

Authors

Financial Consultant

Need Help With Social Security Decisions? Let's Talk

Our financial consultants can help answer questions you have about claiming your benefits and how it may work with your overall retirement plan.

Social Security: Understanding the Benefits, ssa.gov, January 2025.

What Happens If I Work and Get Social Security Retirement Benefits? ssa.gov , March 2024.

Why Do So Many Older Americans Owe Student Loans? New America, May 2023.

Social Security Cost of Living Adjustments, ssa.gov, July 2024.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.