Tax Time: You Can Still Max IRA Contributions

The countdown is on to get your taxes in order, including taking advantage of potential deductions and tax benefits. One way is to make or max out IRA contributions for the previous year. Until your tax filing deadline, you can!

Key Takeaways

Investing in an IRA is a popular way for investors to save for retirement. At tax time, their advantages are highlighted—especially since you can still contribute for last year until your tax filing deadline.

Knowing whether to choose a Traditional or Roth IRA may begin with understanding how their tax advantages work and why you may want to choose one over the other.

Understanding IRA guidelines and some of the pitfalls can also help you make smart decisions about investing in an IRA and making the most of it.

Why Contribute to an IRA Now?

Is there ever really a bad time to contribute to an IRA? Not necessarily, but tax season may make the benefits even better. In addition to adding to your savings, Traditional and Roth IRAs provide tax benefits, and tax time means you don’t have to miss out on saving for last year if you didn’t contribute the max before December 31.

The IRS sets contribution limits for each tax year ($7,000 for 2024 and 2025, with an extra $1,000 for those aged 50 and over). For Traditional IRAs, some or all contributions may be tax deductible and could potentially lower your taxes. Contributing before Tax Day means taking advantage of these benefits for last year’s tax bill.

You can make 2024 IRA contributions until April 15, 2025. But unlike extensions for regular tax filings, the IRS does not allow extra time for IRA contributions. Once the April deadline has passed, you miss the opportunity for the previous tax year.

Check irs.gov or your state's tax website for updates on current extensions or in case of other potential events.

How Much Difference Could Maxing Out Make?

Potential growth in an IRA over time may be one of the best reasons to contribute the maximum to your IRA this year—and every year. Plus, IRAs are often an essential part of retirement planning because of their tax benefits.

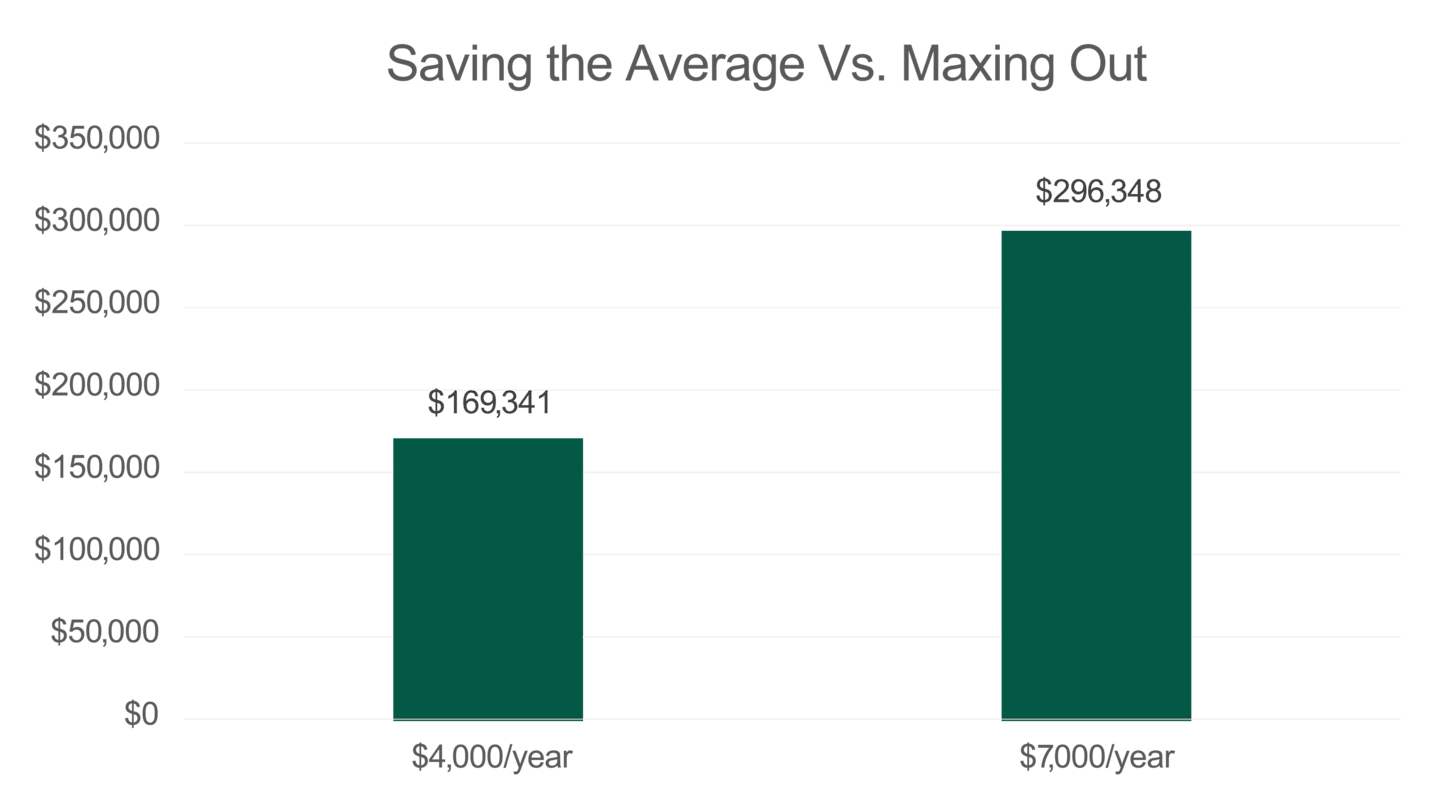

But will contributing the maximum to an IRA make a difference? Below is a hypothetical example of how much maxing out your retirement every year for 20 years could make compared to the average $4,000 Americans save in an IRA every year.1

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. The calculations represent an annual investment in an IRA for $4,000 versus $7,000 over 20 years with a 6% return rate. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

You could invest the same amount in a taxable account and get potentially similar results, but it would not offer the same tax benefits as an IRA contribution.

Putting money into a Traditional IRA lets the money grow without paying taxes right away. You only pay taxes when you take the money out.

Contributing to a Roth IRA lets you withdraw your contributions tax-free because you already paid taxes on them. If you have owned the IRA for five years, your earnings may also be tax-free.

The government thinks these benefits are worthwhile too. In fact, because investors may have missed out on those advantages in the past, the IRS created “catch-up” contributions for those 50 or older. This allows them to contribute an additional $1,000 each year.

Finding Money to Max an IRA

A client's lack of extra money may be a barrier to investing the maximum every year, but you might be able to find the funds elsewhere. For example, we've seen clients with large taxable accounts and no IRAs. For them, we systematically moved the money every month to the IRA for long-term tax benefits.

No IRA Yet? How to Choose

If you don’t have an IRA or want a different type, comparing Traditional and Roth IRAs can help you determine the best choice for you. And just like contributing to a current IRA can be done until Tax Day, you can also open a new IRA until then, and not miss out on a contribution year.

Two key questions are whether you’ll be in a lower or higher tax bracket in retirement. Also, consider how long or short your time frame will be when you begin withdrawing the money.

Same Tax Bracket: If you expect to remain in the same tax bracket when you make contributions and withdraw the full balance (or if you have a long time frame), a Roth IRA generally may be the best option.

Lower Tax Bracket: A Traditional IRA may be a better choice if you'll be in a lower tax bracket when you begin withdrawals (or have a shorter time frame).

Roth vs. Traditional IRAs: A Comparison

There are other ways to compare Roth versus traditional IRAs, but here are some important points to consider.

Roth IRA

Income Requirements

You must have earned income below annual limits to be eligible for contributions (or eligible if your income is within a certain range).

Taxes on Contributions and Earnings

Contributions are not tax deductible but can be withdrawn tax-free and penalty-free at any time. 2

Earnings can be tax-free if the account is at least five years old and you are at least age 59½.

Withdrawal Considerations

At age 59½, you can make penalty-free, qualified withdrawals.

You are not required to take money out at any age and can contribute as long as you have earned income.

Traditional IRA

Income Requirements

You must have earned income to make contributions.

Taxes on Contributions and Earnings

Some or all contributions may be tax deductible.3

Income tax on earnings is deferred until you withdraw them.4

Withdrawal Considerations

At age 59½, you can make penalty-free withdrawals.

The year you turn 73, you must take annual required minimum distributions (RMDs) to avoid a 50% penalty on the required withdrawal. (If you turned 72 in 2022 or earlier, you’ll need to continue taking RMDs.)

Required Withdrawals for Traditional IRAs

One big difference between Roth and Traditional IRAs is the required minimum distribution requirement for the latter. There are specific rules around when to take an RMD and the amount you need to take, so it’s important to consider this in your decision.

The penalties for not taking enough are high and calculating the amount on your own can be confusing. Using an RMD calculator can help, and you can also enlist assistance from your financial company.

Here at American Century, we’re always happy to help you make sure you’re taking the right amount, and we can also assist you with strategies for your RMD if you find you don’t need the money for your daily expenses.

Make Too Much for a Roth IRA? Consider Converting

If your income exceeds the IRS limits for a year and you don’t qualify, you can still consider a Roth IRA conversion. You can convert all or part of your Traditional IRA to a Roth IRA without being subject to the 10% early withdrawal penalty.5

In the year you convert, you will owe taxes on your previous contributions and earnings, which were not taxed while in the Traditional IRA. Want to know what effect a conversion may have? Try our Roth IRA Conversion calculator.

Common Pitfalls of IRA Investing

While IRA investing seems straightforward, there are some things to be aware of. One is thinking all you need to do is invest in the IRA for a secure retirement. Where your money goes is just as important. For example, investing in a cash equivalent in an IRA, such as a money market, will likely not provide the growth you want to live off your savings.

Instead, consider the benefits of diversifying your investments within the IRA using several different types of assets that can help potentially grow your money and manage market ups and downs.

Another misunderstanding is not realizing you can still contribute to an IRA in retirement if you earn income, such as from a part-time job. However, you cannot contribute more than you make. For example, if you make $5,000 a year, you can contribute up to $5,000 in the IRA. Also, you still must follow the IRS contribution limit and adjusted gross income requirements.

Investing in an IRA in retirement can be beneficial from a tax standpoint, but it can also be a powerful estate planning tool if you ultimately intend to leave that money to an heir.

Other Tax Tips and Reminders

Investing in an IRA annually can give the tax and retirement benefits we’ve already covered. However, there are other tax tips and strategies to consider at tax time and throughout the year.

You can also visit our Tax Center to find additional information, such as fund-specific exemptions, help understanding cost basis, and discover other tools, resources and tips.

Make Tax Time Your Time to Save

For your future and on taxes, this could be your time to save more. Log in or register to contribute or open a new IRA.

Retirement Account Statistics 2024, NerdWallet, August 2024.

State and local taxes may apply.

Some or all contributions may be tax deductible, depending on your modified adjusted gross income, tax-filing status and if you or your spouse participated in a workplace plan.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

If you choose to withhold taxes as part of a Roth conversion, the amount withheld is generally subject to the 10% early withdrawal penalty. Please consult your tax advisor as needed.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

Diversification does not assure a profit nor does it protect against loss of principal.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.