A Lifetime Guide to Budgeting

A budget isn’t a set-it-and-forget-it, one-time task. Discover ways a budget can evolve with you as your financial situation changes.

Key Takeaways

Though it sounds basic, one of the most impactful money skills may be creating a budget and adjusting it as needs change.

Sticking to a budget has its challenges when your income fluctuates, but it's not impossible if you find the right approach.

You still need a budget in retirement, and it’s important to review it regularly as you move through different phases.

One of the most elementary but important financial skills is budgeting (and having the commitment to stick to it). Having a budget can serve you in all stages of life, and it isn’t just for people with big paychecks, mortgages and retirement accounts.

Armed with a budget, you can see where your money is going, identify areas that are no longer a priority and adjust savings goals as your financial situation changes.

Let’s walk through some key components of a successful budget—from creating your first one to managing your money in retirement.

3 Key Principles of Budgeting

Know Where Your Money Goes

Effective money management starts with awareness. Make a weekly or monthly appointment with yourself to track your spending using apps, spreadsheets or even pen and paper. Categorize expenses and look for patterns.

Are you overspending on dining out or entertainment? Are subscriptions piling up? You might be surprised by what you find.

Prioritize Paying Down Debt

Take a look at your debt. Some debt is inevitable for many when it comes to big purchases like cars or homes. But remember, you're essentially borrowing money from your future self. Too much of your income going to loan payments limits what goes to growth opportunities.

A budget can help you pay off debt and save—and it’s possible to tackle both goals at the same time.

Build Backup Funds

Life is unpredictable, and financial plans can get derailed when unexpected expenses pop up. Though it might not sound related, emergency and rainy-day funds have a role in helping you meet your retirement savings goals.

Cutting retirement contributions is one of the first things many people do when they don’t have enough money in reserve. Some people may even be tempted to borrow from their retirement accounts, which can have long-term financial ramifications. Others may see taking an early withdrawal from their retirement accounts as an option, but what they'll pay in taxes and penalties may cost them more in the long term than the cash would help in the short term.

Building your backup funds may take a while, especially if you run into setbacks and need to use those savings. But the risks of not having them can be greater.

Use this interactive PDF to calculate how much you may need in your emergency fund to cover 12 to 24 weeks of living expenses. Download PDF

Ways to Create a Budget

Following a budget involves being more intentional about where your money goes. First, list all income sources and monthly expenses. Include what you’ve been spending on discretionary items.

Housing and utilities

Health care and insurance

Food and transportation

Travel, hobbies and entertainment

List income and expenses and set guidelines to move you forward.

Once you have your list together, you can form a budget. Here are some ways to approach it.

The ‘Bills Before Frills’ Rule

All budgets have this simple principle: Cover your needs before your wants. It’s a concept even young kids can learn. This mindset builds discipline and helps you avoid lifestyle inflation as your income grows. It means:

Rent and utilities before streaming subscriptions

Groceries before takeout

Insurance before impulse buys

For many people, it’s easy for long-term savings to fall to the bottom of their to-do lists. Yes, you need to pay your mortgage, utilities and credit card bills. However, you may have flexibility on other expenses but only take whatever’s left at the end of the month and stash that in savings.

To avoid making savings an afterthought, consider making it another budget line item, treating it like a bill you pay yourself.

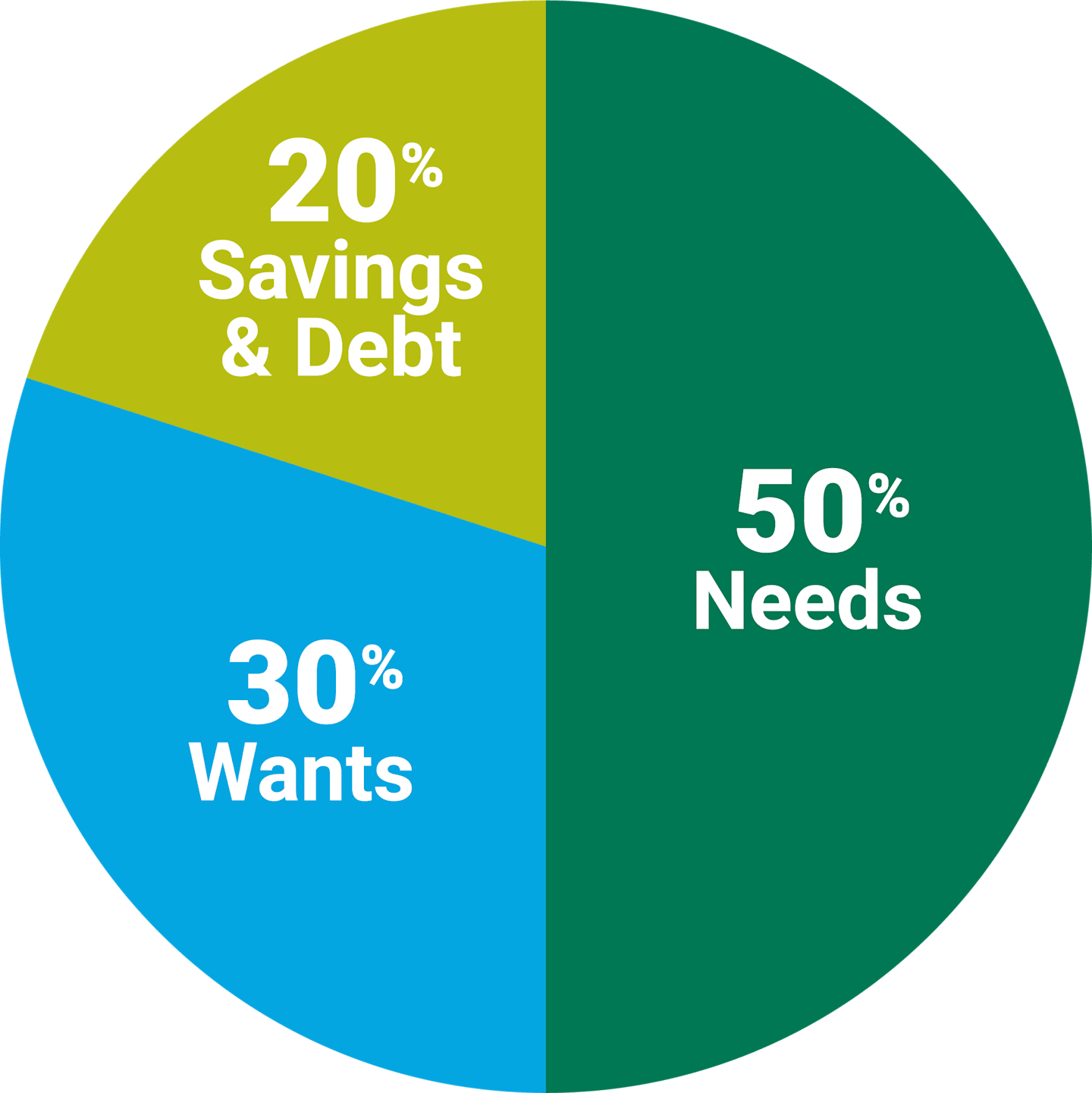

The 50/30/20 Rule

A quick, high-level method for making a budget uses the 50-30-20 rule. This percentage-based plan can be a great starting point for budgeting:

50% for needs (housing, food, transportation)

30% for wants (entertainment, travel)

20% for savings and debt repayment

Adjust these percentages based on your goals and income.

Keep It Simple

Annual Budgets

If you know roughly what you’ll make in a full year—even if your income varies from month to month—you could use an annual budget following the 50-30-20 rule or another method.

Be sure to earmark cash for retirement before you spend a penny on “wants.” Financial experts often suggest setting aside between 10% and 20% of what you earn for retirement.

If you’re an employee with a 401(k) or 403(b), take advantage of an automatic investment plan with payroll deduction. If you don’t have access to a company retirement plan, individual retirement accounts (IRAs) provide a tax-advantaged way to save for retirement, and you may be able to set up automatic contributions.

Budgeting With Variable Income

Freelancers, gig workers and entrepreneurs often face unpredictable income. This makes it harder to stick to a traditional budget—but not impossible.

One strategy is to plan for both feast and famine months.

Create 2 Budgets: Lean and Full

Full budget: For high-income months—includes savings, debt payments and discretionary spending.

Lean budget: For low-income months—only covers essentials.

Target a Percentage Instead of a Dollar Amount

When your take-home pay has highs and lows, it can be tough to stick with a fixed savings goal every single month. Target a percentage of your earnings to save each month. That way, while the amount of cash you put aside may vary, you’re still putting money toward your goal.

If you’re saving on your own without the convenience of paycheck deductions, consider setting regular reminders or automating the process with electronic transfers. Whenever you get paid, shift the money from your bank directly to your retirement account with just a few clicks.

Pad Your Emergency Fund

If you want to be consistent in building long-term savings when you have variable income, it’s essential to have emergency funds to support you. During lower-income months, you might need to pull from savings to pay bills.

So, if your cash reserve could use a boost, go back to the budget you created. Can you trim a budget line item or two and target a higher amount to set aside each month? Even little tweaks over time can help you build up a strong financial safety net, especially if you put the power of compounding on your side.

Why You Still Need a Budget in Retirement

Don’t retire your budget when you stop working. You might think there’s not much to do if you have an income stream coming in from Social Security, pensions and retirement accounts. But your expenses—especially health care—can fluctuate more as you get older.

As people age, the financial risk of needing long-term services and support, such as in-home care or nursing home stays, is one of the most significant threats to retirement-income adequacy, according to the Morningstar Center for Retirement & Policy Studies.

Inflation's impact on the cost of living is another threat to retirement savings. Unexpected surges in the prices of goods and services stress retirement budgets as fixed amounts of money lose purchasing power and can’t buy as much as it once did. High inflation can also negatively impact investment portfolios, which are important sources of most retirees’ incomes.

Spending Habits Change in Retirement

Some say to budget 70% to 80% of your preretirement expenses for retirement to keep your current lifestyle. But moving to a full 52 weeks of freedom in retirement can be a big lifestyle change. Current research shows that retirement spending patterns vary by age, and you won’t necessarily spend less.

For example, younger retirees and those who just retired tend to spend more in the first few years in retirement than they did while working. That may be attributed to having more time to travel and do more things. As retirees age, they tend to focus on essential needs, such as health care, over discretionary ones.

Budget for the Phases of Retirement

Prepare for your budget to evolve with you as spending changes throughout retirement. You might break down a plan into four key phases of retirement—with the first one beginning while you’re still working.

Your Preretirement Budget

At least three to five years before retirement, it’s smart to look at your current budget and financial situation.

Plan ahead to best utilize your Social Security benefits and understand what Medicare does (and doesn’t) cover. hyperlink to that section.

Examine your debt situation and pay off as much as you can.

Consider how you will convert your savings into an income stream that can last.

And have you looked into long-term care insurance? The costs are more affordable if you purchase a policy while healthy.

Your Year 1 Retirement Budget

The first year in retirement is estimated to be the time of most upheaval, both emotionally and financially. You no longer receive a regular paycheck, but you have lots of freedom, which could be a reason many retired people spend more in the first year.

However, if there was ever a time to stick to your budget, it’s now. Not that you shouldn’t enjoy yourself, but the last thing you want to do is overspend and jeopardize your retirement readiness.

Here are three questions to ask yourself while you enjoy your liberty:

Did your estimated budget hold up? Review your spending and see where you may need to adjust. Ask yourself: Am I using too much of my savings too quickly?

Do you need more income, such as getting a part-time job? Even if you’re already drawing Social Security, you can still earn a certain amount each year without penalty.

Does your budget allow you to keep adding to your investment portfolio?

Your Retirement Budget for Years 2 to 15

In this stage, many begin to settle into the retirement they want. The important thing to ask yourself regarding money is, can you afford the “new” you? It will take a budget to find out.

Three questions to ask yourself in this phase:

If you reach age 73 (or 75 if you were born after 1960) during this phase, what will you do with the required minimum distributions the IRS requires you to take from retirement accounts? If you don’t need them for expenses, they could be a good way to invest in a taxable account or support a grandchild’s education.

Have your spending patterns changed, or have retirement expenses gone up? Continue to review your expenses and needs and adjust your budget accordingly.

Are you thinking about your legacy? If you have ideas about what should happen to your money, belongings or children after your death (or about who can make medical or financial decisions on your behalf if you’re incapacitated), you need an estate plan.

Your Retirement Budget for Year 16 and Beyond

In this phase, maybe you won’t travel as much as you did before. On the other hand, you may see increases in other expenses.

Will you or a spouse need short- or long-term assisted living? How will these significant expenses affect your budget?

Has leaving a legacy become more important to you? You’ll want to think through whether you want to reduce expenses to leave more.

Have you been overspending? Are you underspending out of fear of running out of money? Evaluate how much is in your savings and investment accounts.

Regularly revisiting your retirement budget helps your savings last. It also gives you peace of mind, knowing you can enjoy your retirement without financial stress.

Make Your Future a Priority

From your first paycheck to your final retirement withdrawal, budgeting is your most powerful financial tool. Whether you're starting your financial journey, building an emergency fund, navigating variable income or planning for retirement, the principles remain the same:

Spend less than you earn.

Save consistently.

Plan for the unexpected as best you can.

Start now, stay flexible and remember: A budget can help keep your money working for you—not the other way around.

Authors

Financial Consultant

Retirement Checklist

Are you ready to take the retirement plunge?

The Overlooked Cost: How Long-Term Services and Supports Impacts Retirement-Income Adequacy. Morningstar Center for Retirement & Policy Studies, July 2024.

Economic Well-Being of U.S. Households in 2023, Board of Governors of the Federal Reserve System, May 2024.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

©2025 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.