What Are the Benefits of 529 Plans?

Anyone Can Open and Contribute

Grandparents, aunts, uncles and friends can open a 529 account or can contribute to a plan already established.

Education Flexibility

Use funds for accredited 2- and 4-year colleges, apprenticeships, vocational/technical and graduate schools, even K-12 private school tuition.

Fits Your Budget and Schedule

Choose when, how and how much to contribute.

Tax Savings

Earnings grow tax-deferred at the federal and state level and can be withdrawn tax free if used for qualified educational expenses.

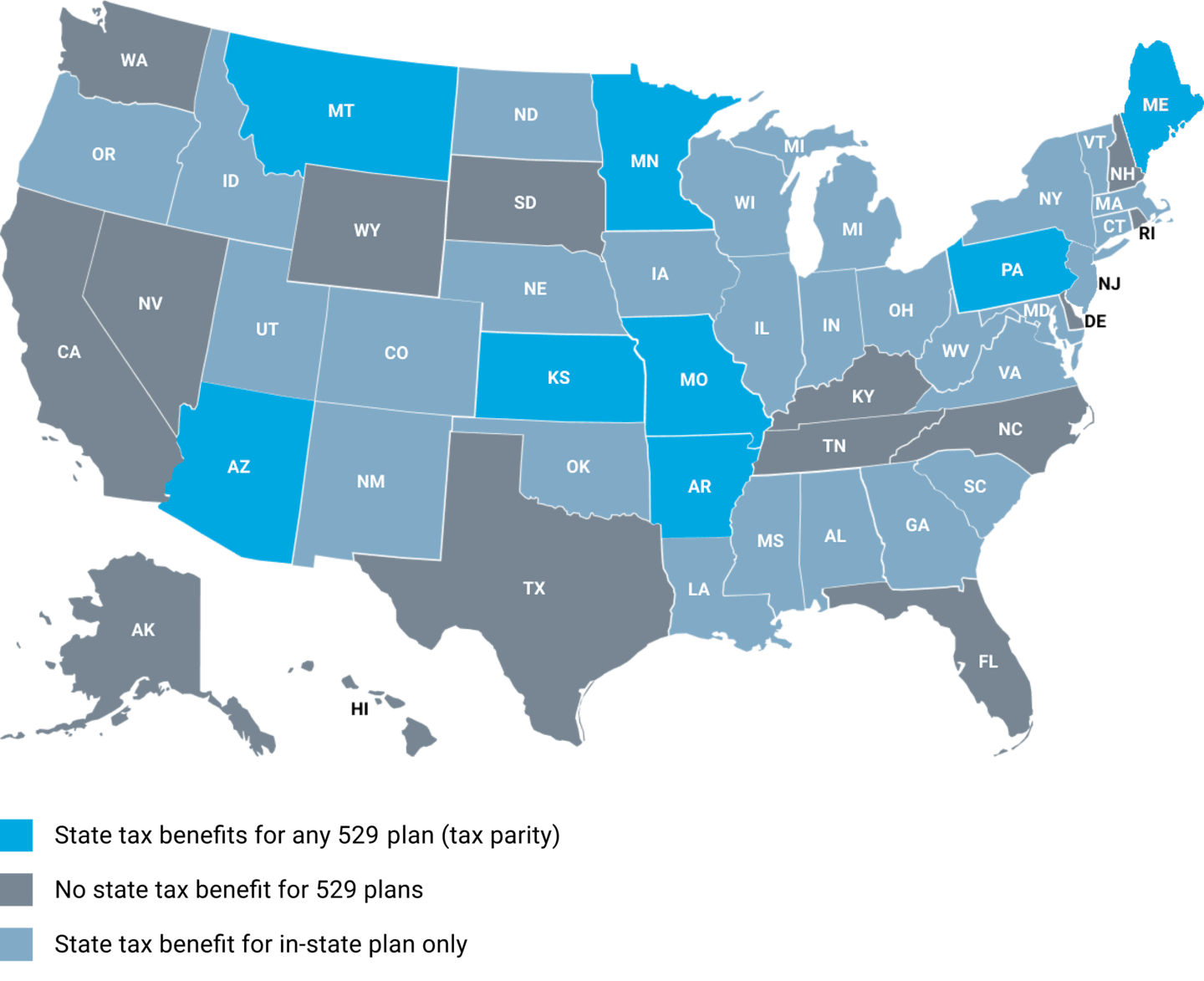

Some states also offer a state tax deduction for contributions to a 529 plan. Review the map for potential state tax benefits available for 529 contributions.

Who Is Eligible?

There are no income or age restrictions. You can even open an account and make yourself the beneficiary.

American Century Investments manages the Learning Quest® 529 Education Savings Plan, the plan for the state of Kansas. Anyone can open a Learning Quest account regardless of what state you live in.

Who Owns and Controls the Account?

Typically, the person who opens the account is the designated owner and is authorized to act on the account.

Any U.S. citizen or resident age 18 or older can open or contribute to a 529 account: parents, grandparents or others. The account owner maintains control of the money even after withdrawals begin.

How Much Can I Contribute?

The IRS doesn’t set contribution limits for 529 plans. However, each state can set its own limit that’s usually based on higher education cost estimates. The Learning Quest® 529 Education Savings Plan caps contributions to an account once the balance reaches $455,000 per beneficiary (as of 2022).

Minimum investment amounts depend on the state plan you choose. Learning Quest 529 accounts do not have a minimum initial investment.

How Can I Use the Money?

Money in a 529 plan can be used for qualified expenses for eligible post-secondary 2- or 4-year colleges, apprenticeships, vocational/technical schools or graduate schools anywhere in the country. The money can also be used for any public, private or religious K-12 school (check your plan for availability).

Examples of qualified expenses include tuition, mandatory fees, computers, books, supplies, equipment, and room and board.

An eligible school is any accredited post-secondary institution that offers credit toward an undergraduate or graduate degree and is eligible for federal financial aid.

A maximum distribution of $10,000 per year, per student, is allowed as qualified education expenses for elementary or secondary school expenses. Any distribution over that amount is treated as taxable income. However, amounts paid as principal or interest on a qualified education loan of a Designated Beneficiary, or sibling of a Designated Beneficiary, can be withdrawn tax-free subject to a lifetime limit of $10,000 with respect to the loans of any individual.

How Will This Impact Financial Aid?

If the account is owned by the parent of the student, the assets are counted as an asset of the parent. Assets owned by a student will also be considered assets of the parent.

Additional Details

Tax Considerations

Earnings grow tax-deferred at the federal and state level and can be withdrawn tax-free if used for qualified educational expenses. Some states also offer a state tax deduction for contributions to a 529 plan (where applicable, view map above).

Contributions can be deducted from a taxable estate and are not subject to federal gift tax under a certain amount.

Non-qualified withdrawals are subject to federal and state income taxes and a 10% penalty.

Distributions for educational expenses for elementary and secondary schools (public, private, or religious) will be treated as qualified higher education expenses up to an aggregated limit of $10,000 per student. Amounts over that limit will be treated as taxable income.

Beneficiary Considerations

Typically, the person who opens the account names themselves as the owner and designates a beneficiary. The account owner maintains control of the money even after withdrawals begin.

The beneficiary does not have to be a minor. You can open an account and make yourself the beneficiary.

You can change the beneficiary designation to another eligible family member of the original beneficiary.

Other Investment Costs

A 529 plan program management fee is charged to the investment portfolio for expenses incurred, including the administration and management of the program.

For Learning Quest accounts, the fee is currently at an annual rate of 0.17%. It is charged against the assets of all the portfolios except the Cash and Cash Equivalents Portfolio and the 80%-10% Equity Index Portfolios.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The availability of tax or other state benefits (such as financial aid, scholarship funds and protection from creditors) may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors.

Before investing, carefully consider the plan's investment objectives, risks, charges and expenses. This information and more about the plan can be found in the Learning Quest Handbook, available by contacting your financial advisor or American Century Investment Services, Inc., Distributor, at 1-800-579-2203, and should be read carefully before investing. If you are not a Kansas taxpayer, consider before investing whether your or the beneficiary's home state offers a 529 Plan that provides its taxpayers with state tax and other benefits not available through this plan.

As with any investment, withdrawal value may be more or less than your original investment.

Notice: Accounts established under Learning Quest and their earnings are neither insured nor guaranteed by the State of Kansas, the Kansas State Treasurer or American Century Investments.

Administered by Kansas State Treasurer Steven Johnson

Managed by American Century Investment Management, Inc.

American Century Investment Services, Inc., Distributor