Support Center

We're here to help.

Individual Investor / Site Help

Access & Registration

What You Need to Know about Viewing Your Accounts Online

Log in with your User Name and Password for secure access to your accounts. Once logged in, you can view account balances, conduct online transactions, and access exclusive financial tools and information.

My Total Assets

The My Total Assets page provides a bird's eye view of all accounts values.1 Each account listed is also a link that, when selected, displays the account's holdings in the main window, where you can find more information and transact.

¹Updated once per business day after market close.

Viewing Your Accounts Online

Register for online account access by clicking Log In at the top right of your screen

Select Register for Access

During the registration process, you will be asked to provide your Tax Identification number (Social Security or Employer Identification number) and an account number*, create a unique User Name and Password and set up enhanced security features, such as setting up multifactor authentication methods.

Log in with your User Name and Password.

*Workplace Retirement Plan Accounts will use a zip code in place of an account number.

Online Account Statements

New User Registration is the process of creating a unique User Name and Password that gives you secure access to your accounts.

The following account types can be accessed when you register:

Traditional IRA, Roth IRA, Roth Conversion IRA, UGMA or UTMA, Coverdell Education Savings Account (CESA), Giftrust®, IRA-Rollover, SEP-IRA, SIMPLE-IRA, 403(b), Personal Trusts, Brokerage Accounts, Defined Benefit, Money Purchase Pension, Partnerships, Operating accounts, Endowments, Profit Sharing, Limited Liability Corporations, Foundations, Unincorporated Associations, Other Qualified Retirement Plans.

Register for online account access by clicking Log In at the top right of your screen

Select Register for Access

Enter a valid Tax Identification number (Social Security number or Employer Identification number).

Set Up Your Account:

Enter a 12-13 digit account number registered to the Tax Identification number entered in Step 2. If you do not have this information readily available, please contact us.

Create a User Name

Enter an email address

Set Up Security Features:

Create a Password

Setup at least one multifactor authentication method

Follow the prompts to complete registration.

Register for online account access by clicking Log In at the top right of your screen

Select Register for Access

Enter a valid Tax Identification number (Social Security number or Employer Identification number).

Set Up Your Account:

Enter a 5 digit zip code registered to the Tax Identification number entered in Step 2. If you do not have this information readily available, please contact us.

Create a User Name

Enter an email address

Set Up Security Features:

Create a Password

Setup at least one multifactor authentication method

Follow the prompts to complete registration.

Register for online account access by clicking Log In at the top right of your screen

Select Register for Access

Enter the Social Security number of the beneficiary.

Set Up Your Account:

Enter the 12-digit UGMA, UTMA or Coverdell Education Savings Account number for verification. If you do not have this information readily available, please contact us.

Create a User Name

Enter an email address

Set Up Security Features:

Create a Password

Setup at least one multifactor authentication method

Follow the prompts to complete registration.

¹Online access is not available for UGMA or UTMA accounts with multiple custodians under the primary Tax Identification number.

²Online access is not available if the Responsible Individual for the CESA is different from the custodian of a UGMA or UTMA account under the same Tax Identification number.

Register for online account access by clicking Log In at the top right of your screen

Select Register for Access

Enter the Employer Identification Number (EIN) assigned to the Giftrust account by American Century Investments®.

Set Up Your Account:

Enter the 12-digit Giftrust account number registered to the EIN entered in Step 2. If you do not have this information readily available, please contact us.

Create a User Name

Enter an email address

Set Up Security Features:

Create a Password

Setup at least one multifactor authentication method

Follow the prompts to complete registration.

We've recently introduced new security measures when you log in called multifactor authentication (MFA).

The steps you will take for forgotten log in information will be different if you have logged in recently and enrolled in multifactor authentication. See the applicable tab below for help.

Forgotten User Name

If you don't remember your User Name, follow these steps to access your account:

Click Log in at the top right of your screen.

Select Forgot Username.

Enter one of the following (not both):

Tax Identification Number registered to the account

Account Number

Select the Continue button

Follow the prompts.

Forgotten Password

If you forgot your Password, simply request a one-time verification code online using these steps:

Click Log In at the top right of your screen.

Enter your Username and select Continue.

Select Forgot Password.

Once you receive your one-time verification code, enter it in the box that say Enter Code and select the Verify button.

Follow remaining prompts to reset your Password and gain access.

If you are not near the phone used for your multifactor authentication options, then call one of our representatives at 1-800-345-2021.

Account Is Locked

If your account is locked, simply request a one-time verification code online using these steps:

Select Unlock Account.

Once you receive your one-time verification code, enter it in the box that say Enter Code and select the Verify button.

Follow the remaining prompts to log in to your account.

If you are not near the phone used for your multifactor authentication options, then call one of our representatives at 1-800-345-2021.

Forgotten Username

If you don't remember your Username, follow these steps to access your account:

Click Log in at the top right of your screen.

Select Forgot Username.

Enter one of the following (not both):

Tax Identification Number registered to the account

Account Number

Select the Continue button

Follow the prompts.

Forgotten Password or Account is Locked

If you forgot your Password, or your account is locked, simply request a one-time security code online using these steps:

Please contact us to access your account.

Forgotten Answers to Challenge Questions

If you are unable to answer your challenge question, you may request a one-time security code online using these steps:

Please contact us to access your account.

There is not a way to change your User Name online. Please contact us to request that your current online access be deactivated. Once deactivated, you can create a new User Name.

Log in with your user name and Password.

Select the Profile icon in the top right corner and choose Profile.

Select the Password link under Security Management.

Enter your Current Password, New Password and re-enter New Password in the fields provided.

Select the Continue button.

Log in with your user name and Password.

Select the Profile icon in the top right corner and choose Profile.

Select Multifactor Authentication under Security Management.

Select Setup or Edit on the method you'd like to modify and follow the steps.

Select the Done button.

Grant, Revoke, or Refuse Account Access

The Grant Account Access feature allows you to grant another individual access to your account for the purposes of viewing the holdings in your account or transacting (investments, exchanges or redemptions) on your behalf.

This feature is useful if you are responsible for multiple accounts registered under different tax identification numbers (e.g. spouse, child, etc.) and you would like to access and transact on these accounts after you Log In with your User Name and Password.

Grant Account Access to Another Individual

Log in with your user name and password.

Select the Profile icon in the top right corner and choose Profile.

Select Link Accounts under Account Management.

Under Grant Account Access, enter the Social Security number (SSN) or Employer Identification Number (EIN) of the individual to whom you want to grant account access. The person whose SSN or EIN you enter will also need to have completed the New User Registration process.

Select the Submit button.

Select the accounts you want to grant another individual access, then the Continue button.

Read the Grant Access Legal Agreement, add a checkmark next to the accounts for which you are granting access and select the Accept button.

Review the Confirmation, then select the Done button.

In addition to granting account access, you may also revoke account access and refuse account access.

Log in with user name and password.

Select the Profile icon in the top right corner and choose Profile.

Select Link Accounts under Account Management.

Under the You have granted Account access to others: section, add a checkmark to the box in the Revoke Access column next to the account for which you wish to revoke access.

Scroll to the bottom of the page and select the Submit button.

Review the Confirmation, then select the Done button.

Log in with user name and password.

Select the Profile icon in the top right corner and choose Profile.

Select Link Accounts under Account Management.

Under the Accounts you have access to section, add a checkmark to the box in the Delete column next to the account for which you wish to refuse access.

Scroll to the bottom of the page and select the Submit button.

Review the Confirmation, then select the Done button.

Can I grant access to someone who has not registered?

No. The person to whom you grant access must be a registered user of americancentury.com.

If I grant access to another individual, can they then grant access to my account to someone else?

No. The person to whom you grant access can accept or refuse the access you have given them, but they cannot grant access to your accounts to another individual.

Can I grant myself access to my children's accounts that I am custodian on without registering their accounts first?

No. You first need to go through the New User Registration for each child. After your children are registered, you will need to Log In with the User Name and Password of the child's account and complete the Grant Account Access process.

To log out of your account, select the drop down arrow in the top right corner of your screen. Then, choose Log Out.

Visit our Security Center for more information on Multifactor Authentication.

Account Maintenance

How to Update

Log in with your user name and password.

Select the Profile icon in the top right corner and choose Profile.

Select Phone Number and Mailing Address.

Make the appropriate changes, then select the Submit button.

*Not available for all accounts. For details, refer to the section below.

What You Need to Know

Mailing address and phone number updates are not available online for the following:

Shareholders with a non-U.S. mailing address

Shareholders with more than one address of record for their Tax Identification number (Social Security or Employer Identification number)

Contact us to change the mailing address and phone number for these accounts

Online mailing address changes are available online, call for phone number updates:

Business accounts (contact us to update the phone number for business accounts)

Which accounts are eligible for online address and phone number changes?

Personal mutual fund accounts, including IRAs, custodial accounts, and trust accounts.

Workplace Retirement Plan Accounts, such as 403(b), 457(b), SEP IRA, SIMPLE IRA and SARSEP (address changes only).

Note: If you have eligible and ineligible accounts, you can only change the address and phone number for the eligible accounts online. Contact us to change the address and phone number for the ineligible accounts.

Temporary Holds

An address change results in a 7 calendar day hold, during which time online1 redemptions by check are not allowed.

A redemption by check request results in a 7 calendar day hold, during which time online1 address changes are not allowed.

¹May be available during the holding period by calling one of our Investment Consultants.

How to Update*

Log in with your User Name and Password.

Select your account.

Select the Accounts tab, then select Profile and select your account number.

Next to Personal Information, select Edit and make the appropriate changes.

[Optional] Add a check to the Update All Accounts option to apply mailing address changes to all accounts.

Select the Save button.

*Mailing address and phone number updates are not available online for clients with a non-U.S. mailing address.

Go Paperless

Improved Security: You'll get safe and secure access through americancentury.com, with less chance of paper statements getting lost or stolen.

Save Time & Space: You can access documents quickly, eliminate clutter and positively impact the environment by reducing paper waste.

Convenience: You'll be able to save and print your documents at any time, from virtually any computer. You'll also have the option to access your information from compatible aggregators, like Quicken or other financial software.

Want Some Documents in Paper?

Customize your preferences. Want to get some documents in paper, and some electronically? We have three options for you:

Paper annual statement, all other documents electronically.

Paper quarterly and annual statements, all other documents electronically.

Paper quarterly and annual statements, and transaction confirmations, all other documents electronically.

Enroll in eCommunication Today

Set your preferences through your My Account page. Enroll:

Enroll or Change Preferences

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Communication Preferences.

Choose an option for how you want to receive your important documents (the All Electronic option is recommended).

Enter a valid email address, if prompted.

If you have been granted access to other accounts, repeat step 4 for each account.

Select the Submit button.

Verify your delivery options are correct and select Continue.

Unenroll

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Communication Preferences.

Select the All Paper option to unenroll from eCommunication.

If you have been granted access to other accounts, repeat step 4 for each account you wish to unenroll.

Select the Submit button.

Verify your changes and select the Accept button to activate.

Enroll or Change Preferences

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Communication Preferences.

Choose an option for how you want to receive your important documents.

Enter a valid email address, if prompted.

If you have been granted access to other accounts, repeat steps 3 and 4 for each account.

Select the Submit button.

Verify your delivery options are correct.

Read the eCommunication Agreement and select the Accept button.

Unenroll

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Communication Preferences.

Select the All Paper option to unenroll from eCommunication.

If you have been granted access to other accounts, repeat step 4 for each account you wish to unenroll.

Select the Submit button.

Verify your changes and select the Accept button to activate.

Edit or Add Email

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Profile.

Select the pencil icon to edit the displayed email address, or + Add New Email to add a new email address.

Make your change and select the Submit button to activate your change.

If you have been granted access to other accounts, repeat steps 4 and 5 for each account.

As an American Century® Brokerage client, you decide which documents you would like to receive electronically. Then you'll access them securely after you Log In with your User Name and Password.

Your choices

Choose any or all of the following account documents to receive electronically*.

Statements and Reports

Trade Confirmations

Notifications

Tax Documents

Proxy/Shareholder Communications

Prospectuses

*Some documents may also be sent in paper.

Enroll

Log in with your user name and password.

Select Accounts in the top navigation to expand a drop-down menu.

Select your brokerage account.

Select the person icon in the top-right margin to expand a drop-down menu.

Select All Settings.

Select e-Delivery Preferences and review your current settings.

Select Edit to make changes and follow the prompts.

What is eCommunication?

eCommunication is a free service for American Century Investments® mutual fund accounts* that reduces paper mail by making the same information available electronically. When a document becomes available electronically, we send a message to your email address that contains the document or a link to our website.

*The eCommunication service is not currently available for certain employer sponsored retirement plan accounts.

What documents are included?

Transaction confirmations**

Periodic account statements (PDF format that you can print, download or save)

Prospectuses and shareholder reports

Tax Information

Proxy materials

**Some transaction confirmations will be sent in paper.

What if the document contains account-specific information?

The email we send contains a link to our site where you must enter your User Name and Password and Log In to access your document securely.

How does American Century Investments use my email address?

We treat all personal information you provide to American Century Investments as confidential information. Select the Privacy & Security link in the footer of most pages of this website to learn more.

If you have a Giftrust® account, you can choose you have the option to receive all electronic communication or your annual statement in paper, all other documents electronically, since you receive only one year-end statement. Electronic quarterly statements and transaction confirmations are not available.

Did you receive a postcard asking to verify or update your email address on file with American Century Investments®?

Edit or Add Your Email Address

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Profile.

Select the pencil icon to edit the displayed email address, or + Add New Email to add a new email address.

Make your change and select the Submit button to activate your change.

If you have been granted access to other accounts, repeat steps 4 and 5 for each account.

IMPORTANT: The registered ownership of the bank account must be the same as the registered ownership of your American Century Investments® account. If you add a new bank account registered to names different from your account registration, the new bank account and any related transactions may be canceled. Additionally, your new bank information is subject to verification and any transactions may be canceled.

Add Bank Information*

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Bank Management.

Select + Add Bank and follow the prompts.

*Not available for American Century® Brokerage accounts or company sponsored retirement plan accounts.

What information will I be asked to provide?

Registered Owner on Bank Account

Joint Owner on Bank Account (if applicable)

9-Digit ABA Routing Number

Bank Account Number

Account Type (checking or savings)

When I add bank for one of my accounts, does it affect my other accounts?

Changes to bank information are made according to the primary Tax Identification number (Social Security or Employer Identification number) registered to the account. When you add bank information to an account online, you are adding it to all eligible accounts registered under that Tax Identification number.

How long after adding bank do I have to wait to Invest or establish an Automatic Investment?

Investments and Automatic Investments are available immediately upon adding your bank information online. Adding new bank information or making a change to existing bank information may require a hold period to verify bank account and routing numbers. Additionally your new bank information is subject to verification and any transactions may be canceled.

How long after adding bank do I have to wait to make a redemption (withdrawal)?

In order to help protect our investors, we will not allow redemptions within 7 calendar days after a change is made to your bank information. A printed confirmation of the change will be sent to your address of record whenever a change of bank information is requested.

Delete Bank Information*

Log in with your user name and password.

Select Profile in the top-right navigation to expand a drop-down menu.

Select Bank Management.

Select the trash can icon next to the bank account to remove and follow the prompts.

*Not available for American Century® Brokerage accounts or company sponsored retirement plan accounts.

American Century® Brokerage accounts and company sponsored retirement plan accounts cannot delete bank information online. Please contact us delete your bank information from these accounts.

Deleting bank information affects all accounts registered under the same Tax Identification number (Social Security or Employer Identification number).

The Delete option is only displayed if you have at least one bank account on file.

Before deleting a bank account, please Stop Existing Automatic Investments for that bank account first. If an Investment or Automatic Investment is pending, you must wait until this transaction is complete (2-3 business days) before deleting the bank account.

Automatic Investments can be re-established through another existing bank account, or by adding new bank information online and re-establishing through the new bank account.

If you have multiple bank accounts on file, one bank account will always be designated as the primary account. The primary bank account is used when no other bank is selected for transactions, such as investments and, automatic investments.

When the primary bank is deleted and a new primary bank is designated, a 7 calendar day hold period is placed on the new bank before it can be used for redemptions. The holding period begins the first business day after receiving the request.

These services are available by completing the appropriate forms and mailing them to us.

Non-Retirement Account Maintenance Forms

Retirement Account Maintenance Forms

Deceased Shareholder Services

Please call an Estate Transfer Specialist at 1-800-422-3301, M-F, 8 a.m.-5 p.m. Central time.

Online confirmations for account transactions are available securely online after you enter your User Name and Password and Log In. Did you know that you can be notified of transaction confirmations by email instead of paper mail? Learn more about eCommunication and go paperless today.

Online Confirmations include:

Transaction date

Transaction dollar amount and share price

Total account value and total number of shares held after the transaction

View Online Confirmations

Log in with your user name and password.

Select Documents from the top navigation to expand a drop-down menu.

Select My Documents.

Filter what documents are displayed by selecting the Document Type and All Available menus.

View Online Confirmations

Log in with your user name and password.

Select Documents from the top navigation to expand a drop-down menu.

Select My Documents.

Filter what documents are displayed by selecting the Document Type and All Available menus.

View Online Confirmations

Log in with your User Name and Password.

Select your account.

Select the Communications link.

Select Trade Confirmations.

What You Need to Know

Online account statements are only accessible after you Log In with your User Name and Password.

If you are signed up for eCommunication, we will notify you by email when your account statement is available online.

Fourth quarter account statements are available online at the beginning of January, and contain a consolidated view of each of the previous quarterly account statements for that year.

Quarterly account statements are available online within the first five business days of April, July and October.

Quarterly account statements are held on file for 2 years. If you need account history prior to this time period, please call or email us.

View Online Account Statements

Log in with your user name and password.

Select Documents from the top navigation to expand a drop-down menu.

Select My Documents.

Filter what documents are displayed by selecting the Document Type and All Available menus.

View Online Account Statements

Log in with your User Name and Password

Select your account

Select the Documents tab

Select your Statement to download and view

View Online Account Statements

Log in with your User Name and Password

Select your account

Select the Communications link

Select Statements & Reports, choose an account number and choose which statement to view

Alternatively, you can access your statements without going directly to your brokerage account:

Log in with your User Name and Password

Select your account

Select the Documents tab

Select your Statement to download and view

What You Need to Know

Tax forms are only accessible after you Log In with your User Name and Password.

Tax forms are held on file, and available online, for 2 years.

Corrected tax forms are mailed and not available online.

What account types offer online tax forms?

Individual or Joint Ownership Accounts

UTMA/UGMA Accounts

Individual Retirement Accounts

Business Retirement Plan Accounts

Note: Find online brokerage tax forms and related help by navigating to your American Century® Brokerage account after you Log In.

Which tax forms are currently available online?

IRS Form 1099-DIV: Reports taxable distributions and capital gains for non-retirement accounts. Distributions are taxable if received in cash or reinvested.

IRS Form 1099-B: Reports redemptions and exchanges from non-money market, non-retirement accounts.

IRS Form 1099-R: Reports redemptions from tax-deferred accounts.

IRS Form 5498: Reports contributions to certain retirement accounts, including SEP-IRAs, SIMPLE-IRAs, and Rollover IRAs (traditional and Roth). This form will be sent in May.

Who will receive a 1099 tax form?

IRS Form 1099-DIV: An investor that has received a distribution, either in cash or reinvested, of dividends and/or capital gains in a taxable account.

IRS Form 1099-B: An investor who sells shares or exchanges shares in a taxable (non-money market) account.

IRS Form 1099-R: An investor who sells shares from a tax-deferred account, including traditional IRA, SEP-IRA, SIMPLE-IRA, Roth IRA, Coverdell Education Savings Accounts (CESA) or business retirement plan accounts, or converts a traditional IRA to a Roth IRA.

Why is my tax form not available online?

Corrected Tax Forms: If your 1099-DIV, 1099-B, or 1099-R tax form has been corrected, it will be mailed. The corrected form, and any other forms under your Tax Identification number, will be available online.

IRS Form 1099-DIV: Accounts with a distribution of $10 or less are not reported to the IRS. A 1099-DIV is mailed by the end of January, but will not be available online.

IRS Form 1099-R: Custodian to Custodian transfers and Maintenance fee deductions are not reported to the IRS and will not generate a 1099-R by mail or online.

Log in with your User Name and Password

Select your account

Select the Documents tab

Select your Tax Form to download and view

Log in with your User Name and Password

Select your account

Select the Documents tab

Select your Tax Form to download and view

Log in with your User Name and Password

Select your account

Select the Communications link

Select Tax Documents

Alternatively, you can access your statements without going directly to your brokerage account:

Log in with your User Name and Password

Select your account

Select the Documents tab

Select your Statement to download and view

Designating your account beneficiaries is an important part of your financial planning. Make sure your legacy is directed as you choose by managing your beneficiaries for your American Century Investments® accounts.

Why it's important to keep your beneficiaries up-to-date

Older designations often contain outdated or incomplete information, making it difficult to distribute assets in a timely manner.

Even if you have a will or trust, you must provide your designation directly to us. That designation will determine how your assets are distributed.

Individual Retirement Accounts

Manage beneficiaries for your retirement accounts securely online*. Retirement accounts include Traditional IRA, Rollover IRA, Roth IRA, Roth Conversion IRA, Minor IRA, and Minor Roth IRA.

Follow these step-by-step directions below:

Log in with user name and password.

Select the Profile icon in the top right cornerand choose Profile.

Select Beneficiaries under Account Management.

*Naming a trust as a beneficiary: If you would like to add a new or modify an existing trust or other entity as a beneficiary, please complete the Designation of Beneficiary form and return accompanied with any additional documentation, as indicated in the form. Naming a trust as a beneficiary can be completed online for Workplace Retirement Accounts. Generally, an entity has a separate identifiable existence that is created for legal or tax purposes. Examples of entities include a trust, charity, your estate, endowment, partnership, corporation, etc.

Taxable Mutual Fund Accounts

Please review the Transfer on Death Rules and download a Transfer on Death (TOD) Agreement .

Taxable accounts are accounts that are reportable to the IRS on an annual basis, meaning you are taxed on any:

dividends and capital gains distributed by the fund each year-the tax rate varies depending on the type of income distributed and your tax bracket

capital gains when you sell shares or exchange them for another fund-the tax rate varies depending on how long you owned the shares and your tax bracket

Make sure your legacy is directed as you choose by managing your beneficiaries for your American Century Investments® accounts.

Workplace Retirement Plan Accounts

Manage beneficiaries for your workplace retirement accounts securely online. Workplace retirement accounts include 403(b) Plan, 457(b) Plan, SEP IRA, SIMPLE IRA and SARSEP Plan.

Log in with your User Name and Password.

Select your account.

Select Change Profile in the right margin.

Select the Beneficiaries tab.

Review beneficiary information, or select +Add/Update and follow the prompts.

Online beneficiary management is not available for Brokerage accounts. To update your beneficiaries, please download and submit the Brokerage Designation of Beneficiary form.

Account Transactions

Log in with your User Name and Password

Select your account

Select the fund name to expand information about the fund*

*Cost basis information only appears for eligible funds.

Log in with user name and password.

Select the Profile icon in the top right corner and choose Profile.

Select the Cost Basis link* under Account Management and make your changes.

*If the link does not appear, you do not have eligible accounts.

Average Cost

A method of calculating the adjusted cost basis in which the investor uses an average of the cost of the shares held in the account at the time of redemption. It assumes the investor is redeeming the first shares purchased before any others (see First In, First Out)

First In First Out (FIFO)

A method of calculating cost basis in which the shares first acquired are the first to be redeemed.

Last In First Out (LIFO)

A method of calculating cost basis in which the shares last acquired are the first to be redeemed.

High Cost

A method of calculating cost basis in which the highest cost shares are the first to be redeemed.

Low Cost

A method of calculating cost basis in which the lowest cost shares are the first to be redeemed.

Loss Gain Utilization (LGUT)

A method of calculating cost basis in which the shares that would result in a loss are the first to be redeemed. For lots that would result in a loss, short-term lots will be redeemed ahead of long-term lots. Due to favorable long-term capital gains rates, long-term gain lots are given priority over short-term gains to reduce taxes assessed.

Specific Lot

A method of calculating cost basis in which the investor indicates the purchase lot(s)—or the actual shares by quantity and date purchased—that he or she would like to redeem.

Review the samples below if you need help in locating your bank account number or routing number on a check or deposit slip.

Portfolio Returns combine information for all holdings in the account*, allowing you to keep tabs on the account as a whole.

Log in with your user name and password

Select your account

Select the fund name to expand information about the fund

*Portfolio Returns do not include mutual funds purchased through an employer-sponsored retirement plan or American Century® Brokerage.

Year to Date

Percentage change since the beginning of the year.

Includes dividends, capital gains, and share price changes.

Accounts closed for 12 months or more are not included.

Accounts closed and reopened within 12 months retain a full account history and are included.

Accounts closed and reopened after 12 months do not retain historical information and are based on the reopen date.

12 Month

Percentage change over the past 12 months.

Includes dividends, capital gains, and share price changes.

Not available for portfolios with accounts open less than a year.

Accounts closed for 12 months or more are not included.

Accounts closed and reopened within 12 months retain a full account history and are included.

Accounts closed and reopened after 12 months do not retain historical information and are based on the reopen date.

Average Annual Return

Translates your total return into an annual average over the indicated period (from the opening date of your oldest open account to the as of date).

Includes timing of cash flows into and out of your accounts and accrued interest.

Is only available for accounts and portfolios open more than two years.

May differ slightly from returns shown in fund materials. The differences will be insignificant and occur because of the way your return is calculated.

Accounts closed for 12 months or more are not included.

Accounts closed and reopened within 12 months retain a full account history and are included.

Accounts closed and reopened after 12 months do not retain historical information and are based on the reopen date.

There is a hold period of seven calendar days for online investments - these funds are not available for redemption (sell) until this period has expired.

Investments received on any business day prior to market close (usually 3 p.m. CT) will receive that day's price. Investments received after that time will receive the price determined on the next business day.

Unless processing has begun, American Century Investments® will use its best efforts to honor revocation requests received prior to market close on the trade date of the transaction.

Current bank information must be provided for your account(s) in order to complete this transaction online. If you request a one-time or ongoing automatic investment, sufficient funds must be available in your bank account to cover the transactions.

What is the minimum initial investment to open a new account?

The minimum initial investment to open a new account varies by fund, but is located in the fund's Prospectus or on the fund's Detail page.

What is the minimum investment for an existing account?

The minimum investment required for an existing account is $50.

What is the maximum online investment amount per account per day?

The maximum online investment amount per account per day is $250,000.

Do I need sufficient funds in my bank account when investing online?

Although it may take a couple days for the transmittal of funds to occur, it is necessary to have the funds available in your account at the time of the request. Otherwise, the investment may be rejected.

Investing in an Individual Retirement Account (IRA)?

It is important to check that the contributions to your IRA do not exceed the contribution limits for the tax year. This can be determined by logging in from your computer and reviewing your total contributions on the Account Summary page.

Invest Online to an Existing Account

Log in with your User Name and Password

Select your account

Find the name of the fund

Select the Transact dropdown

Select Buy

Continue with the prompts to complete your purchase

Invest in a New Fund Using One of Your Existing Registrations

Invest in a new American Century Investments' mutual fund that you don't currently own by selecting to invest in a new fund using one of your existing registrations (e.g. Individual Account, Joint Account, etc.).

Log in with your User Name and Password

Select Transact at the top and choose Make a Transaction

Select Buy

Follow the prompts to complete your purchase

Please submit your investment check with signed instructions that include your account number(s) and the amount to invest in each account. If submitting a contribution to an IRA, designate whether your investment is for the current tax year, previous tax year or if it is a rollover or conversion. Also indicate whether it is for a Traditional or Roth IRA.

If you prefer, you may provide your investment instructions on our One Time and Automatic Transaction Form , available in our Form Center. Please visit Contact Us for address information.

Personal, IRA and Business Accounts

Please provide the following information to your bank to initiate an investment by federal funds wire into your American Century Investments' account. If you are wiring to more than one fund, indicate the amount to be invested in each fund. If an IRA, designate whether your investment is for the current tax year, previous tax year or if it is a rollover or conversion. Also indicate whether it is for a Traditional or Roth IRA.

American Century Investments bank and routing number:

(Receiving bank and routing number)

Commerce Bank, N.A.

101000019Wire funds to:

(Beneficiary)

American Century Services Corporation

4500 Main St., Kansas City, Missouri 64111American Century Investments Commerce Bank account number:

(Beneficiary account number)

2804918American Century Investments fund or funds into which you wish to invest:

(Reference to beneficiary)

Reference the American Century Investments fund that you want the money to go in.Name and address of account owner:

(Originator to beneficiary)

Your name and addressAdditional Information:

(Bank to bank information)

Your Social Security or Employer Identification number

International Wires-Include the following in the wire text:

ACI Swift Code CBKCUS44 (Commerce Bank Kansas City US)

Brokerage Accounts

Provide the following instructions to the financial institution that will be wiring the assets:

The Bank of New York: ABA# 021000018

Pershing LLC Account Number: 890-051238-5

For Further Credit: Your name and American Century® Brokerage account number

International Wire Swift Code: IRVTUS3N

Workplace Retirement Plan Accounts

Instructions apply to 457(b) Plan, 403(b) Plan, SEP IRA, SARSEP IRAs and SIMPLE IRA accounts.

Plan Sponsors/Employers, please provide the following information to your bank to initiate an investment by federal funds wire into your American Century Investments account.

Please also specify on the wire:

RFB: (Plan ID for QRP, 457 or 403(b) OR SSN for SEP, SARSEP or SIMPLE IRA)

OBI: Plan Name

BBI: Additional free form text if needed.

Log in with your User Name and Password

Select your account

Find the name of the fund

Select the Transact dropdown and choose Make a Transaction

Select Auto Invest

Follow the prompts to setup your automatic transaction

Log in with your User Name and Password

Select your account

Find the name of the fund

Select the Transact dropdown and choose Make a Transaction

Select Auto Invest

Select the Automatic Investment you wish to modify

Select Modify

Follow the prompts to modify your automatic transaction

Log in with your User Name and Password

Select your account

Find the name of the fund

Select the Transact dropdown and choose Make a transaction

Select Auto Invest

Select the Automatic Investment you wish to delete

Select Delete

Follow the prompts to delete your automatic transaction

IRA Accounts & Automatic Investments

Total contributions to your IRA cannot exceed the contribution limits for the tax year.

Are you the registered owner of the bank account you intend to use?

Only individuals listed on the bank account registration may request to start, increase, decrease, or hold an Automatic Investment on an existing or new account. If you are listed on the American Century Investments® account, but not on the bank account, you can only cancel an Automatic Investment.

7 Calendar Day Hold Notice

Automatic Investments (new, modify existing or stop an existing): The bank account on file used to create, modify or stop an Automatic Investment is subject to a 7 calendar day hold for online redemptions. The holding period begins the first business day after receiving the request.

Investments: Mutual fund shares purchased directly through American Century Investments are subject to a 7 calendar day hold, during which time will not be available for redemption. The holding period begins the first business day after receiving the request. This holding period applies to shares purchased through an Automatic Investment from a bank account on file.

Call Us: Please contact us during normal business hours and request a transaction that is not available online due to a hold on your bank account.

Reminders

Automatic Investments do not stop automatically when an account is liquidated. Please be sure to stop all Automatic Investments before liquidating your account.

Confirmation statements are sent when an Automatic Investment is established or modified.

Confirmations for regularly-scheduled Automatic Investments are available securely online. Simply log in with your User Name and Password, choose the appropriate account under Portfolio of Accounts in the margin, and selecting the Transaction History tab. You can also view confirmations in your quarterly statements (see Help for Online Account Statements).

Automatic Investments must be at least $50 per individual investment.

You may establish multiple Automatic Investments on your account if you want to invest more than once per month.

Current bank information must be provided for your accounts in order to complete this transaction online. If you request a one-time or ongoing automatic investment, sufficient funds must be available in your bank account to cover the transactions.

A Direct Deposit, unlike an Automatic Investment, begins when you notify the payer (i.e. the source of the money to be invested). Requirements to establish a direct deposit vary depending on the payer.

Payers can include:

Your employer

Your pension provider

Social Security

Other U.S. government entities

Generally, establishing a Direct Deposit requires completion of Direct Deposit Authorization form and an IRS Direct Deposit Sign-Up form, both available when you contact us.

View Direct Deposit Instructions for more information.

Important Note: If you use American Century Investments® CheckWriting checks, please do not use a blank check or your CheckWriting check number. Your direct deposit will not transmit properly with the CheckWriting check information and will likely be rejected by the banking system.

Please contact us to determine what information your situation requires to establish a direct deposit.

Exchanges & Taxes

If required to file a tax return with the Internal Revenue Service (IRS), you must report when the sale of shares from an exchange between non-tax-deferred accounts results in a capital gain or loss.

Exchanges between IRAs are not considered taxable events and are not reported to the IRS.

American Century Investments® uses the first-in first-out method for shares sold through an exchange.

Reminders

There is a hold period of seven calendar days for online investments - these funds are not available for redemption (sell) until this period has expired.

Exchanges received on any business day prior to market close (usually 3 p.m. CT) will receive that day's price. Exchanges received after that time will receive the price determined on the next business day. Unless processing has begun, American Century Investments will use its best efforts to honor revocation requests received prior to market close on the trade date of the transaction.

Identical account registration is required for exchanges between accounts.

$50 minimum for exchanges to existing accounts.

The maximum online exchange is $250,000 per account per day.

If you are exchanging all shares from an existing account that has one or more automatic investments, you must first stop all automatic investments on the account you are closing. Learn more by visiting the Automatic Investments site help topic.

If you are exchanging to a new account, the new account will be set up with the same registration as the account from which you are exchanging.

There is no limit on the number of exchanges allowed per calendar year.

Exchange Between Accounts or to a New Fund

Log in with your User Name and Password

Select the Transact dropdown and choose Make a Transaction

Select Exchange

Follow the prompts to complete your exchange

Exchange Between Accounts or to a New Fund

Log in with your User Name and Password

Select your account

Select the My Portfolio tab

Select Change Investments

Select Exchange and follow the prompts

There is a hold period of seven calendar days for online investments—these funds are not available for redemption (sell) until this period has expired.

Automatic investments do not automatically stop when an account has been liquidated. Please be sure to stop your automatic investment if you have liquidated your account. View Steps to Stop Existing Automatic Investments online.

Please verify that bank information is correct. Once funds are transmitted, they cannot be retrieved or recovered by us. We are not liable for any loss you may incur as a result. Allow 2-5 business days for transfer of proceeds.

Redemptions (sell) requests received on any business day prior to market close (usually 3 p.m. CT) will receive that day's price. Redemptions received after that time will receive the price determined on the next business day. Unless processing has begun, American Century Investments will use its best efforts to honor revocation requests received prior to market close on the trade date of the transaction.

Before requesting a redemption from a CheckWriting account, please verify that all CheckWriting checks have cleared. If a CheckWriting check has not cleared, leave enough money in the account for the check to clear. Choose All Shares to close out the account completely.

Steps to Sell (Redeem) Online

Log in with your User Name and Password

Select the Transact dropdown and choose Make a Transaction

Select Sell

Select the account and holding you want to sell

Enter the amount that you want to sell ($50 min):

Dollars—Enter a dollar amount to redeem.

All Shares—Do not enter an amount and select Redeem All Shares to liquidate your account.

Choose how to receive the proceeds from this sale:

Bank (2-5 business days

Check by Mail (7-10 calendar days; payable to all account owners)

Select the Continue button and follow the prompts.

You may sell (redeem) shares of your mutual fund securely online¹, and direct the proceeds from the sale to the following (if on file for your account and eligible²):

A bank account via Automated Clearing House (ACH).

Check by mail payable to all account owners to the mailing address on file for your account.

The maximum online redemption is $25,000-please call 1-800-345-2021 if you wish to redeem a larger amount.

¹Online redemptions are not available for IRA Beneficiary, CESA accounts or workplace plans—please contact us to redeem.

²Bank accounts and/or mailing addresses will not appear if subject to a 7 calendar day hold.

What is a redemption?

A redemption is a sale of shares or a liquidation from an account, in which the money is directed to your bank account or by check to the address of record. An exchange from one mutual fund to another mutual fund is also considered a redemption.

Redeeming only a portion of your account balance?

If you intend to keep the account open, the remaining account balance must meet the fund's minimum initial investment requirements. Otherwise, the account may fall in the low balance liquidation cycle.

If you own shares of an American Century Investments® mutual fund that offers the CheckWriting service, you can reorder your checks securely online.

Reorder Checks

Log in with your User Name and Password

Select your account

Select your fund to expand information about the fund

Select the More Actions ellipses

Select Order Checks and follow the prompts

Will I receive confirmation statements for checks written against my account?

Yes, a confirmation statement is mailed to the investor confirming each check that is written against your account. You can also view what checks have cleared securely online. See the Transaction History/Pending Transactions site help topic for more information.

Reminders

CheckWriting checks cannot be ordered on accounts that have a zero balance.

CheckWriting checks can only be mailed to the address of record.

There is a hold period of seven calendar days for investments - these funds are not available for CheckWriting until the hold period has expired.

To be honored, CheckWriting checks must be signed by the required authorized individuals designated by the investor.

CheckWriting checks must be written for at least $100.

CheckWriting checks may not be written for more than $1,000,000.

Transactions Types

Pending Transactions: View your pending transactions securely online. Once your transaction request has been submitted, it cannot be changed or canceled.

Transaction History: Complete transaction history is available securely online on the Transaction History page.

View Transaction History / Pending Transactions

Log in with your User Name and Password

Select the Transact dropdown at the top and choose Transaction History

Two years of transactions are shown. Filter and sort as needed

To access all transactions, select Download Full History

Transaction History

View your completed transactions on the Transaction History page.

Business Retirement Accounts (401(k), 403(b), SEP-IRA, etc.) - Transactions completed during the previous calendar year and the current calendar year.*

*Transaction history is purged once per year. Until the annual purge occurs, you may see transactions older than the stated time frame.

View Transaction History for Workplace Retirement Plan Accounts

Log in with your User Name and Password

Select your account

Select the Transaction History tab.

For history prior to the last 30 days, select +Show Filter, specify the desired time period and select Retrieve Transactions. For details information on a transaction, click on the number next to the transaction.

Log in with your User Name and Password.

Select your account.

Select the History link.

Log in with your User Name and Password

Select your account

Select your fund to expand information about the fund

7-Day Current Yield

The 7-day current yield more closely reflects the current earnings of the fund than the total return.

7-Day Effective Yield

The 7-Day Effective Yield can be slightly higher than the 7-Day Current Yield because of the effects of compounding. The 7-Day Effective Yield assumes that income earned from the fund's investments is reinvested and generating additional income.

MTD (Month to Date) Earned Dividends

Track earned dividends for your money market fund account as they accrue daily until they are paid to the account on the last business day of the month. The MTD Earned Dividends amount displayed is not included in money market fund's account value until the dividends are distributed.

Available CheckWriting Balance

The displayed amount is the balance available for writing checks through our CheckWriting service, and may be different than the total value. The amount does not include:

hold periods for the purchase of shares in the fund*

outstanding CheckWriting checks

pending transactions

earned dividends that have not been paid to the account

*Visit this FAQ for more information on hold periods: How soon can I write a check?

Log in with your User Name and Password

Select your account

Select your fund to expand information about the fund

MTD (Month to Date) Earned Dividend

Track earned dividends for your money market fund account as they accrue daily until they are paid to the account on the last business day of the month. The MTD Earned Dividends amount displayed is not included in money market fund's account value until the dividends are distributed.

Available CheckWriting Balance

The displayed amount is the balance available for writing checks through our CheckWriting service, and may be different than the total value. The amount does not include:

hold periods for the purchase of shares in the fund*

outstanding CheckWriting checks

pending transactions

earned dividends that have not been paid to the account

*Visit this FAQ for more information on hold periods: How soon can I write a check?

Conducting Business

If your online application is submitted before the market's close (3 p.m. Central time), you will receive that day's closing share price, and your account will be established on the next business day. If your application is submitted after the market's close, you will receive the next business day's closing share price.

Access your American Century Investments® account online one business day after your account has been established. Before accessing your account online, you must register a User Name and Password.

All purchases have a hold period of either seven calendar days, excluding holidays, or one business day, excluding holidays. During the hold period, the value of the purchased shares is unavailable for release by any means, including checks written against the account through our CheckWriting service.

Seven Calendar Day Hold

The seven calendar-day hold period includes weekend days, but excludes holidays. The hold period begins the day after a purchase order is received and applies to purchases made with the following funding sources:

Initial purchase of the mutual fund*

Online purchases

Automatic Investments

Purchases by personal check with investment slip

Direct Deposit by check

U.S. Treasury Check

Traveler's Check

Money Order

American Century Investments CheckWriting Check

One Business Day Hold*

The one business-day hold period*, excluding holidays, begins the day after a purchase order is received and applies to purchases made with the following funding sources:

Wire

Direct Deposit by ACH

*The seven calendar day hold period applies to the initial purchase of the mutual fund, regardless of the purchase funding source.

Each time you make an investment with American Century Investments® by means other than bank wire or direct deposit, there is a 7 calendar day holding period before you can redeem those shares, unless you provide us with satisfactory proof that your purchase funds have cleared. This 7 calendar day holding period begins the day after your investment is processed. Investments by wire require only a one-day holding period.

If you have established the ability to transfer investments directly from your bank account to your American Century Investments account, we will not allow redemptions within 7 calendar days after a change is made to the bank information associated with your account. A printed confirmation of the change will be sent to you whenever a change of bank information is requested.

If your online application is submitted before the market's close (3 p.m. Central time), you will receive that day's closing share price, and your account will be established on the next business day. If your application is submitted after the market's close, you will receive the next business day's closing share price. You can make additional investments in your account by mail or telephone as soon as it has been established.

There is a hold period of seven calendar days for online investments not received by bank wire or direct deposit - these funds are not available for redemption until this period has expired.

If your online application is submitted before the market's close (3 p.m. Central time), you will receive that day's closing share price, and your account will be established on the next business day. If your application is submitted after the market's close, you will receive the next business day's closing share price. You can provide exchange instructions by mail or telephone as soon as your account has been established. Online exchanges should be available the next business day. There is a $50 minimum for exchanges to existing accounts. Also, you must meet fund minimums for new accounts.

American Century Investments® is offering an online survey from a leader in website customer satisfaction management.

We have engaged GetFeedback™ to help us find out what you think we're doing well and what we can do to improve americancentury.com. As a result, you may be presented with a pop-up survey invitation a few times a year when you visit our website.

The survey should take between three and five minutes to complete and all responses will remain anonymous and confidential. No personal information about you will be reported to us. As a client, your candid feedback is one of the most important tools we have in measuring the success of our website and the results of this survey will be a significant part of the process we use for considering future website enhancements.

We charge an annual account maintenance fee to investors whose total investments are less than $25,000. Below is a description of our fee policy as well as information about waiving the fee.

Fee Policy Specifics

Personal mutual fund investors, including IRA investors, whose total investments are less than $25,000 are subject to the fee. Personal accounts include individual, joint, UGMA/UTMA, personal trusts, Coverdell Education Savings Accounts (formerly Education IRAs) and Traditional, Roth and Rollover IRAs.

If you have only business or business retirement accounts [SEP-, SARSEP-, SIMPLE-IRAs, 403(b)s and 457(b)s], you are currently not subject to this fee, but you may be subject to others.

We will review investment balances on the last Friday of October each year. If your total eligible investments are less than $25,000 at that time, $25 will automatically be deducted from one of your personal mutual fund accounts in November.

Your total eligible investment balance is based on the sum of personal and most business retirement accounts (listed under your Social Security number), which includes individual, joint, UGMA/UTMA, personal trusts, Coverdell Education Savings Accounts, IRAs (Traditional, Rollover, Roth, SEP, SARSEP and SIMPLE), Non-ERISA 403(b) and governmental 457(b) custodial accounts (other types of retirement accounts are not included). We will include the same types of accounts held through American Century Brokerage, Private Client Group, Digital Advice and the Learning Quest® 529 Education Savings Program.

If you are a joint owner or have authority over an account listed under someone else's Social Security number, we will calculate those assets as part of that person's eligible investments, and not yours.

Account maintenance fees do not apply to non-matured Giftrust® accounts.

Non-resident aliens and foreign investors who do not have a U.S. Social Security number are not subject to the fee.

Waive the Fee

To waive the account maintenance fee, you can:

Increase and maintain a total investment balance of $25,000 or more, or

Enroll in paperless document delivery by enrolling in the ""All Electronic"" delivery option under the eCommunication service.

The following questions and answers will give you specific details about our fee policy. If you have more questions, please Contact us.

Why charge an account maintenance fee?

American Century Investments® charges an annual fee to offset some of the additional costs associated with managing smaller balanced accounts. The fee collection enables us to continue offering investors a full range of products and services. We are committed to helping investors achieve their financial goals. We believe we can do so by continuing to offer sound investment management combined with services designed to help you build on your investment and preserve it for the future.

Who is subject to the fee?

You may be subject to the account maintenance fee if:

You hold Investor Class shares of any American Century Investments® fund or Institutional Class shares of the American Century® Diversified Bond Fund in any American Century Investments' account, and

You purchased those shares directly from American Century Investments or American Century® Brokerage and not through a financial intermediary or retirement plan account, and

The total value of those shares is less than $25,000 per taxpayer identification number (such as Social Security number).

Who is not subject to the fee?

At this time, you will not be charged the fee if you invest only in the following account types:

Business - corporations, partnerships, not-for-profits, foundations and endowments

Business retirement accounts and employer-sponsored retirement plans, including SEP-, SARSEP- and SIMPLE-IRAs and 457s and 403(b)s

American Century® Brokerage

Learning Quest®

Non-matured Giftrust® accounts

Investors in the Priority Investor® program, non-resident alien and foreign investors without a U.S. Tax Identification number are not subject to the fee at this time.

What if my account balance goes above $25,000 after the fee is taken?

If your total investments reach $25,000 or more after the fee has been taken, the $25.00 will not be refunded. The fee is assessed based on asset levels as of the last Friday in October. Please be aware that market fluctuations could cause your total eligible investment balance to go above or below $25,000. If your total eligible investment balance is below $25,000 on the day the fee is assessed, you will be charged the fee.

Will there be tax implications when the fee is deducted from my account?

If the fee is deducted from an IRA or other tax-sheltered accounts, there will be no tax impact. However, if the fee is deducted from a taxable accounts, there will be tax implications. Generally, we'll deduct the fee from an IRA if available. If not, we'll look for a money market or bond fund, and finally an equity fund if you have no other types of funds.

Technical Support & Tools

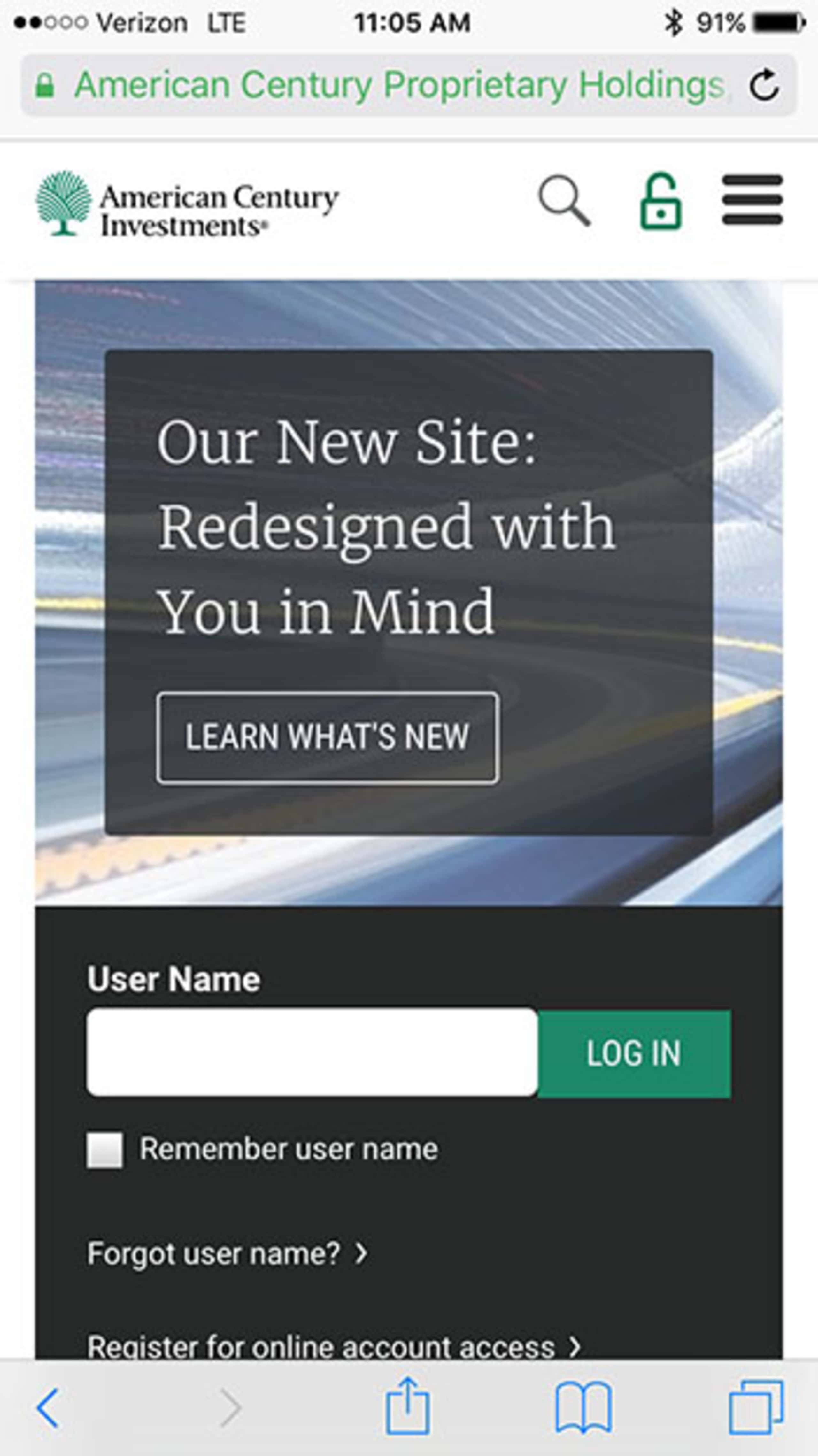

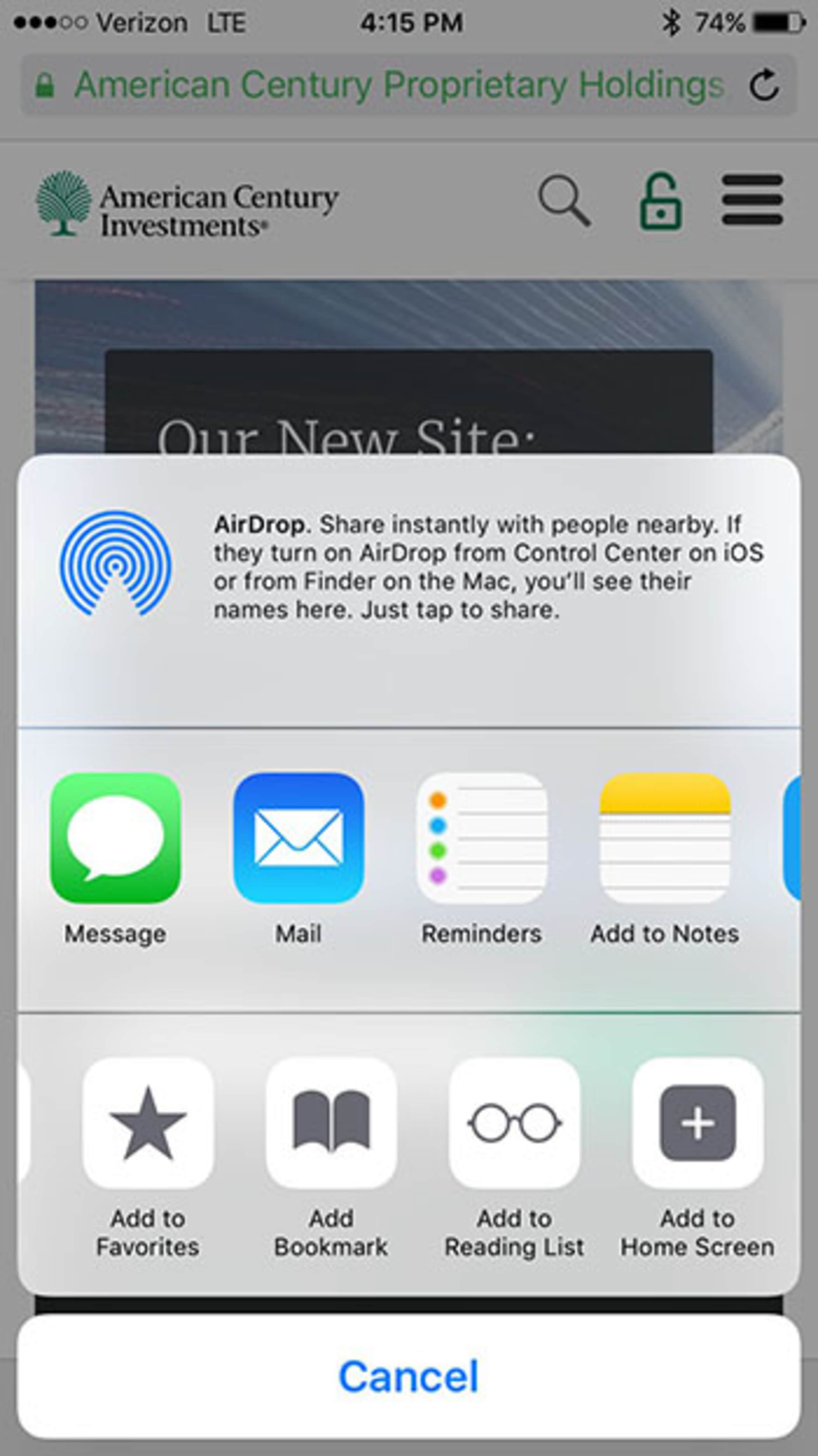

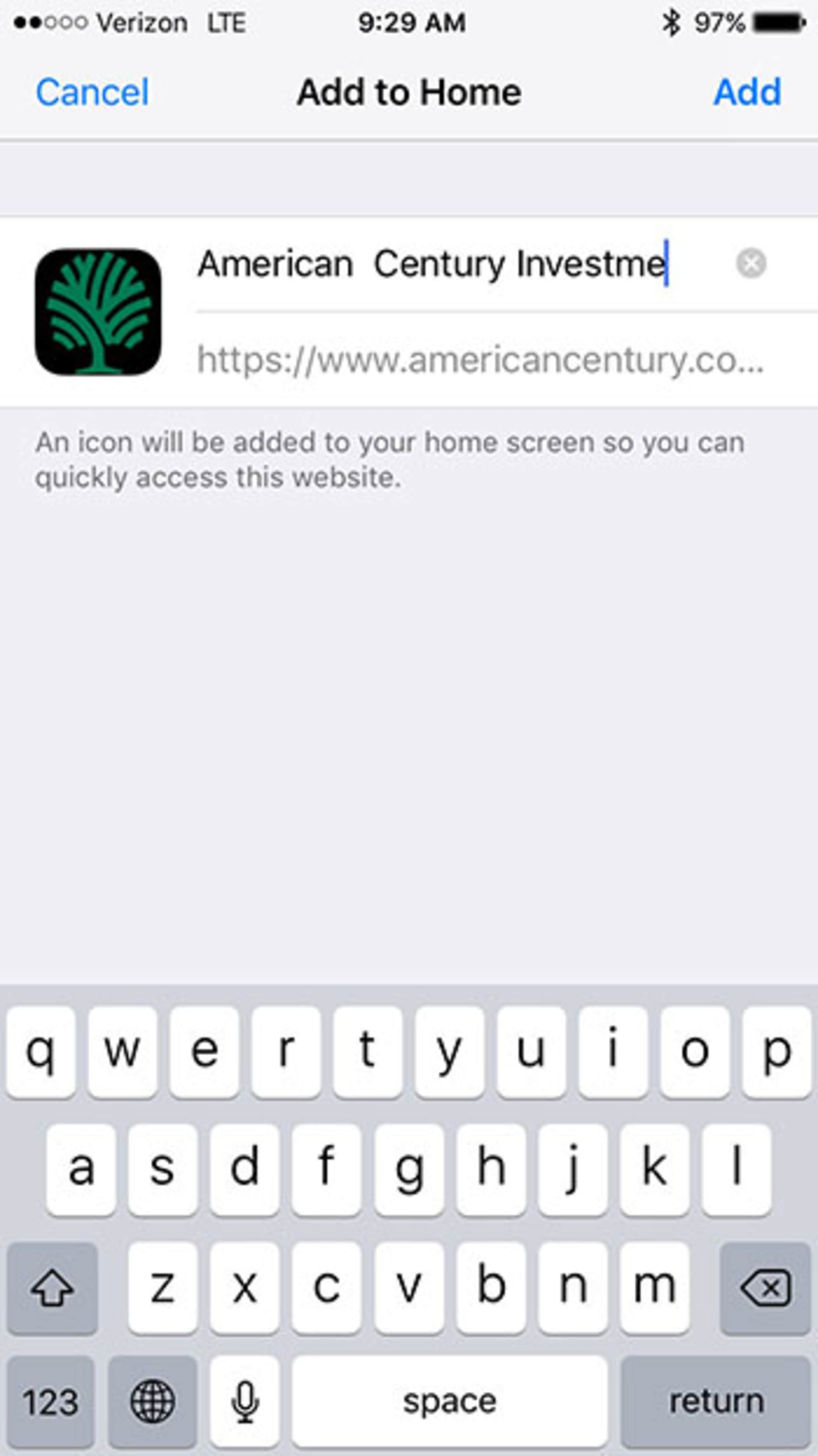

There are 3 quick steps to easier online access from your smart device.

1. Tap the Download icon (box with the up arrow) at the bottom of the screen.

2. Tap Add to Home Screen.

3. Type in a name and tap Add at the top of the screen.

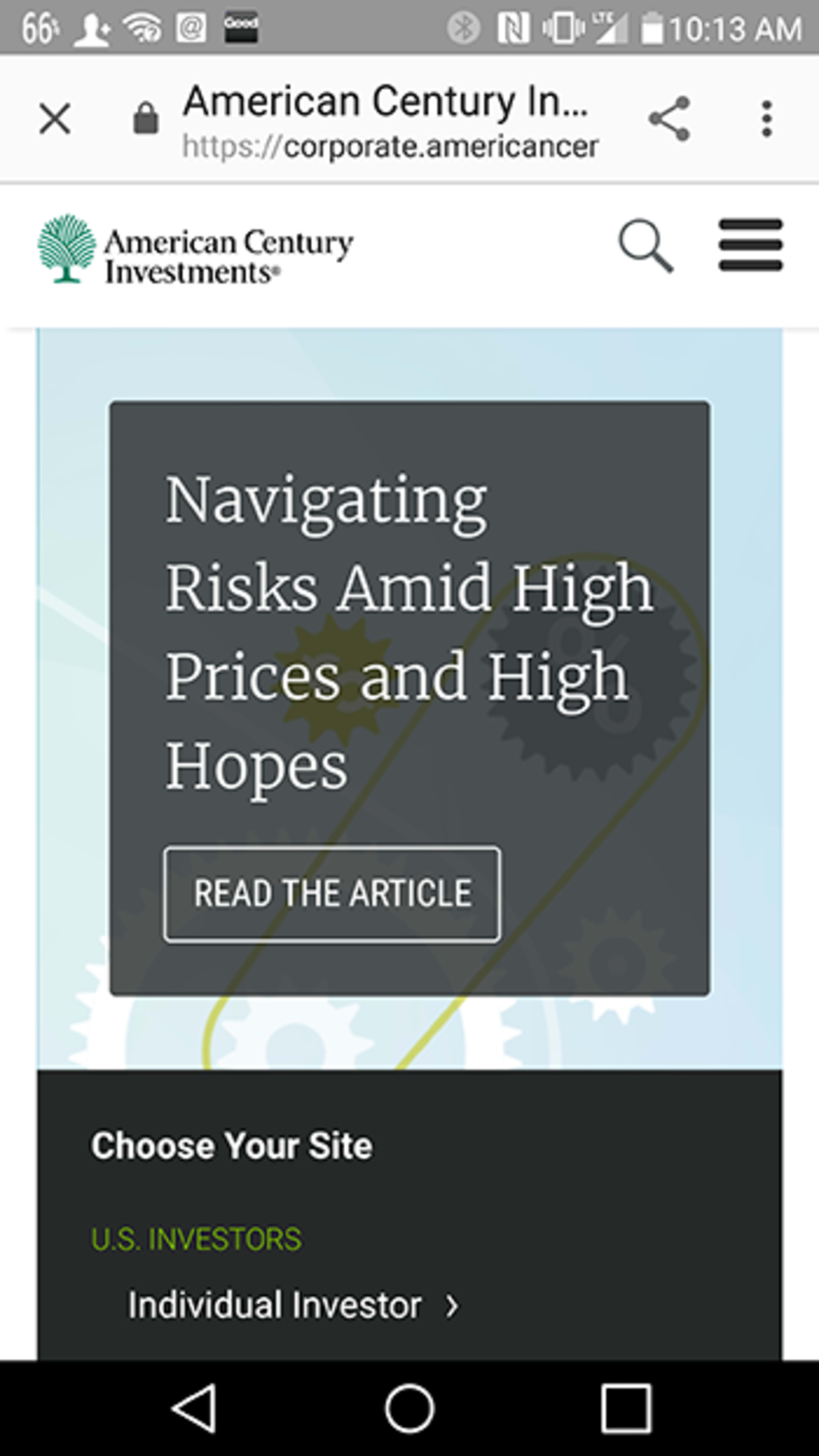

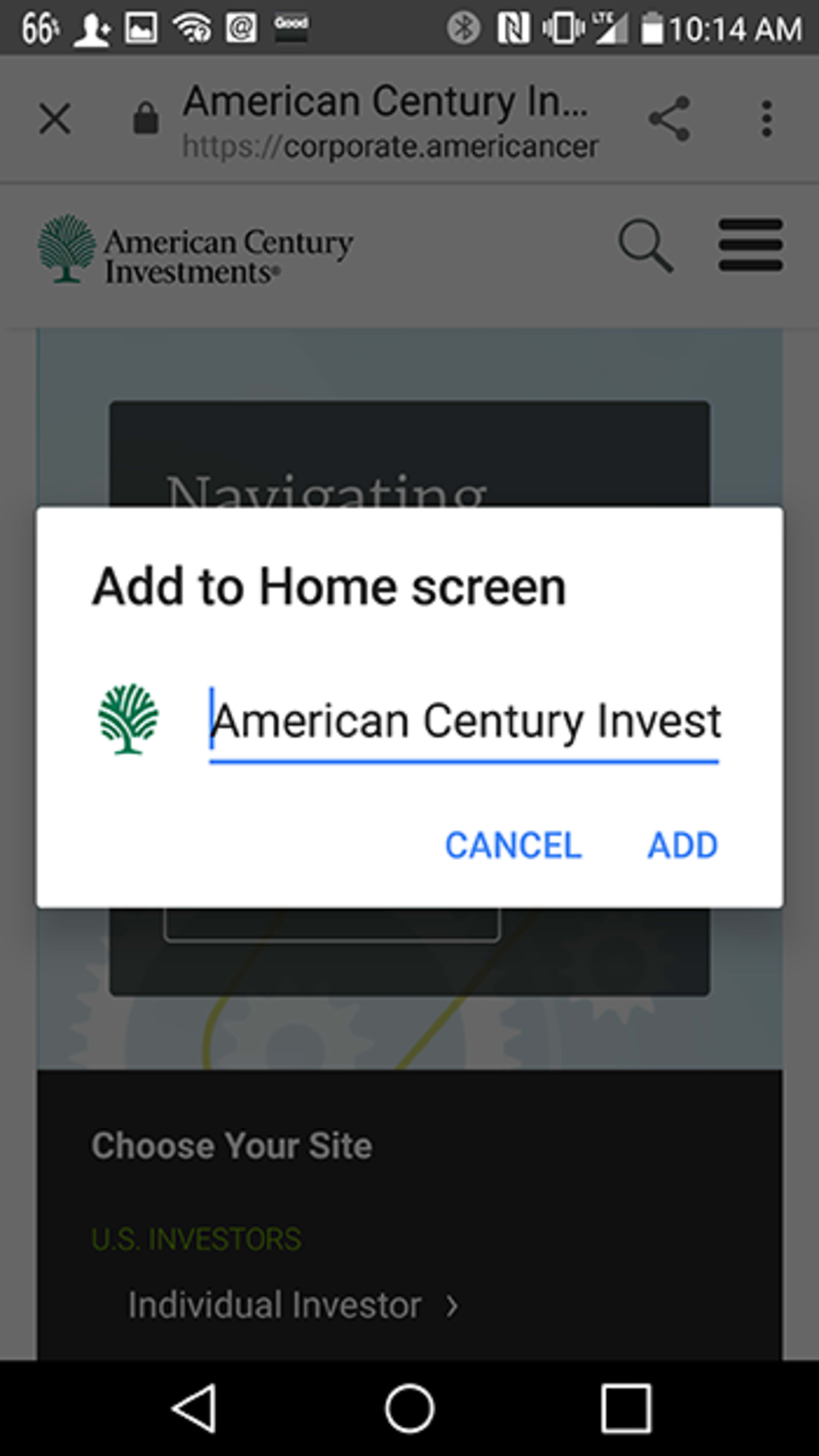

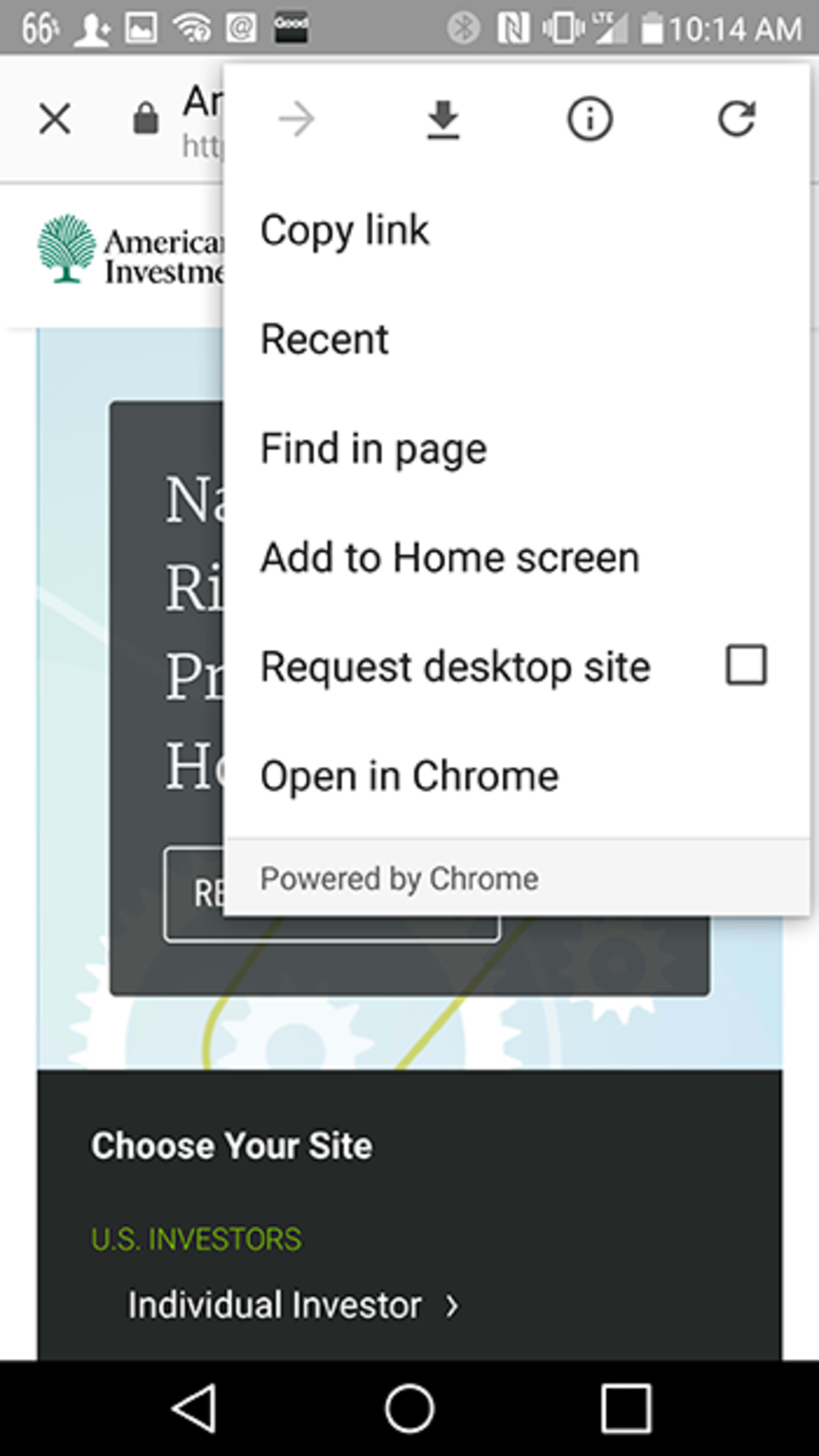

There are 3 quick steps to easier online access from your smart device.

1. Tap the three dots in the top right corner of the screen.

2. Tap Add to Home Screen.

3. Type in a name and tap Add at the top of the screen.

PDF is an acronym for documents created in Adobe's Portable Document Format. The PDF format simply converts information into an electronic format. Adobe Reader is required to open PDF documents on your computer.

Click on this Sample PDF link.

What if the Sample PDF does not open on your computer? You must have the latest version of the Adobe Reader software installed on your computer, which is free and available for download at www.adobe.com .

You may experience problems viewing PDF files if the version of Adobe Reader on your computer is not the latest version available on www.adobe.com . Follow these steps to determine which version is installed on your computer:

Open Adobe Reader on your computer Click on the Help menu, then select "About Adobe Reader..." The version is listed as "Adobe x.x.x mm/dd/yyyy" (where x is the version installed on your computer, and the date is when Adobe released the version). Write down this version. Visit www.adobe.com and compare the version on your computer to the latest free version of Adobe Reader available for download. If you need to update the version on your computer, follow the download and installation instructions on Adobe's website.

American Century Investments® offers a variety of PDF documents on our Web site, such as mutual fund prospectuses, brochures, forms and more.

Please note that accessing a PDF document may be somewhat slower than accessing documents provided in other formats, such as HTML.

Visit www.adobe.com if you have additional questions or need technical support.

Our site is best viewed with 32-bit color and 1024x768 resolution.

Note: Your monitor must support at least 256 colors and 800x600 resolution.

We require users to access their accounts online with the current version of one of the following:

American Century Investments® requires 128-bit browser encryption and Transport Layer Security 1.2 (TLS 1.2). If your browser does not support 128-bit encryption or TLS 1.2, please access the supported browser's website and upgrade to 128-bit encryption. If, for any reason, your session is no longer secure, it will be disconnected.

Microsoft Windows (latest version)

Macintosh OS X (latest version)

We recommend using the most current version of your device's operating system. Keep your device up to date by installing updates as they are released.

The latest free version of the Adobe Reader software is needed to view PDF files.

Learn more about Adobe Reader and PDF Files.

Visit www.adobe.com to download this software.

H&R Block® At Home™ includes the Smart Import® feature, that enables the automated import of 1099-DIV, 1099-B and 1099-R tax data directly from American Century Investments® for your retirement1 and non-retirement accounts. Once imported, you can download this information directly into your H&R Block At Home return.2

Important:

Real Estate Fund and Global Real Estate Fund tax information will not be available until late February. Learn more.

What You Need

Internet Access

Current Version of H&R Block At Home

Tax Identification Number (Social Security or Employer Identification number)

Personal Access Code (PAC)

View or Change Your PAC Online

Log in with user name and password

Select the Profile link in the left navigation.

Select the Personal Access Code link under Security Management.

Select the Modify link to change your Personal Access Code.

Enter and re-enter the new Personal Access Code, then select the Modify button.

If you need assistance with your Personal Access Code, please contact us.

If you need additional assistance using H&R Block At Home or completing your taxes, please refer to the integrated step by step guidance and help files, or consult your tax advisor.

What You Need

Internet Access

Current version of H&R Block At Home

Your American Century® Brokerage website User Name (used when logging into our website)

Last 4 of the Social Security number (SSN) or Tax Identification number (TIN) associated with your Brokerage website User Name

If you need assistance with your website User Name, please contact us.

¹Automated import of tax data is not available for American Century Investments workplace retirement plan accounts.

²When using tax forms imported from American Century Investments, it is your responsibility to confirm the accuracy of the information on your tax return.

H&R Block At Home is a registered trademark of HRB Innovations, Inc.

If you provide your American Century Investments® login information to financial aggregators that combine information about you from multiple sources over the Internet, you do so at your own risk. We cannot be held responsible for any losses that you may incur as a result.

If you choose to proceed, you will need your:

americancentury.com User Name

PAC (Personal Access Code)

View or Change Your PAC Online

Log in with user name and password

Select the Profile icon in the top right corner and choose Profile.

Select the Personal Access Code link under Security Management.

Select the Modify link to change your Personal Access Code.

Enter and re-enter the new Personal Access Code, then select the Modify button.

If you need assistance with your Personal Access Code, please contact us.

TurboTax software and TurboTax for the Web include the Instant Data Entry feature, that enables the automated import of 1099-DIV, 1099-B and 1099-R tax data directly from American Century Investments® for your retirement1 and non-retirement accounts.2 Once imported, you can download this information directly into your TurboTax return.

Important: Real Estate Fund and Global Real Estate Fund tax information is typically available in late February. Learn more.

¹Automated import of tax data is not available for American Century Investments® workplace retirement plan accounts.

²When using tax forms imported from American Century Investments, it is your responsibility to confirm the accuracy of the information on your tax return.

What You Need

Internet Access

Tax Identification Number (Social Security or Employer Identification number)

Personal Access Code (PAC)

View or Change Your PAC Online

Log in with user name and password

Select the Profile link in the left navigation.

Select the Personal Access Code link under Security Management.

Select the Modify link to change your Personal Access Code.

Enter and re-enter the new Personal Access Code, then select the Modify button.

If you need assistance with your Personal Access Code, please contact us.

If you need additional assistance using the TurboTax software or completing your taxes, please refer to the integrated TurboTax EasyStep® interview and help files or consult your tax advisor.

Notice:

Beginning with the 2024 tax year, TurboTax no longer supports downloading American Century brokerage account data. TurboTax does support uploading tax forms.

TurboTax and EasyStep are trademarks and TurboTax for the Web is a service mark of Intuit, Inc., registered in the United States and other countries.

American Century Investments® offers transaction downloads into Quicken for mutual fund, brokerage and workplace retirement plan accounts. Please select the appropriate tab below to learn more.

What You Need

Any version of Quicken Classic or Simplifi, 2018 or later.

Internet Access.

Your Tax Identification Number (Social Security or Employer Identification number).

Your American Century Investments Personal Access Code (PAC).

View or Change Your PAC Online

Log in with user name and password

Select the Profile icon in the top right corner and choose Profile.

Select the Personal Access Code link under Security Management.

Select the Modify link to change your Personal Access Code.

Enter and re-enter the new Personal Access Code, then select the Modify button.

If you need assistance with your Personal Access Code, please contact us.

Note: In Quicken, the PAC may be referred to as a Password.

Guidelines for Set Up

Please use the following guidelines when adding your American Century Investments directly-owned mutual fund accounts in Quicken:

Select Brokerage or IRA.

Select American Century Investments as the financial institution.

When Quicken asks for your:

-Customer ID/Tax ID: Enter your Tax Identification Number (Social Security or Employer Identification number) without dashes.

-Password: Enter your American Century Investments PAC.

What You Need

Any version of Quicken Classic or Simplifi, 2018 or later.

Internet Access

Your americancentury.com User Name (used when logging into your brokerage account)

The Social Security number (SSN) or Tax Identification number (TIN) associated with your Brokerage account and User Name

If you need assistance with your website User Name, please contact us.

Guidelines for Set Up

Please use the following guidelines when using the Quicken Account Setup wizard to add your American Century® Brokerage account:

Select American Century Brokerage as the financial institution.

When Quicken asks for your:

-User Name: Enter your americancentury.com User Name.

-Last 4 digits of SSN: Enter the last four digits of the account owner's SSN or TIN.

Account history downloads are not supported from within the Quicken product. To save manual entry for the account history of your Business Retirement accounts you will need to download a Quicken compatible file from the account history page on the website.

What You Need

Any version of Quicken Classic or Simplifi, 2018 or later.

Internet Access

Your American Century Investments website User Name and Password

Steps to Download Workplace Retirement Plan Account Information into Quicken

If you need assistance with your User Name and/or Password please contact us.

If you're having problems that are specific to your Quicken software, such as accessing the Internet from within Quicken, please refer to the help information within the Quicken program, or visit Quicken Technical Support .

General

How often is account information updated?

Monday through Saturday between 11 p.m. and 5 a.m. Central time

I invested $2,000.00 in a particular fund, but the transaction is being shown as $2,000.01. Why is this?

This discrepancy is the result of the way Quicken rounds share values in individual transactions. Please be assured that your number of shares will always be accurate.

Why do I get the message, "Do you want specific identification of lots?" even when there is only one lot to choose from during online investment activities?

This message appears or doesn't appear depending on the specific transaction history involved with a specific security. In some cases, when accepting transactions individually and this message appears, pressing Accept All will take care of the message. In other cases, the message will continue to appear if there is only one lot to choose from when accepting transactions, or when you perform a sell or a Transfer Out (XOut).