Why Growth Investors Are Turning to Europe in Early 2025

As trade tensions and economic uncertainty drive some investors away from U.S. markets, we think Europe offers an alternative with robust growth prospects and attractive valuations.

Key Takeaways

European stocks have outperformed U.S. stocks through early 2025, marking a shift from previous years.

European companies could benefit from stronger demand, higher defense and infrastructure spending, and other forces.

European equities may offer investors overexposed to U.S. stocks a way to spread risk and open their portfolios to a broader set of opportunities.

International investing involves special risks, such as political instability and currency fluctuations.

With the U.S. outperforming other developed markets during four of the last five years, many expected U.S. exceptionalism to continue in 2025.1 However, this hasn’t been the case, thanks to the “Sell America” trade. Many investors have been diversifying away from the U.S. amid escalating trade tensions and rising economic uncertainty.

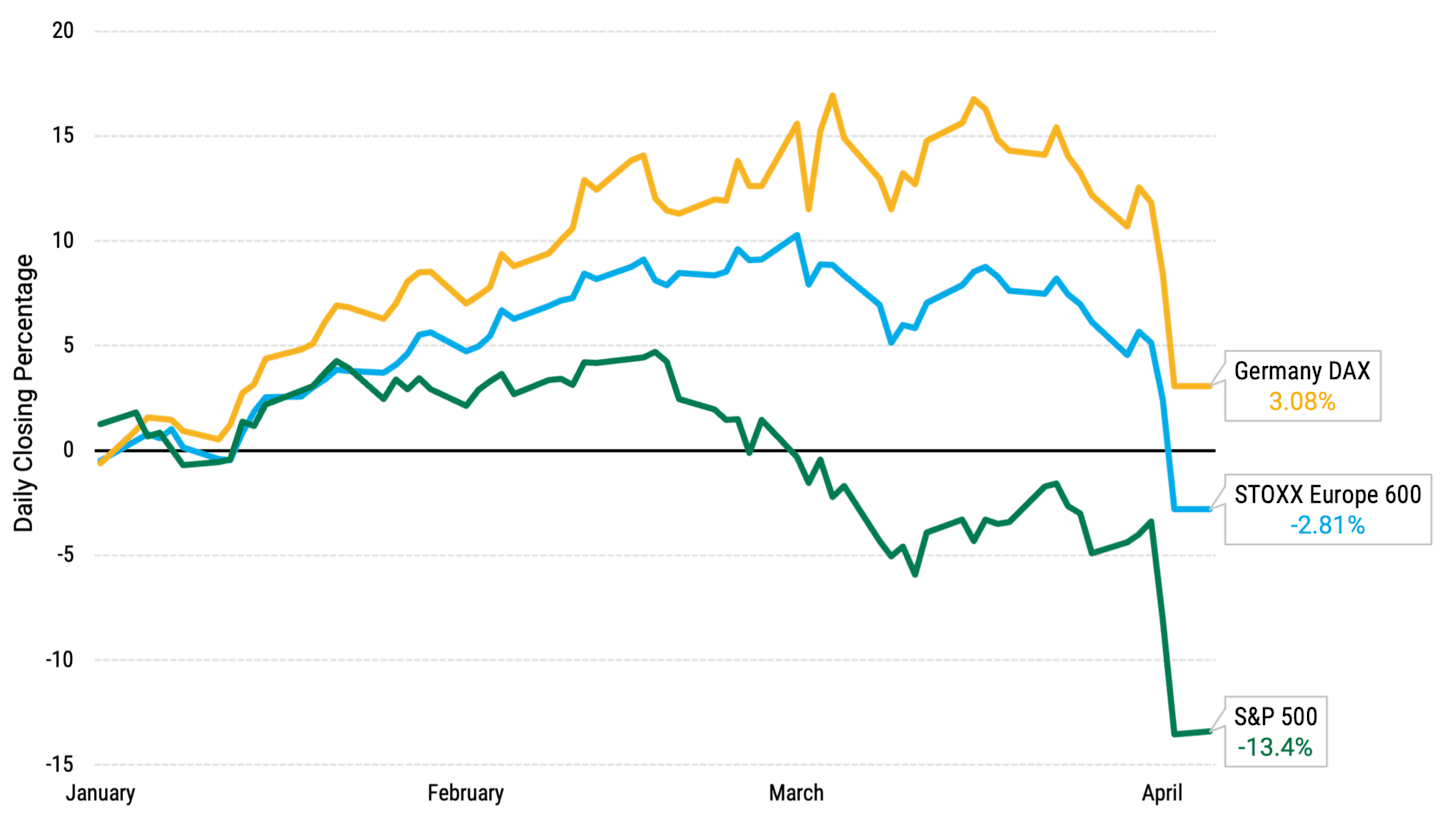

Europe and its largest economy, Germany, have notably benefited from this shift by outperforming the U.S. early in the year. See Figure 1. Despite this period of outperformance, European equities appear to be relatively inexpensive compared to the U.S.

Figure 1 | European Stocks Have Outperformed in 2025

Data from 1/3/2025 - 4/7/2025. Source: FactSet. Past performance is no guarantee of future results. The DAX® index is composed of the 40 largest companies listed on the Frankfurt Stock Exchange. The Stoxx® Europe 600 Index is composed of 600 companies across 17 countries and 11 industries within Europe’s developed economies.

This article explains why we believe Europe may offer opportunities for investors looking to reduce their exposure to the U.S.

Boosting Defense: Europe's New Spending Strategy

Amid growing concerns about the stability of its alliance with the U.S., the European Commission, the executive body of the European Union (EU), has unveiled a blueprint to enhance military readiness and bolster its defense industry. Under the “Readiness 2030” plan, the EU would:

Allow member states to deviate from the bloc’s fiscal rules by dedicating an additional 1.5% of each member’s gross domestic product (GDP) to defense. Over four years, this could generate another 650 billion euros in spending.2

Launch a 150 billion euro fund for defense spending. Member states would be encouraged to order from European suppliers.

The plan also supports the creation of a savings and investment union to facilitate Europeans' investments in European companies. Defense firms, for example, could see increased investment.

On the downside, however, Goldman Sachs has cautioned that any economic boost from defense spending could be smaller than expected. To stay within their debt limits, European countries might offset increased spending with higher taxes or less spending on other needs.3

European Companies Are Poised for an Upswing in Demand

The makeup of Europe’s economy could also prove to be advantageous. While information technology (IT) companies account for nearly 30% of the S&P 500® Index, technology stocks represent roughly 7% of the MSCI Europe Index.4

This structural difference helps explain strong U.S. outperformance in 2023 and 2024 when enthusiasm about artificial intelligence (AI) spending propelled the market. With investors questioning these spending projections and the high valuations of tech stocks, the U.S. market’s significant IT stake could be a headwind.

In contrast, the financial sector is the largest part of Europe's economy. Improved loan pricing and economic activity could fuel earnings for European banks.

Industrial companies account for a larger share of Europe's economy than those in the U.S. Many are poised to see improving growth prospects due to low inventories and rising demand.

We’ve seen positive developments in European manufacturing. Demand seems to have bottomed out and is now climbing with an increase in new orders. This trend is illustrated by the rise of the HCOB Eurozone Manufacturing PMI® Index, which reached 50.5 in March, marking the highest level in nearly three years.5

Other advances could also strengthen demand for European companies.

For example, if China’s economy recovers and boosts consumer demand, it may help European exporters. China is the EU’s third-largest export market, particularly for machinery, vehicles and vehicle parts.6

Interest Rate Strategies: Europe Cuts Faster Than the U.S.

The European Central Bank (ECB) has lowered its interest rates faster than the U.S. Federal Reserve (Fed). Lower rates could serve as a tailwind for Europe.

In April, the ECB reduced its key interest rate from 2.5% to 2.25%, the latest in a recent series of cuts. While inflation has continued to decline, policymakers said the potential for trade disruptions is negatively affecting the growth outlook.7

Meanwhile, the U.S. federal funds rate ranges from 4.25% to 4.5%, among the highest of developed nations. The Fed’s Federal Open Market Committee held rates steady at its March meeting.

The central bank previously forecasted that interest rates would end the year at around 3.9%, implying two rate cuts in 2025. Given current economic uncertainties, policymakers could also make additional cuts.

The Importance of Remaining Selective

We see great potential in European stocks but believe various issues could hinder the region’s growth.

First, European economies have grown modestly, and higher U.S. tariffs may introduce another headwind, possibly pushing the region into recession. Even before President Donald Trump’s recent tariff announcements, the ECB predicted real GDP would grow just 0.9% this year, 1.2% next year and 1.3% in 2027.8

Politics is another potential obstacle. EU nations broadly agree on matters like increased military preparedness and economic self-reliance. However, the EU could struggle to maintain this unity over the long term.

Europe is generally more regulated than other markets, which could also hold back economic growth. Though the move could be politically unpopular, the region might need to embrace deregulation to sharpen its competitive edge.

With all this in mind, we are taking a selective approach to European investments. We aim to identify opportunities early, focusing on companies with accelerating growth and strong fundamentals.

Finding a Balance on European Stocks

Increased public spending, higher demand and other factors could support earnings growth among European companies. At the same time, however, Europe may face challenges that limit this progress, such as stubbornly low growth, higher tariffs and a complicated political landscape.

We think our bottom-up investment philosophy is well-suited to these times. By seeking specific companies with accelerating growth, we aim to identify equities in areas of the market that others tend to overlook. As Europe’s outlook evolves, we’ll watch closely for emerging opportunities.

In today’s volatile markets, European equities also offer investors overexposed to U.S. stocks one way to achieve greater diversification.

Authors

Senior Portfolio Manager

Senior Client Portfolio Manager

Explore our Growth funds offering diversified international exposure.

FactSet.

European Union, “White Paper for European Defense – Readiness 2030,” March 19, 2025.

Allianz Research, “What to Watch: Germany’s Big Spending, the Transatlantic Gap Persists in Corporate Earnings and China’s Turning Point Reinforced by Stimulus,” March 7, 2025.

S&P Dow Jones Indices, S&P 500 Factsheet, as of 3/31/2025; MSCI Europe Index Factsheet, as of 3/31/2025.

Compiled by S&P Global, the HCOB Eurozone Manufacturing PMI Index is a measure of the overall health of eurozone factories; S&P Global, HCOB Eurozone Manufacturing PMI: Eurozone Factory Output Rises for First Time in Two Years, News Release, April 1, 2025.

Eurostat, “China-EU – International Trade in Goods Statistics,” February 2025.

European Central Bank, “Combined Monetary Policy Decisions and Statement,” April 17, 2025.

European Central Bank, “Economic Bulletin,” Issue 2, 2025.

Purchasing Managers' Index (PMI): Indicator of the economic health of the manufacturing sector, based on monthly surveys.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Diversification does not assure a profit nor does it protect against loss of principal.