Investing for Women: Closing the Wealth Gap

Key Takeaways

An income and investing gap for women has led to a longer-term concern: a wealth gap, which will be especially important as they get closer to retirement.

There are several societal and circumstantial reasons why women experience these gaps, including lower pay, caregiving responsibilities and investing barriers.

Understanding the differences between women and men investors can help women overcome potential obstacles to building wealth.

For years, a gender pay gap and gender investing gap have loomed over women. These have led to deeper challenges in wealth-building and retirement readiness. The good news is that studies show women have gained more control over their money in recent years.

In addition to the income gap narrowing slightly, particularly for younger individuals,1 more women are involved in financial planning. More are receiving professional financial advice, too.2

However, closing wealth gaps is still critical for everyone, especially women, who may have a more significant divide between how much they have saved and how much they will need. Let’s explore the gaps and ways to help close those chasms.

Why a Gender Investing Gap?

Let’s start by answering: What is the gender investing gap? A quick definition is the difference between how much women invest versus their male counterparts. And for years, the disparity has been significant. However, more women are investing now.3

The difference in investment account sizes (such as IRAs and 401(k)s) has been attributed to many things, including how women invest. That includes them traditionally taking fewer risks and feeling less confident about their investing knowledge. However, there have been societal reasons too, including the three below.

1. The gender pay gap means women have less to save.

Though the gap is narrowing, women still earn less than men on average. According to the Pew Research Center, women earned an average of 85% of what men earned in 2024, up from 81% in 2003. The gap is smaller for younger women aged 25 to 34, who earn 95 cents for every dollar a man earns.

Still, income gaps over the years mean women have less saved, especially those in or nearing retirement. One study reported that 28% of retired women reported less than $50,000 in savings, and only 44% reported more than $200,000. By contrast, 24% of men had less than $50,000, and 54% reported more than $200,000.4

2. Longer life requires more savings.

On average, women outlive men by nearly six years.5 Time is a great gift, but women must plan for more out-of-pocket costs and day-to-day spending. If women are behind in investing, they'll have to catch up and surpass men to make up for the extra time they have in retirement.

3. Caregiving cuts into income.

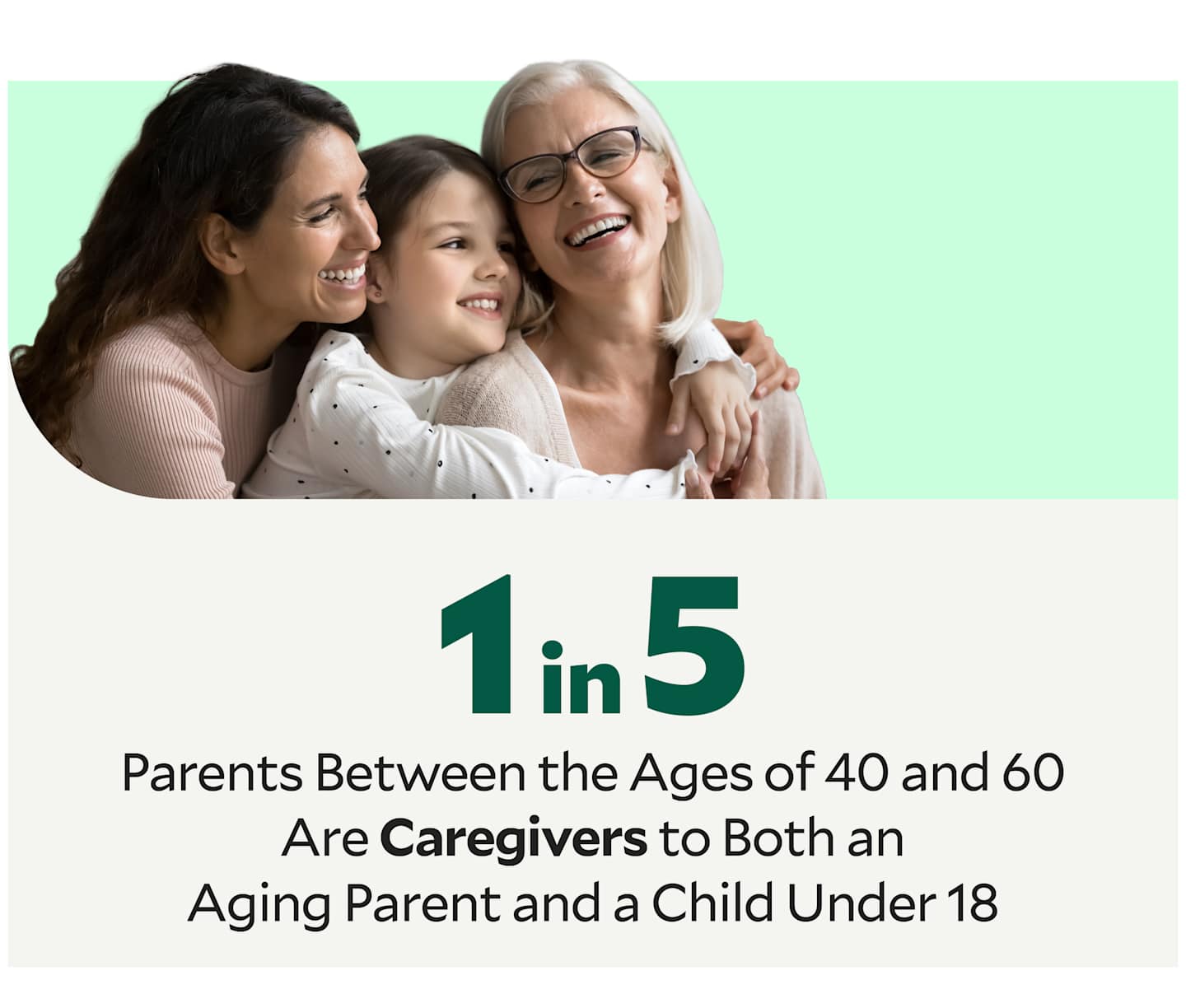

One in five parents between the ages of 40 and 60 are caregivers to both an aging parent and a child under 18.6

This “sandwich generation” phenomenon disproportionately impacts women: Women are more likely to take time off after the birth of a child, which can lead to wage stagnation. Additionally, 62.5% of all caregivers are women,7 which may result in more time off work to care for aging parents.

Overcoming Gender Investing Differences

Outside of societal and circumstantial obstacles for women to invest more, there are differences in how women approach investing that you should know and potentially overcome if they hinder you. Not all may apply to you, but it can be helpful to figure out what kind of investor you are (or will be).

Some differences between males and females may benefit women when they decide to invest. And that leads to the first point:

Women Have Saved; Men Have Invested

While this has traditionally been the case, many more women are investing now—some 70%. And it’s even higher for Gen Z females. Older women may now be playing catch-up. According to one report, women have a third of the amount saved for retirement as men.8

However, when women decide to invest, they practice some tried-and-true investing principles that can help them succeed—maybe even more so than men.

Women Tend to Be More Conservative Investors

While that’s not necessarily bad, especially as you get closer to retirement, it may also not be beneficial if you have a longer time to invest. While it might feel “safer” to invest in less risky investments, it may also not give you the potential growth to overcome inflation or the risk of running out of money in retirement.

Conversely, if you haven’t invested enough over the years, choosing riskier investments to make up for lost time is not advisable either. It could lead to greater losses.

One important principle is to invest with the amount of risk right for you based on your goals, timeline and your feelings about risk.

Women Hold Investments Longer, Avoid Impulse Decisions

We are big advocates of long-term investing. It has many advantages, such as helping you avoid market timing and those impulse decisions many people make when markets turn volatile. However, some research shows that women may back off on investing during those times, more than men.9

It’s understandable to want to avoid losses, but in doing so, you may also miss out on a market recovery. We believe staying invested is essential and can make a difference in the long term.

Women Are Less Confident About Investing, but…

Even while practicing sound investing principles, women have reported feeling insecure about their knowledge and understanding of investing. While women feel more confident about paying bills, maintaining credit scores and saving for emergencies, we are less confident about creating investment portfolios.10

And yes, there’s a “but.” Many women report wanting more information on building wealth and saving for retirement. Women are also seeking out financial advice more than before.

Approximately 57% of women work with a financial advisor.2 If you’re looking at your financial future and wondering about financial security, it may be a smart decision to hire an investment advisor for your retirement plans.

It may also help you understand how to invest your money today. It starts with finding the right financial partner.

Finding a Financial Advisor for Women

An advisor can help with decisions about saving for retirement and making investment choices. They can also offer advice on managing investments during retirement. Financial advisors can also help you set and plan for short-term goals like buying a house and sending kids to college. Prepping before your first meeting with a financial advisor can help you clarify your goals.

The best financial advisors for women will have:

A track record of working with clients with similar goals. When meeting advisors, ask about their average clients. Are those clients working toward similar goals?

Services that enhance your financial plans, such as building your retirement savings or helping you invest more short-term for emergencies or a vacation.

The availability to work with you on your terms. Do you want to meet frequently or communicate through email? As a woman working with a financial advisor, the professional should understand and complement your communication style.

I’ve found that some women prefer to work with female advisors. Perhaps their communication style resonates with women, or they mutually understand women’s financial needs when discussing their goals. Regardless of the gender of your financial advisor, it’s important to work with someone who understands your purpose for investing.

How to Close Your Wealth Gap

Closing your investing gap may sound like, “Where do I start?” In my opinion, all investing should start with a plan—either an investment plan or a financial plan, depending on your current needs.

Creating Your Plan

An investment plan includes setting goals, figuring out how much money you’ll need and determining how much to invest to get there. Our investing calculators can help you do that. Then you’ll need to decide what to invest in and build a portfolio that matches your goals, timeline, and the amount of risk you are comfortable with.

A financial plan will cover all aspects of your finances, not just your investments, and include your investment plan. Financial plans can cover retirement planning, social security planning, tax planning, family changes and so much more.

Managing Your Investments

You’ll also want to consider if you wish to be hands-on or hands-off. Being hands-on means deciding what you will invest your money in. One key to success is having a diversified portfolio, or spreading your money across several different investments that react differently when markets move. Hands-off looks more like getting help from an advisor, which may be something to consider if you don’t have the time and inclination to manage your own investments.

Sticking With Your Plan

With a plan in place and your portfolio set, the final step is to follow through. That can look like staying invested (even in rough times), investing regularly such as with an automatic investment and regularly checking in with a financial professional.

The gender wealth gap is real, but there are steps women can take today to close it. With a plan, goals, and some follow-through, we can start to bridge the gap.

Authors

Financial Consultant

Need Help Closing Your Wealth Gap?

Consider our advice services.

Gender pay gap in U.S. has narrowed slightly over two decades, Pew Research Center, March 2025.

Women are feeling financially prepared for retirement thanks to hands-on learning, according to a new study from Bryn Mawr Trust, WSFSbank.com, February 2024.

IWD 2025: Gender investment gap set to narrow in 2025 as appetite for investment risk increases, Nutmeg analysis shows, ifamagazine.com, March 2025.

Diving Deeper Into the Financial Vortex: Challenges Women Face Saving for Retirement, Goldman Sachs, March 2024.

Social Security Actuarial Life Table, Period Life Table 2021 as used in the 2024 Trustees Report, socialsecurity.gov, April 2025.

Sandwich generation stressors and how to manage them. The Currency, empower.com, February 2024.

The Number of Family Caregivers Helping Older U.S. Adults Increased From 18 Million to 24 Million, 2011-2022, HealthAffairs, February 2025.

2024 Pulse of the American Retiree, Midlife Retirement Crisis: Pre-Retirees in Focus, Prudential, June 2024.

Women and Investing Statistics: What You Should Know, The Motley Fool, March 2025.

Women Confident Managing Short-Term Finances, But Less So On Long-Term Strategies, Finds New York Life Wealth Watch, New York Life, March 2024.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.