Rebounding From Market Corrections and Bear Markets

When harsh winter weather approaches, bears retreat into their caves. Similarly, investors can feel like retreating when market conditions deteriorate. But history offers compelling reasons to stay invested.

Key Takeaways

Double-digit market declines can occur when market prices seem overvalued or unexpected news shakes investors’ confidence.

It’s tempting to sell investments during a market decline, but it may lock in your losses and lower your returns substantially.

History shows that markets have recovered after periods of declines—and even rewarded those who stayed invested.

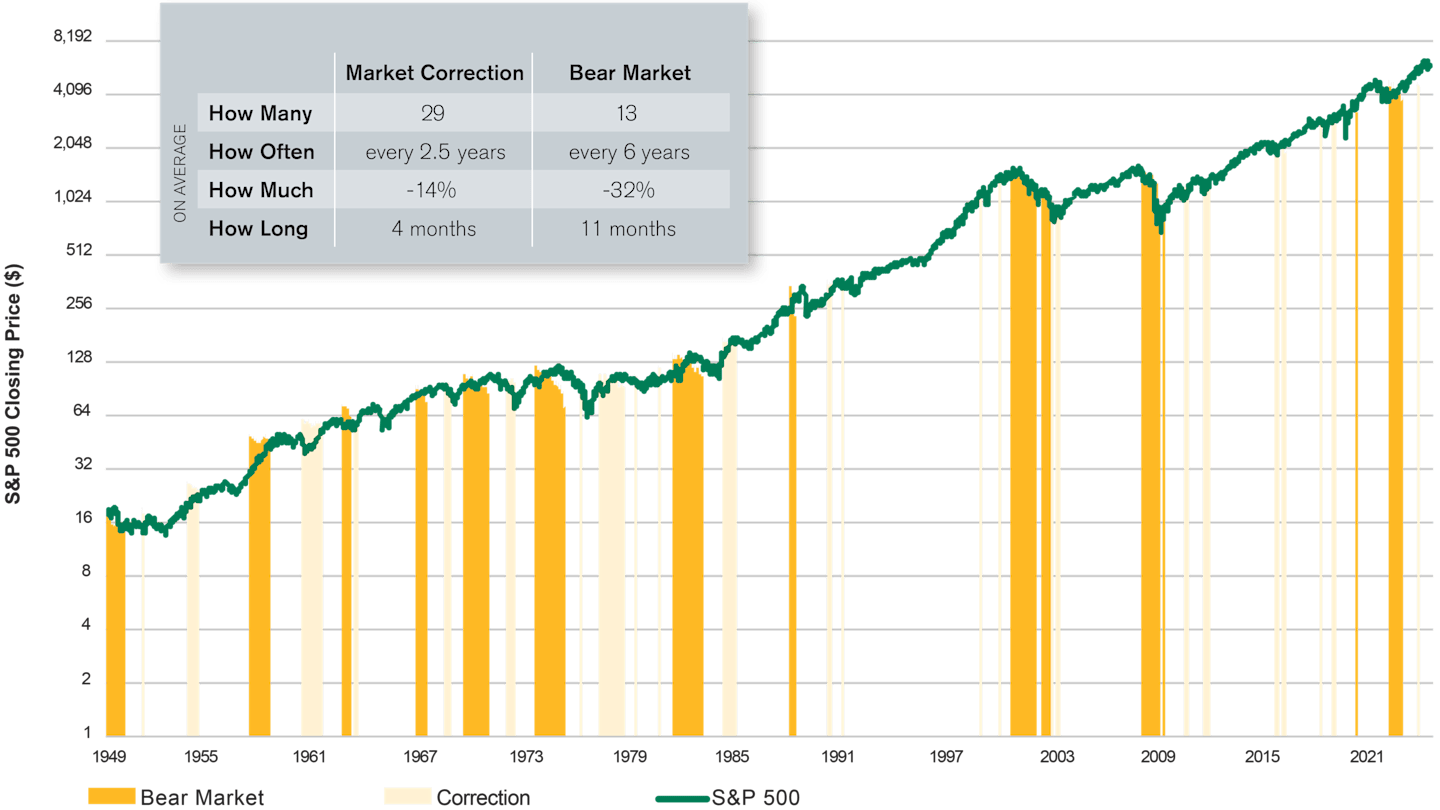

Market ups and downs occur daily. When the percentage loss reaches double digits, however, investors’ worries can spike. There are even special names for those losses: a stock market decline between 10% and 20% is known as a market correction; declines of 20% or more over an extended period are known as bear markets.

Market Correction vs. Bear Market

Market corrections are declines between 10% and 20% and are generally short-lived.

Bear markets are declines of 20% or more and usually last longer than corrections.

My team naturally gets more calls when the stock market is in negative territory. Here are answers to some of the most common questions about market corrections and bear markets.

Why Do Markets Decline?

A combination of factors often causes a market downturn, but three reasons top the list:

An asset class’s prices seem overvalued.

Unexpected news and events shake investors’ outlook for the economy.

Investors lose confidence in businesses’ abilities to meet their corporate goals and earnings forecasts.

How Long Do Corrections and Bear Markets Last?

On average, market corrections have happened about every two years and lasted a few months. However, they can take place more or less frequently.

Bear markets have happened less often than corrections, but they are generally “stickier” as they cover a time when overall negative sentiment about the economy has set in. Some of the most memorable bear markets include the Great Depression, the dot-com bubble in 2000 and the Great Recession of 2007-2008. But one of the shortest bear markets lasted only 33 days. It began in February 2020 in response to COVID-19 pandemic lockdowns across the world.

It’s impossible to know when the ups and downs will occur, but looking back in history provides important reminders about stock market behavior.

Average Length of Bear Markets and Market Corrections

Data from 1/1/1949 to 3/31/2025. Source: FactSet and American Century Investments. Past performance is no guarantee of future results.

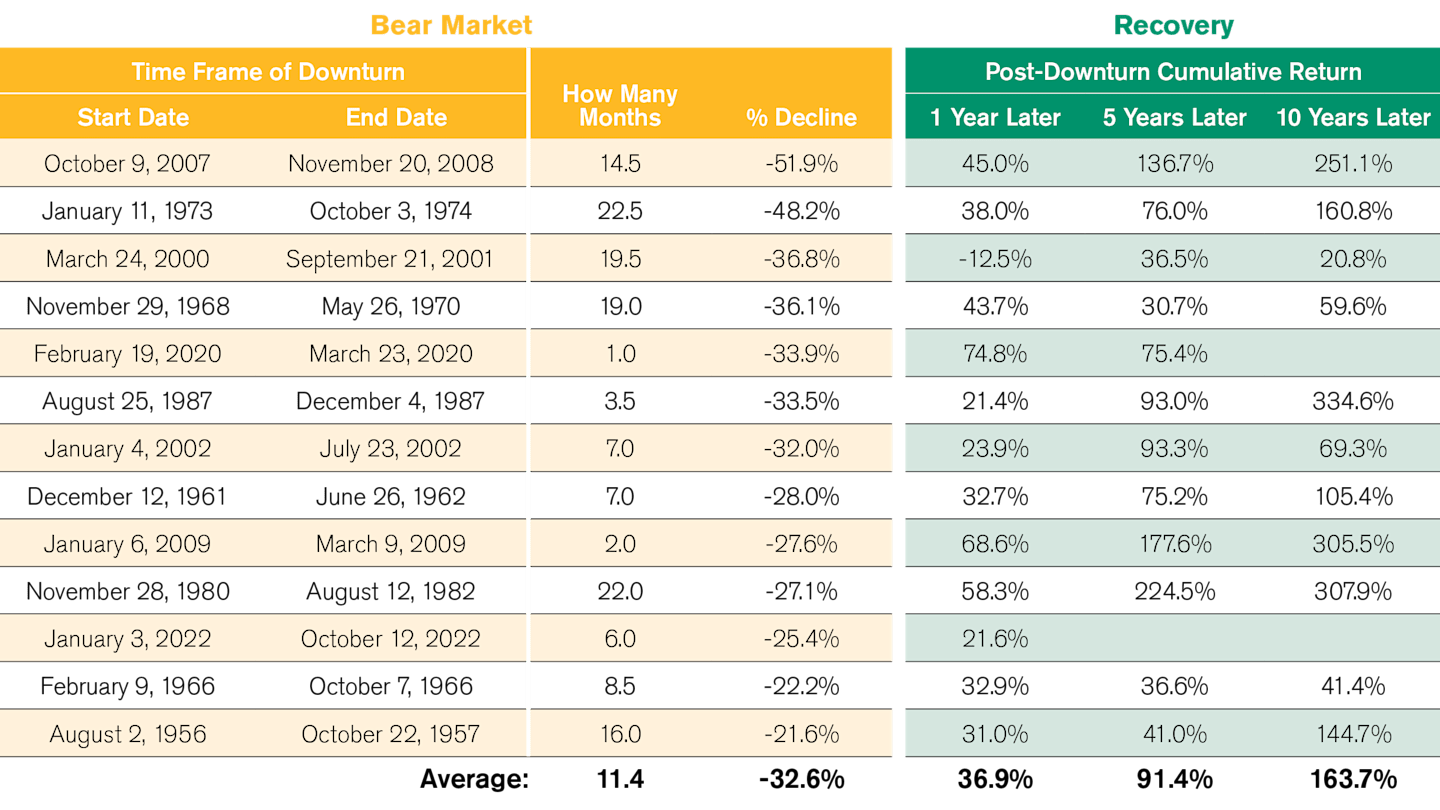

What Were the Biggest Bear Markets and Stock Rebounds?

While no one can accurately predict when bear markets occur, history shows that markets have recovered after periods of declines—and even rewarded those who stayed invested.

The table above shows all of the bear markets since 1950, as defined by Standard & Poor’s using the S&P 500® Index. The returns are price returns only, not total returns, and thus do not include dividends. Past performance is no guarantee of future results. Thus, the table should not be taken as an implication of future returns. Rather, it should serve as a reminder of the past resiliency of U.S. financial markets.

Sources: FactSet; American Century Investments.

Do Inflation and Interest Rates Cause Bear Markets?

While every bear market has unique reasons behind its arrival, inflation and interest rates can contribute.

Rising Inflation Rates

Rapidly rising inflation rates make it more difficult to determine what corporate earnings or consumer buying power will be. What’s more, people worry about the Federal Reserve's ability to control inflation without slowing economic growth too much. Explore how inflation affects the market.

Rising Interest Rates

Interest rate increases can lead to bear markets. If borrowing costs go up, people and businesses may spend less money. This can hurt the economy, lower company profits and decrease stock prices. Learn more about the effect of interest rates on bonds.

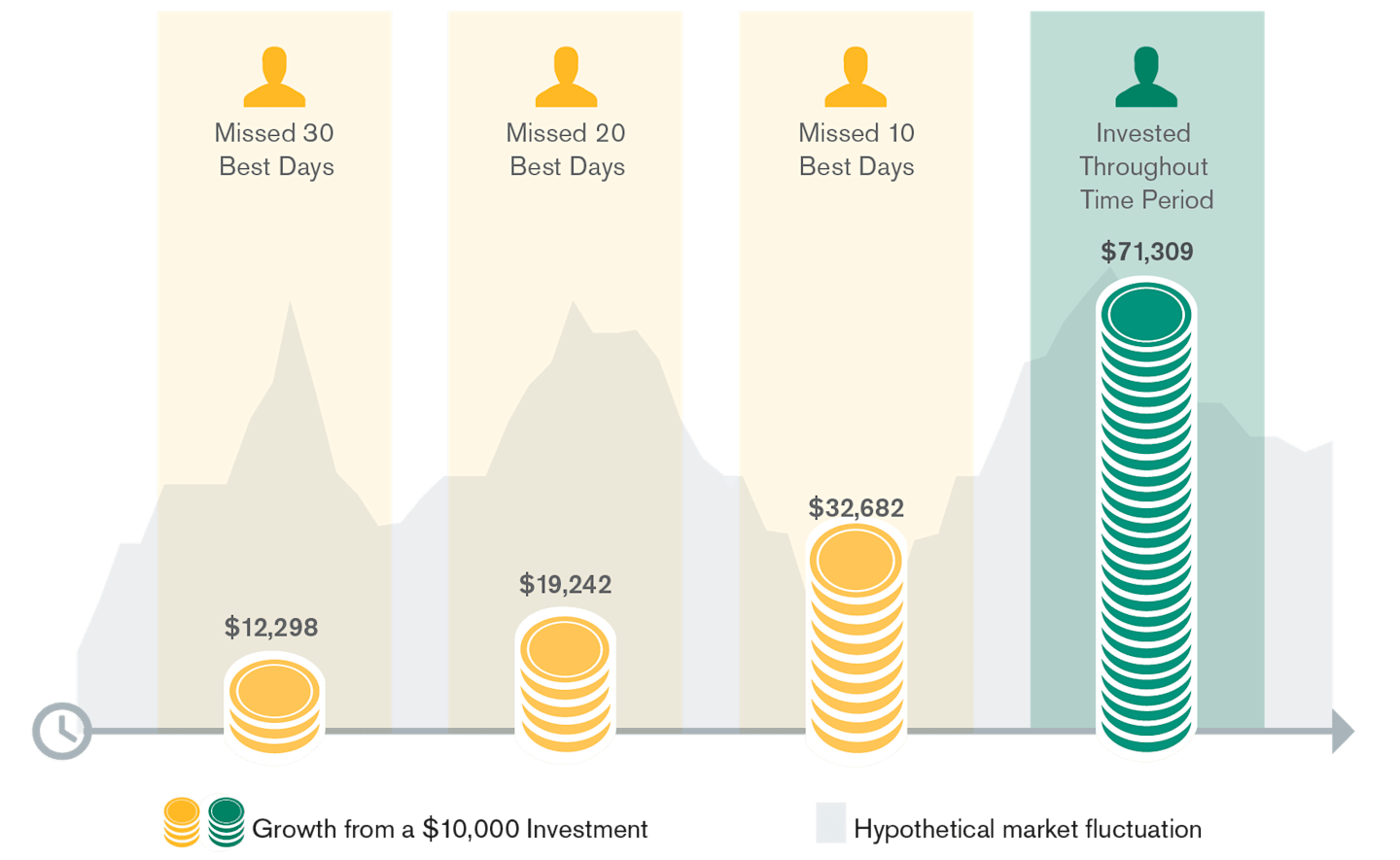

What’s the Impact of Missing the Best Days in the Market?

Watching the stock market go down can be stressful. But selling stocks when the market is low can lock in losses—you no longer have the opportunity for those holdings to rebound. Also, having fewer stocks in your overall portfolio could drag down performance when the market improves.

As shown below, trying to time when to buy and sell investments can lower your returns substantially. If you are still a ways off from needing to use your money, keeping it invested for longer increases your chances of achieving your long-term goals.

Jumping In and Out of Stocks May Cost You

Source: FactSet. Growth of $10,000 in the S&P 500® Index. Data from 01/01/1999 - 3/31/2025. The index does not reflect fees, brokerage commissions, taxes or other expenses of investment. Investors cannot invest directly in an index. Past performance is no guarantee of future results.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

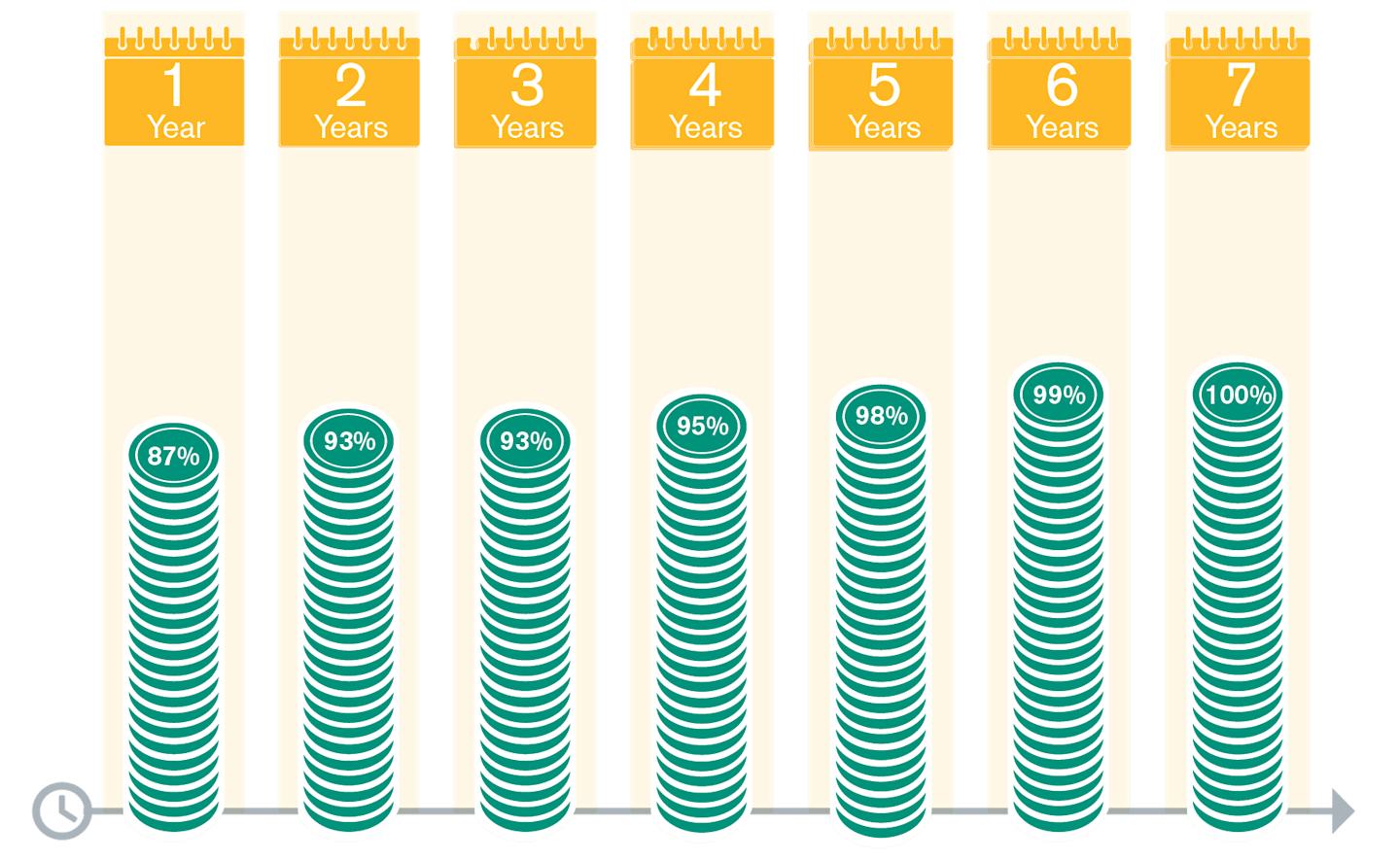

Bolting From Bonds Too Early May Cost You

Percentage of Time Bonds Increased in Value Over Each Time Period

A buy-and-hold strategy with bonds may be beneficial. Bonds are represented by the Bloomberg U.S. Aggregate Bond Index. Source: Ibbotson Associates. Data from 01/31/1976 - 12/31/2023. Past performance is no guarantee of future results.

The indices do not reflect fees, brokerage commissions, taxes or other expenses of investment. Investors cannot invest directly in an index.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

The farther away a bond is from its maturity date, the more its price can swing. As the maturity date nears, a bond’s price becomes less volatile as it moves toward par. Investors who sell a bond before it matures may get a far different amount than its par value, explains the Securities and Exchange Commission.

What Can I Do to Combat Market Declines?

It’s sometimes difficult to hear that doing nothing might be the best move in a market downturn. But your financial plan should already incorporate strategies for coping with volatility. These strategies include emergency funds and allocations to more defensive holdings.

Still, it’s human nature for emotions to run high when financial stresses hit. A “precommitment strategy” can help you stay focused on your long-term goals. Making dollar-cost averaging1 a part of your precommitment strategy can help keep you invested during tough market conditions. It involves automatically investing the same dollar amount at regular intervals.

When the market goes down, your money buys more investments at cheaper prices. When the market goes up, you buy a lower number of investments at higher prices. Over time, dollar-cost averaging may lower the average cost of your investment.

Finally, remember that investing is a long-term strategy. Historically, the market has tended to be more bullish than bearish. Concentrate on your long-term goals instead of worrying about short-term market trends. This can help you navigate through the fluctuations more effectively.

What Our Investment Leaders Say

During volatile times, time-tested principles of long-term investing are more crucial than ever. Adhering to these principles can help guide your financial journey and may improve your chances of success.

Rich Weiss, our chief investment officer of multi-asset strategies, urges investors to stay informed and take a long-term approach when navigating the current market environment.

1. Time is on your side. Despite periods of short-term decline, the market’s recovery over the long term has rewarded those who remain invested.

2. Stick with your plan. With market alerts, financial TV programs and breaking headlines, news can lead investors to make emotional decisions. Sticking with your plan means resisting the urge to buy high when the markets are going up and selling when they go down.

3. Diversification matters. This probably isn’t the first time you’ve heard it, but diversification is a strategy that has stood the test of time. A diversified portfolio of stocks, bonds and cash may give you the best chance of reaching your long-term goals. This does not mean that a diversified portfolio never loses money. Rather, a mix of investments that react differently to market changes may ultimately provide more stable returns over time.

Talk to a Professional

No one can predict the best time to buy and sell investments, but making money and avoiding losses are more than just guessing at the market’s direction. And research suggests that trying to time the market can do more harm than good.

For those close to retirement or other major financial goals, it may be a good time to reevaluate your portfolio’s level of risk. A financial professional can help you figure out if your investments are aligned with your goals.

Authors

Financial Consultant

Market Volatility and Your Portfolio

What will you do with your investments when faced with market volatility?

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

©2026 Standard & Poor's Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.