Stablecoins Could Help Drive Cryptocurrency Adoption

A more stable form of crypto may provide an alternative to traditional payment providers and financial institutions.

Key Takeaways

Stablecoins are designed to be less volatile than other cryptocurrencies because they’re often pegged to more stable assets, like the U.S. dollar.

Stablecoins could provide faster, lower-cost financial transactions than existing payment systems.

Despite issuers’ efforts, stablecoin values aren’t immune to fluctuations or collapse.

Many investors are familiar with Bitcoin, the leading cryptocurrency. However, another type of crypto asset is gaining market capitalization and popularity. Stablecoins are attracting attention because they can facilitate fast, low-cost transactions in certain situations.

Unlike other cryptocurrencies, stablecoins tend to hold relatively stable values because they’re pegged to other assets like the U.S. dollar (USD) or the euro. This stability allows users to enjoy crypto’s advantages and decrease the volatility risk that often deters consumers.

Stablecoins might also make it easier for the general public to use crypto-powered decentralized finance services and other blockchain-based applications.

Stablecoin use is rising.1 According to a recent industry study, the global supply of stablecoins increased by 63% between February 2024 and February 2025. During that period, stablecoins facilitated more than $35 trillion in transfers, as monthly transfer volume doubled.

Established financial firms are also demonstrating more interest in stablecoins. Payment company Stripe recently spent $1.1 billion to acquire Bridge, a platform that helps businesses accept stablecoin payments.2 PayPal has introduced its own stablecoin, and Bank of America plans to launch one as well.3

Could stablecoins catalyze more crypto adoption? This will depend on how the technology, regulatory environment and crypto ecosystem evolve. Big questions remain.

What Makes Stablecoins Different from Other Cryptocurrencies?

Cryptocurrencies like Bitcoin and Ether have exhibited sharp swings in their values over time.

To prevent similar fluctuations, stablecoins’ values are tied to, or pegged to, a fiat currency, commodity, algorithm or another cryptocurrency. (Fiat currency refers to government-issued money, like the U.S. dollar or euro, which usually has a stable value, making it a dependable reference point for stablecoins.)

For example, the peg for one stablecoin might be set at $1. Theoretically, if you hold one dollar-pegged stablecoin, you should be able to exchange it for $1. In practice, stablecoins may trade slightly above or below their pegged values. Any difference is typically very small.

Some stablecoin issuers hold reserve assets to support their coins’ pegged values. Two leading stablecoins, USDT from market leader Tether and USDC from Circle, both possess billions in short-duration U.S. Treasuries, dollars and other assets.4

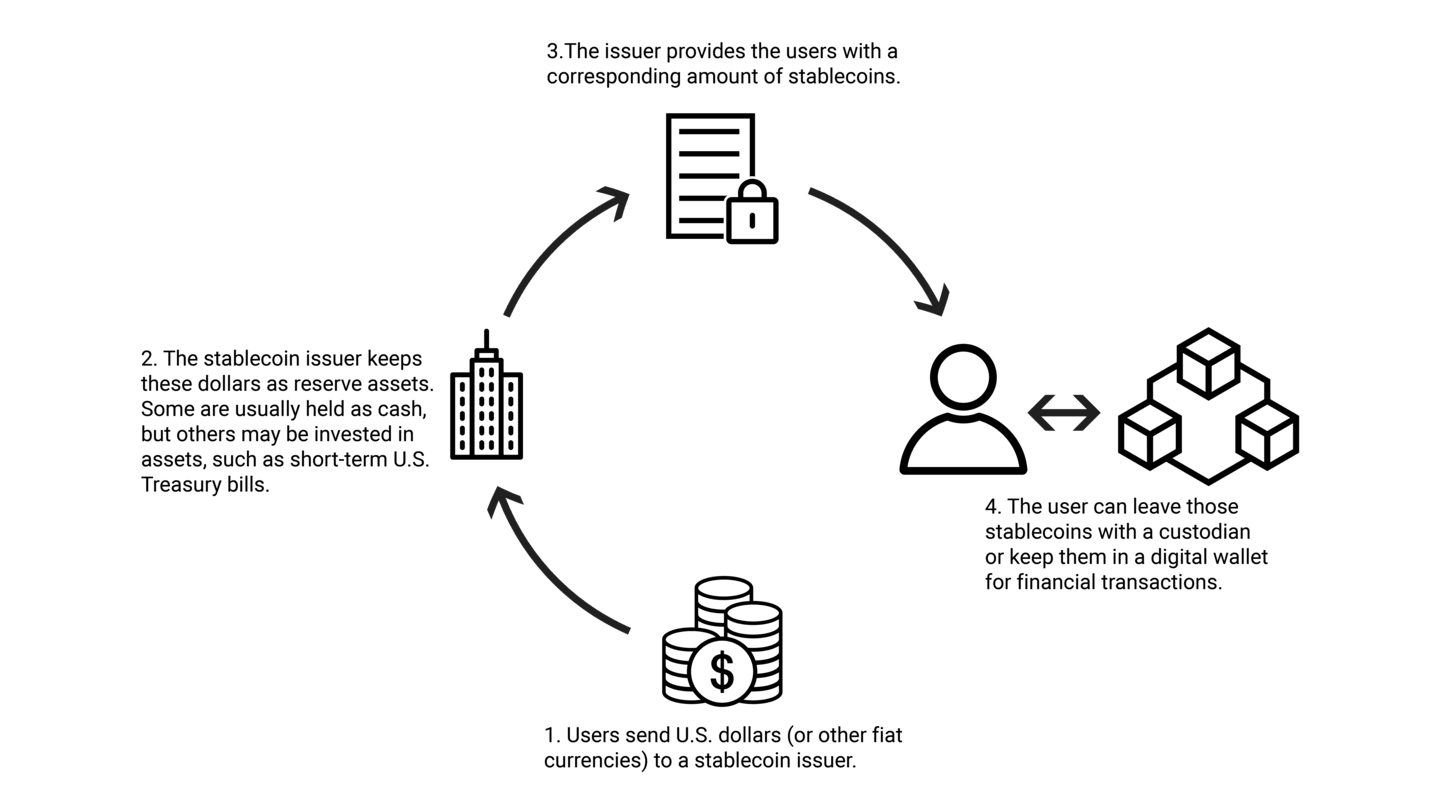

Figure 1 | How Dollars Become Stablecoins

Source: American Century Investments.

Some stablecoins keep other fiat currencies, gold or other cryptocurrencies as reserves.

Other stablecoins don’t own any reserve assets. Instead, an algorithm manages their values to ensure they don’t move too far from their pegs.

For example, an algorithmic stablecoin might be pegged to the U.S. dollar. If the coin’s value rises above $1, the issuer’s algorithm will automatically create more of the coin. By increasing the coin’s supply, its value in the marketplace should fall.

If the stablecoin’s value falls below the dollar, the algorithm will “burn” or remove some coins from circulation, limiting supply and raising value.

Algorithmic stablecoins without reserve assets have proven tricky to execute. One of the most prominent, Terra, collapsed in 2022 alongside its sister coin, Luna.5

Currently, algorithmic stablecoins don’t enjoy a meaningful level of adoption relative to stablecoins with reserves.

It’s critical to understand a stablecoin’s peg and what supports its value, whether that’s an algorithm or reserve assets. These elements ultimately determine the stablecoin’s stability and trustworthiness.

What Are the Key Advantages of Stablecoins?

Stablecoins have three advantages over existing payment systems in certain applications: speed, cost and availability.

Transaction Speed

If you’ve used traditional ACH payments, you know they may require one to three days to resolve.6 By contrast, stablecoin transactions usually take a few seconds to a few minutes. Payments move from one account to another with little or no intermediation.

Stablecoins’ speed stands out when it comes to cross-border payments.

In the traditional financial system, some international transactions must travel through multiple banks or payment systems, with each player charging a fee. This is especially true for transactions involving countries whose banks aren’t well integrated with global payment systems.

Cost Efficiency

Using stablecoins may cost less than making payments through banks and other intermediaries.

The World Bank reported that during the third quarter of 2024, the average cost of remittances globally was 6.62% of the amount transferred.7 According to Coinbase, the cost of stablecoin remittances typically ranges from 0.5% to 3% of the transfer amount.8

Global Accessibility

Because stablecoins are web-based, essentially anyone in the world can buy them.

This availability can be important for individuals who want to access currency pegged to U.S. dollars. People in some countries have looked to protect themselves from hyperinflation and currency devaluation by putting their money into USD-pegged stablecoins.

How Do Businesses and Individuals Use Stablecoins?

Companies like Chipotle and Whole Foods Market have started accepting stablecoins as payment, but most consumers don’t use them for everyday transactions.9

However, if stablecoin use took off, retailers might be able to shrink their transaction costs. In 2023, U.S. companies spent $172 billion on processing fees related to credit, debit and prepaid card purchases of $11.24 trillion.10 Reducing these fees even slightly could translate to significant savings.

Right now, international remittances are one of the most popular applications of stablecoins. Foreign workers send wages to their home countries using stablecoins, where their families exchange the coins back into fiat currencies. Companies like Starlink have repatriated their earnings back to the U.S. with stablecoins.11

Stablecoins could even make accounts receivable and supply chain management more efficient.

Stablecoin transactions are recorded on a blockchain ledger. Each transaction can include more information than a traditional bank ACH payment. Invoice numbers, SKUs and other data could be attached to their relevant payments.

That transaction data could then be automatically fed into a company’s accounting software to reconcile accounts and confirm payments faster.

What Are the Risks of Stablecoins?

The value of a stablecoin ultimately depends on user confidence, which rests on the coin’s pegs, its reserves or the algorithm that manages its supply. If these come into question, the stablecoin’s value can deteriorate or collapse.

Some prominent stablecoins have experienced questions and disruptions regarding their pegs:

In 2023, the collapse of Silicon Valley Bank temporarily impacted Circle. The stablecoin issuer kept about $3.3 billion, or roughly 8% of its reserve assets, with the lender and couldn’t access those funds for a period.12 This caused Circle’s USDC stablecoin to fall below $1, although it recovered.13

In 2021, stablecoin issuer Tether was fined $41 million by the Commodity Futures Trading Commission because Tether said it had enough U.S. dollar reserves for each USDT stablecoin in circulation. “In fact, Tether reserves were not ‘fully-backed’ the majority of the time,” the commission reported.14

Increased regulation — something cryptocurrencies were created to avoid — might help boost confidence in stablecoins.

Congress is considering the GENIUS Act, bipartisan legislation that would establish standards for reserve assets, require monthly certification of these assets and provide other safeguards.15

The bill would require stablecoin issuers to meet compliance standards, such as those against money laundering. Stablecoins have acquired a reputation as a preferred way for criminals to move money around. According to Chainalysis, a blockchain analysis firm, 63% of all illicit crypto transactions involve stablecoins.16

How Will Stablecoins Impact the Crypto Market?

Critics of cryptocurrencies often ask about their practical use. Stablecoins might be one of the best arguments for the technology if they can deliver more convenient, affordable transactions with less risk than other cryptocurrencies. Their growth may support greater adoption of other blockchain-based services.

Moves by Stripe, PayPal and other established players signal that stablecoins bear watching. However, despite issuers’ efforts to set and maintain consistent values, significant questions remain about their volatility.

If new regulations lead to greater stability and higher consumer confidence, adoption may increase, too. We continue to watch how stablecoins develop to see if they can encourage new efficiencies in the payments and banking industries.

Authors

Portfolio Manager

Senior Client Portfolio Manager

Explore More Insights

Read our latest articles and market perspectives.

Artemis and Dune, “The State of Stablecoins 2025: Supply, Adoption & Market Trends,” 2025.

Stripe, “Stripe Completes Bridge Acquisition,” News Release, February 4, 2025.

PayPal, “PayPal Launches U.S. Dollar Stablecoin,” News Release, August 7, 2023; Helene Braun, “Bank of America CEO Says Bank Will Likely Launch Its Own Stablecoin,” CoinDesk, February 26, 2025.

Tether, “Tether Hits $13 Billion Profits for 2024 and All-Time Highs in U.S. Treasury Holdings, USDT Circulation and Reserve Buffer in Q4 2024 Attestation,” News Release, January 31, 2025; Circle, “USDC Reserve Report,” March 28, 2025.

U.S. Securities and Exchange Commission, “SEC Charges Terraform and CEO Do Kwon with Defrauding Investors in Crypto Schemes,” Press Release, February 16, 2023.

ACH” refers to electronic money transfers between financial institutions across the Automated Clearing House network.

The World Bank, Remittance Prices Worldwide Quarterly: 51, September 2024.

Coinbase, “Stablecoins and the New Payments Landscape,” August 5, 2024.

Chris Colson, “Here a Coin, There a Coin, Everywhere a Stablecoin,” Federal Reserve Bank of Atlanta, January 13, 2025.

Nilson Report, “Merchant Processing Fees in the United States – 2023,” March 2024.

All-In Podcast, “DOGE Kills Its First Bill, Zuck vs OpenAI, Google’s AI Comeback,” YouTube, December 20, 2024.

Circle, “$3.3 Billion of USDC Reserve Risk Removed, Dollar De-peg Closes,” Press Release, March 13, 2023.

Krisztian Sandor, “Circle Confirms $3.3B of USDC’s Cash Reserves Stuck at Failed Silicon Valley Bank,” CoinDesk, March 11, 2023, updated May 9, 2023.

Commodity Futures Trading Commission, “CFTC Orders Tether and Bitfinex to Pay Fines Totaling $42.5 Million,” Press Release, October 15, 2021.

Congress.gov, “S.394 – GENIUS Act of 2025,” February 4, 2025.

Chainalysis, “The Chainalysis 2025 Crypto Crime Report,” February 2025.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Diversification does not assure a profit nor does it protect against loss of principal.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.