Is ‘Sell in May and Go Away’ Fake News?

Here’s why we believe you should think twice before taking a break from the stock market over the summer.

Key Takeaways

While some investors look for seasonal patterns in the market, historical data indicates “Sell in May and Go Away” is a myth.

Data suggests that staying invested has yielded better returns than following calendar-driven investing strategies.

Investors should focus on building a diversified, all-season portfolio that aligns with their long-term goals.

With all the market turmoil this year, following the adage to “Sell in May and Go Away” may be especially tempting. Before you consider stepping away from the stock market this summer, let’s break down the numbers, risks and what you may miss by following this outdated belief.

What Is ‘Sell in May and Go Away’?

It’s catchy and it rhymes, but where did this phrase originate? It first took root in London’s financial district in the late 18th century, when wealthy British aristocrats and bankers left the city in May and returned in the fall.

“Sell in May and go away, come back on St. Leger’s Day” originally referred to the St. Leger Stakes horse race held in September. The race marked the time when investors usually returned to the market.

This practice eventually reached Wall Street, where some investors slowed their trading or exited positions between Memorial Day and Labor Day. They believed stocks tended to underperform during the summer months and performed better between November and April.

But does this theory still hold weight in modern markets? The answer might surprise you.

The term “Halloween indicator” isn’t meant to be scary, but it might be if you follow this market timing strategy. This theory suggests investors might be rewarded when exiting the stock market in May and returning around October 31.

Is ‘Sell in May and Go Away’ a Myth?

The idea behind “Sell in May” is simple: There’s a perception that stock performance tends to weaken in the summer. While this might have been true decades ago when trading activity slowed in summer, today’s globalized and technology-driven markets don’t take vacations.

Consider summer 2023. The Magnificent Seven stocks — Apple, Microsoft, Amazon, Alphabet (Google), Tesla, NVIDIA and Meta Platforms — played a significant role in driving the rally from May to August. The market surged by 8.75% and defied seasonal expectations.1 Investors who followed the “sell in May” approach would have missed a significant period of gains.

Debunking the Myth: Stock Market Performance During Summer Months

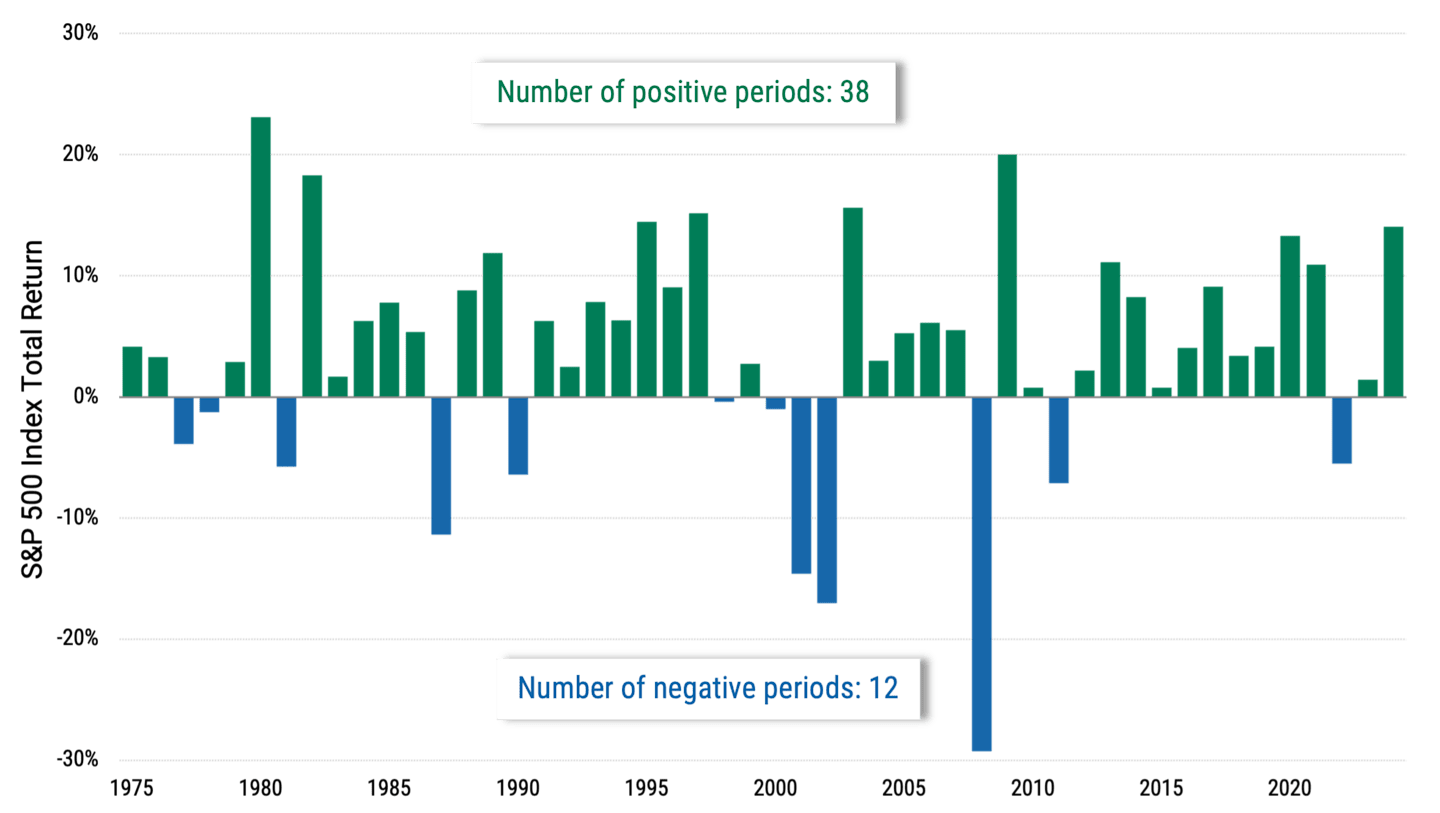

In Figure 1, you can see that the stock market had positive returns during the summer months in 38 of 50 calendar years. The average return from May 1 to October 31 over the last 50 years was +3.86%. Withdrawing money from the market during these months would have caused investors to miss out on positive returns more often than not.

Figure 1 | School’s Not Always Out for the Stock Market

Data from 1/1/1975 - 12/31/2024. Source: Bloomberg. Past performance is no guarantee of future results.

Comparing ‘Buy and Hold’ to ‘Sell in May and Go Away’

Historical performance paints a clearer picture of what happens when investors step away from the markets. An investor who put $1,000 into the S&P 500® Index on January 1, 1975, would have over $340,000 if they held it until the end of 2024 (“buy and hold”).

Conversely, an investor who withdrew their money from the S&P 500 each April 30 and reinvested it on November 1 (“Sell in May and Go Away”) would have just over $64,000. Moreover, an investor who missed the best 20 trading days over the last 50 years would have $88,043.

Figure 2 | Buy and Hold Has Historically Outperformed

Growth of $1,000 from 1975 to 2024 Using Different Strategies

Strategy | Account Value | Total Return |

|---|---|---|

Buy and Hold | $340,910 | 33,991% |

Sell in May and Go Away | $64,053 | 6,305% |

Market Timing: Missing the Best 20 Days | $88,043 | 8,704% |

“Buy and hold” represents the growth of $1,000 in the S&P 500 Index from 1975 to 2024. “Sell in May and go away” represents the growth of $1,000 in the S&P 500 Index if an investor held securities from January 1 to April 30, sold their investments and reinvested on November 1 of each year from 1975 to 2024. Dividends are reinvested in each scenario. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Source: Bloomberg, American Century Investments. Past performance is no guarantee of future results.

Long-term portfolios that adhered to a buy-and-hold strategy consistently outperformed those that exited in May, proving that sticking with investments through all seasons yielded better results.

These figures highlight the opportunity cost of following seasonal strategies. Market gains often come unpredictably, and missing key days could harm long-term wealth accumulation.

Strong market rallies often occur in short bursts following company earnings surprises, economic reports or Federal Reserve policy shifts. Some of the most significant gains follow periods of market downturns. If investors exit the market in May and re-enter in October, they may miss the rebounds following temporary pullbacks that could happen over the summer.

Why Stock Market Seasonality Theories Don’t Hold Up

Company performance, macroeconomic shifts, geopolitical events, interest rate policies and technological disruptions influence returns, not the time of year.

Take the volatility curveball the market has thrown us in 2025: Tariffs, trade wars and an economic slowdown have rattled the markets. These are real-world factors that no seasonal investing trend could have predicted. Investors who react solely based on calendar trends could have serious blind spots and risk ignoring broader market events and macroeconomic realities.

Strategies Beyond Market Timing

Rather than chasing seasonal patterns, we believe investors should focus on building resilient, long-term portfolios designed to help weather all market conditions. Here’s how:

Do's

Diversify across asset classes (stocks, bonds, real estate), sectors and geographies.

Invest automatically.

Monitor and rebalance.

Don’ts

Time the market.

Speculate.

Panic sell.

Walk Away From ‘Sell in May and Go Away’

Successful investing isn’t about following catchy seasonal adages — it’s about understanding your long-term goals, managing risk and making informed decisions.

Seasonal investing theories can oversimplify an increasingly complex financial landscape. They may not account for the global economic, political and technological factors that drive market performance year-round.

Authors

Associate Client Portfolio Manager

Ready for a portfolio that’s diversified regardless of the season?

Learn how our One Choice Portfolios® can help you diversify and manage risk.

Data is based on the total return of the S&P 500® Index from May 2023 to August 2023. Source: Bloomberg.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.