Economy and Politics Impact Investors

Study shows market conditions affect impact investors.

Explore the infographic.

Please select a version of the press release below:

American Century Investments’ impact investing study shows appeal declines although impact investors are still willing to give up some returns

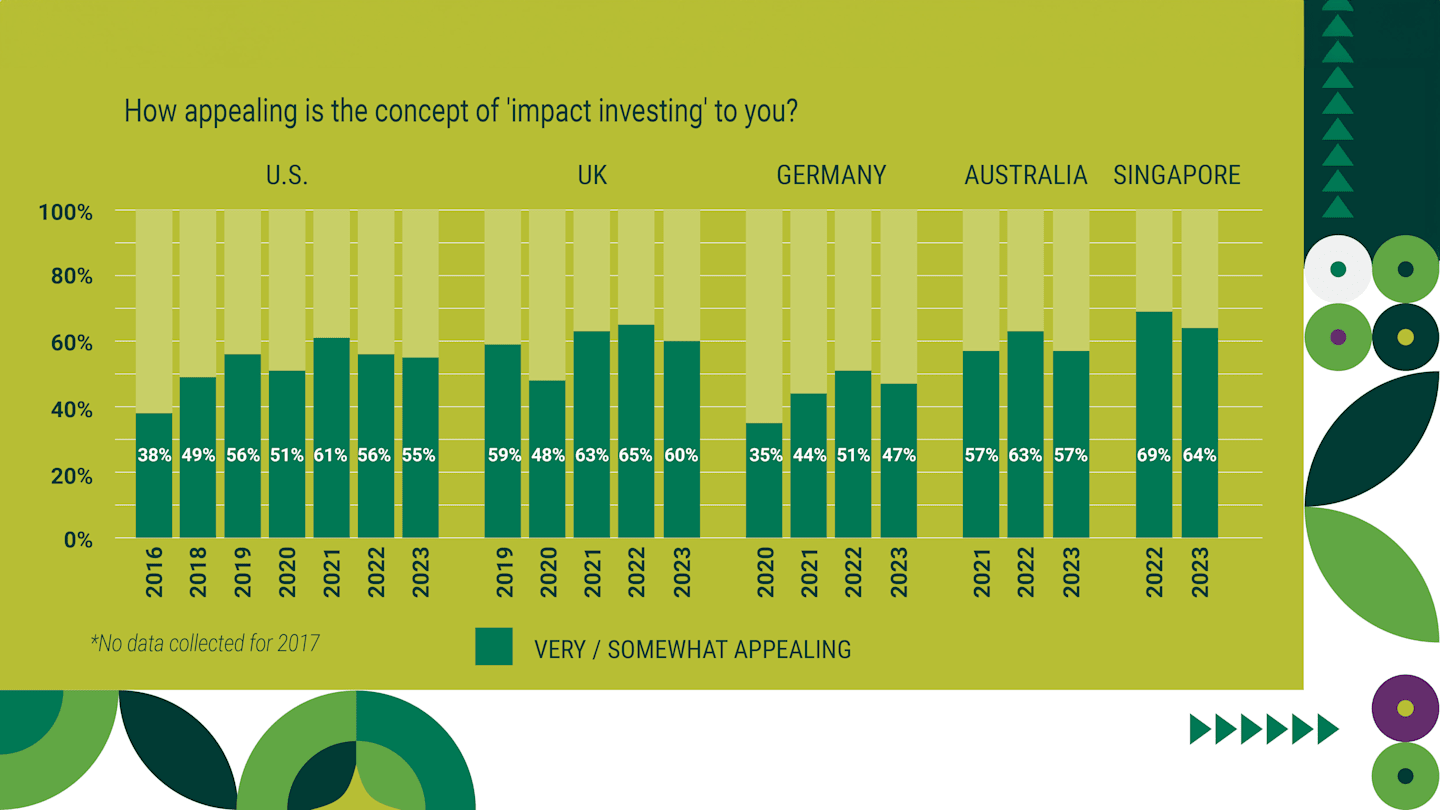

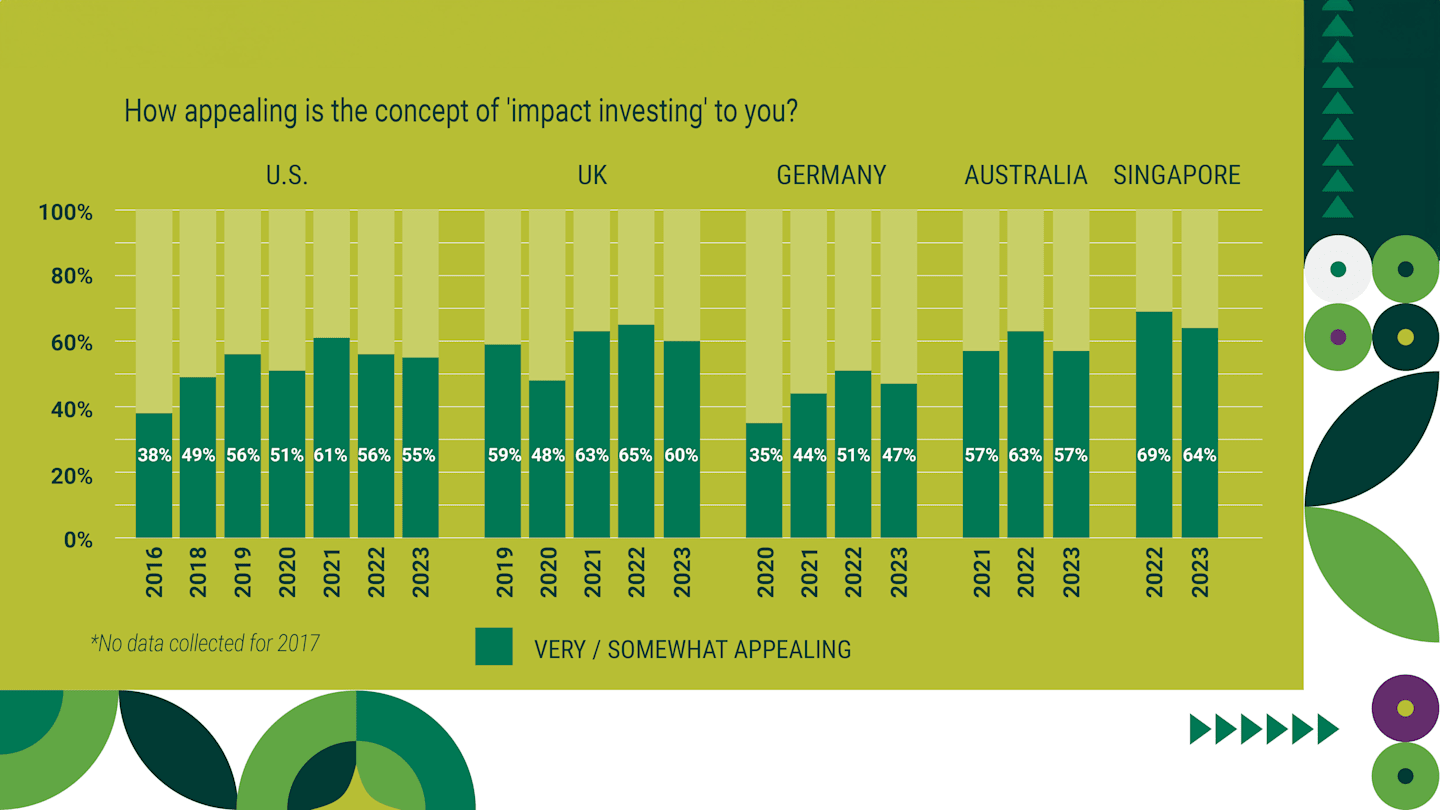

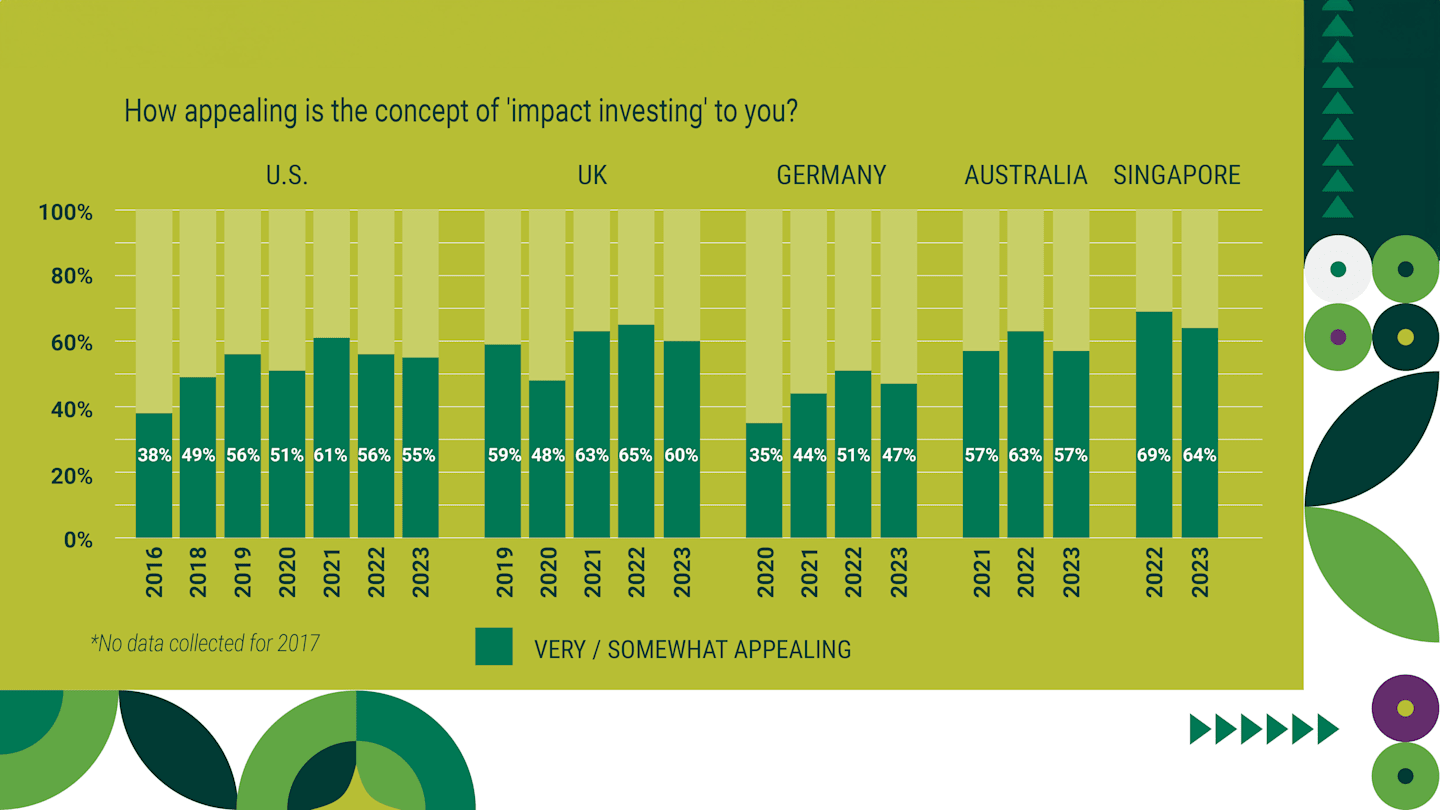

KANSAS CITY, Mo., March 27, 2024 – In the seventh impact investing survey by the $240 billion* global asset manager American Century Investments, U.S. investors buck international trends as the only surveyed country where a growing number of respondents are willing to sacrifice returns to create a positive impact. Yet, the appeal of impact investing has declined in each country surveyed, including the U.S. The survey results offer multiple reasons for this decline in appeal, including market conditions, concerns about greenwashing and the sustainability backlash. Survey results go back to 2016 in the United States, 2019 in the U.K., 2020 in Germany, 2021 in Australia and 2022 in Singapore.

U.S. investors more willing than ever to make rational and balanced sacrifices

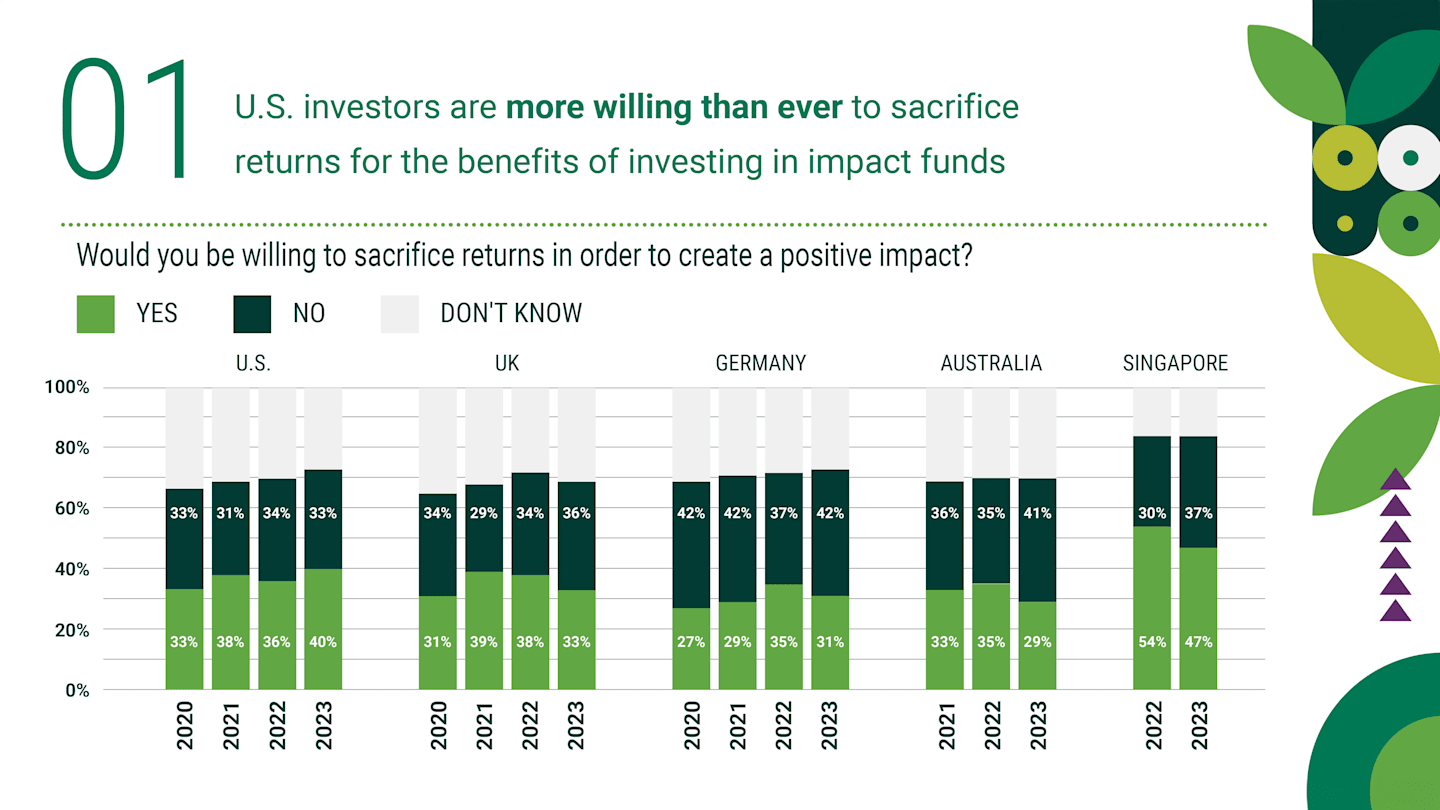

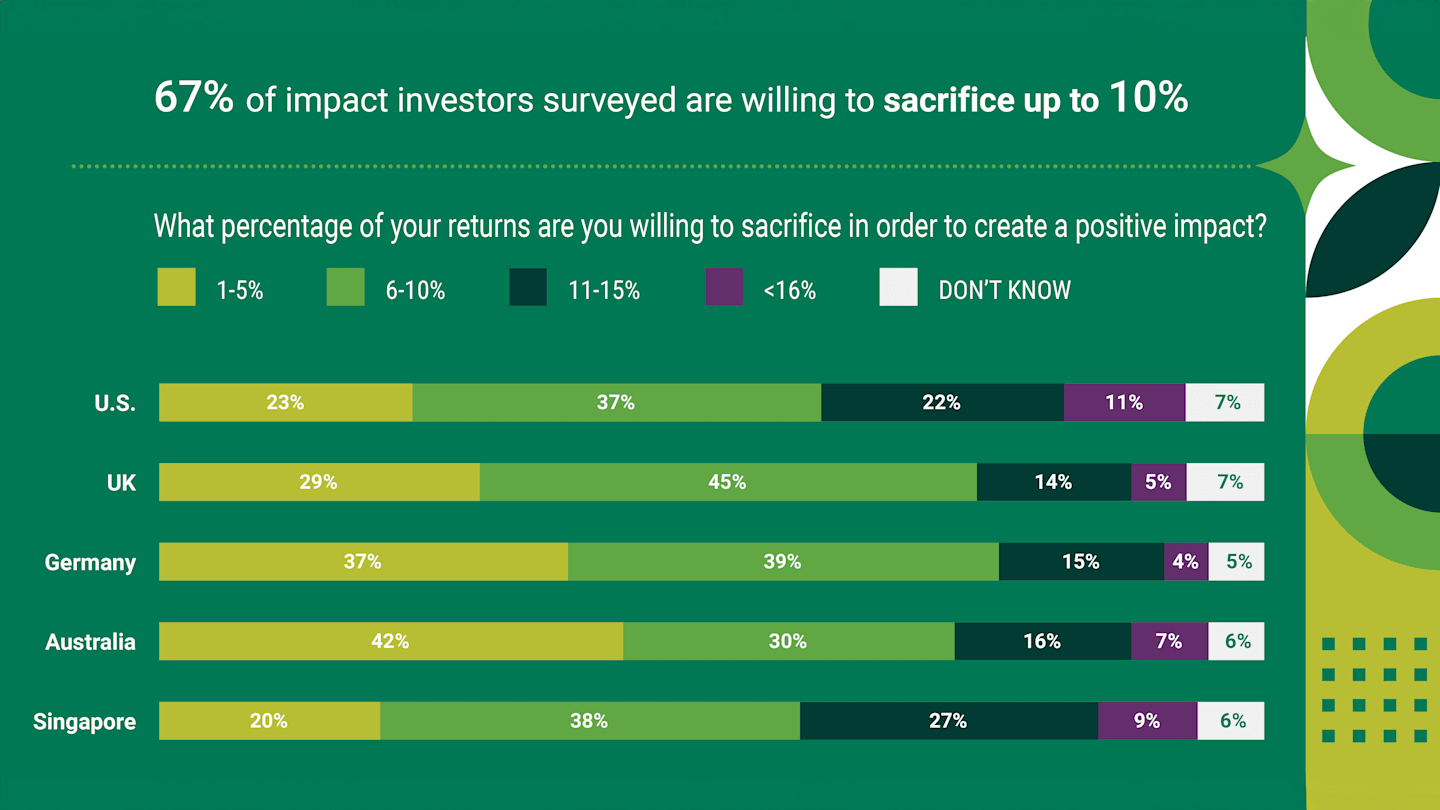

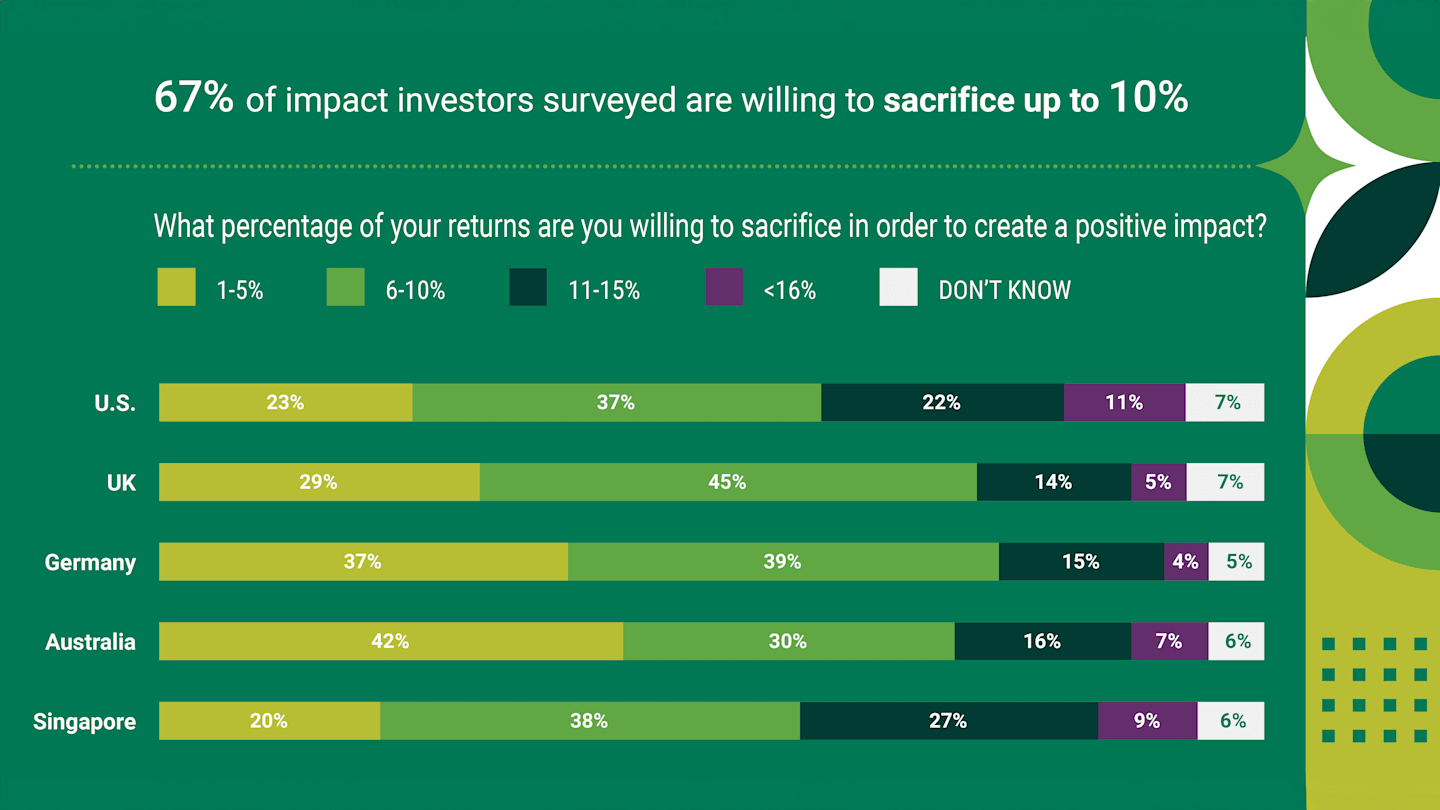

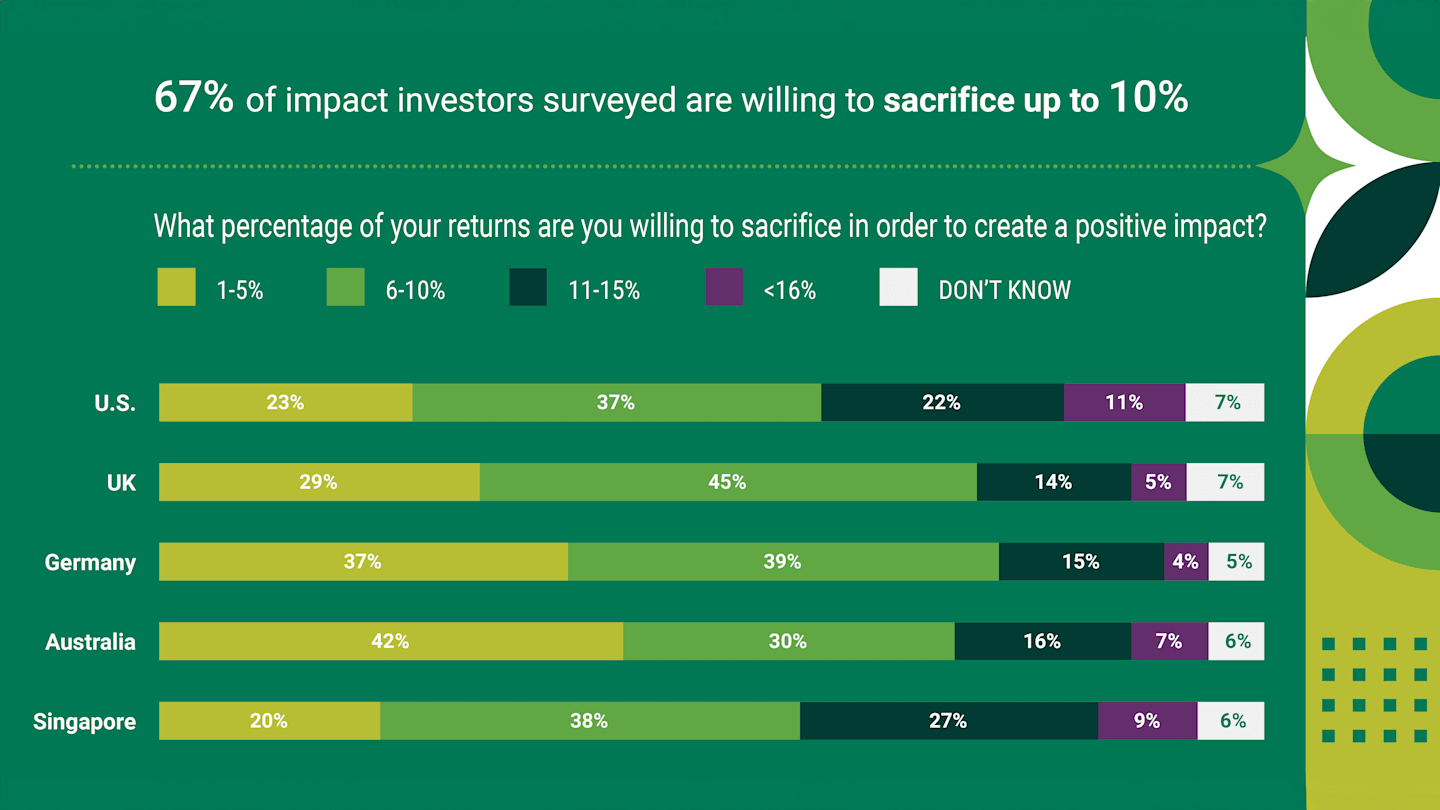

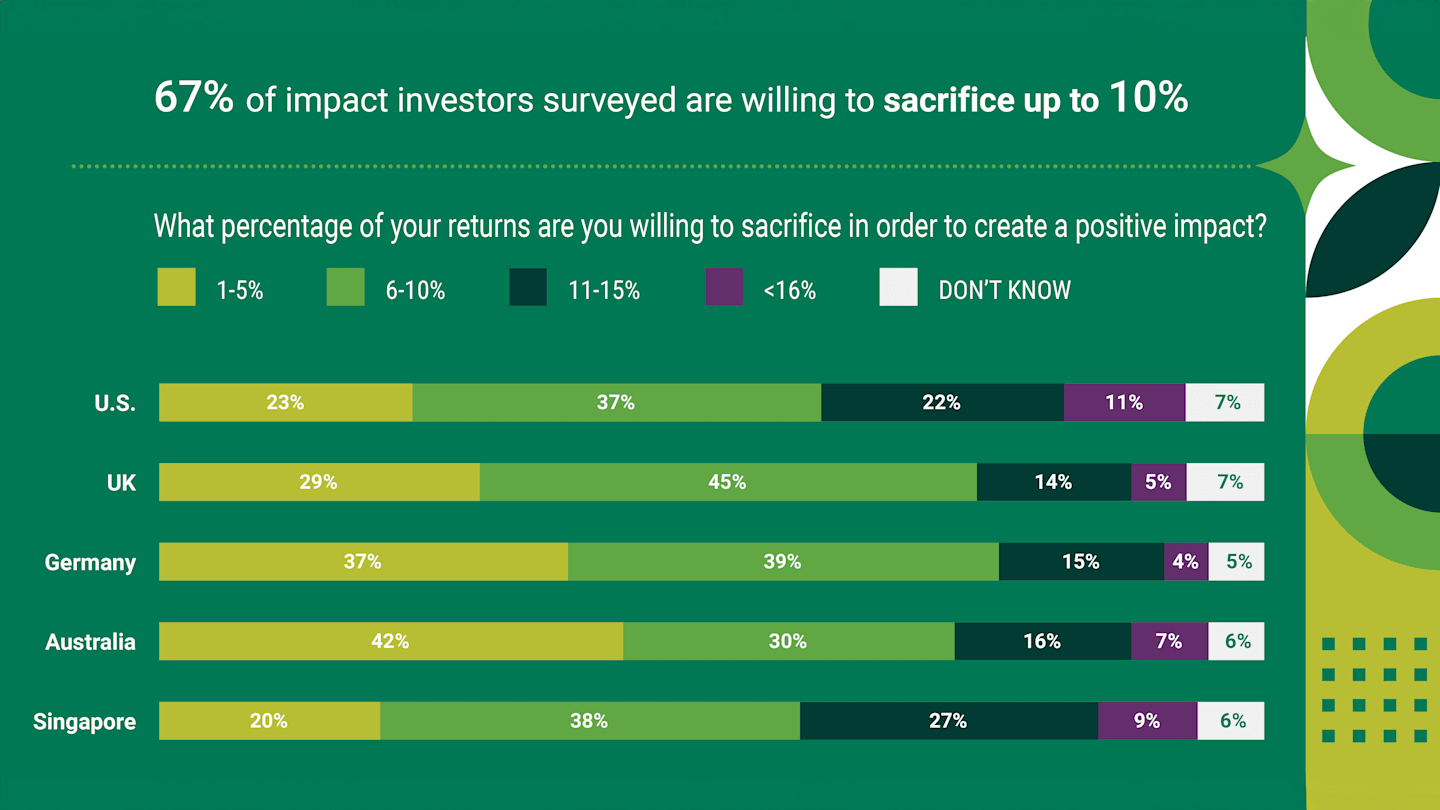

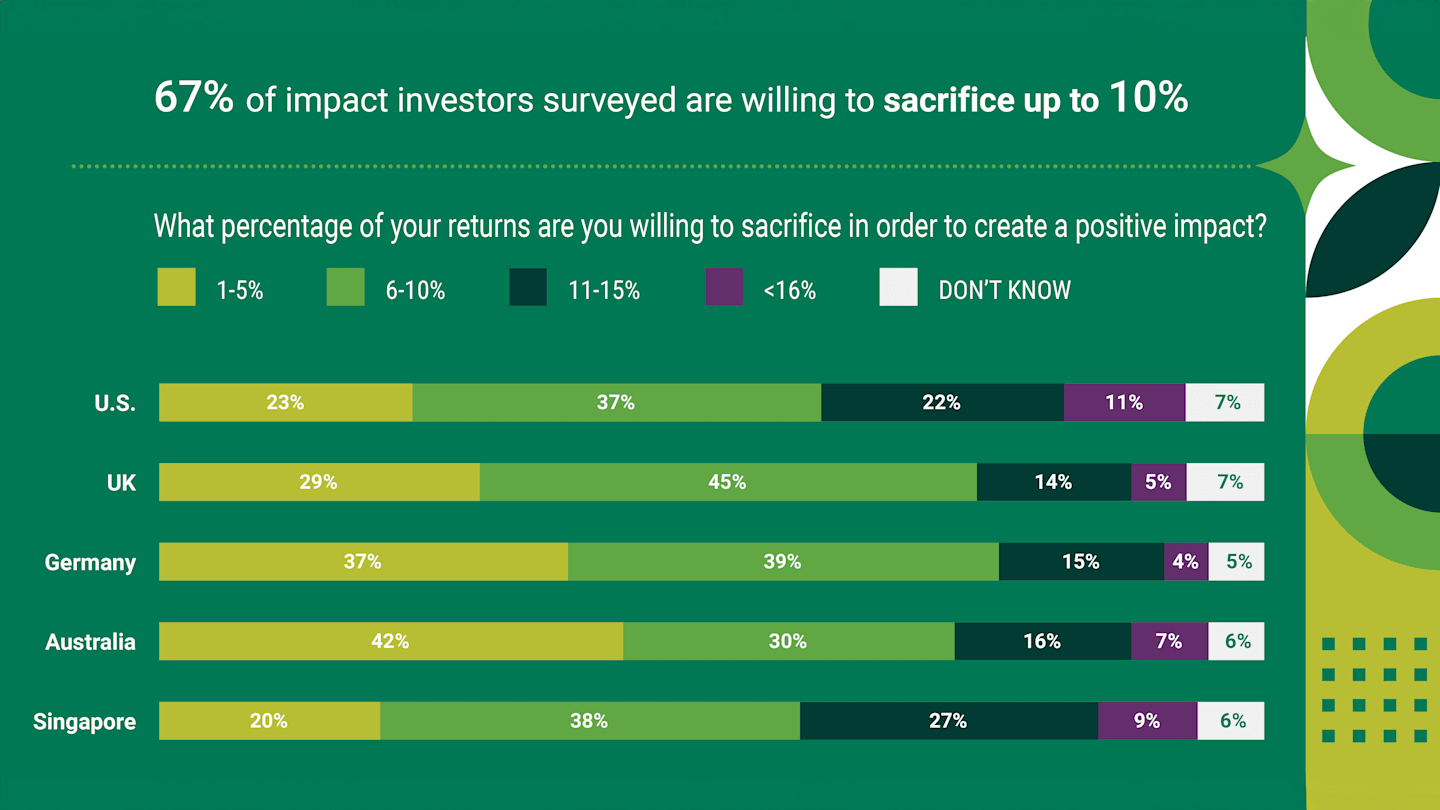

40% of U.S. respondents are willing to sacrifice returns in order to create a positive impact, up 4% from the previous survey and the highest share among U.S. respondents since the question was first asked in the 2020 survey. This is a larger share of respondents who are willing to sacrifice returns than in the UK (33%), Germany (31%) and Australia (29%). Only Singapore (47%) has a larger share of respondents who are willing to sacrifice returns, although that number has declined 7% since last year. Overall, 67% of interested investors would sacrifice up to 10% of returns to create a positive impact, with 6-10% the most common range. A willingness to sacrifice 16% or more was by far the smallest share of respondents who knew how much they would forgo for a positive impact on society.

“In its earliest forms, impact investing often accepted lower expected returns to have a bigger impact, but our impact investment strategies emphasize sustainability-related attributes or outcomes in addition to delivering a financial return. Identifying impact-related factors that could affect a company’s ability to stay competitive over the long term has the potential to add to returns,” said Sarah Bratton Hughes, senior vice president and head of sustainable investing for American Century Investments. “A willingness to give up as much as 10% of an expected return shows that impact investors expect to earn competitive returns and are making rational choices to realize an impact emphasis in addition to a financial return.”

Appeal of impact investing has declined in every country since last survey

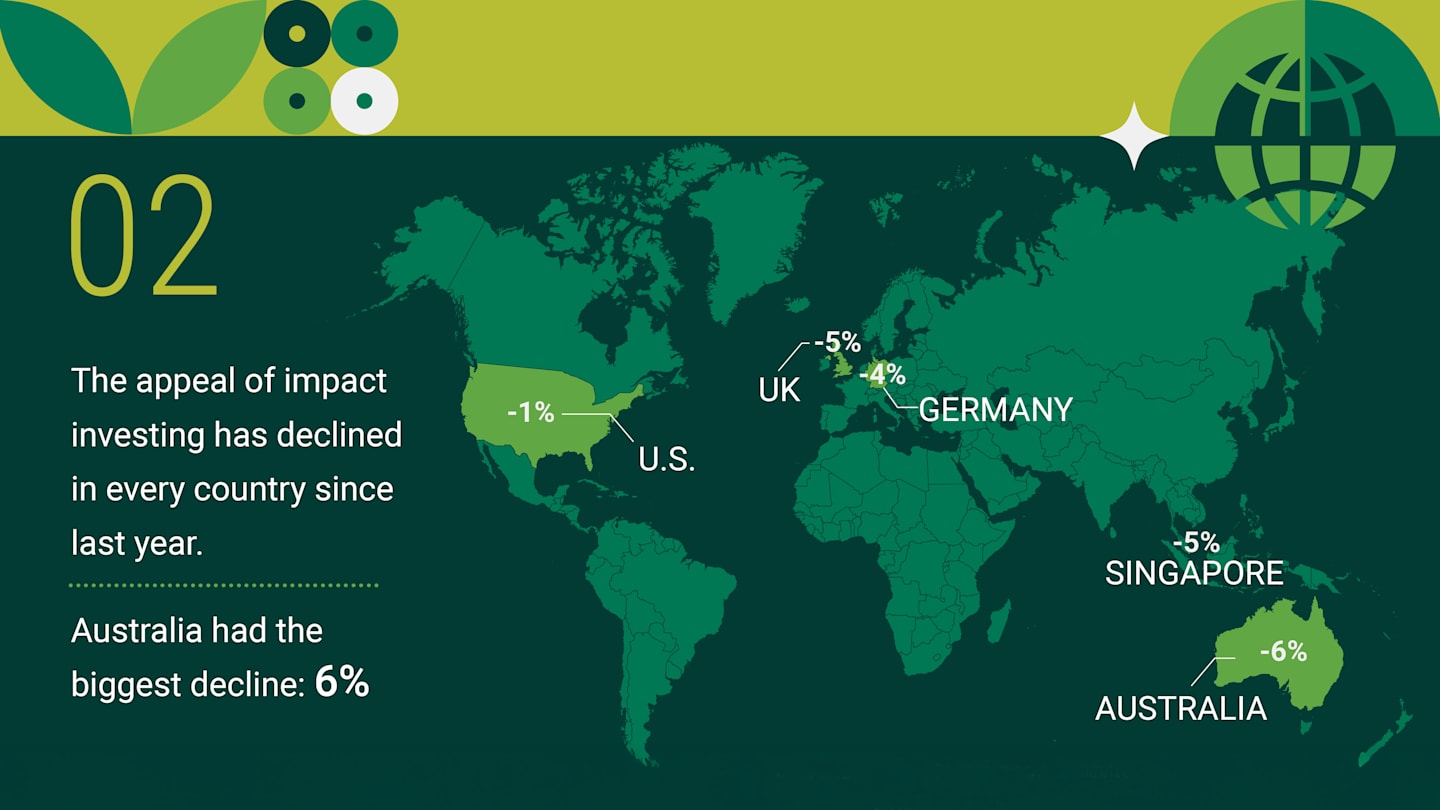

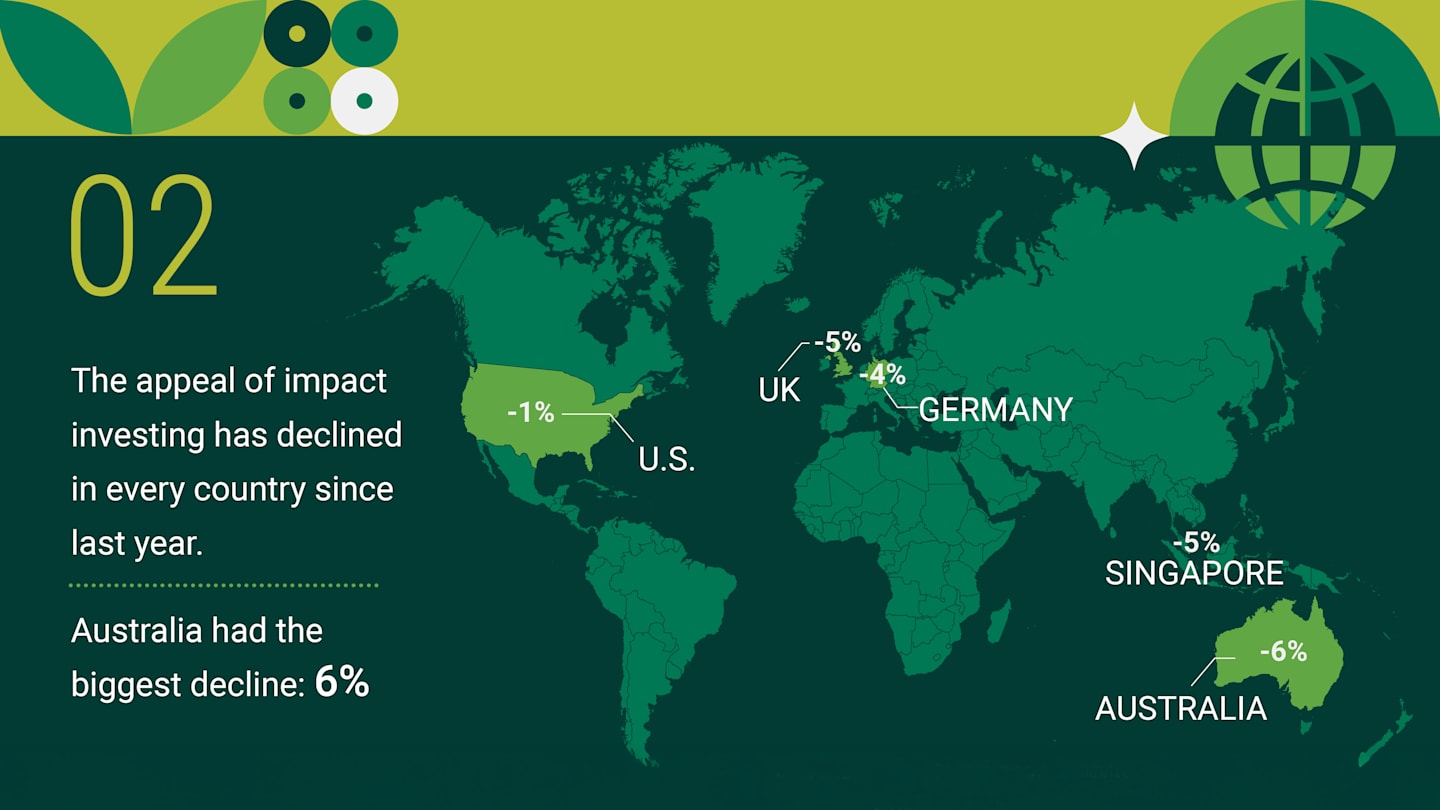

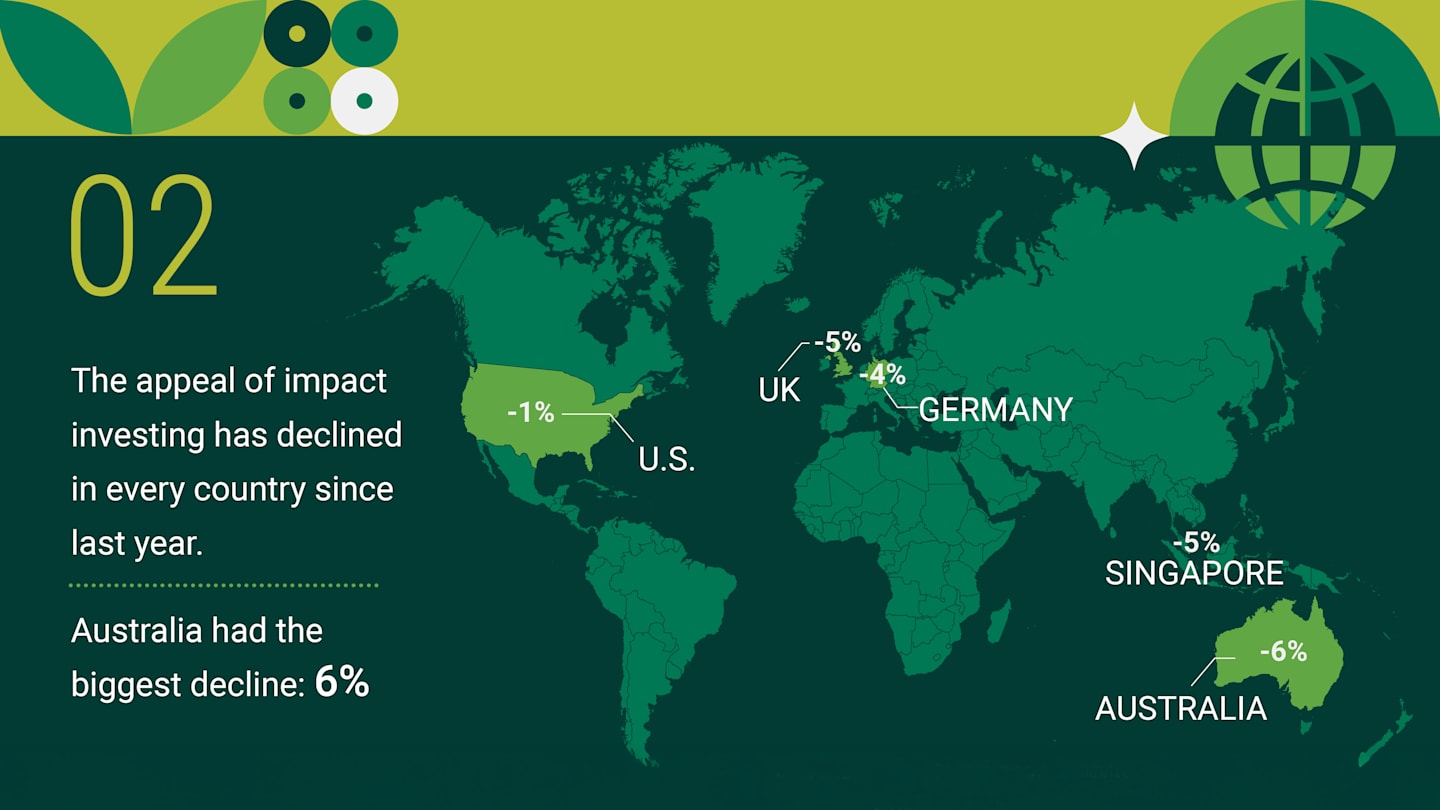

Since the previous survey, the appeal of impact investing has declined in Australia (-6%), Singapore (-5%), the UK (-5%), Germany (-4%) and the U.S. (-1%). This decline is also seen across generations, where appeal among Baby Boomers (-8%) has seen the greatest decline, followed by Gen Z (-7%), Gen X (-5%) and Millennials (-1%).

“In the seven years of impact investing studies we’ve done, it’s unique to see such uniform results across nations and ages in a single question, like we see this year with the decline of the appeal of impact investing. Even though the decline holds for all groups, the reasons are more varied,” said Bratton Hughes.

Economy and geopolitics among reasons for the decline in appeal

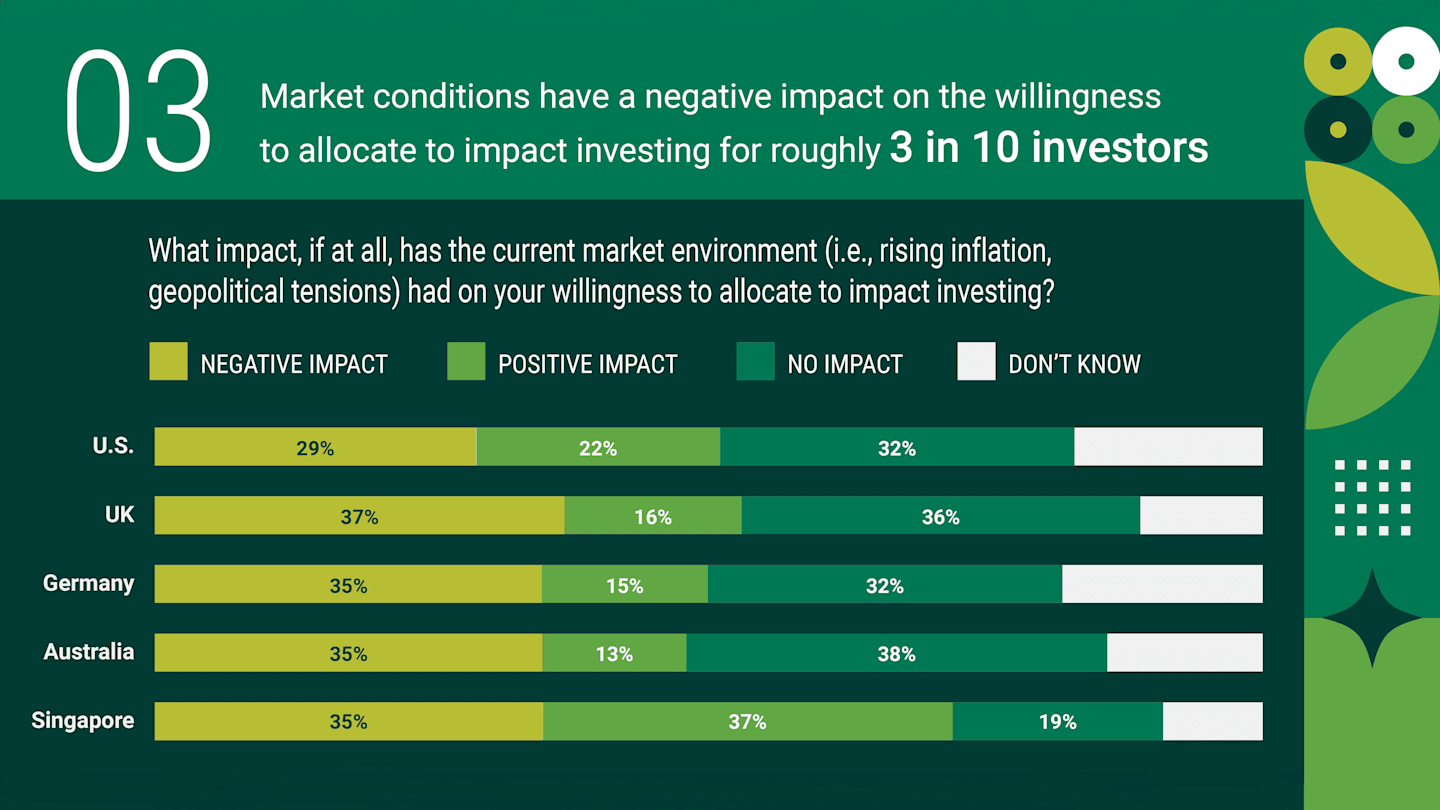

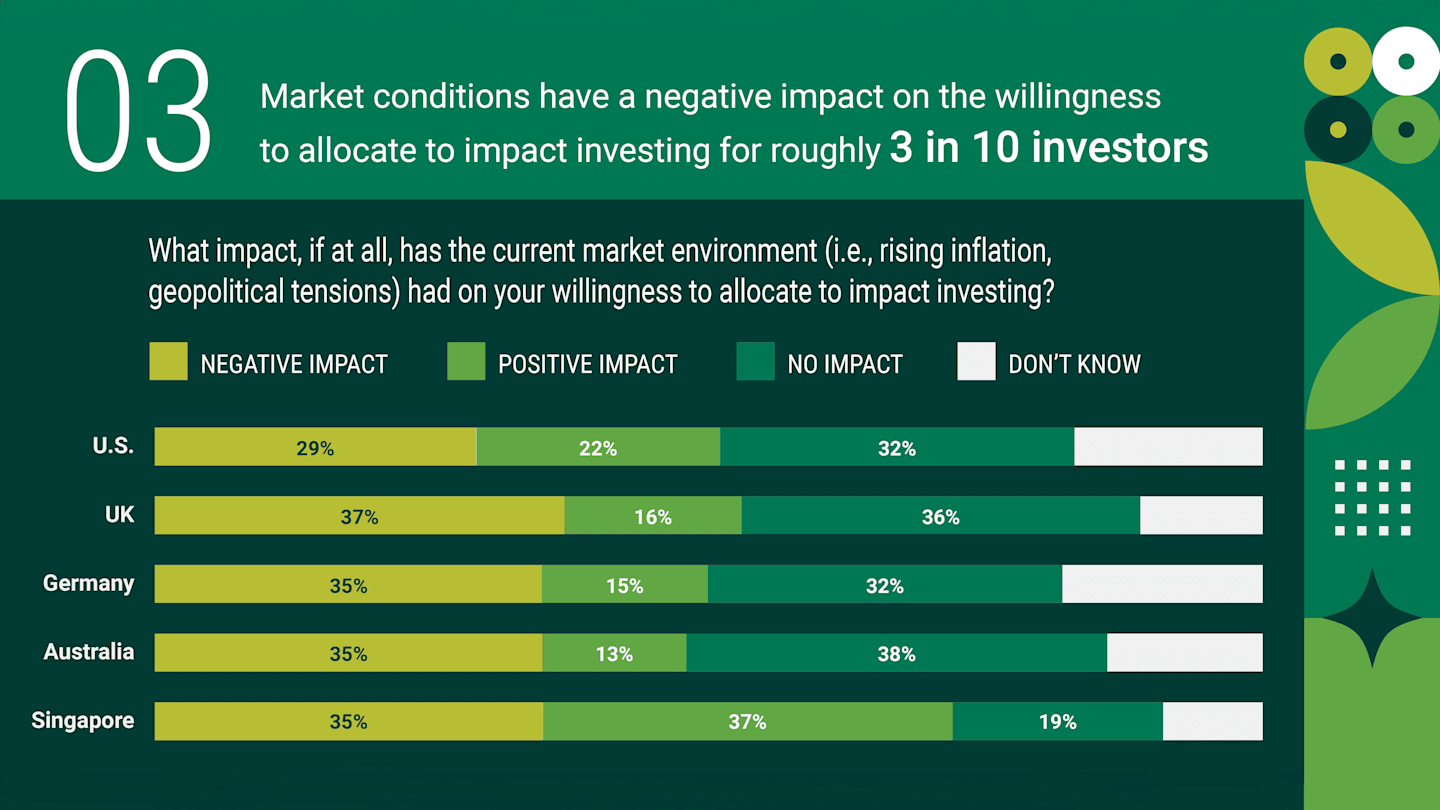

Market conditions have a negative impact on the willingness to allocate to impact investing for roughly 3 in 10 investors in each of the five countries, although in Singapore, respondents were more likely to say market conditions positively impacted their willingness to make these investments. In the U.S., greenwashing and the sustainability backlash both influenced interest in impact investing at higher levels than the prior year, but not for respondents in the other countries.

Health care surpasses the environment to become the top cause overall

For the first time since 2020, health care is the top concern overall. The environment fell to second place after holding a lead over health care in 2020 (4%), 2021 (5%) and 2022 (1%).

As an asset manager with an impact on global health, American Century Investments has a unique perspective on sustainable investing. More than 40% of American Century dividends go to the Stowers Institute for Medical Research , a world-class biomedical research organization with an equity stake in American Century. American Century Investments has generated more than $2 billion in dividends for the Stowers Institute since 2000.

“Through our unique relationship with the Stowers Institute, we generate an impact on global health while helping clients achieve financial success. As a foundational research organization, the Stowers Institute takes a long-term view and commitment to research and innovation, which has helped to shape our culture and naturally aligns with integrating sustainability into our investment practices to help us deliver better long-term, risk-adjusted returns for our clients,” said Bratton Hughes.

Survey methodology

The 2023 survey was conducted with representative samples of adults 18 years of age and older. There were 1,007 participants in the U.S. survey, 1,004 in the U.K. survey, 1,003 in Germany, 1,005 in Australia and 1,002 in Singapore. The study was fielded using Big Village’s Online CARAVAN Omnibus Survey, with the results weighted by age, sex, geographic region, race and education to ensure reliable and accurate representations of the adult populations in each country. For the purposes of this survey, millennials were defined as those aged 25 to 40, Gen Xers were defined as those aged 41 to 56, and baby boomers were defined as those aged 57 to 75.

American Century Investments’ impact investing study shows appeal declines 5% during 2023, although impact investors are still willing to give up some returns

LONDON, March 27, 2024 – UK investors have shown a decline from previous years in their willingness to sacrifice returns when impact investing, spanning across all generations, in the seventh impact investing survey by the $240 billion* global asset manager American Century Investments.

The survey results offer multiple reasons for this decline in appeal, including market conditions, concerns about greenwashing and the sustainability backlash. Survey results go back to 2016 in the U.S. 2019 in the UK, 2020 in Germany, 2021 in Australia and 2022 in Singapore.

UK investors have shown a decline in willingness to sacrifice some returns for impact investments

The UK has shown a decline in the share of respondents willing to sacrifice returns to create a positive impact to 33%, down from the previous year (38% in 2022), with the U.S. the only market to show an increase. The UK is followed by Germany (31%), and Australia (29%), with the U.S. and Singapore showing the most willingness to sacrifice returns at 40% and 47% respectively.

However, the UK had the second highest rate of participants that would be willing to sacrifice up to 10% of their returns in order to create a positive impact at 74%, following Germany at 76%, and followed by Australia (71%), the U.S. (60%) and Singapore (58%).

Sarah Bratton Hughes, senior vice president and head of sustainable investing at American Century Investments said: “Although interest in impact investing is still higher than in earlier years of our research, the results suggest that there is room for improvement in the way the asset management industry communicates what investors should (and should not) expect from impact investing.”

“Participants do want some of their investments to have a positive impact, but they are not naïve, or overly idealistic – they are not keen on sacrificing return. Investors typically allocate only a proportion of their portfolio to impact funds – in other words, impact investing is not an all or nothing proposition.”

The appeal of impact investing has declined across all markets, falling 5% in the UK

Compared to 2022 figures, the appeal of impact investing has declined to 60% in the UK (down 5%); however, it has shown a large disparity between male and female UK participants, with female rates dropping 2% to 60% (‘very/somewhat appealing’), while male rates dropped 8% to 61% appeal, highlighting the potential gender differences when it comes to impact/sustainable investing. While appeal in the UK has declined across all generations, Gen Z has the biggest decrease, falling 6% from 74% in 2022 to 68%, followed by Baby Boomers (7%), Gen X (6%) and Millennials (2%).

Bratton Hughes continued: “For younger investors, some appear discouraged by the lack of progress on environmental and societal issues or perhaps they are searching for more direct ways to bring about changes which affect their generation the most.”

Along with appeal, the importance of impact in society has declined in every country, falling 5% in the UK to 62%; however, UK participants reported the highest percentage out of all countries surveyed, followed by the U.S. (60%), Australia (58%), Germany (57%), and Singapore (53%).

For the first time in five years of survey results, health care topped the list of causes that matter most to UK investors at 30%, pushing the environment to second at 27%.

Survey methodology

The 2023 survey was conducted with representative samples of adults 18 years of age and older. There were 1,007 participants in the U.S. survey, 1,004 in the U.K. survey, 1,003 in Germany, 1,005 in Australia and 1,002 in Singapore. The study was fielded using Big Village’s Online CARAVAN Omnibus Survey, with the results weighted by age, sex, geographic region, race and education to ensure reliable and accurate representations of the adult populations in each country. For the purposes of this survey, millennials were defined as those aged 25 to 40, Gen Xers were defined as those aged 41 to 56, and baby boomers were defined as those aged 57 to 75.

Impact Investing Appeal Declines But Greenwashing Not a Concern

SYDNEY, Australia, March 27, 2024 — Nearly three-quarters (71 per cent) of Australian investors are willing to sacrifice between 1–10 per cent in returns in order to create a positive impact, according to the seventh global impact investing survey by American Century Investments, a $240 billion* global asset manager.

The survey, undertaken in December 2023, measured how attitudes to impact investing have changed over time. Survey results go back to 2016 in the U.S., 2019 in the UK, 2020 in Germany, 2021 in Australia and 2022 in Singapore.

The latest survey found almost one-third of Australians (30 per cent) were willing to give up between 6 to 10 per cent of returns in order to create a positive impact, and a further 42 per cent said they would give up between 1 and 5 per cent.

However, the appeal of impact investing overall has declined after several years of steady growth, with Australia showing the biggest decline compared to the other countries surveyed.

While over half of Australians surveyed agreed that impact investing appealed to them (57 per cent), this is a fall from last year’s survey (63 per cent).

Across the board, there was a drop in interest in impact investing in all countries surveyed. In Australia interest was down 6 per cent, while in Singapore and the UK it fell 5 per cent. In Germany it was down 4 per cent. The U.S. experienced the smallest decline of just 1 per cent between 2022 and 2023.

This decline is also seen across generations. In Australia, appeal has fallen by 8 per cent between 2022 and 2023 for Gen Z, 11 per cent for Millennials and 9 per cent for Gen X. Perhaps surprisingly, for Baby Boomers it has stayed the same.

Health care was the top impact concern for Australian investors in 2023 at 33 per cent, followed by the environment at 26 per cent and education at 12 per cent.

More than 40% of American Century dividends go to the Stowers Institute for Medical Research , a world-class biomedical research organization with an equity stake in American Century. American Century Investments has generated more than $2 billion in dividends for the Stowers Institute since 2000.

Australian investors are feeling the impact of the current market environment

More than one-third of Australians surveyed (35 per cent) cited recent economic conditions, including rising inflation and geopolitical tensions, as negatively affecting their willingness to allocate to impact investing.

Greenwashing did not influence most investors: fewer than one-third of respondents in the UK, Germany and Australia said greenwashing had affected their interest in impact investing, a smaller share of respondents than in last year’s survey. Only the U.S. has seen an increase in the influence of greenwashing and a sustainability backlash.

“It seems that ongoing market volatility, and persistent inflation, has investors’ minds focused on returns rather than on the impact of their investment,” says senior vice president and head of sustainable investing for American Century Investments, Sarah Bratton Hughes.

“Nonetheless, there is still a strong willingness to sacrifice some returns for the benefits of investing in impact funds.

“A willingness to give up a proportion of expected returns shows that impact investors still expect to earn competitive returns and are making rational choices to realize an impact emphasis in addition to a financial return.

“While it is positive that investors are willing to sacrifice returns in order to realise the benefits of investing in impact funds, often this is not necessary, as impact funds historically show returns in line with their non-impact counterparts.

“Identifying impact-related factors that could affect a company’s ability to stay competitive over the long term has the potential to add to returns,” Bratton Hughes added.

Survey methodology

The 2023 survey was conducted with representative samples of adults 18 years of age and older. There were 1,007 participants in the U.S. survey, 1,004 in the U.K. survey, 1,003 in Germany, 1,005 in Australia and 1,002 in Singapore. The study was fielded using Big Village’s Online CARAVAN Omnibus Survey, with the results weighted by age, sex, geographic region, race and education to ensure reliable and accurate representations of the adult populations in each country. For the purposes of this survey, millennials were defined as those aged 25 to 40, Gen Xers were defined as those aged 41 to 56, and baby boomers were defined as those aged 57 to 75.

Interest in Impact Investing is Declining Globally

Multi-year impact investing study shows decreasing attractiveness. Impact investors are still willing to give up some of the returns. Health trumps the environment as the number one concern.

FRANKFURT, Germany, March 27, 2024 – Interest in impact investing has paused. This is the result of a study for which the $240 billion* global asset manager American Century Investments surveyed investors in the U.S., UK, Germany, Australia and Singapore. In the seventh edition of the study, respondents cited not only market conditions but also greenwashing and a setback in sustainability as the reason for the decline in investor interest.

According to the study, only in the U.S. are a growing number of respondents willing to forego returns in order to achieve a positive effect, contrary to the international trend. At 40 percent of U.S. respondents, the proportion was even four percent higher than in the last survey and the highest proportion measured to date. By comparison, the figure is 33 per cent in the UK, 31 per cent in Germany and 29 per cent in Australia. The absolute highest proportion of investors willing to sacrifice returns is found in Singapore at 47 percent – but fell by seven percent there.

Of the globally interested investors, 67 percent of respondents would sacrifice up to 10 percent of returns to make a positive impact. In the past, impact investors would have expected only low returns in order to be able to make an impact, but this picture has changed. Sarah Bratton Hughes, senior vice president and head of sustainable investing at American Century Investments, said: "Impact investors today expect competitive returns. Expectations are that impact-related factors that have a positive impact on a company's long-term competitiveness have the potential to contribute to financial returns as well."

For the first time since 2020, health care as a whole is the top concern for impact investors, followed by the environment, which has been the top driver of impact investing in recent years. The decreasing interest of impact investors in environmental issues is a global trend, says Volker Buschmann, Managing Director American Century Investments: "Germany is the only country in the study that invests more in environmental issues than in health. Even here, however, we have seen a continuous decline in investor interest in environmental issues for the past three years." The decline in demand for impact investing observed globally has been observed across generations, with the most decline in attractiveness among baby boomers (-8 percent), followed by Generation Z (-7 percent), Generation X (-5 percent) and Millennials (-1 percent).

Survey methodology

The 2023 survey was conducted with representative samples of adults 18 years of age and older. There were 1,007 participants in the U.S. survey, 1,004 in the U.K. survey, 1,003 in Germany, 1,005 in Australia and 1,002 in Singapore. The study was fielded using Big Village’s Online CARAVAN Omnibus Survey, with the results weighted by age, sex, geographic region, race and education to ensure reliable and accurate representations of the adult populations in each country. For the purposes of this survey, millennials were defined as those aged 25 to 40, Gen Xers were defined as those aged 41 to 56, and baby boomers were defined as those aged 57 to 75.

Appetite for Impact Investing Declines in Singapore

SINGAPORE, March 27, 2024 – A new global survey reveals that the appeal of impact investing declined in Singapore in 2023, with investors generally less willing to give up returns to invest responsibly, although impact investors still believe that they can earn competitive returns over time.

The seventh impact investing survey by $240 billion* global asset manager American Century Investments revealed a drop in interest in impact investing in all countries surveyed. In Singapore, fewer than half of all investors, or 47 per cent, were willing to sacrifice returns to create a positive impact in 2023, a decline from 54 per cent in 2022.

The survey, undertaken in December 2023, measured how attitudes to impact investing have changed over time. Survey results go back to 2016 in the U.S., 2019 in the UK, 2020 in Germany, 2021 in Australia and 2022 in Singapore.

In Singapore, the appeal of impact investing fell 5 per cent between 2022 and 2023, the same fall in the UK, compared to 6 per cent in Australia, 4 per cent in Germany. The U.S. experienced the smallest decline of just 1 per cent between 2022 and 2023.

However, while the appetite for sustainable investing is down, the survey found that 58 per cent of impact investors in Singapore are willing to sacrifice up to 10 per cent of returns to have a positive impact in their chosen area. A total of 85 per cent are willing to give up no more than 15 per cent.

“A willingness to give up as much as 10 per cent of an expected return shows that impact investors expect to earn competitive returns and are making rational choices to make an impact but also seek a financial return,” said Sarah Bratton Hughes, senior vice president and head of sustainable investing for American Century Investments.

“In earlier times, impact investors often thought they had to accept lower returns to have a bigger impact, but our impact investment strategies help to identify impact-related factors that could improve a company’s ability to stay competitive long term, and potentially add to returns,” she said.

Respondents in Singapore said the market environment positively impacted their willingness to allocate to impact investing (37%), surpassing the trend in Australia (13%), Germany (15%), UK (16%) and the U.S. (22%). Market conditions had a negative impact on the willingness to allocate to impact investing for roughly 3 in 10 investors in each of the five countries.

“We can conclude from this that the interest in impact investing does not exist in a vacuum; investors rationally look at the big picture and if markets fall, then the appetite to make an impact seemingly falls too,” she said.

“Ongoing market volatility, and persistent inflation, has investors’ minds focused on returns rather than on the impact of their investment. Investors are facing an increasingly challenging geopolitical landscape and the decision to allocate to impact investing is made as part of a mix of considerations,” said Bratton Hughes.

“Nonetheless, there is still a strong willingness overall to sacrifice some returns for the benefits of investing in impact funds.”

Across the five countries, health care was the top concern for investors, with the environment falling to second place after holding a lead over health care in 2020. However, in Singapore, the environment was an equal top impact concern for investors with health care at 24 per cent, while racial equality concerned 11 per cent of impact investors, the highest of the five countries surveyed.

According to Bratton Hughes, investing for impact may well be a way to invest in trailblazing companies that deliver on the goal of doing well financially by doing good.

“That applies to health care companies, and to companies developing new ways to fight climate change or help address water scarcity. Technology can also improve access to education and help to alleviate poverty, which governments are eager to do. Our impact investment strategies emphasise sustainability-related attributes or outcomes in addition to delivering a financial return,” she said.

More than 40% of American Century dividends go to the Stowers Institute for Medical Research , a world-class biomedical research organization with an equity stake in American Century, giving American Century a special perspective on sustainable investing. American Century Investments has generated more than $2 billion in dividends for the Stowers Institute since 2000.

“Through our unique relationship with the Stowers Institute, we generate an impact on global health while at the same time helping clients achieve financial success. As a foundational research organization, the Stowers Institute takes a long-term view and commitment to research and innovation, which has helped to shape our culture and naturally aligns with integrating sustainability into our investment practices to help us deliver better long-term, risk-adjusted returns for our clients,” said Bratton Hughes.

Survey methodology

The 2023 survey was conducted with representative samples of adults 18 years of age and older. There were 1,007 participants in the U.S. survey, 1,004 in the U.K. survey, 1,003 in Germany, 1,005 in Australia and 1,002 in Singapore. The study was fielded using Big Village’s Online CARAVAN Omnibus Survey, with the results weighted by age, sex, geographic region, race and education to ensure reliable and accurate representations of the adult populations in each country. For the purposes of this survey, millennials were defined as those aged 25 to 40, Gen Xers were defined as those aged 41 to 56, and baby boomers were defined as those aged 57 to 75.

About American Century Investments

Who We Are

American Century Investments is a leading global asset manager focused on delivering investment results and building long-term client relationships while supporting breakthrough medical research.

Quick Facts

Founded in 1958, American Century Investments' 1,400 employees serve financial professionals, institutions, corporations and individual investors from offices in Kansas City, Missouri; New York; Los Angeles; Santa Clara, California; Portland, Oregon; London; Frankfurt, Germany; Hong Kong; and Sydney.

Management

Jonathan S. Thomas is chairman, chief executive officer and president, and Victor Zhang serves as chief investment officer.

Giving Back

Delivering investment results to clients enables American Century Investments to distribute 40% of its dividends to the Stowers Institute for Medical Research, a 500-person, nonprofit biomedical research organization with a focus on foundational research. The Institute is the controlling owner of American Century Investments and has received dividend payments of more than $2 billion since 2000. For more information about American Century Investments, visit www.americancentury.com.

Assets under supervision as of 3/8/2024.

American Century Investment Management (UK) Limited is registered in England and Wales. Registered number: 06520426. Registered office: 12 Henrietta Street, 4th Floor, London, WC2E 8LH

American Century Investment Management, Inc. ("ACIM") (CRD#105778/SEC#:801-8174) is a U.S. registered investment adviser pursuant to the Investment Advisers Act of 1940 of the Securities and Exchange Commission.

American Century Investment Management, Inc. is exempt from the requirement to hold an Australian financial services licence under the Corporations Act 2001 (Cth) (Australian Corporations Act) in respect of the financial services it provides to "wholesale clients" for the purposes of the Australian Corporations Act, and does not hold such a licence. American Century Investment Management, Inc. is regulated by the Securities and Exchange Commission under United States laws which differ from Australian laws. Any financial services given to any person by American Century Investment Management, Inc. in Australia are provided pursuant to ASIC Class Order [CO 03/1100].

American Century Investment Management, Inc. is not authorised by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)). American Century Investments (EU) GmbH is registered with the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)).

American Century Investment Management (Asia Pacific), Limited currently holds Type 1 and Type 4 registrations from the Securities and Futures Commission ("SFC"). American Century Investment Management, Inc. is not registered with the SFC. Neither ACIM (Asia Pacific) or ACIM are registered with the Monetary Authority of Singapore.

©2026 American Century Proprietary Holdings, Inc. All rights reserved.