Target-Date Blueprint

Align target-date selection with each plan’s profile.

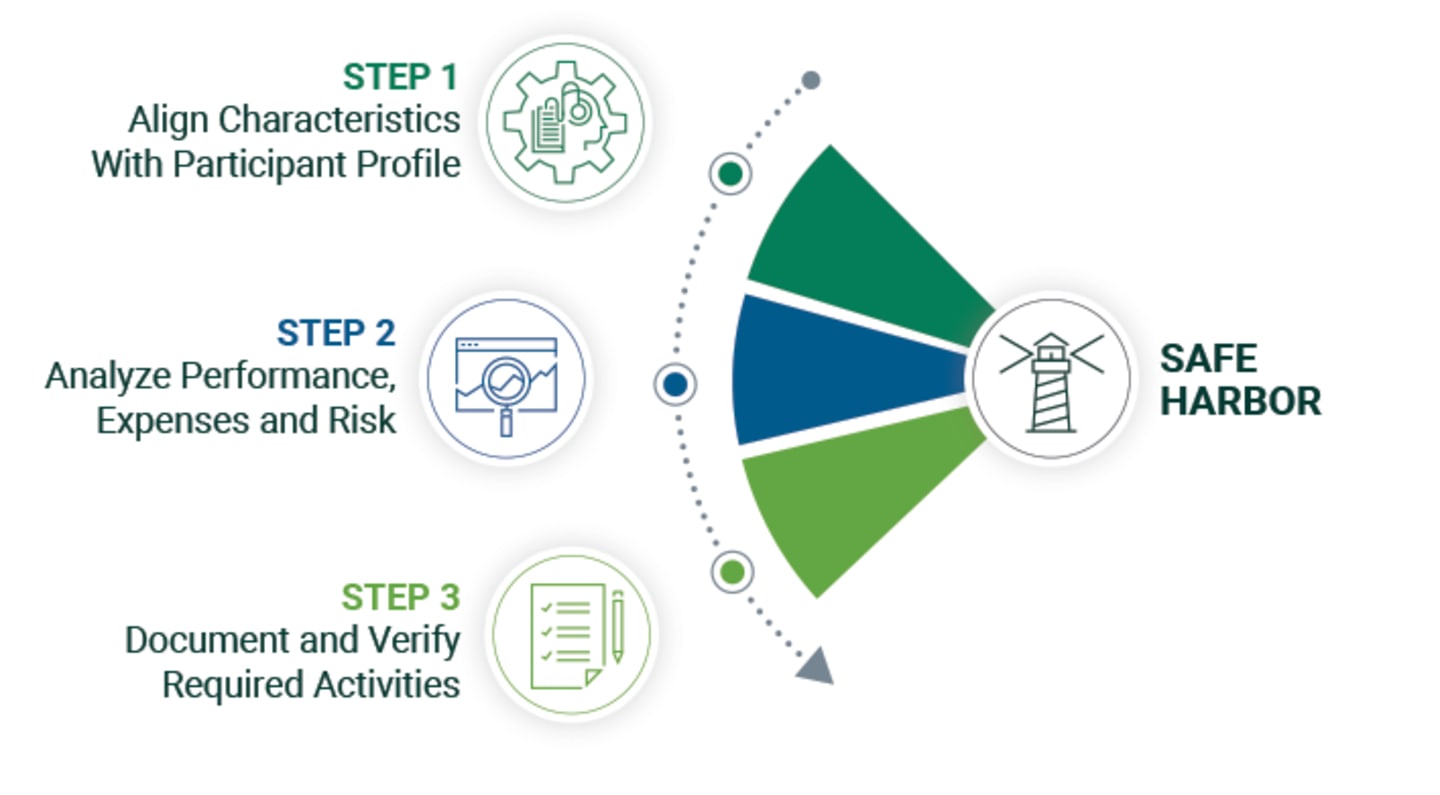

You know how important it is to employ a prudent fiduciary process to identify the right target-date solution for each plan. Now you can document the process following DOL guidance and share a personalized report with your clients.

Our online analytical tool, Target-Date Blueprint, helps you narrow the target-date fund (TDF) universe to focus only on funds with investment profiles that align with a plan’s demographics, risk profile and preferences.

Enhanced Features:

Optimized glide path* based on plan-specific inputs appears alongside selected TDFs for easy comparison.

Drawdown risk versus growth potential chart gives a straightforward risk/reward comparison of each selected fund during the retirement transition zone.

Updated scoring calculation incorporates optimized glide path research to better represent the relative suitability of each TDF.

As one of the longest-running target-date providers in the industry, American Century Investments has proudly offered retirement solutions for over 20 years.

As of August 31, 2024, out of 51 total mutual fund target-date strategies listed in Morningstar, there were only 5 other strategies with a 20-year track record.

Other Tools and Insights

Watch the replay for expert tips on bracing for expected lawsuits.

Matthew Eickman, National Retirement Practice Leader at Qualified Plan Advisors, offers insights into factors fiduciaries should consider in evaluating the suitability of a target-date solution to a given plan.

Use a forward-looking approach to evaluate TDFs on four key risk metrics.

Learn how American Century Investments successfully defended itself against allegations of breach of fiduciary duty.

American Century Investments does not guarantee the quality, accuracy or completeness of data entered by advisors. In addition, American Century isn’t responsible for any errors or omissions, or for the results obtained from the use of such data or information entered by the advisor.

This information is for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. There are different options available for your retirement plan investments. You should consider all options before making a decision.

*The optimized glide path is based on research demonstrating that the optimal TDF allocation must be explicitly linked to a savings rate and account for accumulated wealth, the investing environment and participant characteristics. Source: Gabudean, Radu; Gomes, Francisco; Michaelides, Alexander; Zhang, Yuxin (2021). On Optimal Allocation of Target-Date Funds, Journal of Retirement.

©2024 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.