Automatic Investing

Save and invest more with an automated plan.

Automatic Investing Starts With a Solid Investment Plan

When things are uncertain around us—the markets, economy, global conflicts, policy proposals and even election outcomes—investors are often tempted to change or pull back on their investment plan. But that plan was put in place for a reason: to ensure you stay invested in your future, no matter what’s happening in the world.

Focus on what you can control. That starts with making sure your portfolio risk level matches your goals, time frame and tolerance for market ups and downs. Successful regular investing may be contingent on having a portfolio that aligns with your needs.

Set Up Automatic Investments

Log in to start or modify regular contributions to your American Century Investments account.

How to Put Automated Investing to Work for You

Consistent investing can help you stay committed to your future. Making regular investments is one of the most important parts of your overall financial plan.

1. Avoid Market Timing

Timing the market is trying to predict the best time to invest based on what you think markets will do. This behavior can include adjusting your portfolio in anticipation of market news, moving in and out of cash equivalents (such as money markets) due to uncertainty and/or stopping investments during a market decline.

How do you know if you’re a market timer? Some people may try to convince themselves they aren’t one. But if you’re guessing at the best time to invest at the right price, it’s market timing.

As much as people know that long-term investing should not be about market timing and chasing performance (or avoiding losses)—many people still do it.

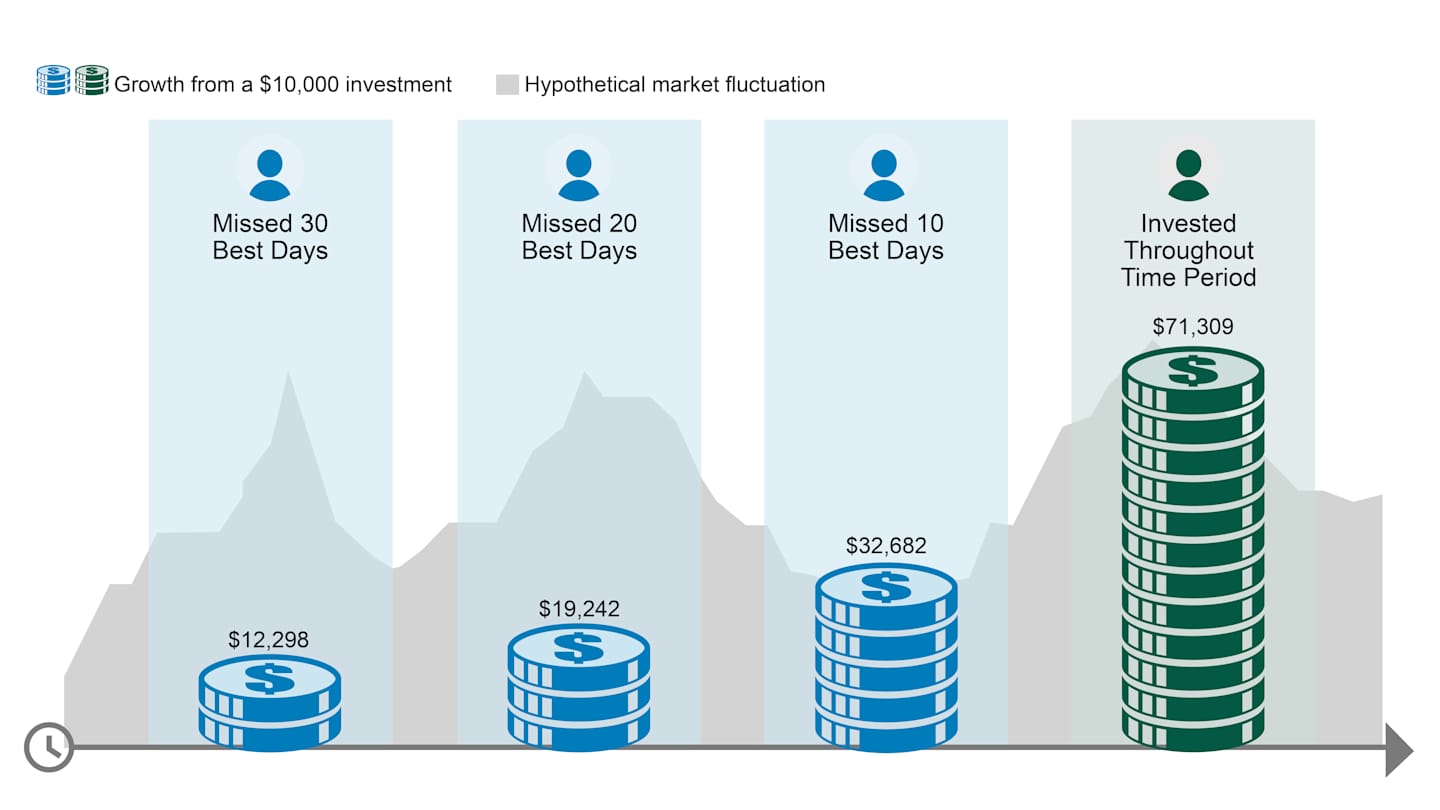

Jumping In and Out of Stocks May Cost You

Source: American Century Investments, FactSet. Growth of $10,000 in the S&P 500® Index. Data from 01/01/1999 – 3/31/2025. The index does not reflect fees, brokerage commissions, taxes or other expenses of investment. Investors cannot invest directly in an index. Past performance is no guarantee of future results. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

2. Leave the Emotion Out of Investing

When you set up and stick with an automatic investment plan, you won’t be as tempted to buy and sell based on headlines. And investing consistently over time may help you have more success. How? If you miss even a few of the market’s best days, as the previous chart shows, your account balance might be lower than had you stayed invested the entire time. Even through the worst days.

Emotions can have a significant impact on your investment decisions. In fact, studies on behavioral finance have provided evidence on the role emotions have on money choices. Investors may not want to admit that they sometimes make emotional investing decisions, so an automatic plan can help take short-term feelings out of the equation.

Whether you have an automatic investing plan or not, reviewing your portfolio periodically can also help ease emotions.

3. Stick to Your Plan

Retirement and other long-term goals require large amounts of money and a disciplined plan to get there. If you’ve ever calculated how much you might need for retirement or other long-term goals, you know that it’s best to start early and invest regularly.

Workplace retirement plans like 401(k)s offer automatic deferrals from each paycheck—because it helps investors stay committed to their future. Automatic investing doesn’t guarantee that you’ll reach your ideal retirement amount, but it does provide a hassle-free way to save and stay committed to your future.

4. Benefit From Dollar-Cost Averaging

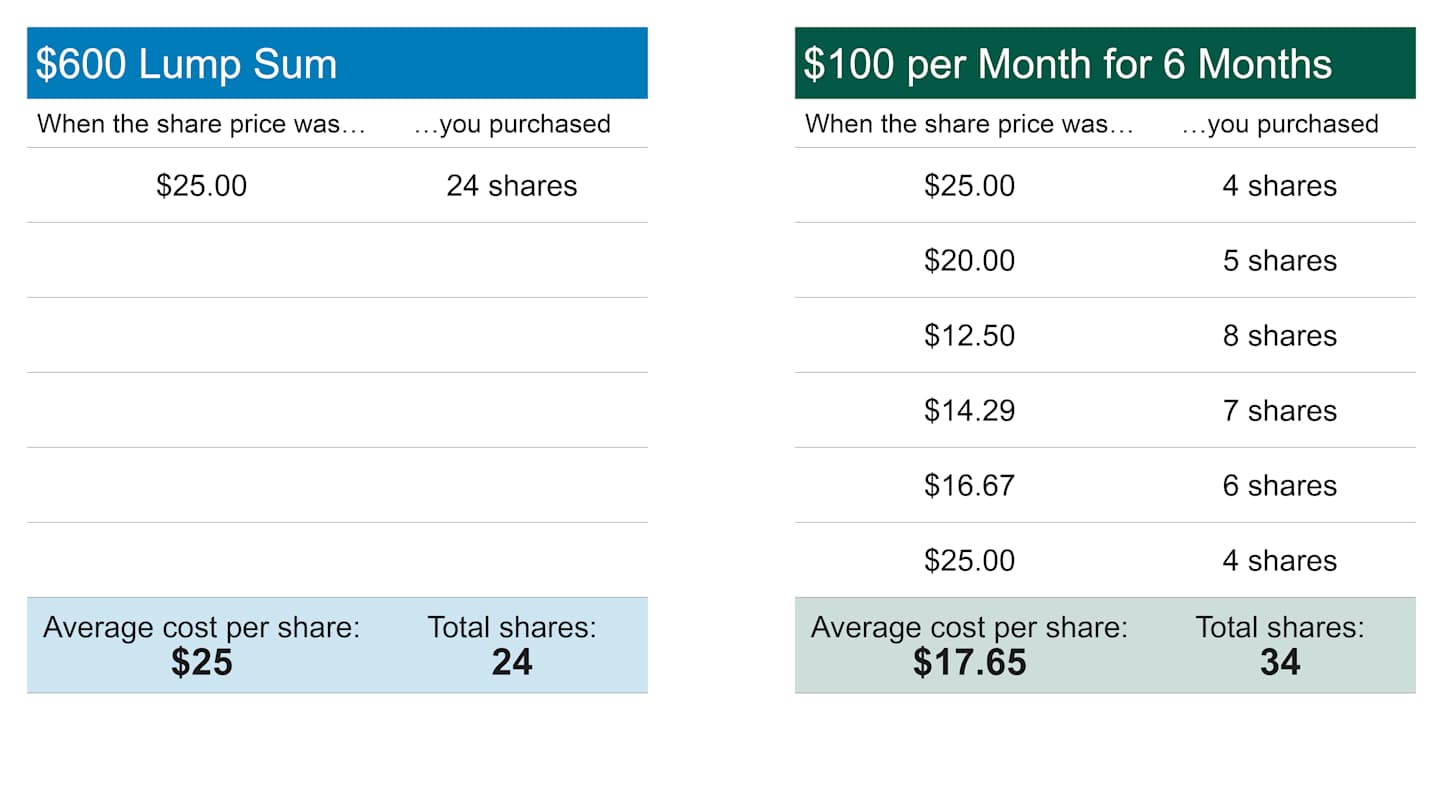

Instead of chasing (and hoping for) the best purchase price, consistent investing allows you to “collect” and average your purchase prices over time. This strategy, called dollar-cost averaging, helps you manage varying market conditions during your lifetime.

Suppose you invest $100 a month in a mutual fund and purchase shares at a variety of prices. At the end of the six months, you own 34 shares that cost $600 and your average cost per share was $17.65 per share ($600 divided by 34 shares).

But if you had invested the full $600 in the first month, you would have bought only 24 shares at $25 each. With dollar-cost averaging, you bought 10 more shares and reduced your cost per share by more than $7.

Source: American Century Investments. This information is for illustrative purposes only and is not intended to represent any particular investment product. This dollar-cost averaging strategy does not assure a profit or protect against loss in declining markets. To fully take advantage of it, be prepared to continue investing at regular intervals, even during economic downturns.

Of course, the opposite is true had you invested $600 at $12.50 per share. But over years of investing, it’s impossible to have perfect timing for every purchase.

5. Build Investments Over Time

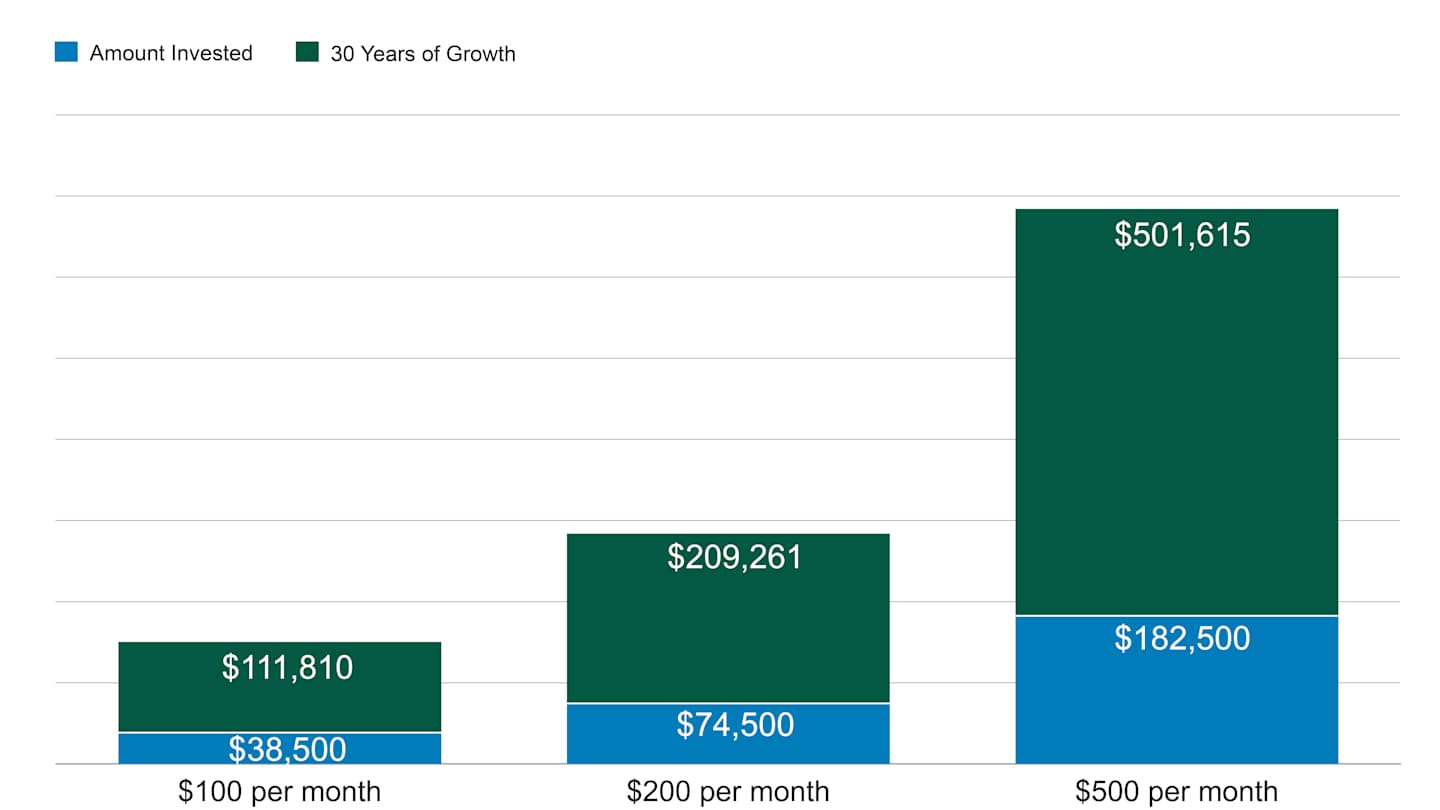

Setting up automatic investments (monthly or per pay period, for example) may help you build assets over time. Here’s why.

The more time you have for your money to grow and compound, the more likely you may be to reach your long-term goals. Compounding—earning money on your original investment and on any earnings for that investment—can have a powerful effect over time. And bumping up your contributions periodically (from annual pay raises, for example) may help build your assets even more.

The Power of Automatic Investments and Compounding

Source: Future Value Calculator, American Century Investments, September 2025. These hypothetical calculations contain assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. The calculations assume a $2,500 initial investment and monthly investments over 30 years of $100, $200 and $500 with a 6% return rate. Assumes reinvestment of all gains, dividends and interest, and does not include fees, expenses or taxes. If all taxes, fees and expenses were reflected, the reported value would be lower.

Of course, while positive returns can lead to exponential growth, negative returns can do the opposite and erode the value of your investments over time.

Questions About Automatic Investing

As much as we believe automatic investing is a great way to practice the smart investing principle of regular investing, we know some investors still have questions.

What If I Don’t Have Enough Money?

You may have the money and not realize it. Sometimes the hesitation is a budgeting issue. Automatic investing can help you make a good start, even with small contributions. Smaller amounts still have the potential to compound and grow over time.

As you create and maintain a budget, you may find more money to invest and a good way to put it to work for you is with an automatic investment.

Should I Set Up Automatic Investments or Invest a Lump Sum?

There are times when investing a single, larger amount makes sense: inheritance, gift, tax refund, proceeds from a sale, etc. Investing it all at once can ensure you use the money for your future rather than spending it today.

If you do have a lump sum to invest, you could wait for the “best” time to invest (also known as market timing). Or, you could consider going ahead and investing it—regardless of current market performance. Being invested could potentially help you take advantage of a market recovery and potential growth.

But occasional lump-sum investing assumes you have large amounts to invest, and this strategy’s success may hinge on timing the market just right to get a good price. Smaller, regular amounts take away the guesswork of when and how much to invest.

Automatic investing may be less applicable to windfalls but more practical for recurring income that can be invested regularly.

Should I Stop Investing When Markets Drop?

Emotions can go both ways with investing. Often, investors want to purchase when an investment is on the rise and find it more challenging to keep investing when markets fall—the opposite of a successful buy-low, sell-high strategy.

Wanting to make a change may be the gut reaction when markets drop, but if you’re dollar-cost averaging, you’re not putting your whole savings on the line. If anything, market downturns may be a good time to buy more and increase your automatic investment.

Does Automatic Investing Work for Everyone?

No matter your age, investing knowledge or financial status, automatic investing is a good strategy to build your investments over time. While investment returns are not guaranteed and are bound to fluctuate over time, your regular contributions and the power of compounding are a key component of growth potential over time.

Start an Automatic Investment Plan Now

Log in to start investing regularly (and conveniently) in an existing account.

Financial Calculators from Dinkytown.net

Financial Calculators ©1998–2026 KJE Computer Solutions, LLC

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.