Retirement Savings Goals by Age: How Much to Save

How far along should you be with your retirement savings goal at your age?

How Much Should You Save for Retirement at Your Age?

Choose the category that fits you and find guidelines for your retirement savings goal by age and income.

I'm in my 20s and 30s or I have 30 to 40 years before retirement.

I’m in my 40s and 50s or have 10 to 20 years before I retire.

I’m in my 60s and/or retirement is getting close (10 years or less).

I’m already in retirement and income is my biggest need.

Some financial planners suggest you put 5-to-20% of your income toward retirement each year, depending on your age. As you get closer to retirement, your savings should increase along with your income. Are you finding this harder to do with recent market uncertainty and fears of a recession? Wondering how much to have saved at each age? Not sure where to start?

While those guidelines may seem like lofty goals, remember that your retirement savings might include more than just your contributions. Money from employer retirement plan matches, smart debt repayment and windfalls (such as bonuses, tax refunds and inheritance) can also put you ahead for retirement.

Want to see how you’re doing? We’ve got smart retirement savings tips, goals and checkpoints for any age and income level.

Retirement Tips for Every Age

These tips are useful no matter your age, so keep reading for yourself and your future self, or to share with your kids, parents or anyone else who might need an extra nudge toward retirement savings.

Keep in mind that everyone’s retirement picture looks a little different. If you’re in a profession like medicine that requires many years of education before you start earning, you may not have socked away a lot of money for retirement in your twenties and early thirties. Not to worry! The hope is that as you establish yourself in your career and your income increases, you’ll be able to put away more for retirement and make up for a slower start.

Retirement Savings Goals by Age

Age | Savings Goal | Savings Checkpoint |

20s | 5-10% | 0.5x-1x by age 30 |

30s | 10-15% | 2x-3x by age 40 |

40s | 15-20% | 4x-5x by age 50 |

50s | 20%+ | 6x-8x by age 60 |

60s | 20%+ or as much as you can afford | 9x-10x by age 67 |

This retirement savings by age chart provides an overview but keep reading for more details and ideas for how to reach the goal. It assumes you will retire sometime in your 60s. If you plan to retire sooner, you may want to set a savings goal and choose a savings checkpoint for a different age.

Long Way Until Retirement

Retirement may seem so far away that it’s hard to imagine. But there are some guidelines to help you know how much to save now, and how to do it if you’re not quite there.

How Much to Save in Your 20s

Savings Goal: 5-10% of your annual income

Savings Checkpoints: 0.5x-1x your annual salary by age 30

How Much to Save in Your 30s

Savings Goal: 10-15% of your annual income

Savings Checkpoints: 2x-3x of your annual salary by age 40

How to Get There

Start early and establish good investing habits

If you’re under 40, you still have many years to contribute toward your retirement and handle the ups and downs of the financial markets. Starting early can help you make the most impact at this stage of your working life. (Not sure if you’re saving enough? Get even more tips to boost your savings in your 20s and 30s.)

Invest the match

If your employer matches your workplace retirement plan contributions, make sure you meet the minimum for the match.

3% of your own contributions + 3% employer match = 6% invested each pay period

Bump up contributions

As you get older, your financial obligations might increase—but so could your income. Even if you already contribute a specific percentage of each paycheck to your employer’s retirement plan, many plans offer automatic annual increases (in 1 percent increments, for example). Opt in for a hassle-free way to increase your contributions.

Don’t have an employer plan? Learn more about different types of IRAs to invest on your own. And if you’re self-employed, workplace plans like SEP IRAs offer a way to save and get tax deductions for your business.

Balance debt and savings

You may find that paying off higher-interest loans might be more of a priority than extra retirement contributions. But if you have a lower rate on your loan, the return on your investments over time has the potential to offset any interest payments you’re making.

Learn more retirement savings hacks.

How do you know if you’ll be ready for retirement?

Find out whether you and your finances are ready for the transition.

Well on the Way to Retirement

Saving takes on new meaning as you get closer to retirement, and you’re likely making more income than ever before. Take advantage of this time in your life.

How Much to Save in Your 40s

Savings Goal: 15-20% of your annual income

Savings Checkpoints: 4x-5x annual salary by age 50

How Much to Save in Your 50s

Savings Goal: 20%+ of your annual income

Savings Checkpoints: 6x-8x annual salary by age 60

How to Get There

Use various investment account types to your advantage

By your 40s and 50s, you’ve likely had time to get settled into a career and savings habits. Knowing your options for IRAs and HSAs can help you save even more—and get tax benefits.

Catch up with IRAs

When you’re age 50 or older, you can make additional $1,000 contributions into IRA accounts. Retirement plans also allow catch-up contributions for those over 50.

Not yet 50? You can play catch-up other ways. Increase your employer plan contributions each year (see “Bump up contributions" above) and get as close to the maximum contribution limit as you can.

Know your IRA options

Depending on your age and income, traditional and Roth IRAs provide different tax benefits. Roth IRAs might be more suitable if you’re currently in a lower tax bracket and expect your tax rate to go up. Traditional IRAs might be better if you think your tax rate will be lower at the time you withdraw the money. A tax advisor can help you decide which type is best for your retirement goals.

Use HSAs for more tax benefits

Health savings accounts (HSAs) can be used for today’s medical expenses and your future retirement, with triple tax benefits: tax-deductible contributions, tax-deferred earnings and tax-free withdrawals for qualified medical expenses. And at age 65, you can use any remaining funds as retirement income.

Avoid cashing out retirement accounts

Once you’ve hit your 40s or 50s and you’ve saved a healthy amount for your retirement, it may be tempting to turn to those funds to cover an immediate expense. Though you may handle the expense quickly, using your IRAs, 401(k) or other retirement plan to do so may have long-term effects. Taking money before retirement age may lead to taxes and penalties and may dent your savings levels.

The Countdown to Retirement Is On

With retirement less than 10 years away, you don’t want to stop saving. And in your 60s it’s a good time to plan when to take Social Security and how your portfolio may need to change for life after the job.

How Much to Save in Your 60s

Savings Goal: 20+% of your annual income, or as much as you can afford

Savings Checkpoints: 9x-10x annual salary by age 67

How to Get There

Make the most of your final savings years

These retirement savings tips for your 60s and beyond may help as you near the finish line.

Add, don’t subtract

Even if you can withdraw from retirement plans and IRAs at 59½, try to avoid it. Instead, continue to add to your IRAs and retirement plan as long as you still have earned income (no more age 70½ cutoff for traditional IRAs) and up to the maximum contribution limits, if possible.

Get your full benefits

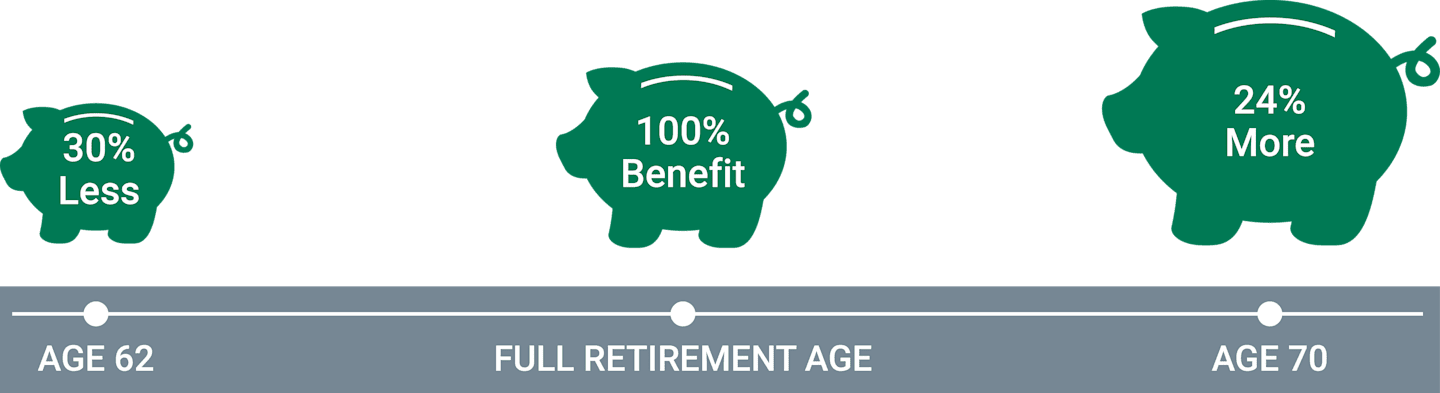

Working a little longer will give you more time to save for retirement—and may help you increase your wages to maximize pension or Social Security benefits.

For example, if your full retirement age is 67, your Social Security benefit is reduced by 30 percent if you apply for benefits at 62. If you wait until 70, your benefit will increase by 24 percent.

Source: Social Security Administration. Full retirement age (FRA) is 67 for those born after 1960. For those born between 1937 and 1960, FRA is 65 plus two months for each year after 1937.

Look for extra contributions

You can use raises, bonuses, tax refunds, inheritance and settlements to boost retirement savings. Investing a lump sum can have its advantages; not only will you avoid spending the money right away, it may grow and compound over time.

Watch your investment mix

Keep an eye on how your retirement assets are invested as you approach retirement. While a more aggressive portfolio may seem attractive for the potential gains it may offer, you're also taking on additional risk. Too much volatility at this stage may make it difficult to recoup losses.

Enjoying Retirement and Wanting Income

You made it! In retirement, your goal changes from saving to spending. Find tips to develop your retirement income plan.

Savings Total: In general, the goal is to have enough saved for 20 to 30 years in retirement. A general guideline is to have 70 to 80% of your preretirement income for each year in retirement.

Spending Rate: ~4% annual spending of your retirement account balance

How to Stay There

Map out your retirement income plan

You’ll need to decide how to convert your savings into a steady income that will need to last the rest of your life. Here are three popular strategies.

Regardless of which strategy you follow, don’t neglect to build a retirement budget strategy. A plan for spending and saving may be even more critical when you no longer receive a steady paycheck.

Total return strategy

This looks similar to a pre-retirement investment portfolio. The goal is to continue to earn money throughout retirement, without taking on unnecessary risk. Too much risk and you could lose money; too little risk and your savings won’t grow.

This strategy may be appropriate for people who have a well-funded retirement, can handle more risk or want more control over their money.

Time segmentation (or “bucket”) strategy

Divide your money into short- and long-term categories that align with your income needs. Short-term buckets contain your less-risky investments. Longer-term buckets can carry more risk because they have time to recover from market drops. The goal is to draw income from the short-term investments and refill it from the long-term.

The bucket strategy may work well if you are anxious about risk, have precise short- and long-term goals or you have a tight retirement budget.

Divide your portfolio into two to six buckets, each with its own allocation according to its capital appreciation, capital preservation or income goal.

Income floor strategy

Divide your savings into two parts: essential expenses (house, vehicles) and discretionary (entertainment, travel). Essential expenses are your “income floor” and should contain highly conservative investments. For discretionary expenses, you’ll manage your money like the total return portfolio above, including more aggressive investments.

This option may be a good retirement income strategy for people who are especially worried about risk or who have lower retirement savings.

Where Do You Stand?

These are some general guidelines that may be helpful. Your personal situation, including when you start taking out social security, is unique to you. Whether you’re not sure if you’re saving enough or if you need help after a slow start, we can help. Our consultants and retirement tools can help you gauge your progress.

Want More Guidance?

Call a consultant today at 888-345-2441 to help you plan your retirement.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.