Best Ways to Save for Retirement? This or That

Deciding the best way to save for retirement involves understanding your choices and deciding what fits you. Our financial consultants discuss different options to consider.

Key Takeaways

Saving for retirement is more than simply putting money away for the future. There are some decisions you need to make.

Considering what account type, how it may impact your taxes and how much to save regularly may determine how ready you are to retire.

Learn some this-or-that options to consider when you’re making decisions about saving now and what you want for your future.

Saving is just one part of being financially prepared to retire. Other big steps are developing a retirement savings plan, calculating how much money you need to save or whether you’re saving enough, and choosing investments that will help cover what may be decades of expenses.

Taking these steps may put you in good company or make you better at saving for the future than your peers. Some 67% of Americans have a retirement account, but only 34% say their savings are on track.1 And only half of workers have calculated how much money they’ll need to save for retirement.2

How can you get on tract with saving if you’re new to investing, feeling a little behind or well on your way? Financial Consultants Kory Klossner and Kyle Ray discuss some “this or that” choices to consider as you make decisions about saving for retirement.

Build a Retirement Savings Plan

Whether you’re just starting out or are well into your career, you should have a plan for your retirement savings. One of the first decisions to consider is how you will save: through work if a retirement plan is available, or with an account on your own. This is where our “this or that” questions begin.

401(k) or IRA?

“Both a 401(k) and a personal IRA are good options for retirement savings, depending on what you are trying to do,” says Kyle.

He says if the goal is to reduce taxable income in the current year, a 401(k) or other type of retirement plan at work may be a good option. Generally, for traditional 401(k)s, contributions from your paycheck are before taxes, and your savings can grow tax deferred. You won’t pay taxes until you withdraw the money in retirement. Some plans also offer Roth options, meaning your contributions will be after taxes, and you pay no taxes when you withdraw the money.

However, with workplace retirement plans that offer it, the benefit most people enjoy is the employer match.

Kory agrees, “In a perfect world, having both a 401(k) and an IRA would be great. I’m a fan of the simplicity of the 401(k) and how you can invest automatically from your paycheck. And as you get promotions, you can increase your contribution and save more. Workplace retirement plans can be the first stop at saving for retirement.”

No workplace retirement plan? You have options to put money away for the future with different kinds of IRAs.

Traditional or Roth IRA?

Many people choose an IRA to save for retirement because of its tax advantages. There are different benefits depending on which one you choose.

“There are reasons to consider both traditional and Roth IRAs,” says Kyle. “And it may be about when you break even with taxes.” If you think you may be in a lower tax bracket in retirement than you are now, you may want to consider a traditional IRA, where you don’t pay taxes on the money until you withdraw it in retirement. Traditional IRA contributions can also be tax deductible.

If you anticipate being in the same tax bracket or a higher bracket in retirement, Roth contributions may make sense. Roth contributions are after-tax, and withdrawals are tax-free. Kory says, “Asking this or that for Roths and traditional IRAs is kind of like asking what’s better, a fork or a spoon. They have different purposes, and investors may want to consider having both, as well as taxable accounts for retirement.”

Kyle agrees, “It’s nice to have multiple buckets for your savings when you retire: tax-deferred, taxable and Roth. How you divvy it up is where you need a strategy. No one wants to pay too much in taxes, and when you have different kinds of retirement accounts, your strategy can be more nuanced to fit you.”

Kory makes another point about Roth IRAs: “They may be a good vehicle for your legacy goals.” When your heirs inherit a traditional IRA, withdrawals are taxed at the beneficiarys' rates, which can be in a higher tax brackets if your heirs are further into their careers. With Roth IRAs, the money your heirs withdraw is tax-free.

Tax rates can be a wild card. Because we don’t know what will happen, it’s an argument for tax diversification for your retirement savings.

Maxed Out 401(k): Stop Saving or Save Elsewhere?

“If you’ve maxed out your 401(k), what you do next depends on what you want for your future,” Kyle says. One question to ask yourself is if you want to continue the same lifestyle you have today. An advisor can help you figure out if you’re saving enough or too much. “Some people don’t need to save at an extremely high level. Others need to catch up if they want the same lifestyle.”

Kory says another option, in addition to a taxable account, is a health savings account (HSA). An HSA could be an alternative through your employer and requires a high-deductible insurance plan.

He says, “You have the benefit of stashing acorns for surprise medical events. An HSA operates like a 401(k) or traditional IRA with tax-deductible contributions. In retirement, you can use it for health-related and non-health-related purposes. It could be an additional avenue if someone maxed out their 401(k) or IRA.”

Calculate How Much to Save for Retirement

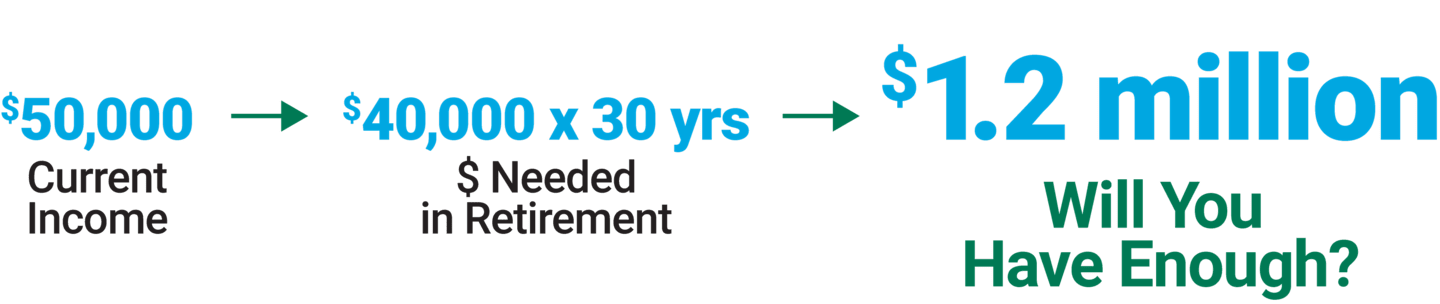

Once you know what vehicle(s) may be the right one(s) for you, it’s time to figure out how much you should invest on a regular basis. One general rule of thumb is that you should save enough for about 80% of your current income to maintain a similar standard of living. With healthier lifestyles, many retirees can expect to live up to 30 years in retirement.

No two retirements are the same. As part of determining how much money you’ll need, you should have realistic expectations about what it will really be like. A retirement filled with travel and hobbies may require a bigger nest egg than a postwork life spent closer to home.

This may be harder for investors whose retirement is several years away. Investing for retirement in your 20s and 30s will look very different from when you’re in the retirement countdown in your 50s and 60s. But Kory encourages investors of any age to just start.

No matter where you are in life, start investing now and take advantage of the power of compounding, which can help grow your investments—sometimes exponentially—over time.

However, note that compounding can work both ways, positive and negative. It can amplify gain in a rising market but also amplify a loss in a falling market. Kory also says to periodically check in on your savings progress. One way is to consider if you’re saving enough based on your age and income.

80% of My Income or More for Retirement?

No matter how you add it up, retirement won't be cheap. “If you are 10 or more years away, using the 80% rule may be fine,” says Kory. However, if you're within five to seven years of retirement, you'll want to develop a more specific plan that helps you convert your savings into a steady stream of retirement income.

Knowing you need to save a lot for your future, is one thing. Putting it into practice can be another because there can still be barriers to starting or saving more. Let’s look at a few of the quandaries investors can find themselves in.

Today’s Expenses or Tomorrow’s Savings?

Lots of expenses compete for your income. It will be the same in retirement, but without a steady paycheck. The more you save now, the easier it may be to cover those expenses.

“For someone juggling today’s bills versus saving for the future, putting money away is important—but you can start small,” says Kory. He says a key may be budgeting. “Knowing where your money is going is critical and you may be surprised to find ways to invest more for your future.”

“Consider starting with a 401(k) and the match, then focus on paying down debts,” says Kyle. “The compounding argument for investing is strong, so the key is to start now. And as your situation improves, you can start saving more.”

Start Now or Start Later?

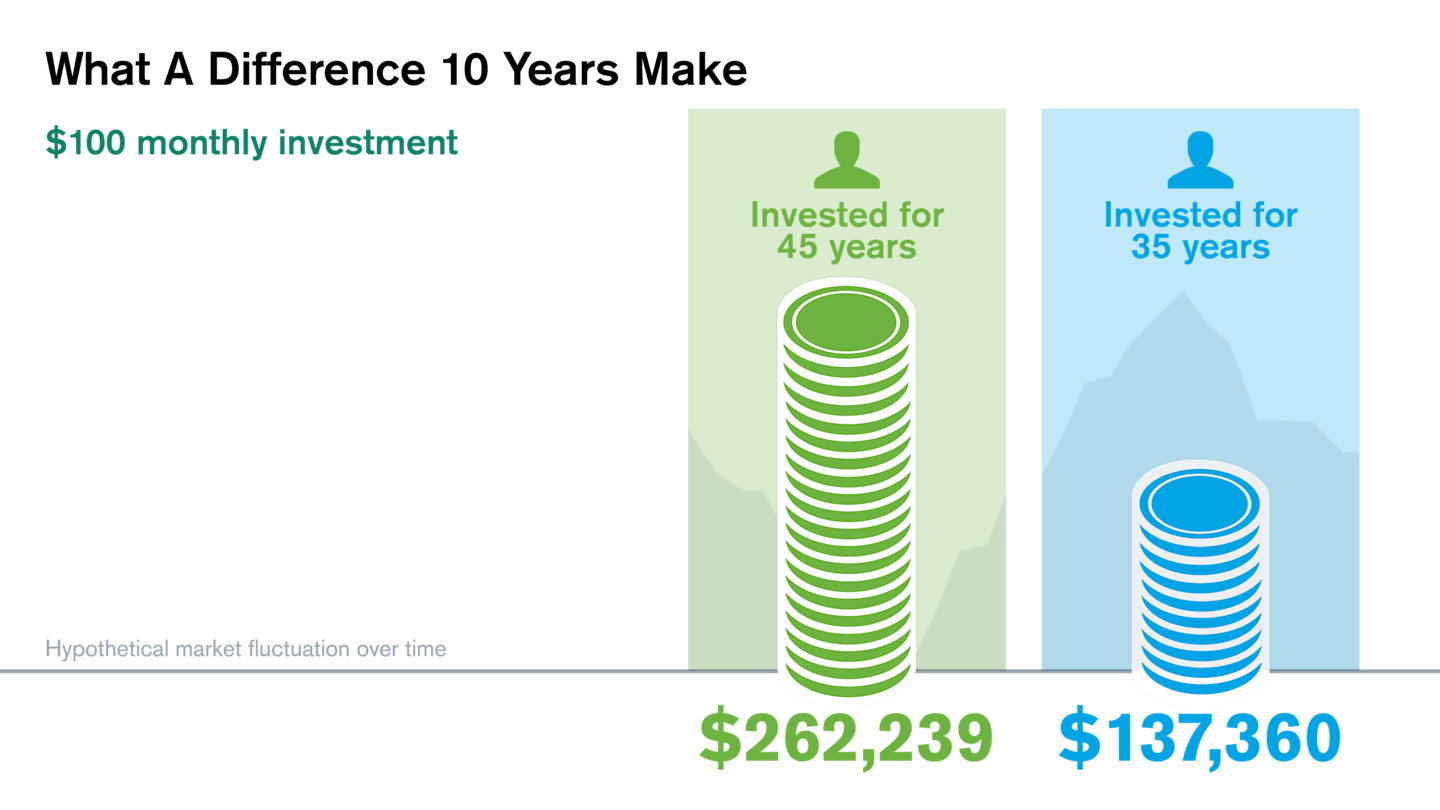

If you are younger and not sure when you need to start investing, consider sooner rather than later. Kyle says, “The longer you wait to invest, the more pressure you may be putting on yourself—especially the longer you wait to make up the difference.”

Starting now versus 10 years from now can have a dramatic impact on your savings. See the difference 10 years could make.

Source: Future Value Calculator, American Century Investments, August 2024.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. It assumes a $100 monthly investment over 35 years compared to 45 years, a 6% annual rate of return, and the reinvestment of interest and dividends. The value of an investment may fluctuate with market conditions, and your redemption may be worth more or less than its original value.

When retirement is far away, it can be tempting to put off investing because you’re busy doing life, but Kory says, “You may find some motivation in seeing just how much you’ve saved and the amount it’s added up to over time. It’s both exciting and empowering knowing your diligence can pay off. And you’ll be glad you invested now rather than waiting when it comes time to live off your savings.”

“Safer” Savings or More Risk?

Sometimes, people try to make up for a savings shortfall by investing in riskier products. But is that a good idea? We advocate avoiding aggressive investments to compensate for a lack of savings.

Kory says, “That strategy might work if you're in your 20s or 30s while you still have the luxury of time. But as you get older, adding more risk—or the wrong kind of risk—can backfire.”

Kyle agrees, “I see investors taking on more risk than needed because they feel they have to. Taking on more risk than you can tolerate can seem like gambling. And from what I’ve seen, it can be a recipe for disaster.”

It's better to:

Save enough, after determining how much you may need.

Put investments in the right risk category for your age, time horizon and comfort level with risk.

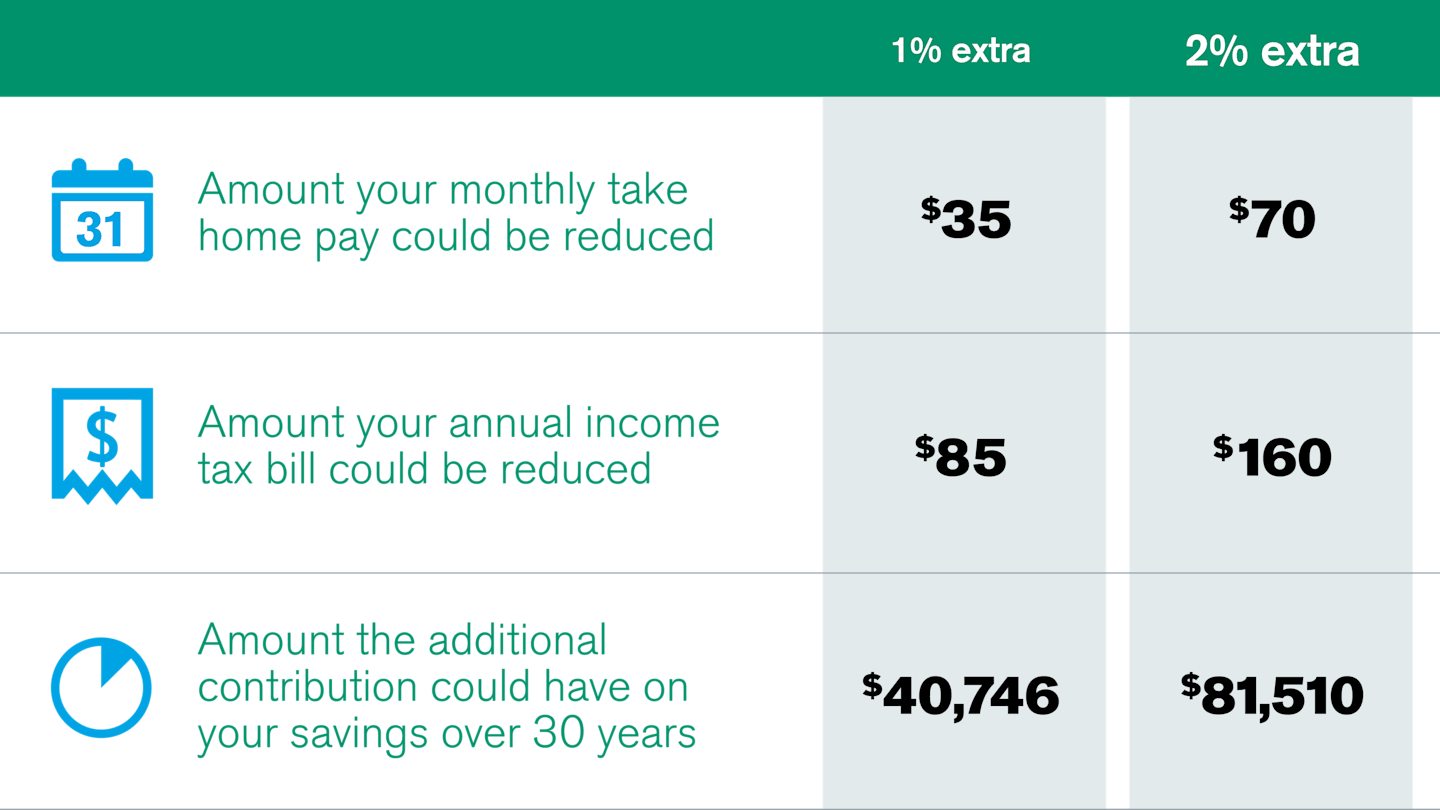

Saving more doesn’t necessarily mean cutting a huge chunk out of your budget, especially if you are participating in a workplace retirement plan. Many plans now have automatic increases that you can opt into and increase your savings by 1% or 2% each year.

“These slight increases every year could really add up for your future,” says Kory. “And you may not see too much change on your take-home pay when your contributions are pre-tax.”

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Calculations assume an annual salary of $50,000 in the 25% tax bracket and contributions of 1% per month and 2% per month with $1,000 in the account before the increase. The amount of take-home pay is reduced is the result of pretax contributions on taxable income. The amount the additional contribution could have on savings assumes investing the 1% or 2% monthly for 30 years with a 6% rate of return. Source: American Century Investments, August 2024, 401(k) Contributions Effect on Your Paycheck Calculator, dinkytown.net.

You can also increase your savings each year in an IRA by a percentage or two and have the same effect on your savings, though any tax benefits will depend on the type of IRA you invest in.

Think About Social Security Now or Later?

It depends. If you are getting close to retirement, Social Security questions become more critical, especially if it will become a major part of your retirement income plan. Knowing the right time to file for you, and considering a spouse or your health are important factors when making those decisions.

“For younger investors,” says Kyle, “The key point here is to remember that Social Security was never intended to be your retirement plan, only a supplement. So, while it will likely be there to help with your retirement income, it should not distract you from starting now, saving an appropriate amount and following a solid retirement savings plan.”

Follow an Investment Plan That Fits You

Another piece that needs to fall into place is an investment plan. This plan includes what types of investments are in your portfolio, how much of each and how much risk you will take. In short, it’s your portfolio’s asset allocation.

DIY or Use an Advisor?

“Choosing investments isn’t always as easy as it seems,” says Kyle, “And that is what we can help with.” What’s important in choosing investments is understanding your timeline and how you feel about taking risks with your investments.

“You can do it on your own by choosing investments that include a mix of different asset types such as stocks, bonds and cash-equivalent funds, like money markets,” says Kory. “Or you could go with an already diversified investment like a fund-of-funds. But sometimes it’s nice to have a professional guide you through those choices.”

American Century Investments offers guidance to help you understand your choices, as well as advice services that range from a one-time session with a certified financial planner to ongoing investment advice with deeper financial planning.

“Our services are all about helping clients reach their investing goals, and we like it that they can choose how they want to work with us,” says Kyle.

Saving for your future is such an important goal. Deciding how, when, how much and what to invest in are important decisions you won’t want to leave to chance. Understanding your options can help you find the best way to save for the future—for you.

Authors

Financial Consultant

Financial Consultant

Ready to Find the Best Way You Can Save for Retirement?

Learn about the advice options available to you.

What is the Average Retirement Savings in the U.S.? motleyfool.com, May 2024.

2024 Retirement Confidence Survey, Fact Sheet #3 Preparing for Retirement in America, Employee Benefits Research Institute, January 2024.

Diversification does not assure a profit nor does it protect against loss of principal.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.