Managing Your 401(k) After Leaving a Job or Retiring

Leaving a job can come with financial decisions, including what to do with your retirement plan. Knowing your 401(k) options can help you make an informed choice.

Key Takeaways

Retiring or changing jobs means you may have to decide what to do with the money in your former employer’s 401(k) or other retirement plan.

Three options are rolling it into an IRA, moving it to a new employer’s retirement plan or leaving it in your former employer’s plan if allowed.

Cashing the money out of your 401(k) and not reinvesting it into another retirement account can trigger penalties and impact your future retirement savings.

Your workplace retirement account offered an easy way to take advantage of tax favored investing as you plan for retirement. Now that you're ready to retire or leave the job, it's important to understand your options for what to do with your 401(k)-plan money.

Three Options for Keeping Your Money Invested and Tax-Favored

1. Move the 401(k) Money to a Rollover IRA for Enhanced Flexibility

One option for your retirement money is to roll it over into an Individual Retirement Account (IRA) with the investment company of your choice. You may gain more control over how you invest the money because IRAs typically offer more investment choices than an employer's plan.

After you roll the money over, you can add to the IRA by making annual contributions within IRS limits, or consolidate other rollovers, but there are some things you should know about combining the money. You can also save in an IRA if you max out contributions to your new 401(k) plan.

Keeping rollover money separate lets you move the funds into another 401(k) or other qualified retirement plan down the road if you want. If you contribute new money into a Rollover IRA, you forfeit that option, and your account will be considered a Traditional IRA.

If you choose to keep the rollover money separate, you can move the money from the rollover IRA into a new employer's plan at a future date. Note there are no current income taxes or penalties imposed for rolling your money into an IRA, though you may pay more in investment fees or account expenses than in your workplace plan.

2. Transfer the Money to a New Employer's Plan

If your new employer also offers a 401(k) plan, you may be able to transfer money from your old job’s plan to the new plan, if the new plan permits. The new plan may offer many of the same advantages (and disadvantages) as your former employer’s plan. Still, you will be able to see the money from your old 401(k) with additional savings from your new plan on statements and through online accounts, possibly making it easier to keep track of all your 401(k) savings in one place.

Starting a new job may bring a raise and allow you to contribute more toward retirement. Check out our 401(k) contribution calculator to see how saving extra money could affect your paycheck and your future.

Note that some employer plans require an eligibility waiting period to complete the rollover or before additional contributions are allowed.

Transferring a Roth 401(k)

If your savings at your former employer are in a Roth 401(k), which can give you tax-free withdrawals in retirement, you may be able to transfer the funds to an eligible new Roth 401(k) plan if the plan allows and your new employer offers one.

Another option is to roll the money over to a Roth IRA. In either case, whether to a Roth 401(k) or Roth IRA, the transfer is not a taxable event.

3. Leave the Money in Your Former Employer's Plan

There may be circumstances where leaving your money in your former employer’s plan makes sense. Your money will continue to grow tax-deferred until retirement. You may be eligible to do that if your vested balance (the amount you can take with you if you leave your job) in your 401(k) is more than $5,000.

Under IRS rules and, depending upon a plan’s provisions, employers are allowed to distribute a former employee’s vested retirement plan account balance if it’s under $5,000 into a personal IRA for the departing employee, even without the employee’s permission.

Note there are some downsides to leaving your money behind in an old 401(k). They include being unable to make additional contributions and potentially facing limited investment choices. There may also be restrictions on changing investments or limits on how often withdrawals can be made. Your former employer could make changes to plan administration and recordkeeping or to investment options.

If your job has changed or you have retired, you may also have different financial goals. Be sure to reevaluate your old 401(k) to ensure it still fits your future plans.

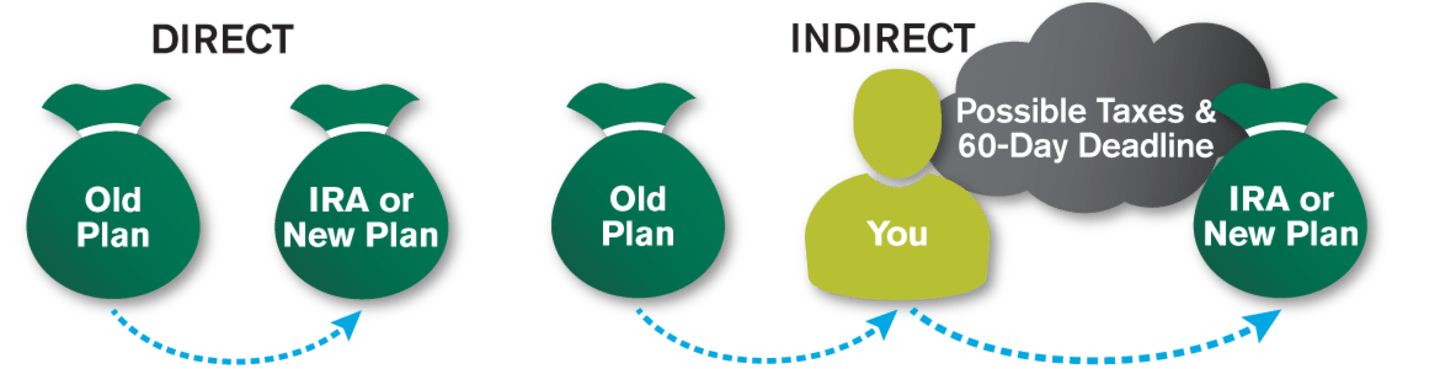

Understanding Direct Rollovers After Leaving a Job

If you decide to roll over your 401(k) into an IRA or new employer’s retirement plan, know there are different types of rollovers. The 401(k) provider can transfer funds directly to the Rollover IRA or new plan or it can be sent to you to make the deposit to the IRA or new plan yourself.

Check with your employer to see if these options are available before you reach retirement age under your plan. Special rules apply to Roth assets. Talk to a tax advisor before choosing which kind of rollover is best for you.

With a “direct rollover,” your 401(k) funds will transfer directly to the financial firm where you’ve opened your new IRA or the recordkeeper/trustee for your new employer’s plan. You don’t have to worry about receiving your retirement funds, which could trigger tax penalties if you don’t complete the rollover within the IRS required deadline.

With an “indirect rollover,” the 401(k) provider will distribute your retirement plan account balance directly to you by issuing a check payable to you. You can then move the money into an IRA or your new employer’s plan.

However, with the indirect rollover method you could incur significant and potential negative tax consequences if you do not deposit the entire amount within 60 days. There could also be additional tax liabilities if you are not 59½. A direct rollover may help you avoid these consequences if you are able to choose that method instead.

Talk to a tax advisor before choosing the best rollover option for you.

Cash Out, Miss Out: The Risks of Cashing Out Your 401(k) Plan

If retirement is years away, it may be tempting to cash out the money in your 401(k) to pay for today’s needs. However, if you withdraw retirement plan money today for emergencies or short-term expenses, besides the potential negative tax consequences described below, you will also forfeit the future likely growth of that money.

Here’s an example of the potential of letting your money grow:

$10,000 invested for 30 years can grow to $57,435 Our cash out calculator lets you run the numbers based on your situation.

This hypothetical situation assumes a $10,000 invested for 30 years with a 6% rate of return, a 24% federal income tax rate and a 6% state income tax rate. These assumptions are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Tax and Penalty Considerations: Navigating Withdrawals

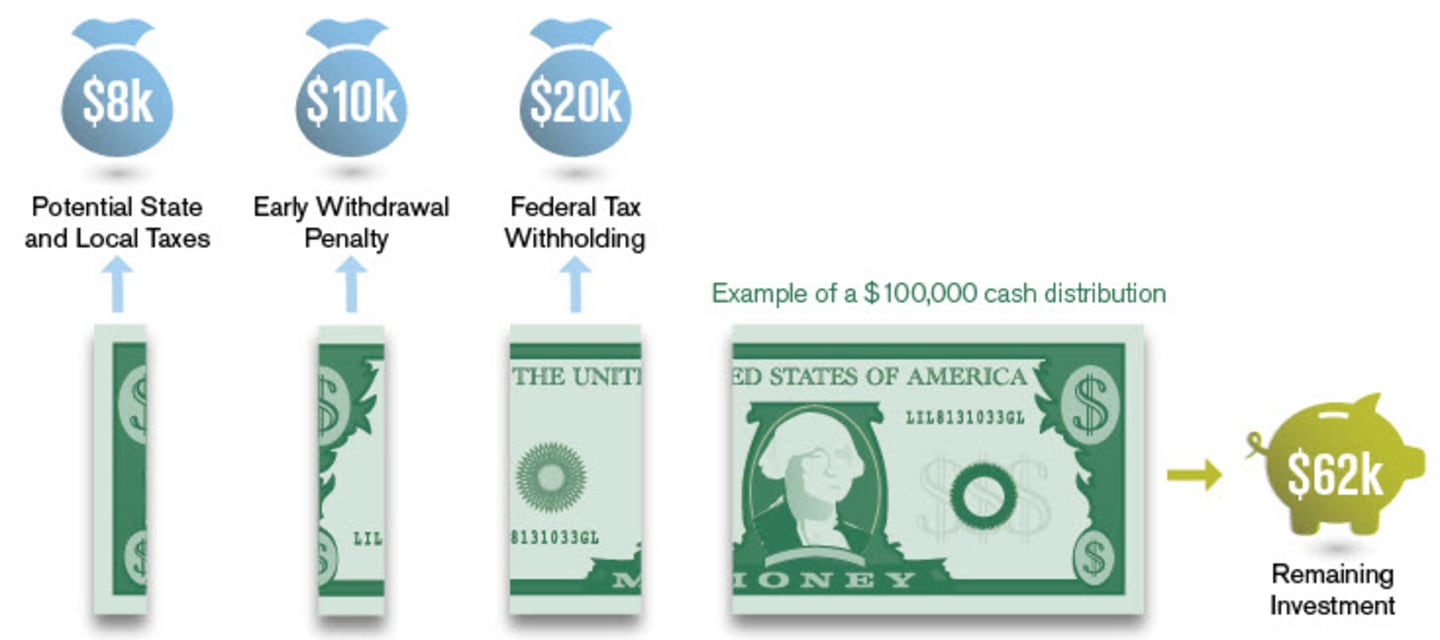

Retirement plans like a 401(k) allow your savings to compound tax-deferred until you begin making withdrawals in retirement. However, if you choose to cash out your retirement plan, you will owe taxes, and possibly penalties depending on your age, immediately on the money you withdraw.

For example, if you take $100,000 from a 401(k) before age 59½, you may receive as little as $62,000 in cash. That includes an immediate reduction by $20,000 in mandatory federal tax withholding at the time of the distribution, $8,000 in potential state and local taxes and a $10,000 early withdrawal penalty when you file your income taxes for the calendar year in which you took the distribution.

Taxes are deferred until withdrawal. State and local income taxes may also apply at withdrawal. A 10% penalty will be imposed for early withdrawal. Penalty may apply if you don't meet age requirements.

If you borrowed money from your 401(k), you may be able to pay that back within a short window after leaving your job. If you don’t, your account balance will be reduced by the money you owe, with that money subject to income taxes, and the 10% penalty if you are under 59½. Check with your plan provider about the rules ahead of time, if possible.

Rollover Benefits: Be the Boss of Your Money

By rolling over your money to an IRA, you gain the financial planning power to choose your investment company and individual investments. You will not be locked into the choices of an employer, which may be limited.

Through an IRA, you may be able to invest in other assets. Also, you simplify recordkeeping by consolidating retirement savings with one provider. Plus, you can get a better snapshot of your finances if you work with one financial company.

Making Informed Decisions About Your 401(k) After Leaving Your Job

Starting a new job is a busy time, but consider retirement planning, including a plan for retirement savings. To recap, your three 401(k) options are to roll over the funds into an IRA, keep your money with your old company’s 401(k) plan (if allowed) or transfer the money to your new company’s 401(k) plan(if allowed). Each option can bring both benefits and potential downsides.

Keep in mind your situation and consider consulting a financial advisor. Making informed decisions about your retirement savings throughout your career can help secure a stable future. Call us today or schedule a call to discuss your options.

Need Help With a 401(k) From a Previous Employer?

Let our consultants help you.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This information is for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. There are different options available for your retirement plan investments. You should consider all options before making a decision. Our representatives can help you evaluate all of your distribution options.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.