3 Reasons to Rethink Cashing Out Your 401(k) Early

Early withdrawals from a retirement account carry a big financial cost. What are the consequences of cashing out—and what might it mean for your future?

Key Takeaways

Cashing out a retirement account can be tempting, but there are financial implications now and at retirement.

If you're in a short-term cash crunch, you could consider borrowing from your retirement account rather than cashing out.

When leaving a job, you have options for managing your old retirement account without taking a 401(k) withdrawal.

It's tempting to cash out your retirement savings during a short-term cash crunch. But you worked hard to save that money. Consider three important reasons to keep your retirement money invested and ignore the urge to cash out and take a premature distribution from your retirement plan.

401(k) Withdrawals Are Common—But Costly

Many people dip into their retirement accounts before they retire. According to research published in 2023, 41% of employees leaving a job cashed out their 401(k).* These figures come from a dataset of over 100,000 employees, most of whom cashed out their entire account balance.

Why do people cash out? Large purchases such as real estate are common reasons. But savers also withdraw money from a retirement account for other reasons, too:

Education

Medical emergency

Job loss

Even though there are a number of reasons to take out a premature 401(k) distribution, it may not be the best plan.

3 Reasons to Think Twice Before Cashing Out

1. The Tax Bill: Now and When You File Your Taxes

Your retirement account is designed to grow tax-deferred until you withdraw from it. A 401(k) withdrawal could mean a higher tax bill. The withdrawal amount is added to your normal income, potentially putting you in a higher tax bracket.

Early withdrawals are subject to immediate 20% mandatory federal tax withholding at the time of distribution. It will be remitted to the IRS as a credit toward the income taxes due on your distribution.

Depending on which tax bracket you're in, you could owe from 10%–37% on your withdrawal when you file your income taxes for the calendar year of the distribution. You could also owe state and local taxes on that amount.

2. The Early Withdrawal Penalty for Cashing Out Your 401(k)

On top of your tax bill, the IRS imposes a 10% penalty on withdrawals if you are under age 59½.

Although the IRS makes some exceptions to the early distribution penalty , such as death or disability, the penalty is generally taken right off the top. Combined with your tax bill, you could forgo nearly half of your retirement savings.

Taxes + Penalty = Potentially Forfeiting Nearly Half of Your Money

Example of a $100,000 Cash Distribution

Source: American Century Investments. This hypothetical example assumes the following: the 20% mandatory federal income tax withholding, 6% in potential state and local income taxes and a standard 10% penalty for early withdrawal. This example is for illustrative purposes only. Please note that the 10% early withdrawal penalty does not apply to distributions made to an employee after separation from service during or after the year in which they turn 55. The 20% mandatory income tax withholding will be remitted to the IRS as a credit toward the income taxes due on your distribution and may be higher or lower than your federal income tax bracket.

3. The Lost Opportunity

Taxes and penalties from a 401(k) withdrawal could hurt your nest egg today. But the biggest hit may come from missed growth opportunities for your financial future. Taking out money today can lead to missing out on your money's growth potential over the years.

Below is an example that shows the money you could potentially forfeit if you withdraw just a portion of your retirement account today versus keeping it invested for 25 years—or keeping it invested and adding to it. The hypothetical example below assumes a beginning balance of $10,000.

Scenario 1

You withdrawal the money now and are under the age of 59½.

Scenario 2

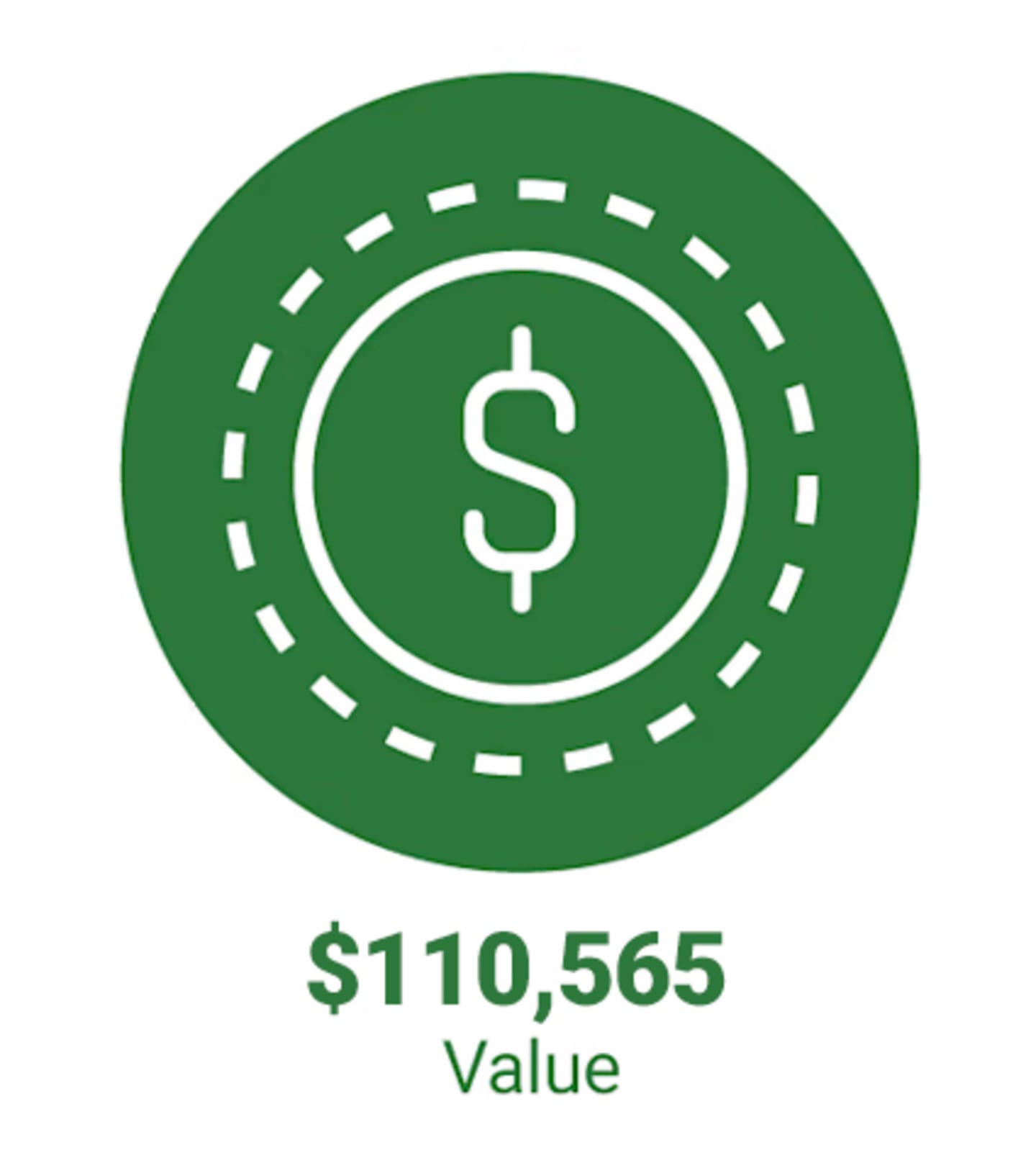

You keep the money invested for 25 years.

Scenario 3

You keep the money invested and you add $100 a month for 25 years.

Source: American Century Investments; Future Value Calculator, Dinkytown, Inc., April 2024. The withdrawal value assumes the following: the 20% mandatory federal income tax withholding, 6% in potential state and local income taxes and a standard 10% penalty for early withdrawal ($6,400) and 6% returns for 25 years if the money ($10,000) stays invested. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance that similar results can be achieved, and this information should not be relied on as a specific recommendation to buy or sell securities.

Financial Calculators from Dinkytown.net

Financial Calculators ©1998-2024 KJE Computer Solutions, LLC

Regret and Worry Are Real for Those Facing Retirement

An early 401(k) withdrawal may also result in sacrifices you may need to make in the future. Less money could mean working longer than you'd planned or rethinking how you want to live.

Building a strategy around your retirement savings can help you avoid the temptation to cash out a 401(k) early. A plan can help you realize how much you should save to cover a retirement that may last 20 years or more.

Not putting away more for retirement is many people's biggest regret. Running the numbers to estimate how much you'll need can help ease the temptation to withdraw money from your 401(k) account early.

Source: 9th Annual survey of plan participants, American Century Investments, published 2022.

Alternatives to Cashing Out Retirement Accounts

Needing to raise cash quickly doesn't have to mean cashing out your 401(k) balance. Before you need money in a hurry, work to build an emergency fund of three to six months' worth of expenses.

Not sure how much you need? Add up your regular expenses to figure that out. To build up your emergency fund, start by looking at your budget to see what you can cut back on or eliminate.

Many 401(k) plans allow employees to borrow from their account balances and then pay themselves back in the form of a loan. (Note that you can't borrow money from an IRA account.) Also consider that you'll have less money for retirement because you missed out on some growth while you paid back the loan. In addition, if you terminate employment before you have paid back the outstanding loan, you may owe taxes and possibly penalties on the amount of the outstanding loan.

If you can't borrow from a retirement account, you might have other options. For instance, you might qualify for a personal loan or a home equity loan. That way, you could keep money in a retirement account and let it grow over time without taxes or penalties.

If you still need the cash and borrowing isn’t an option, you can also see if you qualify for any early 401(k) withdrawal exceptions that are not subject to the 10% penalty tax, if your plan allows for early withdrawals.

Expenses relating to the birth or adoption of a child, a first-time home purchase, disaster recovery, medical premiums (if you are unemployed), among others, could qualify you for penalty-free withdrawals. And starting this year, the SECURE 2.0 Act allows you to take up to $1,000 a year from your 401(k) for emergency expenses for yourself or your family.

Managing a Retirement Account When You Leave a Job

When you leave a job, you don't have to be tempted to cash out your 401(k). You have a few options for managing the money.

Leave it in the old plan.

If you leave money in an old retirement plan, you cannot continue contributing. The account will be subject to rules set by your former employer, but this is likely preferable to a 401(k) cash out. When you leave the money where it is, you won’t be subject to taxes and early withdrawal penalties until you take a distribution.

Roll it into an employer's plan.

Money from an old account would work alongside the new money you and your employer contribute. You might prefer to manage a single retirement account versus having multiple scattered accounts.

Transfer it to an IRA.

Perhaps your new employer's retirement account charges high fees, or it's a small company that doesn't offer retirement accounts. You might decide to transfer your old 401(k) into an IRA as a direct rollover. That way, you can continue contributing and consolidate it with other accounts.

None of these three options involves withdrawing money from your retirement account. Your access to these may vary depending on the details of the old and new retirement plans. If nothing else, you can transfer the old account into an IRA to avoid taxes and early withdrawal penalties.

Keep Your Eyes on the Future

Need help avoiding the cash-out temptation? Let us help answer questions or run your numbers.

Cashing Out Retirement Savings at Job Separation. Marketing Science, Vol. 42, No. 4, July–August 2023, pp. 679–70.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.