Dividends: Balancing the Scales in an Uneven Market

When headlines chase risk, dividends can add needed context.

Key Takeaways

Dividend-paying stocks may offer income potential and diversification in today’s risk-driven market.

High dividend-yielding stocks are undervalued compared to the broader market, offering a potential opportunity.

Reinvesting dividends has historically led to greater wealth growth than depending solely on price returns.

During times when investors tend to gravitate toward riskier and more speculative assets, dividend-paying stocks may offer a compelling counterbalance.

The appeal of dividends, distributions paid to shareholders from a company’s profits, extends beyond simply generating income. They can also help diversify portfolios, lower volatility and provide avenues for investors to realize returns in a stock market where prices may not advance appreciably after an extended bull run.

How Much Do Dividends Matter to Total Return?

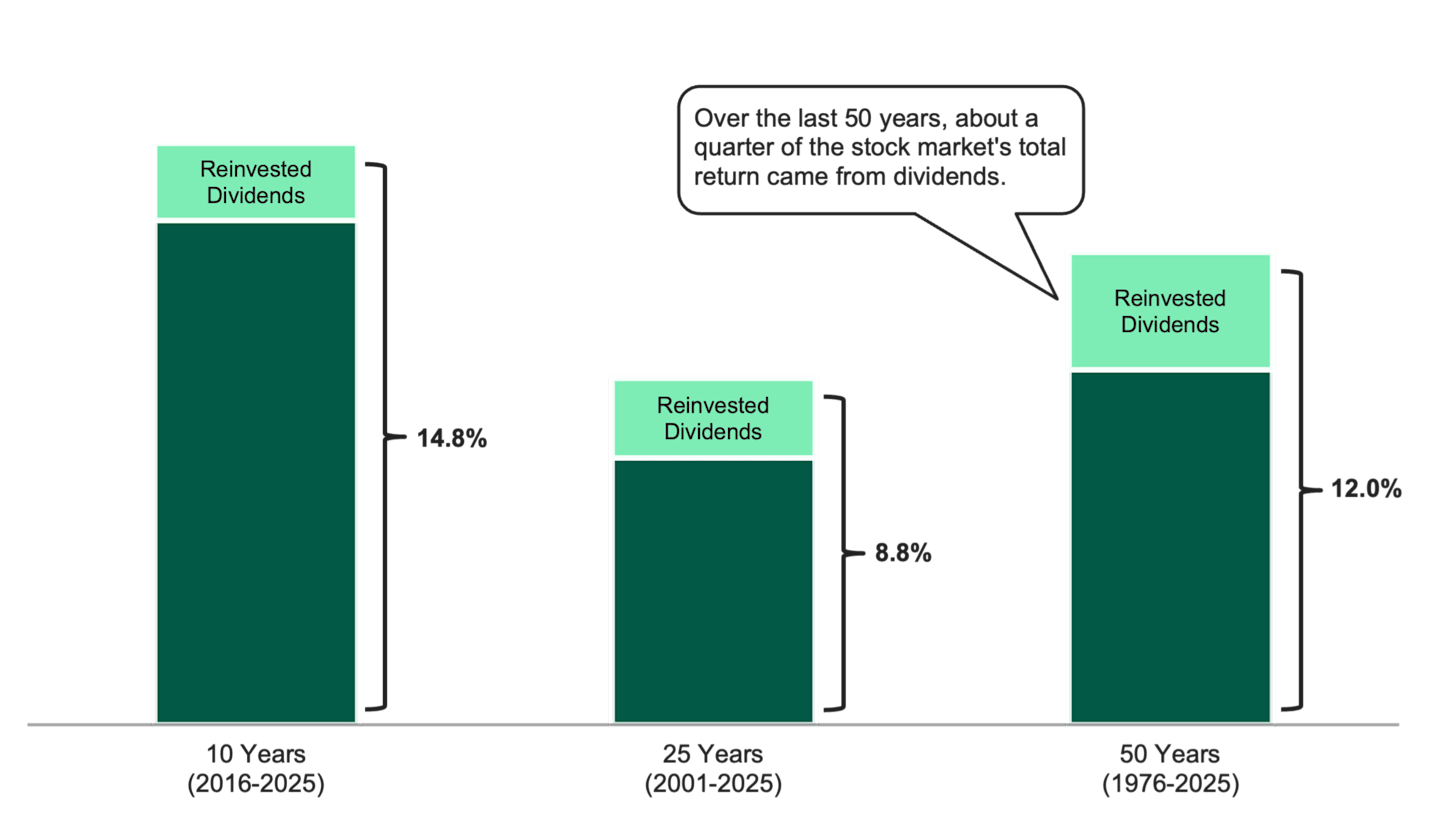

Dividends have accounted for about 25% of the total returns generated by the S&P 500® Index over the last 50 years. See Figure 1.

Figure 1 | Reinvested Dividends Have Significantly Contributed to Total Return

Data as of 12/31/2025. Source: Morningstar. Performance in USD. Past performance is no guarantee of future results.

This fact alone suggests that dividends can play an essential part in a broader investment strategy. Dividend contributions have historically been high during periods of market turbulence, such as the World War II years of the 1940s and the 1970s, when runaway inflation and oil supply shocks led to stagflation.

During the early 2000s, known as the 'lost decade” (2000-2009), equity returns were negative. Yields accounted for more than the entire total return during this period.

With the Uncertainty of Today’s Bull Market, What Role Can Dividends Play?

Investors have recently become cautious about the level of investment in artificial intelligence (AI), as there has been relatively little revenue generated so far.

Meta’s stock sold off on October 30, 2025, after the technology giant announced a new wave of AI-related investments that increased the company's debt on its balance sheet. In December 2025, Oracle’s share price plummeted after the technology company, which has a significant stake in AI, failed to meet its revenue growth estimates. The next day, it was Broadcom’s turn in the glare: The chipmaker’s shares declined when its earnings disappointed Wall Street.

Beyond AI, other risks loom in the current market environment. The labor market is weakening. U.S. tariffs, which roiled the markets last April, stand on unsteady legal ground. Inflation remains above the Federal Reserve’s target.

Dividend-paying stocks may present a contrast to the unpredictable market and the severe effects that bad news can have on riskier stocks.

Many dividend-paying stocks have tended to reflect companies with stronger fundamentals, such as ample free cash flow generation, savvy capital allocation strategies and durable business models. As a result, their stocks have generally tended to be less volatile.

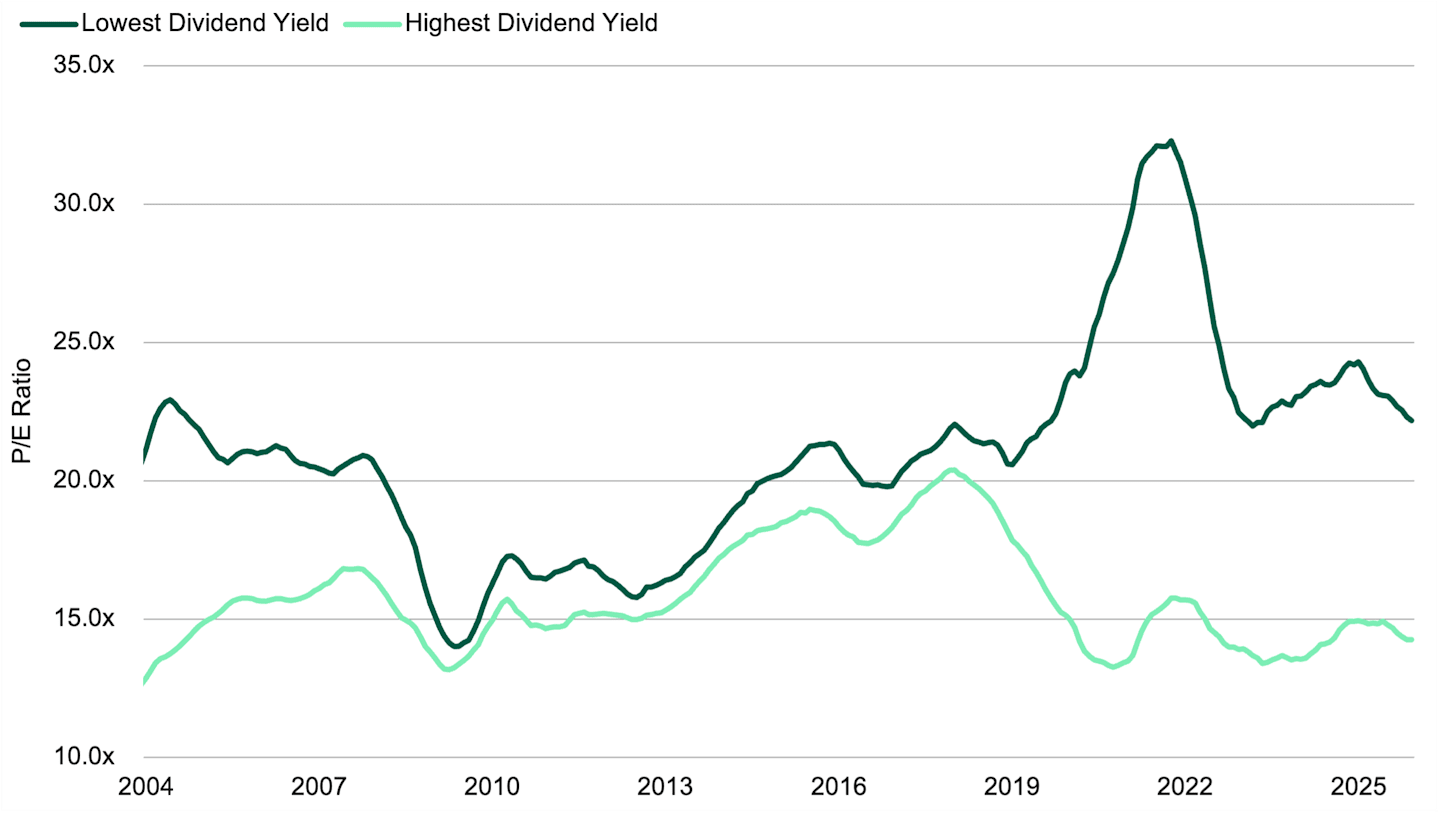

Despite these compelling characteristics, investors have largely overlooked dividend yield. As Figure 2 shows, high dividend-yielding stocks are trading at historically low levels compared to the market and lower-yielding securities.

Figure 2 | Stocks with High Dividend Yields Are Cheap

Data from 1/1/2004 - 12/31/2025. Source: FactSet. 12-month average, dividend quintiles of the Russell Midcap Index. In our glossary, we define price-to-earnings (P/E) ratio. Past performance is no guarantee of future results.

We believe this extended period of stretched valuations suggests there’s a chance that the trend could reverse. If and when it does, it may happen quickly.

Overall, these qualities offer low correlations to the growth-oriented stocks that dominate today’s market environment.

Can Dividends Help Balance Risk and Return?

Like any investment security, dividend stocks aren’t perfect. Investors chasing high dividends risk investing in companies that may be struggling, as falling stock prices can make dividend yields appear more attractive.

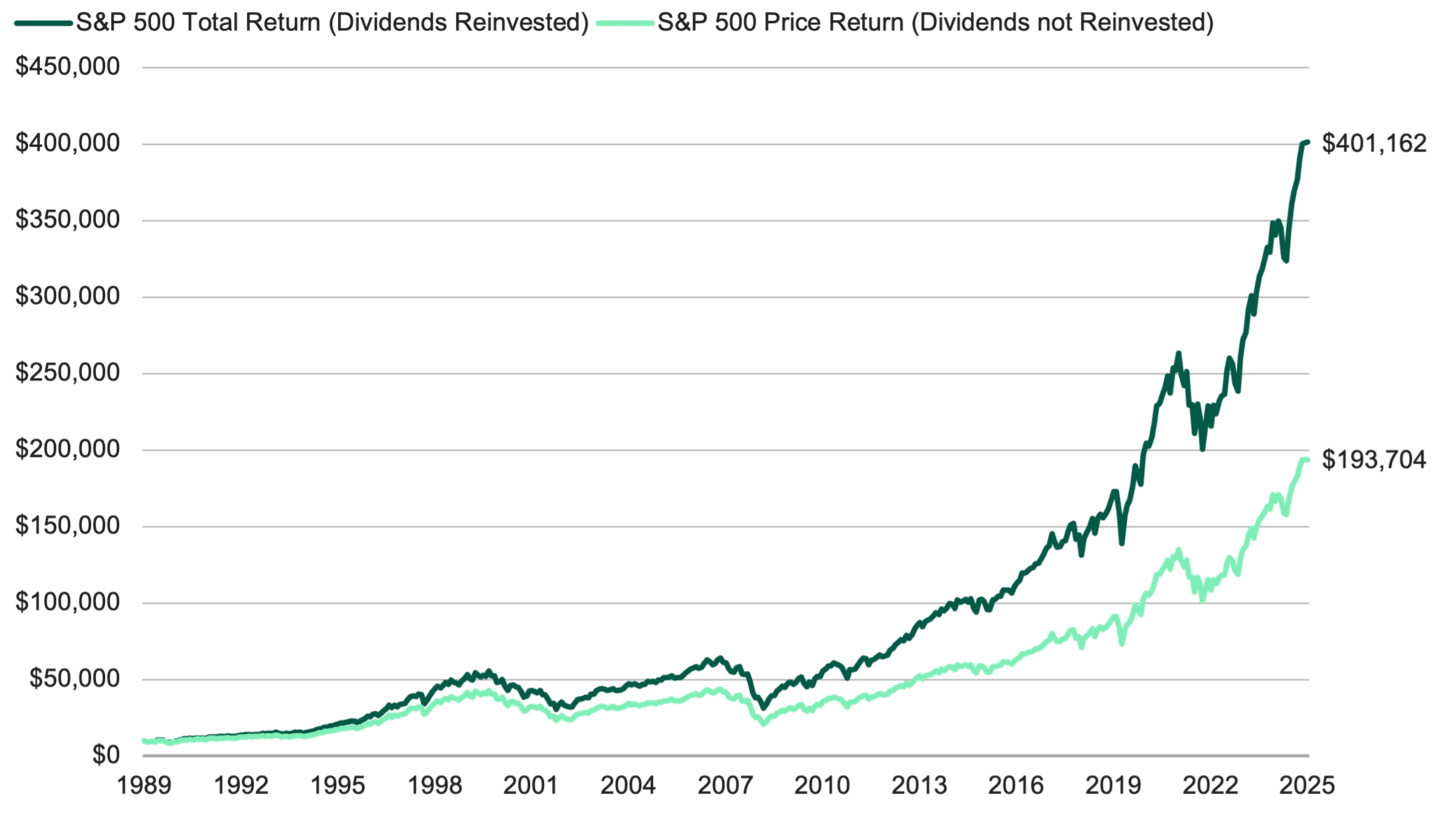

Still, reinvesting dividends has historically led to greater wealth accumulation compared to price returns when dividends aren’t reinvested, as illustrated by the hypothetical example in Figure 3.

Figure 3 | Dividends Have Helped Build Wealth Over Time

Data from 12/31/1989 - 12/31/2025. Source: FactSet. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Past performance is no guarantee of future results.

The chart shows that dividend-paying stocks aren’t just a way to play defense. They can also offer the potential to lower risk and correlations in a market where investors tend to chase higher returns in riskier sectors.

Authors

Senior Client Portfolio Manager

Check Out Our Value Capabilities

Dividends and yields represent past performance and there is no guarantee that they will continue to be paid.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

©2026 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.