AI-Driven Energy Demand: Uncovering Large-Cap Growth Opportunities

Fueling the future with advanced energy innovations.

Key Takeaways

AI-related energy demand is straining aging U.S. power infrastructure, highlighting the need for significant investment in power generation.

Given the surging energy demand, investing in natural gas infrastructure has become a more viable and appealing option than it was a few years ago.

We see upside potential in select energy-related stocks, but careful analysis is crucial given the high expectations and valuations in the sector.

A famous tech CEO compared artificial intelligence (AI) to the mastery of fire or electricity in terms of its importance to humanity.1

That’s a bold assertion! Fire is believed to have played an essential role in human evolution by transforming our ancestors’ diet and enabling the development of their large, all-conquering brains.

Electricity has been the driving force behind the modern global economy for over a century. Its adoption and use directly correlate with a society’s level of development across nearly every meaningful metric.

While we can’t claim that AI will similarly impact future human evolution, we can recognize its significant potential to transform economic and social conditions in contemporary society.

Fire and electricity are important to consider because they represent energy's crucial role and transformative power in human experience. If AI comes anywhere close to achieving even a fraction of its envisioned potential, access to energy will be vital in making that a reality.

This means that investing in AI isn’t limited to the companies that manufacture chips or computer models. The specific opportunity we want to discuss is investing in power generation.

Of course, this isn’t exactly new. The rally in AI-related power-producing stocks has been ongoing for more than a year, which can feel like a long time in the fast-paced world of modern investing.

But that doesn’t mean the opportunity is gone or that every power-producing company is worthy of a place in your portfolio. Thoughtful company-specific analysis is essential.

Just as fire can be beneficial yet dangerous without proper precautions, investing in energy companies requires a broader context and careful consideration.

The Connection Between AI and U.S. Electricity Demand

Our story begins with the so-called “hyperscalers,” which include Alphabet (the parent of Google), Amazon.com, Meta Platforms (the parent of Facebook) and Microsoft.

Financial analyst Moody’s conservative estimate is that U.S. hyperscalers spent more than $210 billion on capital expenditures in 2024, largely driven by the need for AI infrastructure.2 State Street forecasts that these companies’ spending will exceed $320 billion in 2025.3

Indeed, our colleagues recently opined about the extent to which the “One Big Beautiful Bill” is a boon to Big Tech. This is significant because power availability is becoming a critical bottleneck for AI development, as it is challenging to scale up energy supply rapidly.4

AI data centers need more electricity than traditional ones because their specialized chips generate more heat and require more power. As technology improves, the power needed for each chip will increase, leading to even higher power use in AI server racks.

According to Goldman Sachs, a ChatGPT query requires approximately 2.9 watts or almost 10 times the amount of electricity to process as a traditional Google search (about 0.3 watts).

Add it all up, and McKinsey predicts data centers could increase their electricity consumption from 3% to 4% (25 gigawatts) of total U.S. electricity today to 11% to 12% (80 gigawatts) by 2030.5

The State of U.S. Energy Demand

The increase in AI energy demand we’ve outlined is occurring at the same time as broader trends that are imposing further strains on the U.S. energy infrastructure.

Specifically, the economy's energy intensity is rising today after more than half a century of decline. Energy intensity refers to the amount of energy needed to produce a given level of economic output.

This is a remarkable reversal. Structural changes in the economy and improvements in the energy efficiency of equipment and electronic devices mean that energy use per unit of economic output has plummeted over time.

For example, we looked at 10-year compound annual growth rates (CAGRs) for U.S. energy demand going back to 1950.

The highest 10-year CAGR was 4.2% (1959-1969). Fast-forward to the period from 2001 to 2024, and it was barely positive, according to a 2025 Barclays Research analysis.

The situation has now changed. We’re experiencing a power supply crunch due to years of underinvestment in our energy infrastructure. This has coincided with a surge in electricity demand from AI-related industries and tax incentives for reshoring manufacturing. As a result, power intensity is increasing once again.

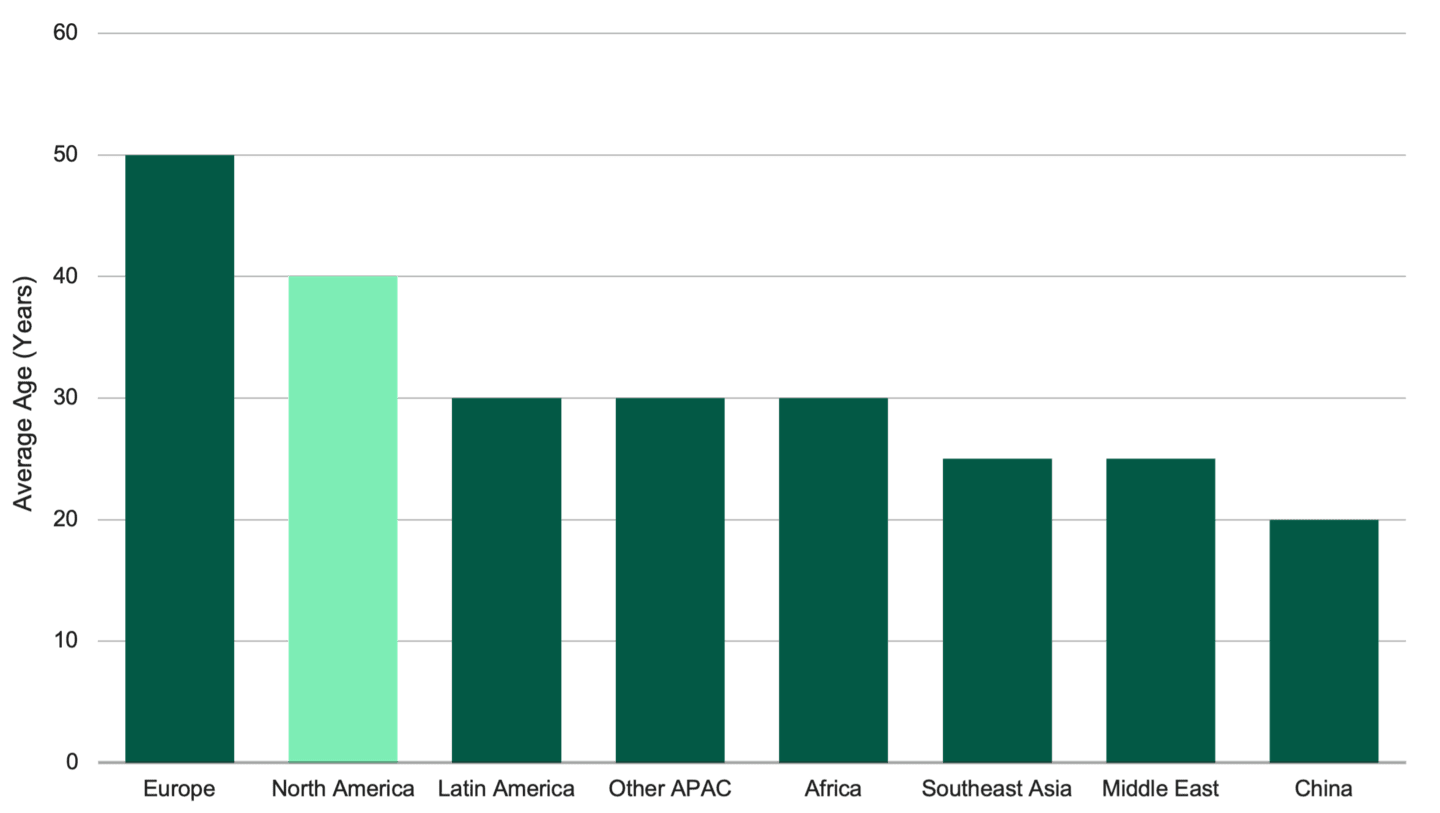

Against this backdrop of rising domestic energy needs, it’s also important to consider the broader international context. As the U.S. is a mature market, we anticipate that energy demand growth will be higher in regions outside the U.S. For example, global electricity demand grew 4.4% in 2024 and is expected to grow by 3.3% in 2025 and 3.7% in 2026.6

Of course, our primary focus is on large-cap companies based in the U.S. that align with our portfolios’ mandates. Nevertheless, it’s essential to understand a company’s exposure to trends outside the U.S. market, which may significantly boost its business.

A recent piece from our colleagues argues that utilities should benefit from the rising global demand for electricity. We view this trend as a further potential tailwind for U.S. energy companies.

Aging Infrastructure and Surging Energy Needs

Unfortunately, matters are even more complicated on the ground. While energy demand surges, U.S. power generation and transportation infrastructure show their age.

Perhaps unsurprisingly, the world’s developed economies also tend to have the oldest energy infrastructures.

It’s not that there has been zero investment in the power grid over time. Energy companies overbuilt capacity in both the early 2000s (brought on by the tech boom) and the mid-2010s. Gas turbines have 20- to 30-year replacement cycles. This means that even this newer power generation capacity built at the turn of the century is now due for refurbishment.

According to a recent Merrill Lynch analysis, nearly a third of U.S. transmission and almost half of distribution infrastructure is nearing the end of its useful life. Figure 1 highlights the aged national power infrastructure and the massive rebuilding job ahead.

Figure 1 | U.S. Power Grid at 40 — Facing a Mid-Life Crisis?

Data as of 12/31/2024. Source: Nexans Presentation.

Four Energy Solutions for Rising U.S. Demand

Natural gas, nuclear power, renewable energy sources and greater efficiency are the key levers available to meet the surging energy demand. We believe increasing U.S. core electricity generation from coal is unlikely.

We expect Trump administration policies to likely slow the rate of coal plant closures but not translate into new coal mining capacity.

Because of the policy uncertainty from one administration to the next, it seems unlikely that companies would commit to the sizable investment necessary to bring new coal plants online when natural gas presents a viable alternative.

1. Natural Gas

The growing need for reliable baseload power is driving demand for natural gas. Given the projections for significant energy demand over the coming years, investing in natural gas infrastructure seems attractive in ways it didn’t just a few years ago.

There’s also a global component to consider, as European countries actively seek to reduce their reliance on Russian natural gas and turn toward the U.S. for alternative sources.

Moreover, the Trump administration's “National Energy Emergency,” Executive Order 14156, has eased concerns about permitting, regulation and litigation risk. Its stated aim is to facilitate the buildout of fossil fuel infrastructure.

As evidence of strong demand, we can highlight the business performance of GE Vernova, an energy equipment manufacturing and service company that operates in three segments: power, wind and electrification. Notably, the firm is the leading manufacturer of natural gas turbines.

GE Vernova's installed base of power-generating capacity accounts for 25% of the power produced worldwide and more than 55% of natural gas power generated in the U.S.7 Furthermore, the company has a growing backlog of orders in its natural gas business, filling its pipeline for the next several years.

2. Nuclear Power

Nuclear power is attractive because it offers reliable, clean, around-the-clock energy. This has resulted in efforts to restart inactive reactors and approvals for new construction of small modular reactors (SMRs).

SMRs are advanced nuclear reactors with a power capacity of about one-third that of a traditional nuclear power reactor. They are cheaper and quicker to construct.

SMRs can theoretically be brought online more quickly than traditional nuclear plants. In addition, their small size should make them easier to manage and offer a better safety profile than full-scale reactors. We said "theoretically" because there are currently no fully operational SMRs in the U.S. The first SMR in the U.S. is expected to be operational in the early 2030s.

However, it’s unclear whether nuclear power will become the dominant energy technology because even these so-called “small” reactors are currently the costliest form of new generating technologies.

Nuclear power providers are highly speculative investment candidates. These companies generate no revenue while incurring massive capital expenditures to build new reactors.

A good example is NuScale Power, whose stock has experienced significant volatility yet has performed well in recent years. The company is focused on securing long-term power contracts. It’s a classic growth stock, similar to those in the biotechnology sector, as investors are betting on future returns to justify the considerable upfront investment.

As we write this in September 2025, the company announced a deal to provide nuclear power to the Tennessee Valley Authority.8 The stock surged on the news, and investors hope this validates the shift to SMRs.

However, we shouldn’t forget that in 2023, the company announced an end to its earlier nuclear power deal with the Utah Associated Municipal Power Systems due to concerns about higher-than-expected costs.

The point is that these are huge, expensive projects that carry unique risks and take years to realize. We believe this further supports the idea that while structural trends favor this area, conducting individual security selection and thorough analysis remains essential.

3. Renewable Energy Sources

Natural gas remains the dominant power source in the U.S., but there has been a gradual shift to renewables, supported by previous presidential administrations.

However, the Trump administration’s opposition to renewable energy projects has led to a slowdown in investments in this sector. Nevertheless, according to an Axios analysis, global investment in such projects reached a record high in the first half of the year.9

The demand for renewable energy is influenced not only by policy but also by market forces. The relatively lower cost and time to market mean investment in renewables will likely continue going forward, unless the regulatory uncertainty and hurdles are perceived as insurmountable.

It’s worth noting that in early 2025, the Trump administration cancelled two advanced wind power projects, calling into question the viability of these sorts of projects.

4. Greater Energy Efficiency

Paradoxically, the technology leading to concerns about a lack of power also offers a potential solution. That’s because AI technology could improve energy efficiency and energy company operations.

Power systems are complex, data-intensive operations, so AI could make distribution systems more reliable and effective. AI could also be deployed to aid in discovering and developing natural gas and other fuel sources.

In addition to advancements in AI and enhancements to the power grid, we anticipate continued energy efficiency improvements in consumer goods and equipment, as seen in the past. Enhancements in industrial processes, building designs and retrofits, along with ongoing developments in transportation technology, all point toward greater energy efficiency across many sectors of the economy.

The ‘Picks-and-Shovels’ Approach to Energy Investing

The scenarios we’ve outlined so far represent our base case. However, it’s important to remember that investing is a probabilistic exercise with various possible outcomes.

The key risk to our view is likely the persistence of AI-driven data center demand. While we think it’s a durable trend, we could be wrong. AI-focused capital expenditures have been substantial, and the hyperscalers continue to forecast robust investment.

It’s important to reiterate that data center demand is vulnerable if companies begin to question the payoff of continued AI spending. We also mentioned the overbuilding of energy capacity in the 2000s following the tech boom.

This current AI spending cycle echoes that one, and it’s possible that overbuilding energy capacity today could lead to years of decreased demand for power generation projects in the future.

In addition, the power mix may be different from what we anticipate. For example, if we had written this article even just a year ago, before the U.S. presidential election, we’d have touted the strength of renewable energy producers.

We believe there are market reasons why renewable energy projects remain viable, but the political and regulatory environment is significantly more challenging today.

Add it all up, and we think this is a promising area for investment in the future, but risks remain. Power generation and distribution projects are expensive, often take years to come to fruition and carry political and regulatory risk.

This is why our investment approach stresses company-specific research and security selection. It's also why we believe it makes sense to consider companies that produce turbines and components used in wind, nuclear, and natural gas power plants.

This might be attractive as a picks-and-shovels approach to benefiting from energy infrastructure spending while remaining agnostic about the form that power generation takes.

Authors

Explore Our Large-Cap Growth Capabilities

Mind Matters, “Google CEO: AI Is More Significant Than the Invention of Fire,” April 24, 2023.

Maya Derrick, “Moody’s: The Challenges Hyperscalers Face with the AI Boom,” Technology Magazine, July 2, 2025.

Dane Smith and Chris Carpenter, “No Let-Up in Capital Expenditures,” Weekly Market Update, State Street Investment Management, February 19, 2025.

Cy McGeady, Joseph Majkut, Barath Harithas, and Kari Smith, “The Electricity Supply Bottleneck on U.S. AI Dominance,” March 3, 2025.

Alastair Green, Humayun Tai, and Jesse Noffsinger, et al., “How Data Centers and the Energy Sector Can Sate AI’s Hunger for Power,” McKinsey & Co., September 17, 2024.

International Energy Agency, “Global Electricity Demand to Keep Growing Robustly Through 2026 Despite Economic Headwinds,” Press Release, July 30, 2025.

GE Vernova, “Investing in the Future,” Investor Overview, accessed September 8, 2025.

Kevin Clark, “TVA Signs Nuclear Agreement Aimed at Deploying 6 GW of Small Modular Reactors,” Power Engineering,” September 2, 2025.

Ben Geman, “Renewables Investors Are Pulling Back from the U.S.,” Axios, August 26, 2025.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Mutual Funds: American Century Investment Services, Inc., Distributor.

Exchange Traded Funds (ETFs): Foreside Fund Services, LLC – Distributor, not affiliated with American Century Investment Services, Inc.