Healthy Money Habits? Our Best Financial Wellness Tips

Whether it’s a New Year’s resolution, time to dust off your finances in Spring, or anytime, practicing healthy money habits is always in season. Here are our best tips to get started.

Key Takeaways

Many people want to improve their financial wellness at the start of a new year, halfway through, or throughout the year when they see a need. They just know, a change is needed.

Practicing healthy habits can help you set a firm foundation for your financial future, and there’s no better time to start than now.

Making healthy money moves can be done on your own, or you can enlist the help of a trusted financial advisor. A key is sticking with a healthy habit long term.

Practicing healthy money habits comes naturally for some people. For others, it takes more effort. However, in the long run, if you commit to making healthy financial decisions, it can help you stay in control of your finances, rather than letting your finances control you. We believe these tips are crucial for maintaining a healthy relationship with your finances.

1. Budget for Healthy Finances

If you’ve never followed a budget, there’s no time like now. Knowing how you spend your money is foundational to your financial health. It not only helps you avoid overspending and stay out of debt, but it is also essential for a good investment plan.

People who dislike budgets often haven't tried it.

Ryan suggests starting with a simple budget. That could mean starting with an annual budget rather than keeping track of one every month. How you keep the budget depends on your preferences.

For some, that means taking pen to paper, while others prefer apps or online tools to help manage the budget. Download our budget worksheet to get a comprehensive list of categories to consider for your spending plan.

Already budgeting? Don’t forget to revisit your spending plan periodically and make sure it still works for you—and that your needs haven’t changed.

Does Everyone Need a Budget?

We think so; however, you might not need the details others do. If you have a solid emergency fund and pay down your debt regularly, you might be able to be more flexible. It’s smart to watch these two things. If one goes off track, it may be time to refocus on the budget.

2. Build an Emergency Fund

Closely tied to your budget is maintaining an emergency fund for unexpected expenses. It’s a healthy habit to set aside money for roughly three to six months of living expenses.

Saving for emergencies can help prevent busting your budget. Investing in an emergency or rainy-day fund should be just as strategic as any other investment you have.

“For emergency funds, investors may want to consider a high-yielding money market to capture some interest,” says Sarah Pedersen. “It may also help savings not sit stagnant and give it a chance to keep up with inflation.”

She continues: "Money market accounts are designed to help preserve capital, which may make them an ideal consideration for emergency funds. Many money markets also allow you to write checks from the account, which gives investors extra flexibility.

3. Checkups Are Good for Your Financial Health

It’s a good idea to review your finances at least once a year, much like an annual medical checkup. Some people prefer to do this at the end of a year or the beginning of a new one.

Where do you start? Jimmy Merdian says, “Reviewing all your financial statements and checking your net worth are two effective ways to diagnose your financial health.” You also want to review your assets and liabilities and see how you are tracking toward your goals.

Review your savings accounts, investments, and debt at the beginning and end of the previous year. This can help you better understand your financial situation.

This simple act may also inspire you to make changes and motivate you to improve your finances now and in the future.

Financial Checkups Are Easier When You Have a Plan

While having a checkup at least every year is important, having a plan may be the best place to start.

"Many people believe they're too busy for financial planning, but it may not take as long as you think," says Ryan. Clients will need to gather their information, which is likely the most time-consuming part. However, other than that, the consultant will create the plan to fit your goals."

It’s the advisor’s job to do the legwork for your financial plan. After we finish the plan, the review will likely take less than an hour.

Of course, the more details you can provide, the better. However, our consultants say they can help you create a plan, even if you don't have exact numbers to start with.

At what age should you start getting a financial plan? A plan is good for any age—it's not just for those nearing retirement. Additionally, the plan may not be as expensive as you think. Check out our prices for financial planning with personal financial consultations.

4. Invest Regularly for Your Future

Investing on a regular basis not only can build up a nest egg for the future, but it also has healthy benefits for your finances. Investing a set amount each month can keep you on track, and helps you:

Avoid guessing about when to invest and instead focus on long-term goals rather than short-term market volatility.

Ignore market swings and the emotions that come with them. Plus, you will buy more shares when prices are low and fewer shares when prices are high. This is known as dollar-cost averaging.

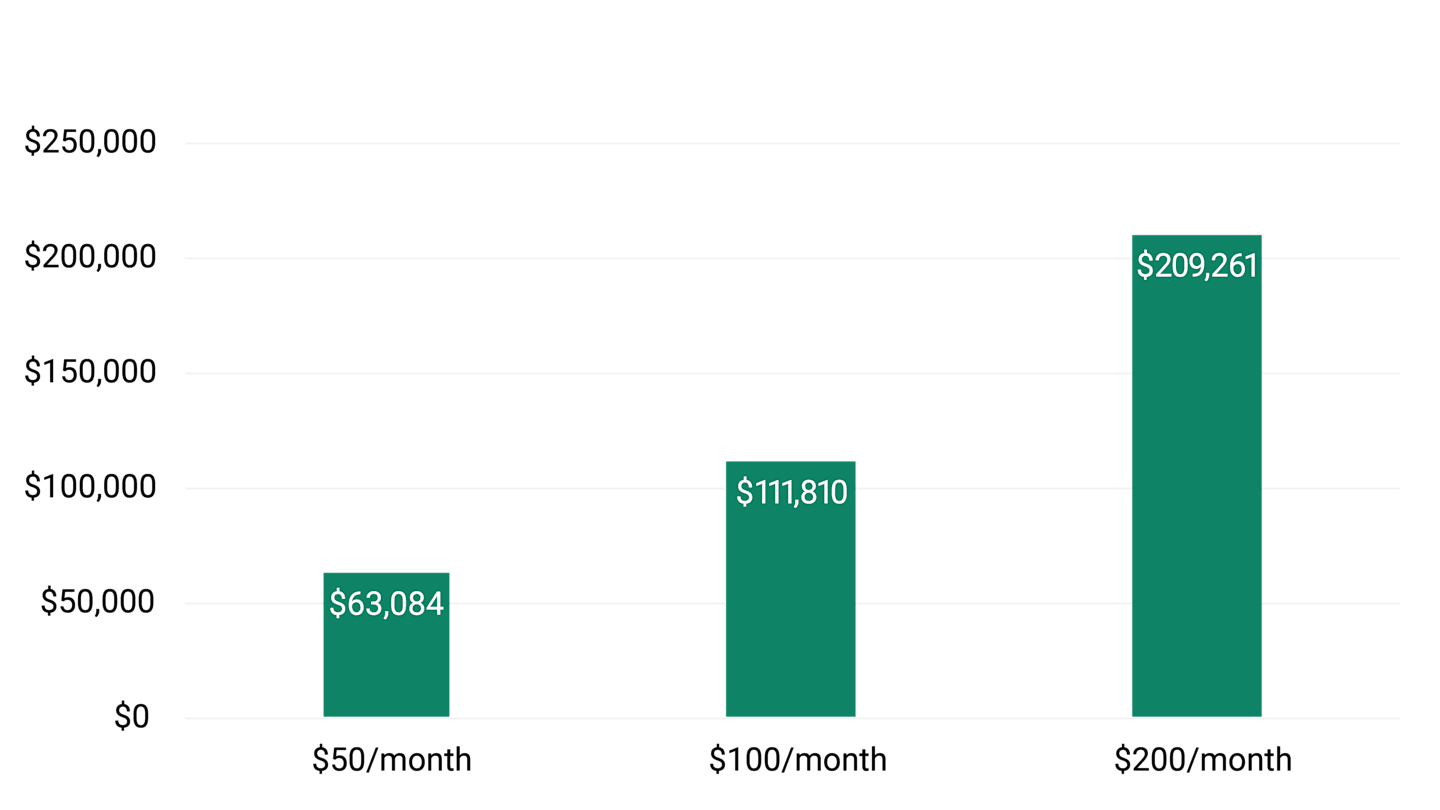

Take advantage of time, which can pay off later. This chart illustrates how regular investments can potentially add up over 30 years.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. The chart illustrates the effects of investing $50, $100 or $200 monthly. Calculations are based on a $2,500 initial investment, investments made at the beginning of each month for 30 years with a 6% average annual return rate. Assumes all reinvestment of all gains, dividends and interest, and does not include fees, expenses or taxes. If all taxes were reflected, the reported value would be lower. Source: American Century Investments Future Value of Investment Calculator. Financial Calculators from Dinkytown.net. ©2025 KJE Computer Solutions, LLC.

Increase Your Investing Annually

Not only does regular investing have its benefits, but you may also want to consider increasing your investment amount—even by a small amount—every year. This applies to your retirement investments, too.

"Start by revisiting your retirement plan contribution limits and income," Addison says. "If you received a raise, it might be a great time to put any extra toward your future."

Sarah says if you have a retirement plan at work, consider increasing your contribution by 1% or 2% each year. "If your contributions are pretax, you might not see much change in your paycheck. This is because it lowers your taxable income.”

No 401(k)? Jimmy says, "You can still boost your retirement savings. Increase your contributions by a percentage or a small dollar amount each year in an IRA. Just remember the annual limits."

Put a reminder on your calendar to review and increase your investment amounts annually. Before long, you could max out your contributions without making a huge dent in your budget.

5. Rebalance Your Portfolio to Keep Risk on Target

Part of a financial checkup will likely include reviewing your investment portfolio. If you have a solid plan that aligns with your goals and timeline, you may not need to make any changes. However, sometimes, a rebalance is necessary.

Rebalancing is buying investments you have too little of and/or selling investments you have too much of if market conditions have gotten your chosen asset allocation mix off balance. The idea is to reset your original stock, bond and cash equivalent target percentages. It’s good to rebalance, but not all the time.

How often you rebalance can depend on market activity that may have resulted in an imbalance of one type of asset or another. It can also depend on whether your goals have changed.

Another consideration for rebalancing is moving your money into other types of investments that align with specific investing objectives. For example, taxes may be weighing on your mind. A move could be to consider more tax-efficient investments, such as exchange-traded funds for non-retirement accounts.

Start With One Tip to Start Improving Financial Wellness

Our tips so far have focused on budgeting and investing, but there are other ways to enhance financial wellness as well. You could plan to pay off debt, increase your credit score or combine old retirement accounts into one. However, choosing one goal to focus on now may give you a better chance of sticking with the habit.

"Whatever healthy money decision you make, make sure you choose one that's doable for you.” Jimmy says that making good financial choices may help significantly improve your financial health for many years. “If you need help with your financial goals, we are here to help.”

Let Us Help With Healthy Money Habits

Are you ready to make a fresh start for financial wellness? You don’t have to go it alone. We can guide you through planning, reviewing, rebalancing and more.

Authors

Financial Consultant

Financial Consultant

Financial Consultant

Financial Consultant

Make a Healthy Start for Your Financial Future

Find out about our personal consultations with a Certified Financial Planner®.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

Rebalancing allows you to keep your asset allocation in line with your goals. It does not guarantee investment returns and does not eliminate risk.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.