Why China and Latin America Are Growing Closer in Trade

Their burgeoning trade partnership continues to strengthen, covering everything from soybeans to electric vehicles.

Key Takeaways

China is challenging — and sometimes surpassing — the U.S. as a trading partner with Latin America.

Latin America exports raw materials to China, while China exports machinery, cars and technology to Latin America, impacting emerging markets portfolios.

This growing trade relationship offers economic growth but also brings competition and potential pressure to limit ties with China.

The U.S. might be Latin America’s next-door neighbor, but over the past 25 years, the region has forged a valuable trade relationship with China. The shift creates opportunities for emerging market (EM) companies on both sides of the Pacific.

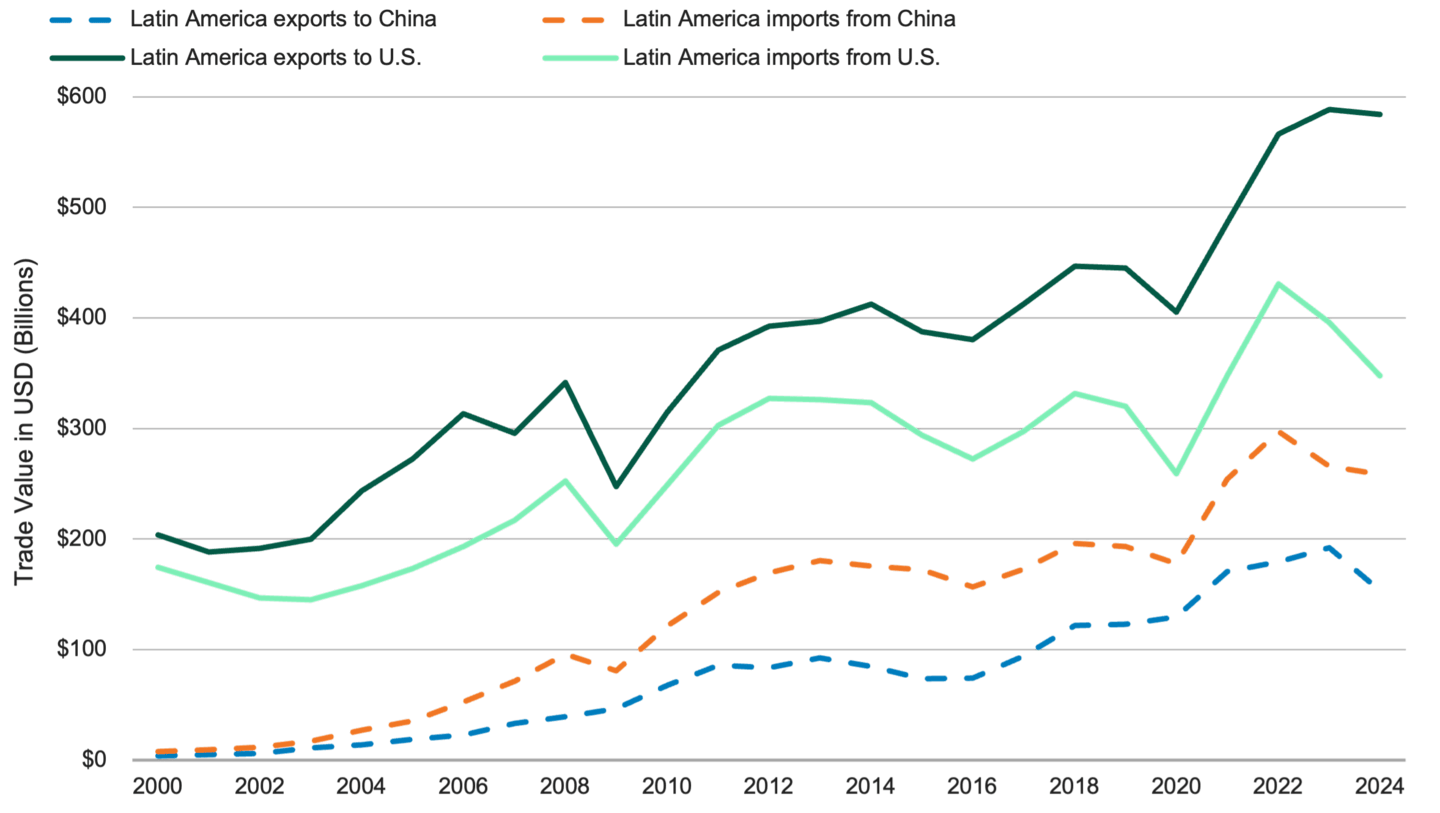

It all goes back to 2001, when China joined the World Trade Organization. Since then, its trade with Latin American countries has steadily expanded, as shown in Figure 1.

Figure 1 | China-Latin America Trade Has Gained Momentum Over the Past 25 Years

Data from 2000–2024. Source: UN Comtrade Database.

If we narrow the focus to South America alone, China has been the continent’s largest trading partner since 2010.1 China is also one of Mexico’s top five export markets.2 (Other regions, however, may be more significant partners from China’s perspective.)

The U.S. remains a major partner for Latin America, especially Mexico, but overall, China’s rise could make the region less reliant on the U.S. This shift could be particularly advantageous for Chinese and Latin American businesses in an environment marked by higher tariffs and geopolitical tensions.

This dynamic is important for investors because China and Latin America combined account for more than a third of the EM investment universe.3 Developments in these regions have significant investment and performance implications for EM portfolios.

What Does Latin America Export to China?

China is the world’s leading manufacturer.4 However, it relies on other countries for the raw materials its factories require to produce smartphones, electric vehicles (EVs), solar panels and other goods.

Latin America has become a key source for many of those materials.

Iron ores and concentrates: Last year, almost 22% of China’s iron ore imports originated in Brazil, behind only Australia.5 China has iron ore deposits; however, they are generally lower quality and more expensive to process.

Copper: Chile and Peru are two of the leading suppliers of copper, which is used in laptops, EV batteries and other products manufactured in China.6 However, earlier this year, China discovered a major copper deposit, which could lessen the country’s need for imported copper.7

Lithium: Chile, Argentina and Bolivia make up the Lithium Triangle, one of the planet’s largest lithium reserves. This metal is another essential ingredient in rechargeable batteries. More than 75% of the world’s batteries come from China, the home of leading producers such as CATL.8

Crude oil: Brazil has become a notable supplier of crude to China, although countries like Russia, Saudi Arabia and Malaysia provide greater quantities.9

China also buys significant amounts of agricultural products from Latin America.

Soybeans: Last year, Brazil shipped about 73% of its soybean production to China, the world’s largest importer of soybeans.10 Most of these shipments became feed for livestock.11

Meat: About 36% of China’s imported meat and edible offal (like liver) comes from Brazil, more than any other country.12 As China’s middle class grows, more households are using their spending power to buy meat.

What Does China Export to Latin America?

Motor Vehicles and Parts

As Chinese companies scale up their EV production, more of their vehicles are arriving in Latin American countries.

According to one analysis, China exported about 130,000 EVs to Brazil during the first five months of 2025.13 That’s roughly 10 times the volume shipped during the same time frame in 2024.

In addition, China-based EV-maker BYD is investing in Brazilian production. The company plans to produce about 10,000 EVs there this year and another 20,000 by the end of 2026.14

Machinery and Electrical Equipment

China has supported Latin American energy, mining and infrastructure developments through programs like its Belt and Road Initiative, which funds roads, ports and other projects globally. This partnership has helped nurture a market for cranes, bulldozers and other industrial equipment made in China.

One example of a high-profile project is the Chinese-funded deep-water megaport in Chancay, Peru. This port can service ultra-large container ships that carry thousands of shipping containers. This development allows South American countries to ship their exports directly to China, bypassing Mexican or U.S. ports and significantly reducing delivery times.

China also exports telecommunications equipment and technology to Latin America. Firms like Huawei have been active in building out 5G infrastructure in the region.15

What Could Complicate the Relationship Between Latin America and China?

Competitive Concerns

Chinese dominance might make it harder for Latin America to cultivate its own value-added industries.

Many countries want to develop advanced manufacturing, technology and other high-value industries. These firms often command higher prices and tend to be more stable than commodity-driven businesses.

When China exports its value-added products to Latin America, it increases competition for local companies. Anfavea, the trade group for Brazil’s automakers, recently warned about a “dangerous flow” of Chinese vehicles into the country.16

To protect its auto industry, Brazil has ratcheted up tariffs on imported EVs. Rates are set to hit 35% next year.17

Pressure from the U.S.

Though China is doing more business with Latin American countries, the U.S. remains a major trading partner. Given today’s trade environment, some nations might avoid developing close relations with China to prevent jeopardizing their ties with the U.S.

Mexico is a prime example. As part of its trade talks with the U.S., the country reportedly offered to match U.S. tariffs on China.18

The Potential for Durable Growth

In our view, the evolving trade dynamics between China and Latin America present significant opportunities for EM investors. Closer ties between the trading partners could further expand trade and strengthen supply chains.

All the countries involved may face concerns about competition and oversupply. However, because of this strengthening relationship, we remain positive about the potential for long-term, durable business growth.

Authors

Sr. Client Portfolio Manager

Check Out Our Global Growth Capabilities

Diana Roy, “China’s Growing Influence in Latin America,” Council on Foreign Relations,” June 6, 2025.

UN Comtrade Database, as of 7/18/2025.

MSCI Emerging Markets Index, as of 6/30/2025; Adrian Carranza, Guillermo Cano, and Naoya Nishimura, “Emerging Markets in Latin America Are Not Just More of the Same,” MSCI, June 20, 2025.

World Bank Group Data, Manufacturing – Value Added, through 2024.

UN Comtrade Database, as of 7/16/2025.

U.S. Geological Survey, Mineral Commodity Summaries 2024.

Li Peixuan, “China Discovered Massive Copper Deposit of 20 Million Tons,” China Daily, January 6, 2025.

Teo Lombardo, Leonardo Paoli, Araceli Fernandez Pales, and Timur Gül, “The Battery Industry Has Entered a New Phase,” International Energy Agency, March 5, 2025.

UN Comtrade Database, as of 7/16/2025.

UN Comtrade Database, as of 7/16/2025.

U.S. Department of Agriculture, “Interdependence of China, United States, and Brazil in Soybean Trade,” June 2019.

UN Comtrade Database, as of 7/16/2025.

Diego Rodríguez Paez, “How the U.S. Is Helping China Quietly Expand Its Foothold in Latin America,” Americas Market Intelligence, July 1, 2025.

Gov.br, “President Lula Welcomes BYD CEO for the Americas, Stella Li,” December 2, 2024.

Teresa Carrelli, “5G Auctions in Latin America Do Not Veto Huawei as Requested by Washington,” Universidad de Navarra, May 16, 2024.

Anfavea, “Semestre se encerra com indicadores em alta, mas desaceleração em junho gera preocupação para o desempenho no ano,” July 7, 2025.

Brazilian Ministry of Development, Industry, Commerce and Services, “Resumption of Taxation for Electrified Vehicles Is Made Official by the DOU,” November 23, 2023.

Jasper Ward, “Mexico Has Proposed Matching US Tariffs on China, Bessent Says,” Reuters, February 28, 2025.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.