How Dollar-Cost Averaging Can Benefit Your Portfolio During Volatility

Market fluctuations can spook investors, but dollar-cost averaging can help you keep investing and potentially lower your average investment cost.

Key Takeaways

Making consistent contributions to your investment accounts can help you take advantage of dollar-cost averaging.

This strategy involves making regular, smaller purchases, which can smooth the effects of market fluctuations on your portfolio.

Many investors already employ dollar-cost averaging in their 401(k) plans, buying shares with each paycheck cycle over time.

Market volatility is unsettling and can tempt us to act, even if it’s not in our best interest. Some investors consider timing the market—selling their investments and keeping their portfolios in cash, waiting to reenter when they feel prices have bottomed.

Yet research continues to show that staying consistently invested in the market has the potential to outperform market timing over the long term.

What Is Dollar-Cost Averaging?

Dollar-cost averaging is a strategy that can help keep you invested during tough market conditions. This automatic investment approach helps keep your emotions in check, while also smoothing the effects of volatility on your portfolio.

Here’s how it works: You make smaller blocks of purchases in a target investment instead of buying a position all at once, and you build up to your desired investment at regular intervals. You can then calculate the average cost of your investment over several purchases.

Focus on the Average, Not Fluctuating Prices

Source: American Century Investments. For illustrative purposes only.

Many investors already benefit from dollar-cost averaging in their 401(k) plans. Contributions are made with each paycheck cycle, and those funds purchase additional shares of their retirement investments over time.

Dollar-Cost Averaging During a Bear Market

It can be tempting to stop investing when times are tough and the markets are sinking. Dollar-cost averaging keeps you investing—and working toward your goals—regardless of what the market is doing. And in a bear market, you may have the opportunity to buy investments at a lower price.

Let’s run through a hypothetical example of investing in a bear market.

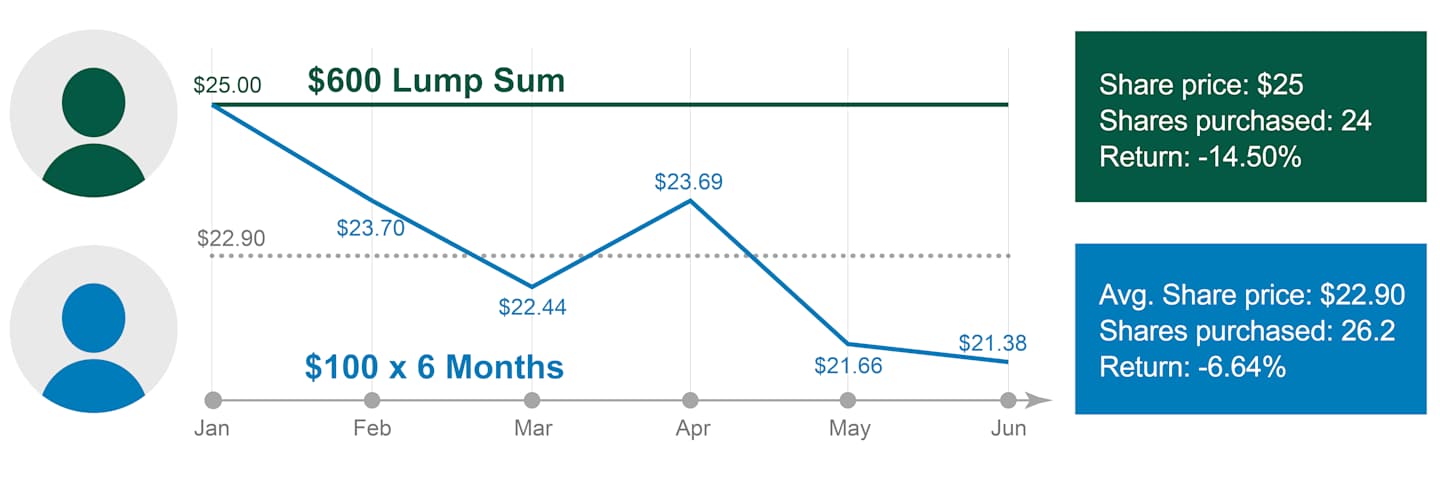

Suppose an investor has $600 in January and wants to invest it in a mutual fund. They can either invest the full $600 in January when the share price is $25, or they can invest $100 a month over six months at various share prices.

At the end of the six months, how did the investment fair under each purchasing method?

Lump Sum Versus Monthly Investments

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

This dollar-cost averaging strategy does not assure a profit or protect against loss in declining markets. To fully take advantage of it, be prepared to continue investing at regular intervals, even during economic downturns

Under the lump sum method, the investor purchased 24 shares in January, so the investment value in June was $513 (24 shares times $21.38 per share). The investment decreased 14.5%.

With dollar-cost averaging—as the mutual fund declined below its January share price—each month’s $100 investment bought more than four shares on average. After six months, the investor accumulated 26.2 shares, and the investment was worth $560.16 (26.2 shares times June’s $21.38 share price). The investment is down only 6.64%.

Will you be receiving money from an inheritance, a settlement or a work bonus? Larger lump sums may require special investment considerations. Managing a Windfall

Does Market Timing Work?

Instead of consistent buying, some investors get drawn into timing the bottom or dips in the market.

Academic research in finance has proved that trying to time the market accurately is nearly impossible. Berkshire Hathaway Chairman and CEO Warren Buffett gave his take on market timing at a past shareholder meeting.

We haven’t the faintest idea what the stock market is gonna do when it opens on Monday—we never have.¹

Attempting to predict a market decline, let alone when it will end, is very difficult. I like to remind clients of the potential growth they miss out on by waiting for the “drop.” If the market goes up by 15% before it drops by 10%, they still would have been better off investing their money from the start.

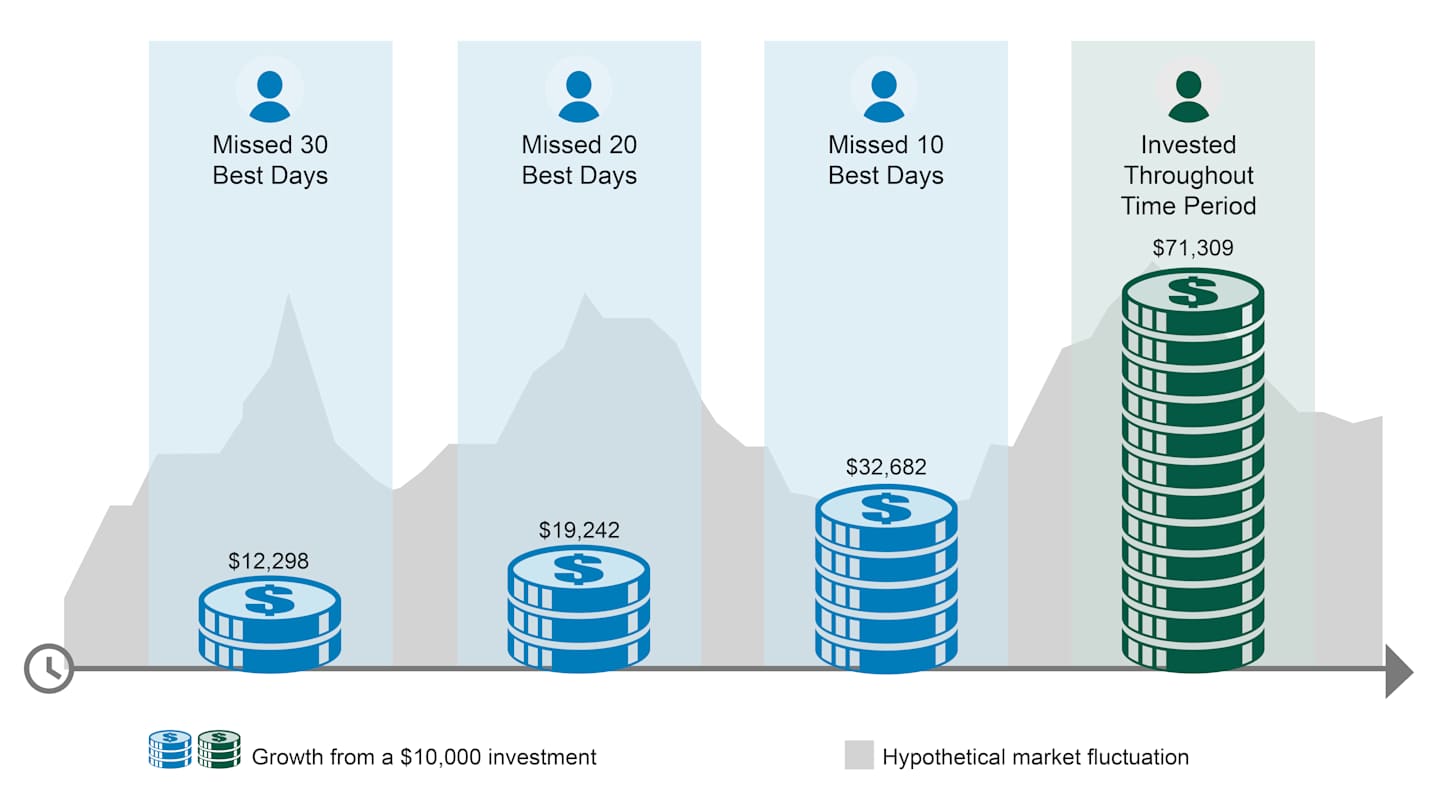

Jumping In and Out of Stocks May Cost You

Source: American Century Investments, FactSet. Growth of $10,000 in the S&P 500® Index. Data from 01/01/1999 - 3/31/2025. The index does not reflect fees, brokerage commissions, taxes or other expenses of investment. Investors cannot invest directly in an index. Past performance is no guarantee of future results.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Dollar-Cost Averaging Versus Buying the Dip

The strategy of “buying the dip” attempts to pinpoint market downturns. Here, an investor builds up money to invest but keeps it in cash and invests it only when the price of an investment declines (dips) from a recent high.

If an investor could accurately predict dips, would it not be better to just buy the dip?

A recent analysis looked at returns for a person with a 40-year time horizon who could time market bottoms perfectly. If they started investing in the S&P 500® anytime between 1920–1980, dollar-cost averaging would still outperform buying the dip 70% of the time.² When the investor’s accuracy was reduced, and they invested within two months of the actual bottom, the strategy underperformed 97% of the time.³

It’s worth noting that neither method will save you from losses if the investment declines in value over your investment time horizon. But when looking at strategies for investing, you typically will do so in investments that you think will rise over time.

Why did consistent investing outperform?

The Power of Compounding

While waiting for the dip, the investor is building cash on the sidelines that does not benefit from investment returns that can compound over time.

Historically, the market can go several months and even years without experiencing a decline large enough to be considered a dip. Missing just a handful of days in the market can drastically reduce an investor’s average returns over the long term.

During times of volatility, there are often swings in the market in both directions—something investors don’t always think about. It’s not uncommon to see a big “up day” during a bear market, and if you miss out on those days too, you could hurt yourself in the long run. Staying in the market and putting your investments to work systematically positions you to capture the power of compounding, often called the “8th wonder of the world.”

Of course, while compounding can lead to exponential growth with positive returns, negative returns can also erode capital.

Automatic Investing Tames Emotions and Simplifies Decisions

Dollar-cost averaging lends itself practically to the investment process. By taking the investment decision off the investor’s plate—much like what’s done with contributing to a 401(k) or other workplace retirement account—an investor can easily stick to an investment plan.

Breaking down contributions into several smaller blocks also greatly reduces the risk of regret from ill-timed purchases. When the market falls, you can be happy to add to your investments at lower prices, and when the market rises, you can be happy that you got in at lower prices.

Authors

Financial Consultant

Start an Automatic Investment Plan Now

Log in to your account to start investing regularly.

2022 Berkshire Hathaway Annual Shareholders Meeting.

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

Maggiulli, Nick (2022). "Just Keep Buying." Harriman House, pg. 167 -177.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

©2026 Standard & Poor's Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.