Beyond Interest Rates: What Else Is in the Fed’s Toolkit?

The Federal Reserve (Fed) is best known for adjusting interest rates. But that isn’t the only tool the central bank uses to manage the U.S. financial system.

Key Takeaways

The Fed seeks to promote a healthy economy by managing monetary policy, regulating banks and providing key services to financial institutions.

The central bank’s highest-profile role includes promoting stable prices and full employment, which guides the Fed’s monetary policy actions.

Beyond setting target interest rates, the Fed uses other tools to manage the U.S. money supply and foster financial stability.

The Federal Reserve (Fed) and global financial markets are inextricably connected. As the world’s largest and most influential central bank, the Fed's policy decisions reverberate throughout the global economy.

Economists, analysts and investors pay close attention to interest rates, and rightfully so. The Fed adjusts rates to fulfill its dual mandate: keeping prices stable (fighting inflation) and promoting maximum employment opportunities.

But the Fed doesn’t just use interest rates to influence the economy. For example, it buys and sells government securities to manage the amount of money in circulation. It also tackles other responsibilities that promote a healthy financial system:

Monitoring and regulating banks.

Providing services to commercial banks.

Acting as the government’s bank.

While setting interest-rate policy is the Fed’s highest-profile responsibility, it’s only one of several policy tools. Understanding how these tools work together can give investors better insight into how the Fed affects the global economy and consumer borrowing costs.

How the Fed Uses Interest Rates to Meet Its Dual Mandate

President Woodrow Wilson established the U.S. central bank in 1913 by signing the Federal Reserve Act into law. The Fed serves as the federal government's banker and a "banker's bank," enabling financial institutions to store reserves, borrow funds and maintain liquidity.

The Fed's dual mandate includes maintaining stable prices (a 2% average annual inflation rate) and fostering full employment (an unemployment rate of 5% or lower). The Fed uses the federal funds rate (fed funds rate) to steer the economy toward these objectives.

When headlines announce the Fed’s latest interest rate decision, they’re referencing the fed funds rate. This is the overnight lending rate banks charge to borrow money from one another. Known as the Fed’s target short-term lending rate, it also influences many consumer loan rates.

The Fed’s Federal Open Market Committee (FOMC) sets a target range for this rate at monetary policy meetings throughout the year. Typically:

The Fed lowers interest rates to stimulate growth when the economy stalls or contracts and unemployment rises.

The Fed raises rates when the economy overheats and inflation increases to slow demand and bring down prices.

Because investors dislike uncertainty, the Fed usually provides forward guidance on its anticipated rate policy and economic perspective to help support financial market expectations.

How Does the Fed Control the U.S. Money Supply?

Lowering and raising rates to achieve inflation and employment mandates aren’t the Fed’s only responsibilities. In fact, the Fed’s founding purpose was to manage the nation’s money supply, a duty that can cause the economy to expand or contract.

To do this, policymakers use three primary tools:

Setting banks’ reserve requirements.

Adjusting the discount rate.

Conducting open market operations.

What Are Reserve Requirements?

The Fed regulates reserve requirements, ensuring that banks and credit unions have sufficient cash on hand to meet sudden customer withdrawals. Adjusting the reserve ratio is one tool the Fed may use to increase or decrease the supply of money flowing through the U.S. economy:

Lowering the ratio allows banks to lend more money, thereby increasing the money supply.

Boosting the ratio will reduce the money supply.

Additionally, the Fed undertakes various actions, including adjusting reserves, to keep interest rates in its target range.

The Term Deposit Facility (TDF) is one tool the Fed uses to achieve this goal. The TDF, which allows eligible institutions to make interest-bearing deposits, is designed to manage overall reserve balances.

What’s the Discount Rate?

The discount rate reflects the rate the Fed charges banks for borrowing money from its reserves. Like the fed funds rate, the Fed adjusts the discount rate to help manage economic conditions and influence short-maturity market interest rates.

The Fed lowers the discount rate to encourage spending and raises it to curtail spending.

For example, a low discount rate makes borrowing from the Fed more attractive to banks. They, in turn, can provide more appealing loan terms to businesses and consumers, sparking spending and economic growth.

How Does the Fed Use Open Market Operations?

The Fed can also influence the money supply by engaging in open market operations (OMOs). This process involves buying and selling U.S. government securities in the open market to influence banking reserves and interest rates.

The Fed uses permanent OMOs to accommodate its longer-term balance-sheet management — that is, growing or reducing the amount of money in circulation. Depending on the Fed's intent, these OMOs can influence interest rates and make financial conditions more accommodating or restrictive.

The Fed uses temporary OMOs, including overnight repurchase agreements (repos), to manage the money supply. Repos are contracts to sell government securities and repurchase them the next day at slightly higher prices. The Fed uses repos to inject money into the economy and reverse repos when it wants to reduce the money supply.

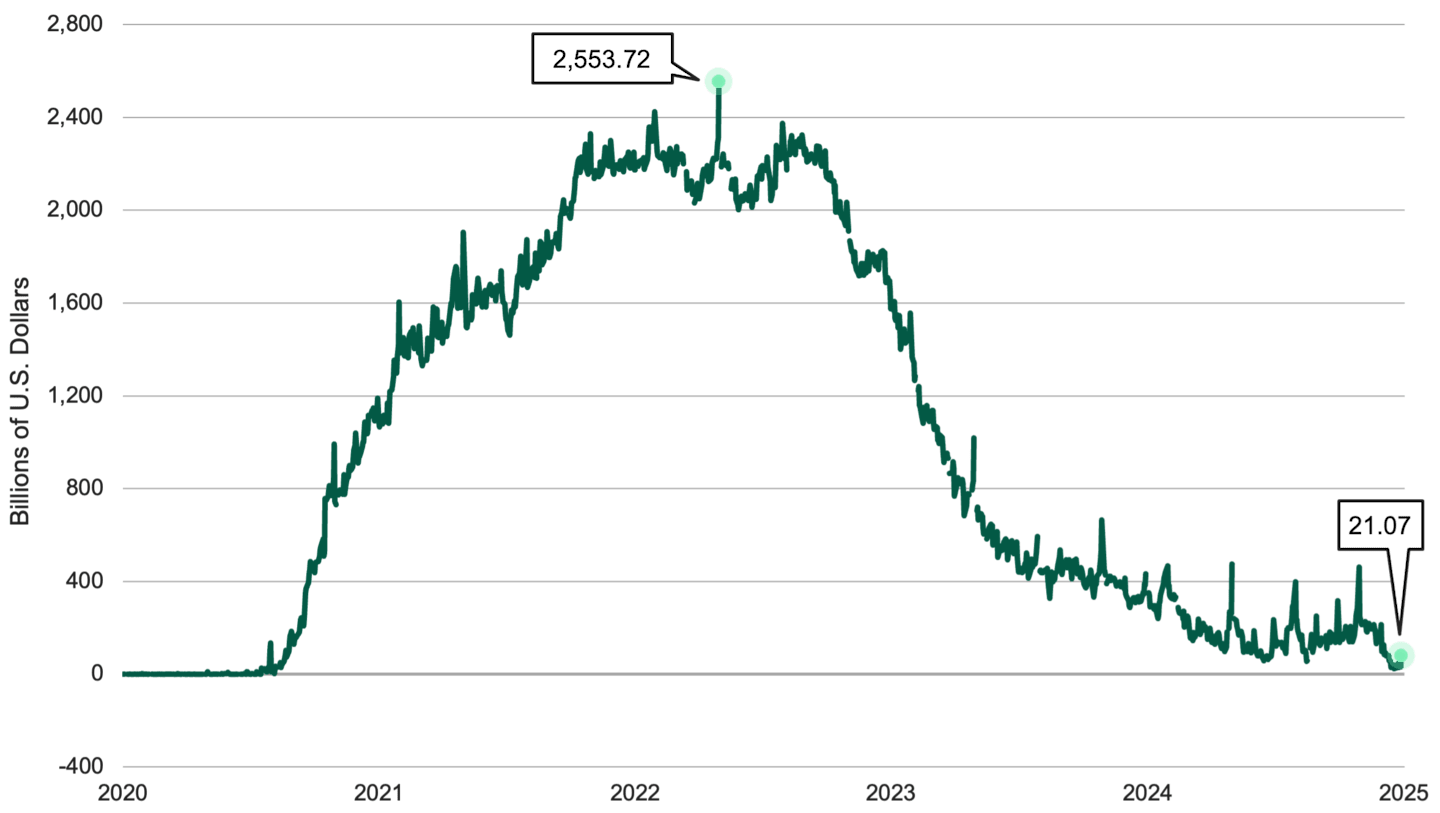

For example, the Fed used reverse repos to boost liquidity during the COVID-19 pandemic and subsequently used reverse repos to tighten the money supply in the post-pandemic years. See Figure 1.

Figure 1 | Treasury Securities Sold by the Fed in the Temporary Open Market Operations

Overnight Reverse Repurchase Agreements

Data from 9/2/2020 – 9/2/2025. Source: Federal Reserve Bank of New York via FRED®.

The Fed also operates the standing repo facility (SRF), which serves as a backstop in money markets to support monetary policy and smooth market functioning. The Fed launched the SRF in 2021 to bolster its ability to provide liquidity to the U.S. financial system.

QE vs. QT: The Fed’s Crisis Response Tools

In crisis times, when OMOs aren’t working sufficiently, the Fed may employ a more powerful tool to spark economic activity.

Through quantitative easing (QE), the Fed purchases securities in the open market. Unlike routine OMOs, this tool involves large-scale purchases of Treasuries, mortgage-backed securities and other debt.

QE injects money into the economy to increase liquidity and lower interest rates. This allows banks to offer more attractive lending terms to borrowers, which can help stimulate economic growth.

The Fed usually resorts to QE during financial emergencies to provide more support to the economy than it can through short-term interest rate cuts alone.

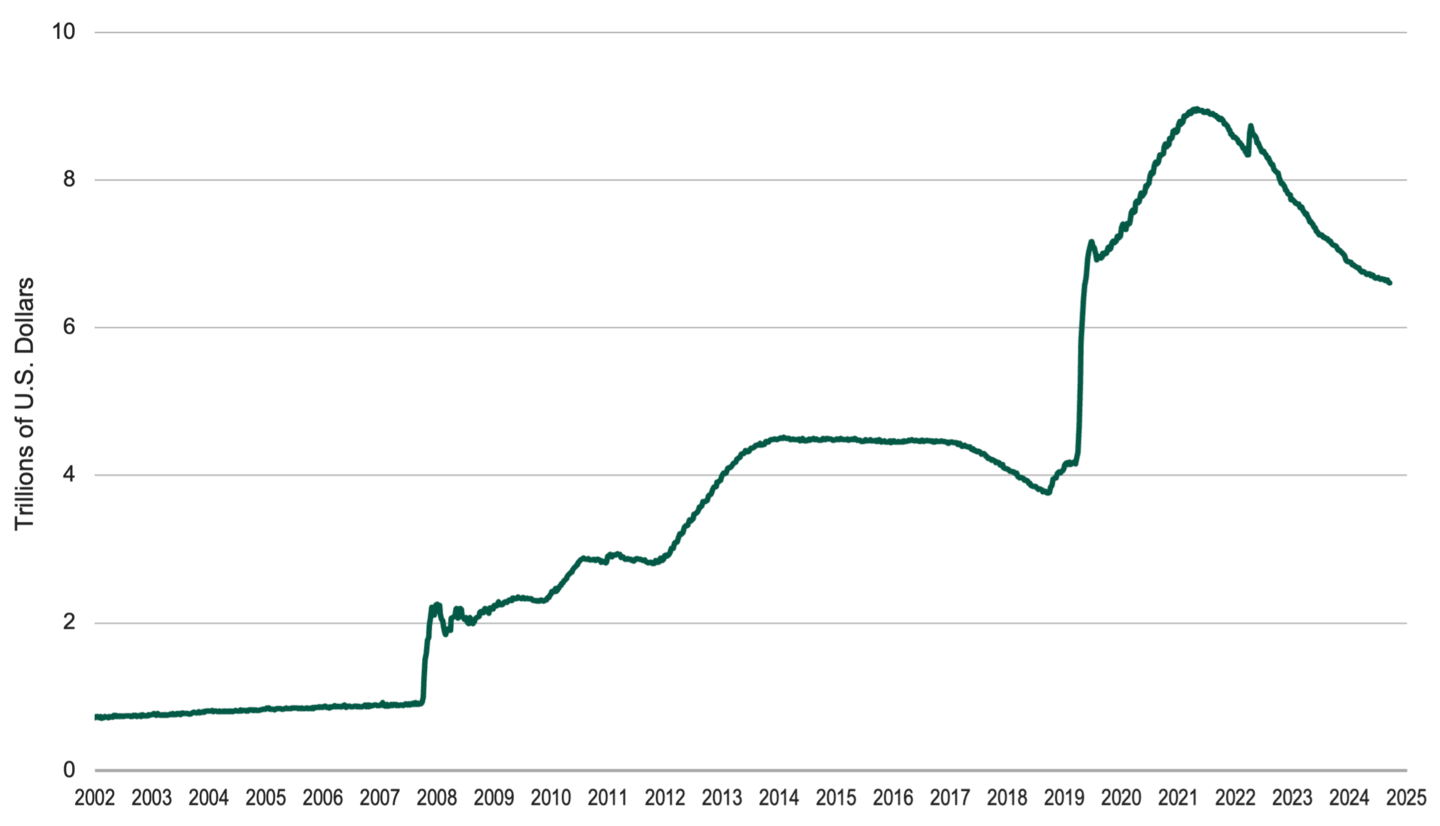

From 2008 to 2014, the Fed’s balance sheet expanded to $4.5 trillion as it used QE to combat the financial crisis and stimulate the economy.1 The Fed also launched a QE program during the pandemic, bringing its balance sheet to a record-high of nearly $9 trillion. See Figure 2.

Figure 2 | Quantitative Easing’s Effects on Fed Asset Levels

Data from 12/18/2002 – 8/27/2025. Source: Board of Governors of the Federal Reserve System (US) via FRED®.

On the other hand, if the Fed believes the economy is overheating and facing rising inflationary pressures, it may implement quantitative tightening (QT).

This process is essentially the opposite of QE and removes assets from the Fed’s balance sheet. The Fed sells its securities holdings or lets them mature, thereby removing liquidity from the financial system.

When buyers purchase those assets from the Fed, they effectively remove from circulation the dollars they paid for the securities. With fewer dollars flowing through the economy, the money supply tightens, interest rates tend to rise, and consumer demand slows.

Most recently, the Fed employed QT in 2022 to ease inflationary pressures following its pandemic-era QE.

What’s Forward Guidance?

As part of its QE and QT programs, the Fed offers a tentative schedule for its asset purchases and sales. By informing investors about its intentions, the Fed seeks to manage financial market expectations.2

This practice is similar to the Fed’s interest rate strategy. The Fed offers forward guidance on its likely interest rate changes and shares its economic perspectives to help shape expectations within financial markets. This helps temper market volatility when the FOMC changes monetary policy.

How the Fed Uses Multiple Tools for Stability

Since its inception more than a century ago, the Fed’s responsibilities and methods for ensuring stable prices and full employment have significantly expanded.

While setting interest rates often attracts the biggest headlines, the Fed uses various tools to manage the money supply. Its role in maintaining economic stability has increased considerably since the global financial crisis, making it increasingly important in the global economy.

Authors

Senior Portfolio Manager

Fed Watch: Latest Insights on the Federal Reserve

Learn how Fed policy can influence financial market trends and affect your portfolio.

Board of Governors of the Federal Reserve System, “Open Market Operations,” last updated December 18, 2024.

Neil Weinberg, “How Quantitative Easing Actually Works,” Chicago Booth Review, February 20, 2025.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.