How Do Government Shutdowns Affect Markets?

Federal shutdowns can ratchet up market volatility, but there’s usually more to the story.

Key Takeaways

Shutdowns can lead to furloughs of federal employees, interrupted services and delays in economic data reports.

Despite negative headlines, our analysis shows stocks have bounced back quickly after most government shutdowns.

Investors who stayed committed to their financial plans and remained invested during past shutdowns often saw gains over the next 12 months.

It’s not déjà vu. Parts of the federal government went into shutdown mode again in late January and early February. This shutdown came just a couple of months after another break that lasted 43 days last fall — the longest on record.

The latest shutdown was relatively short-lived, lasting only a few days, and several agencies weren’t affected because their funding had already been approved.

Fortunately for investors, government shutdowns usually have more bark than bite. They typically don’t last long, and while market volatility may rise, stocks have generally recovered quickly once the shutdown ends.

We believe investors should avoid making investment decisions based solely on these events. Maintaining a consistent and sound investment strategy is typically the best approach for long-term success, regardless of short-term circumstances.

How Congress Handles Annual Government Funding

Each year, Congress must approve spending for the federal government’s fiscal year by September 30. In the spring, the House and Senate Finance Committees begin working on 12 regular appropriations bills to fund the departments of defense, agriculture, energy, labor and veterans affairs, among others.

An appropriations bill is a law passed by Congress that allows the federal government to spend money on specific programs and services.

However, Congress often struggles to pass all the necessary bills on time, with the last successful instance occurring in 1996.1 Political disagreements between the two parties frequently lead to deadlocks.

When Congress can’t agree on appropriations bills, it can pass a continuing resolution to keep the government running while negotiations continue.

A continuing resolution is a temporary law Congress passes to ensure government funding when the regular appropriations bills aren’t approved on time.

Government Shutdowns Explained

A government shutdown occurs when Congress fails to pass the necessary appropriations bills or a continuing resolution by midnight on September 30. A shutdown only affects the expenses tied to the appropriations bills that Congress hasn’t approved.

Since there are 12 funding bills, the impact of a shutdown can differ depending on which bills have been passed and which agencies still have the legal authority to spend money. Many federal agencies must halt or scale back their operations on October 1 if they lack legal permission to continue spending.

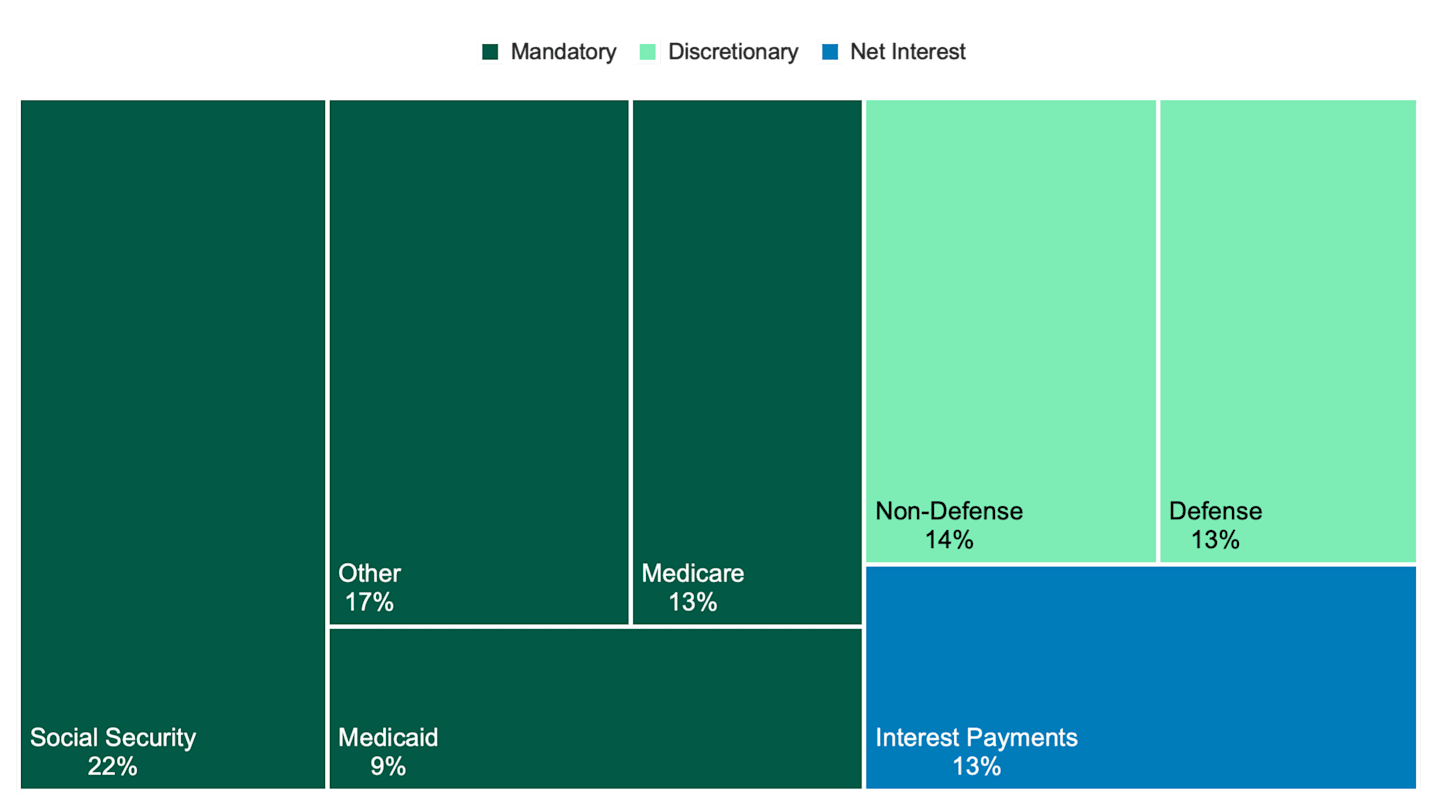

Government shutdowns only affect programs funded through discretionary spending, which accounted for 27% of the government’s total budget in 2024. See Figure 1. They don’t affect mandatory programs like Social Security, Medicare or Medicaid because they receive funding through separate long-term mechanisms.

Figure 1 | Discretionary Spending Accounted for 27% of the Total Budget in 2024

Breakdown of the Federal Government’s $6.8 Trillion Budget in Fiscal Year 2024

Data as of 9/30/2024. Source: Congressional Budget Office.

Other essential services like postal delivery also continue, and shutdowns don’t affect the government’s ability to pay interest on its debt.

Nonetheless, a shutdown can impact other government functions and programs, like scientific research, passport and visa processing and food safety inspections.

How Common Are Government Shutdowns?

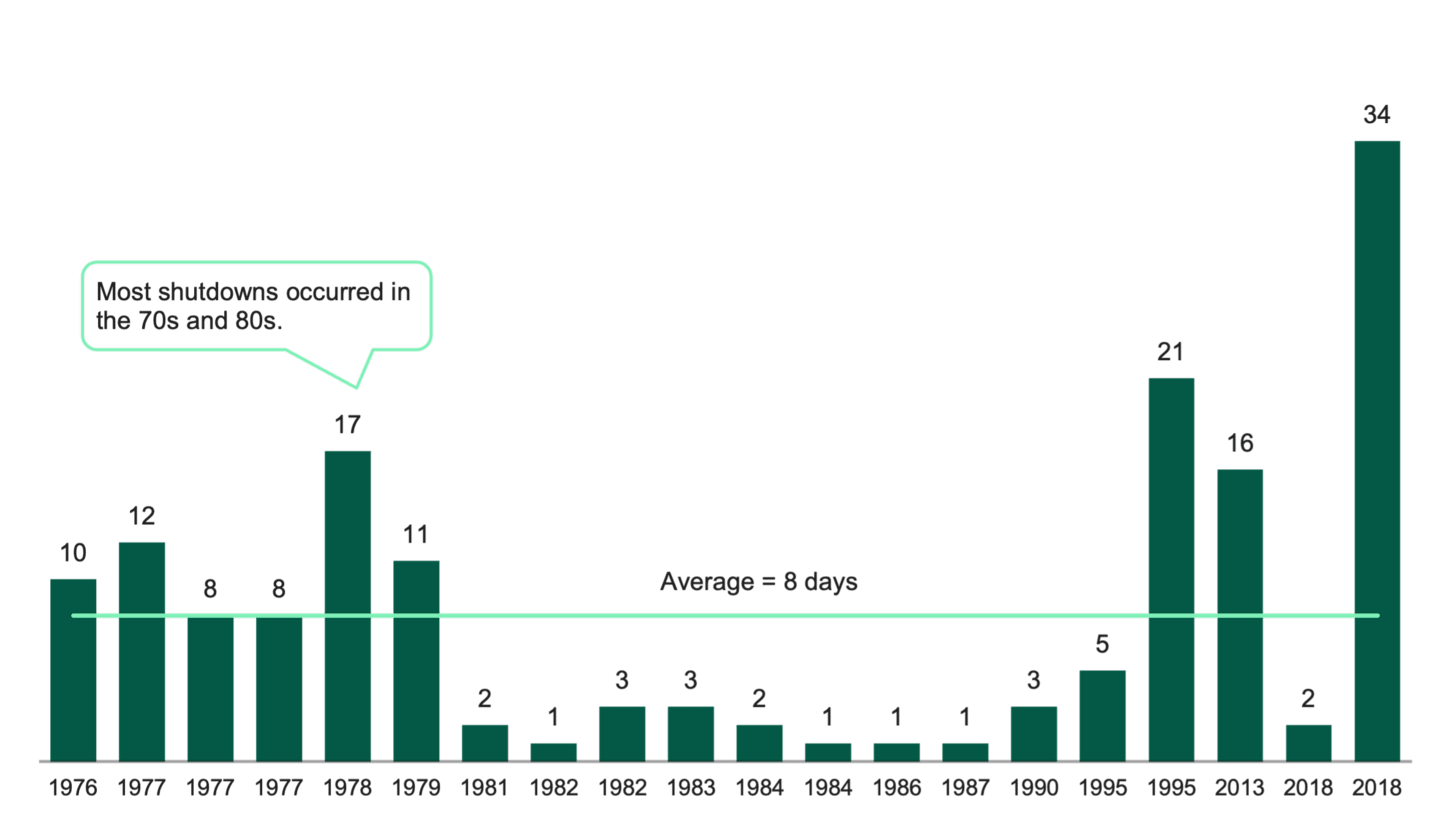

Government shutdowns are less common today than in the 1970s and 1980s, but they sometimes last longer now, as shown in Figure 2. Since 1976, the average duration has been a little over a week. Many of the shutdowns have only lasted a few days.

Figure 2 | Half the Government Shutdowns Lasted No Longer Than Three Days

Length of Shutdowns in Days

Data from 10/1/1976 – 1/31/2026. Source: James V. Saturno, “Federal Funding Gaps: A Brief Overview,” Congressional Research Service.

How Do Government Shutdowns Affect the Economy?

While short-term U.S. government shutdowns may be disruptive and erode public confidence in political leadership, they typically have minimal long-term economic impact. However, prolonged shutdowns can lead to more significant — though mostly temporary — economic consequences.

Each week of a shutdown could reduce gross domestic product (GDP) growth by approximately 0.2 percentage points (annualized), with a similar rebound expected in the quarter following the shutdown's resolution.2

The Congressional Budget Office (CBO) examined the five-week partial shutdown from late 2018 to early 2019. The shutdown caused a 0.1% decline in GDP during Q4 2018 and a 0.2% decline in Q1 2019, mainly due to lost wages for furloughed federal employees and postponed government spending.

Although most of the lost output was eventually recovered, the CBO estimated that the economy permanently lost $3 billion, roughly 0.02% of 2019 GDP. These numbers do not account for indirect impacts, such as delays in federal permits or loan applications.

These economic effects, while often modest and temporary, still play a key role in shaping how financial markets respond to government shutdowns.

How Have Markets Responded to Past Government Shutdowns?

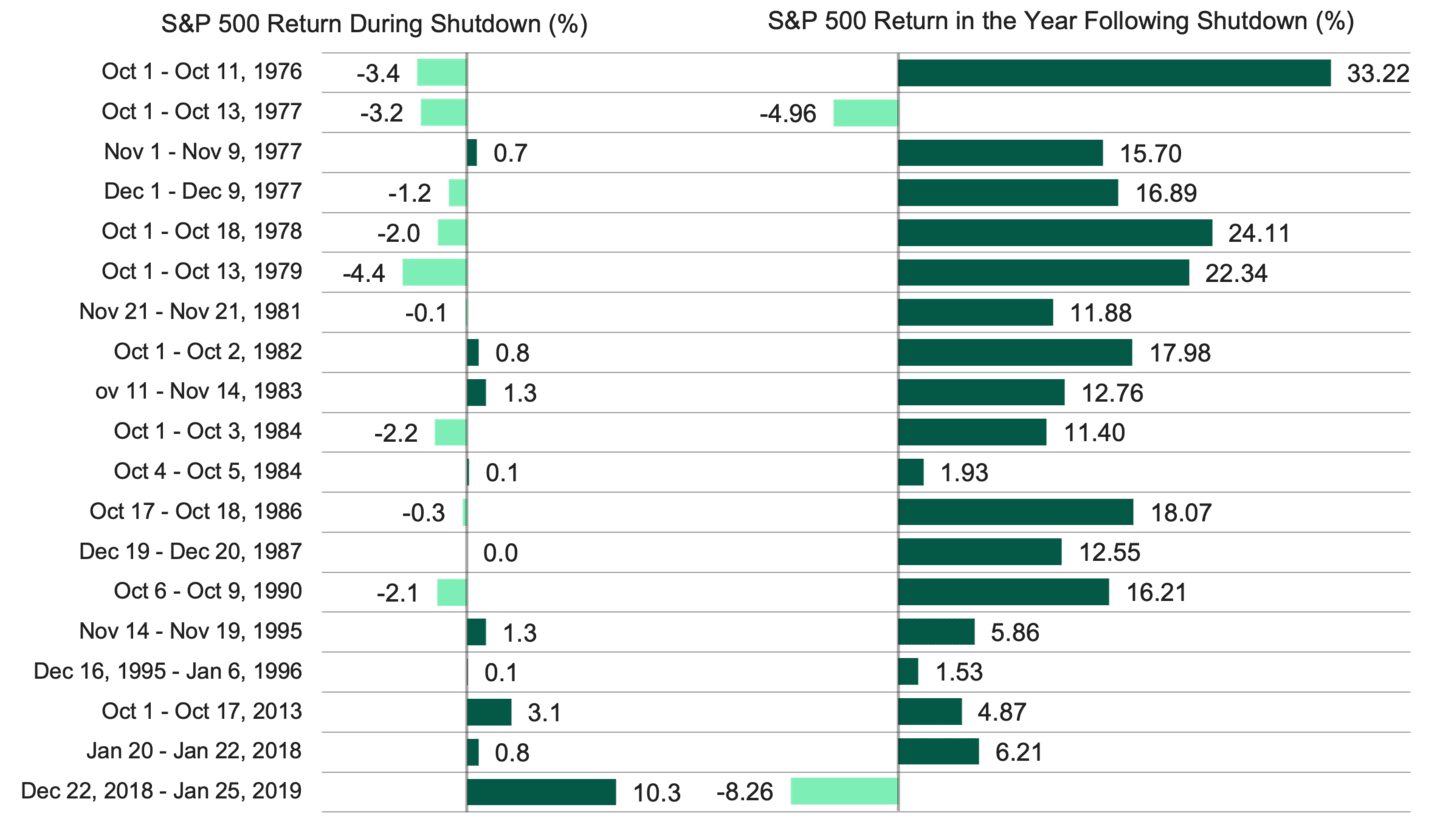

While the threat of a government shutdown often makes headlines, the market tends to ignore the excitement. As Figure 3 shows, stock performance during shutdowns has been mixed, ranging from a 3.9% drop in October 1979 to a 9.3% gain during the 2018–2019 shutdown. More importantly, our research shows that stocks have generally risen over the 12 months following a shutdown.

Figure 3 | U.S. Stocks Have Generally Gained Ground in the Year Following a Shutdown

Data from 10/1/1976 – 11/11/2025. Source: Morningstar. U.S. stocks are represented by the S&P 500® Index, which we define in our glossary.

Managing Uncertainty During Government Gridlock

The recurring threat of a federal government shutdown often generates headlines, but financial markets have historically demonstrated strong resilience during these periods. Data shows that investors who remained committed through the uncertainty were rewarded with positive returns in the months that followed.

This trend highlights the value of staying focused on long-term goals amid short-term political disruptions.

Authors

How Do Government Policies Affect the Market?

Get insights about the intersection of U.S. government policies and the financial markets from our investment professionals.

Drew Desilver, “Congress Has Long Struggled to Pass Spending Bills on Time,” Pew Research Center, September 13, 2023.

Alec Phillips, “How Much Does a U.S. Government Shutdown Cost the Economy?” Goldman Sachs, September 1, 2023.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

©2026 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.